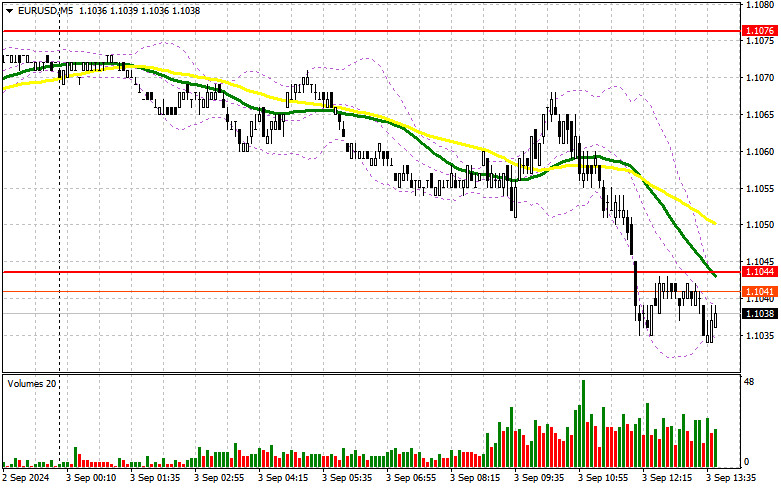

In my morning forecast, I focused on the 1.1044 level and planned to make trading decisions based on it. Let's examine the 5-minute chart to understand what happened. The 1.1044 level was broken, but there was no follow-up test of this level. As a result, I was left without suitable entry points. The technical outlook for the second half of the day has been slightly revised.

For Opening Long Positions on EUR/USD:

