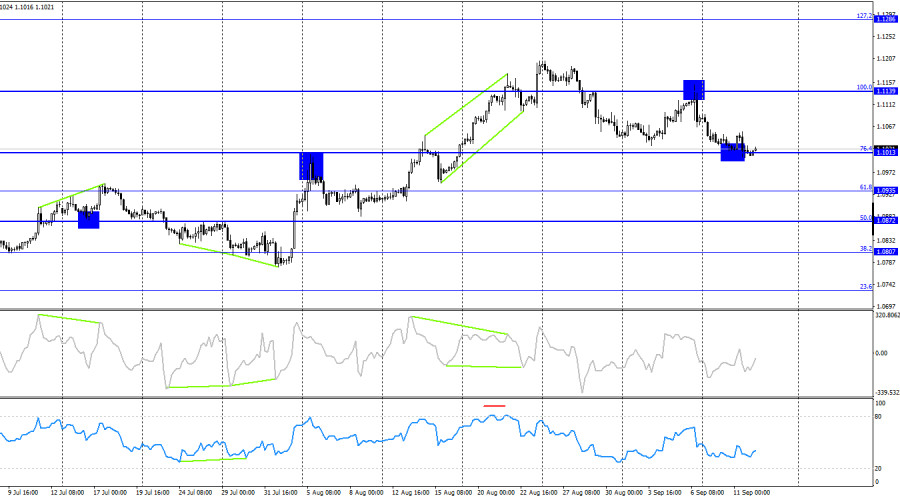

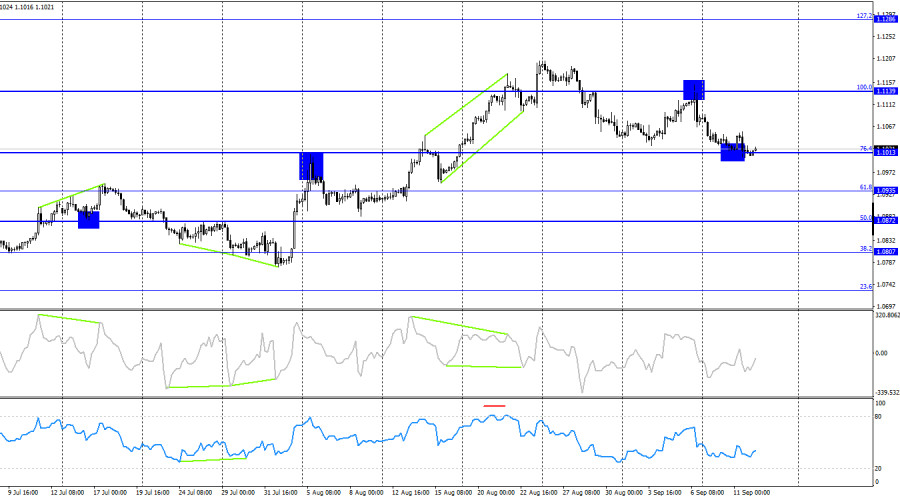

On Wednesday, the EUR/USD pair experienced another reversal in favor of the U.S. dollar and resumed its decline towards the corrective level of 127.2% – 1.0984. A rebound from this level would favor the euro and lead to some growth towards the corrective level of 161.8% – 1.1070. However, I remind you that a "bearish" trend is currently forming, not a "bullish" one. A close below the 1.0984 level will increase the likelihood of a further decline toward the next level at 1.0929.

The wave structure has become a bit more complex, but overall, it raises no major questions. The last completed wave down did not break the low of the previous wave, but the last completed wave up also failed to break the peak of the wave from August 26. Thus, the "bullish" trend is now invalidated. The current wave down confidently broke the low of September 3, which is an additional confirmation of the formation of the "bearish" trend.

