Despite gold reaching record levels on Wednesday, some economists expect prices to approach $3000.00 per ounce by the end of the year.

Today, market participants will focus on the ECB meeting and its press conference, which starts at 12:45 (GMT). If ECB President Christine Lagarde makes "dovish" statements or if the ECB interest rates are unexpectedly lowered at today's meeting, we can expect a new surge in gold and the XAU/USD pair (gold prices are susceptible to changes in the monetary policies of the world's major central banks).

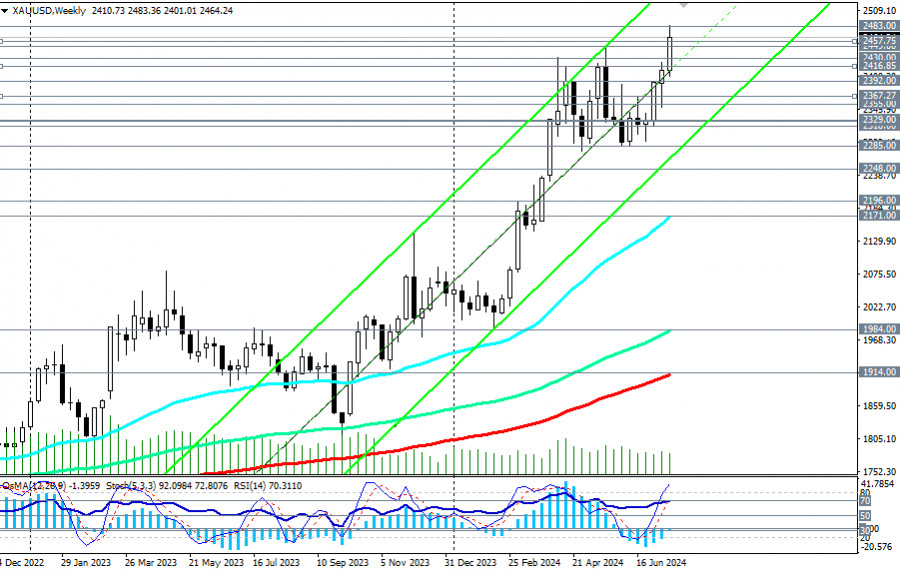

A break of today's high at 2475.00 will be the first signal to increase long positions in XAU/USD, and a break of yesterday's record high at 2483.00 will be the confirming signal.Despite gold reaching record levels on Wednesday, some economists expect prices to approach $3000.00 per ounce by the end of the year.

Today, market participants will focus on the ECB meeting and its press conference, which starts at 12:45 (GMT). If ECB President Christine Lagarde makes "dovish" statements or if the ECB interest rates are unexpectedly lowered at today's meeting, we can expect a new surge in gold and the XAU/USD pair (gold prices are susceptible to changes in the monetary policies of the world's major central banks).

A break of today's high at 2475.00 will be the first signal to increase long positions in XAU/USD, and a break of yesterday's record high at 2483.00 will be the confirming signal.The dollar and the markets, in general, continue to be volatile, and investors are trying to find new benchmarks in a situation of slowing inflation, ambiguous statements from politicians and representatives of central banks in key economies, and the US presidential race.

Recently, US presidential candidate Trump, whose prospects for re-election have sharply increased after an assassination attempt, spoke about the undesirability of a strong dollar, as it makes it difficult for American products to compete successfully in the global commodity market. Economists are also analyzing the prospects of the American economy in the event of his re-election. Overall, they believe the American economy should benefit from Trump's return to the presidency, and that the Fed will remain independent of politics. The dollar could also benefit from this, as Trump is likely to resume protectionist and pro-American policies in the global market and implement domestic economic policies that include tax cuts and wage increases. This should, in turn, result in higher inflation, which means a return to a more stringent monetary policy by the Fed. Although Trump, as president, repeatedly criticized the Fed for what he perceived as overly tight monetary policy, he recently stated that the Fed should refrain from lowering rates, which would boost the economy and, consequently, help his rival Biden.

According to media reports, Trump also wants to introduce a 15% corporate tax. However, "if he is elected president, he will not seek to remove Powell from his post as Fed chairman until Powell's term expires."

At the same time, the unstable political situation in the Eurozone and geopolitical risks are forcing investors to seek refuge in traditional safe-haven assets – government bonds and gold.

Against this backdrop, prices for US government bonds are rising, thus lowering their yields. Gold futures reached a new record high above 2488.00 on Wednesday, and the XAU/USD pair is near the 2483.00 mark.

Meanwhile, despite Powell's recent moderately hawkish statements about the need to wait for clearer signals of declining inflation and its movement towards the target level of 2%, the markets stubbornly believe that the Fed will begin lowering its interest rates in September.

Despite gold reaching record levels on Wednesday, some economists expect prices to approach $3000.00 per ounce by the end of the year.

Today, market participants will focus on the ECB meeting and its press conference, which starts at 12:45 (GMT). If ECB President Christine Lagarde makes "dovish" statements or if the ECB interest rates are unexpectedly lowered at today's meeting, we can expect a new surge in gold and the XAU/USD pair (gold prices are susceptible to changes in the monetary policies of the world's major central banks).

A break of today's high at 2475.00 will be the first signal to increase long positions in XAU/USD, and a break of yesterday's record high at 2483.00 will be the confirming signal.