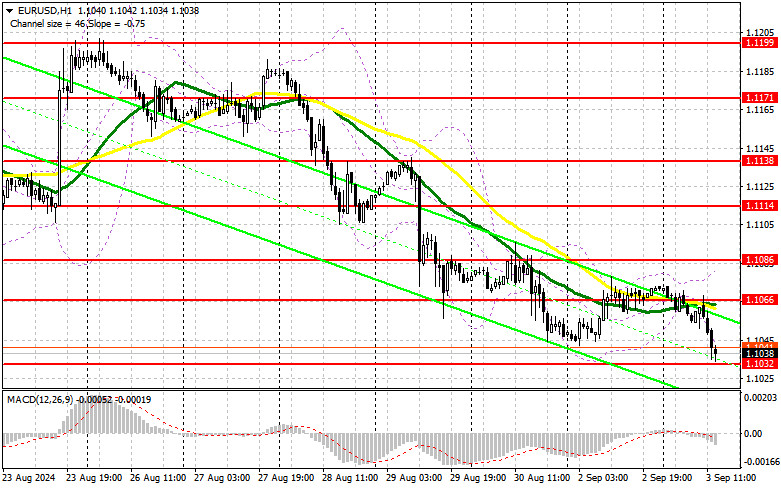

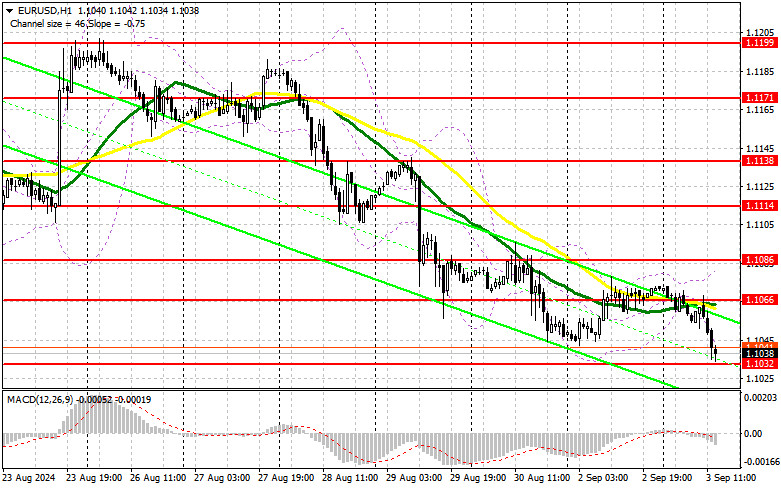

Given the complete absence of statistics in the first half of the day, the U.S. manufacturing data, which are published with a one-day delay, are now crucial. Strong figures from the manufacturing index, ISM manufacturing index, and RCM/TIPP economic optimism index could be detrimental to euro buyers, potentially pushing the EUR/USD pair lower to the new support level at 1.1032. I plan to act only after a false breakout at this level, anticipating a rise and a new resistance level at 1.1066, where the moving averages are positioned in favor of sellers. A breakout and a downward test of this range against weak data, which cannot be ruled out, could lead to a rise in the pair with a chance to test 1.1086. The furthest target will be the 1.1114 high, where I will take profit. In the event of further declines in EUR/USD and a lack of activity around 1.1032 in the afternoon, sellers will strengthen their positions, providing a chance for a larger drop. I will enter the market only after a false breakout near the next support level at 1.1009. I plan to open long positions immediately on a rebound from 1.0984, targeting an intraday upward correction of 30-35 points.

For Opening Short Positions on EUR/USD:

Sellers made their presence known after a lackluster attempt to recover the euro in the first half of the day and have now targeted 1.1032. However, before aiming for a breakout of this level, it would be beneficial to review U.S. statistics, as weak figures could attract new buyers of risk assets. In this case, the primary task for bears will be to defend 1.1066. A false breakout at this level will present a suitable condition to open short positions with the target of updating the new support level at 1.1032, where I expect the first signs of buyers. A breakout and settlement below this range, as well as a subsequent test from below, will provide another selling point with a move towards 1.1009. The furthest target will be the 1.0984 level, where I will take profit. If EUR/USD moves upward and bears are absent at 1.1066, buyers will regain initiative, with a chance to update the resistance at 1.1086. I will also sell there, but only after a failed attempt to hold above. I plan to open short positions immediately on a rebound from 1.1114, targeting a downward correction of 30-35 points.

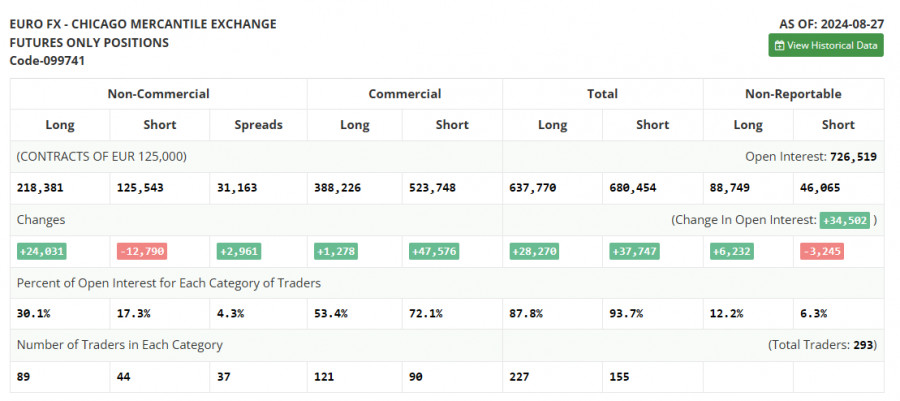

In the COT report (Commitment of Traders) for August 27, there was an increase in long positions and a significant reduction in short positions. This indicates a continued bullish sentiment among risk asset buyers, which was further strengthened after Fed Chair Jerome Powell's speech at Jackson Hole, clearly signaling that U.S. rates will be lowered in September. The current report reflects the full market reaction to these statements. The future direction of the dollar will entirely depend on incoming labor market and inflation data, so I recommend paying special attention to these indicators. The COT report shows that long non-commercial positions increased by 24,031 to a level of 218,381, while short non-commercial positions decreased by 12,790 to a level of 125,543. As a result, the gap between long and short positions increased by 2,961.

Indicator Signals:

Moving Averages

Trading is below the 30 and 50-day moving averages, indicating further market decline.

Note: The periods and prices of moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator around 1.1032 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Period – 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long Non-commercial Positions: The total long open position of non-commercial traders.

- Short Non-commercial Positions: The total short open position of non-commercial traders.

- Net Non-commercial Position: The difference between the short and long positions of non-commercial traders.