Wednesday's fundamental backdrop was very weak for the U.S. dollar, yet the bearish traders continued to attack. Their attacks are not massive at the moment, but the dollar continues to rise. The consumer price index (CPI) fell more than traders expected in August. The 2.5% year-on-year figure could have sparked a bullish reaction, but instead, the dollar rose. In my opinion, this is not entirely logical but still justified. It's important to note that the inflation figure is of interest to the market only in terms of the outlook for the Federal Reserve's monetary policy. At the moment, no one doubts that the FOMC will begin lowering rates next week, with further easing to follow. Therefore, I assume that inflation figures no longer carry as much weight with traders as before. In other words, it doesn't matter how quickly inflation is falling—the decision to start the monetary easing process has already been made.

On the 4-hour chart, the pair fell to the corrective level of 76.4% – 1.1013. There are some early signs of a new "bearish" trend on the 4-hour chart, but without a strong fundamental backdrop from the U.S., it will be difficult for the dollar to maintain prolonged growth. No emerging divergences are seen on any indicators today. A rebound from the 1.1013 level would favor the euro and result in slight gains towards 1.1139. Consolidation below this level will increase the chances of further decline towards the next Fibonacci level of 61.8% – 1.0935.

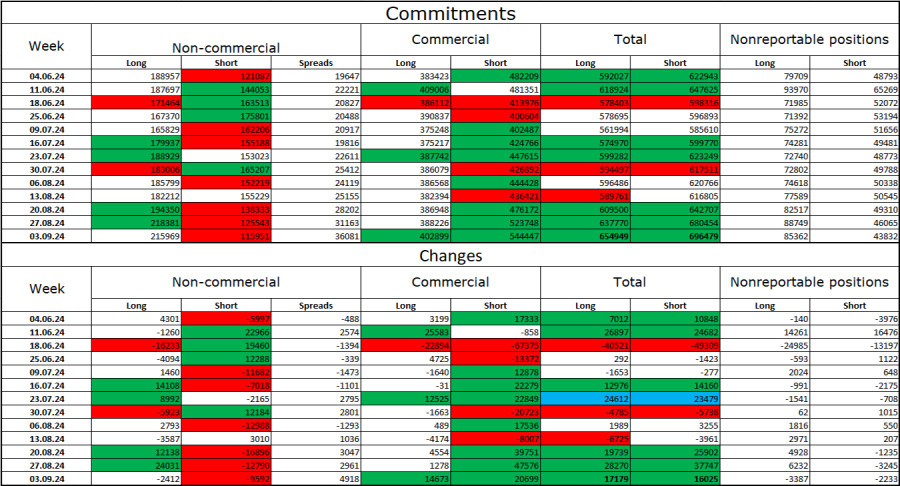

Commitments of Traders (COT) Report:

In the latest reporting week, speculators closed 2,412 long positions and 9,592 short positions. The sentiment of the "Non-commercial" group turned bearish several months ago, but bulls currently dominate. The total number of long positions held by speculators is now 215,000, while short positions amount to only 115,000.

I still believe the situation will continue to shift in favor of the bears. I see no long-term reasons to buy the euro. It's also worth noting that the market has already priced in a 100% probability of the FOMC rate cut in September. The potential for a decline in the euro looks significant. However, we should not forget about the technical analysis, which, at the moment, does not strongly suggest a sharp drop in the euro, as well as the fundamental backdrop, which regularly creates challenges for the dollar.

News Calendar for the U.S. and Eurozone:

- Eurozone – ECB Interest Rate Decision (12:15 UTC).

- Eurozone – ECB Press Conference (12:45 UTC).

- U.S. – Producer Price Index (12:30 UTC).

- U.S. – Initial Jobless Claims (12:30 UTC).

The economic calendar for September 12 includes several important events. The influence of the fundamental backdrop on market sentiment today could be strong.

EUR/USD Forecast and Trading Tips:

Selling opportunities were available after a rebound from the 1.1139 level on the 4-hour chart, with a target of 1.1070–1.1081. Another selling opportunity emerged after the euro closed below the 1.1070–1.1081 zone, targeting 1.0984. These trades can still be held. I would not consider buying the pair this week.

Fibonacci retracement levels are drawn from 1.0917–1.0668 on the hourly chart and from 1.1139–1.0603 on the 4-hour chart.