On Friday, the EUR/USD currency pair showed some movement during the second half of the day. However, calling it "interesting" would be a stretch, even considering it was a holiday week. The pair's volatility reached just 39 pips, which is quite low, though nearly double the volatility observed on Thursday. This movement was not influenced by any fundamental or macroeconomic events, as there were none to consider.

In essence, the pair is either stagnant or trading with low volatility. Last week provided almost nothing for analysis—there were no central bank speeches or significant economic releases, and on Wednesday, the market was closed. Currently, the focus is solely on technical analysis and the overall trend. The technical indicators suggest that the pair has begun a new upward correction, although it appears to be very weak. Additionally, after failing twice to break through the 1.0350 level, the pair has formed a "double bottom" pattern.

Previously, we noted that such patterns are often too obvious to have more than a 50% probability of being realized. They are easily recognized by most market participants, and if everyone were to buy based on this pattern, it would be overly simplistic. Thus, we lean toward the view that in January, the price will manage to break the 1.0350 level and continue its decline. This outlook is supported by nearly all currently available factors. A downward trend persists across all higher timeframes. The fundamental backdrop, as we have emphasized throughout 2024, remains decisively in favor of the US dollar.

Of course, a new correction targeting around 1.0620 could begin. The pair might even enter a flat range between 1.0350 and 1.0620, but such movements would not alter the broader technical picture. Flat periods and corrections are typically used by major market players to accumulate positions.

For this week—which can rightfully be considered as festive as the previous one—there will be slightly more significant events, though not by much. On Thursday, January 2, the second estimates of manufacturing PMIs for Germany, the EU, and the US will be released, along with the US unemployment claims report. On Friday, Germany's unemployment rate and the US ISM Manufacturing PMI will be published. Only the ISM PMI is likely to provoke a strong market reaction and shake the market out of its holiday slumber. The other reports are of secondary importance. Therefore, if a market awakening is to occur, it will likely happen on Friday.

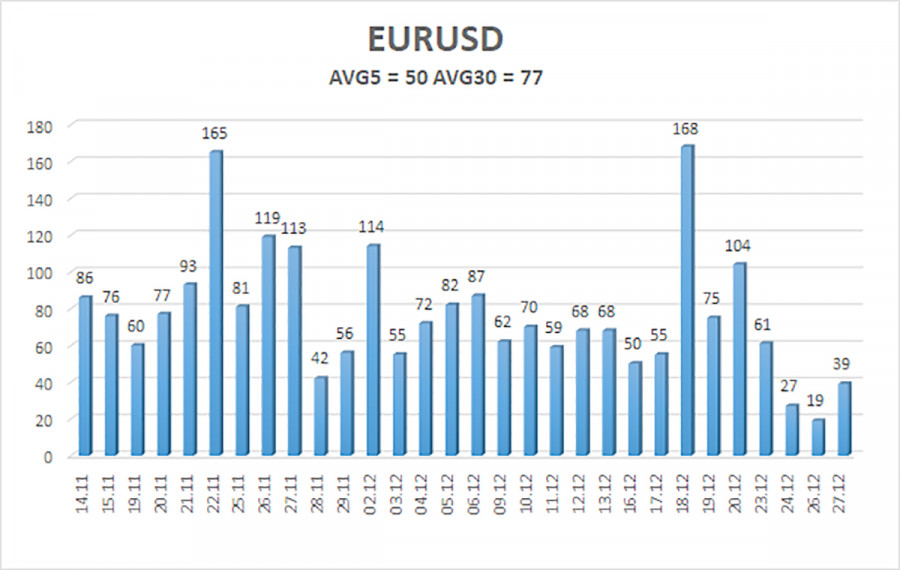

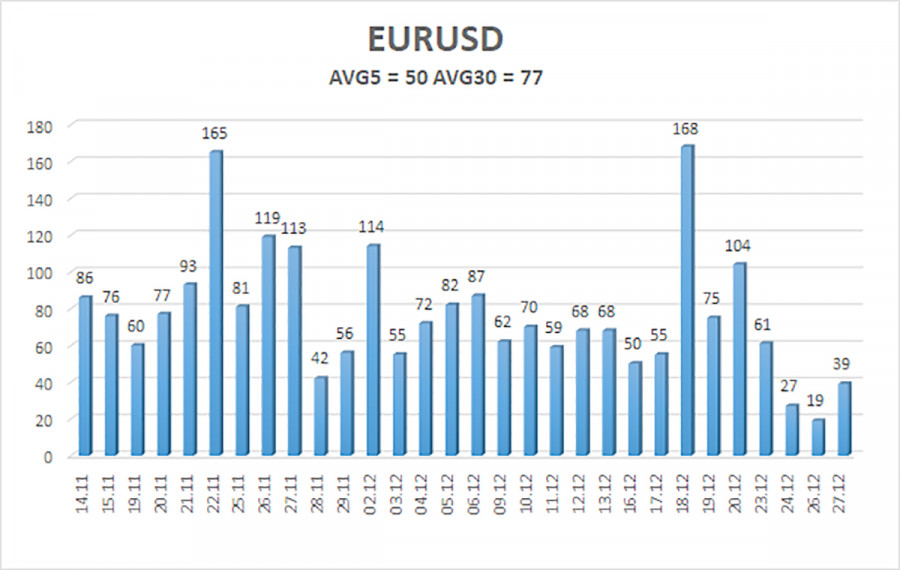

The average volatility of the EUR/USD currency pair over the past five trading days, as of December 30, is 50 pips, which is classified as "average." On Monday, we expect the pair to fluctuate between the levels of 1.0377 and 1.0477. The upper regression channel is currently pointing downward, indicating that the broader downward trend is still in effect. Additionally, the CCI indicator has once again entered the oversold zone after a significant decline, suggesting the potential for a correction at most.

Nearest Support Levels:

- S1 – 1.0376

- S2 – 1.0254

- S3 – 1.0132

Nearest Resistance Levels:

- R1 – 1.0498

- R2 – 1.0620

- R3 – 1.0742

Trading Recommendations:

The EUR/USD pair may continue its downward trend. Over the past few months, we have consistently anticipated further declines in the euro in the medium term, fully supporting the overall bearish outlook, which we believe is not yet complete. There is a high likelihood that the market has already priced in all future Federal Reserve rate cuts, leaving the dollar with little reason to weaken in the medium term.

Short positions remain relevant, with targets set at 1.0376 and 1.0254 if the price stays below the moving average. For those trading based solely on technical analysis, long positions might be considered if the price moves above the moving average, with a target of 1.0620. However, current movements are weak, and any upward movements should be classified as corrections.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.