The highlight of the day will be the release of US consumer inflation data. The overwhelming majority of markets believe that the red-hot CPI will give the Federal Reserve the green light to start cutting interest rates.

According to the consensus forecast, the Consumer Price Index (CPI) year-on-year is expected to show a serious slowdown in inflationary pressure from 2.9% in July to 2.5% in August, while the month-on-month growth rate is projected to remain at 0.2%. No changes are expected in core inflation, with the annual and monthly core CPIs predicted to stay at 3.2% and 0.2%, respectively.

Most market participants believe that regardless of the outcome—whether inflation declines less than expected or even remains at 2.9%—the funds rate will still be cut. The question is, by how much?

Futures on federal funds rates currently indicate a 65% probability of a 0.25% rate cut and a 35% chance of a 0.50% rate cut. In any case, the market is confident that the Fed's key interest rate will be reduced. The main argument remains the significant slowdown in job growth and the declining inflation trend in recent months. However, if we compare US inflation with that of the eurozone or the UK, we have an interesting idea. Consumer inflation in the eurozone and the UK has fallen to 2.2%, while it remains at 2.9% in the US, at least until today's release. The Bank of England and the European Central Bank have been hesitant to cut rates further, citing uncertainty about whether inflation will remain low for an extended period. Meanwhile, the Federal Reserve has been signaling for several months that it intends to lower borrowing costs, even when inflation was above 3.0%, although it conditioned these promises on a prospective slowdown in inflation.

Observing these developments, one can argue that there is coordination among the central banks of the Western economies, led by the Federal Reserve. I have pointed this out before. Under no circumstances will the Bank of England, the ECB, or other key partners of the Fed begin to lower borrowing costs until the Fed takes the lead in rate cuts, ensuring they don't deviate from the "party line." If all Fed partners, including the ECB, were to cut interest rates, it would lead to a sharp rise in the US dollar's value, harming the competitiveness of American goods in foreign markets and, consequently, the US economy. Even if, hypothetically, the Fed does not cut rates on September 18 due to a potential rise in inflation—a possibility I mentioned in my previous article—the ECB, the Bank of England, and other US-aligned central banks will still likely hold off on rate cuts, even if their inflation drops to 2.0%. This would provide support for the US hegemony in global markets.

What can we expect in the markets today?

I believe the Federal Reserve has already decided to cut interest rates, and any potential inflation decline would serve as the perfect excuse to do so. How will the markets react to data showing inflation dropping to 2.5% year-on-year, as predicted? I believe this would lead to a local rise in stock indices, starting with the US indices, while the dollar will come under pressure, and the ICE index is likely to fall below 101.00 or even lower.

How deep could the decline in the US dollar be? I think the decline will not be very significant, as the upcoming rate cut, especially by 0.25%, has largely already been priced into assets. Further dollar weakening will depend on the Fed's decision. If it cuts interest rates by 0.25%, we might even see the beginning of a correction at the end of the meeting as investors take profits. In other words, the market could follow the classic rule of "buy on the rumor, sell on the news."

Forecast of the day

EUR/USD The EUR/USD pair is trading below the resistance level of 1.1050. It may break this level if US inflation data comes in below the forecast. In that case, the instrument is likely to rise to 1.1150. However, if there is a surprise and inflation increases, the pair could fall to 1.1000.

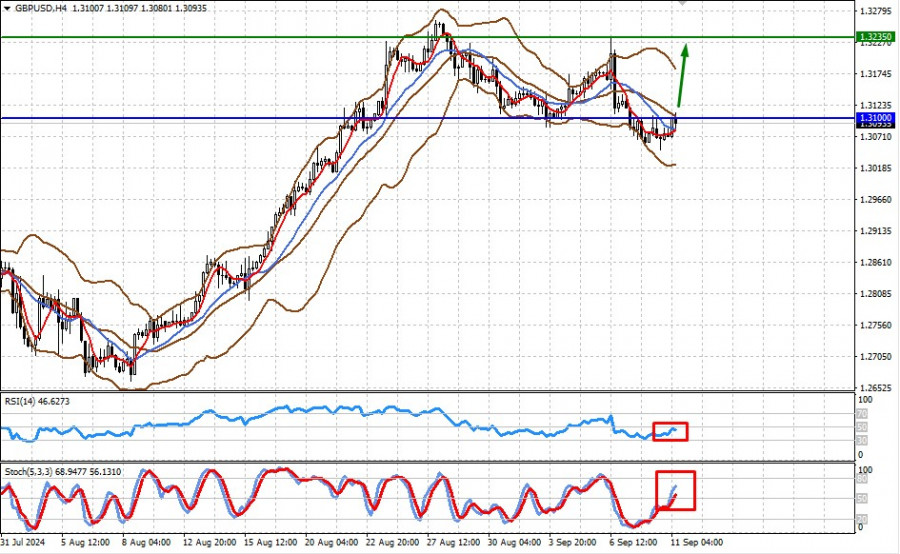

GBP/USD The GBP/USD pair is below the strong resistance level of 1.3100, awaiting the release of US inflation data. A lower-than-expected CPI will support the instrument and allow it to break this level and aim for 1.3235. However, if the data exceeds the consensus, the pair could fall to 1.3020.