Trade Analysis and Tips for Trading the Japanese Yen

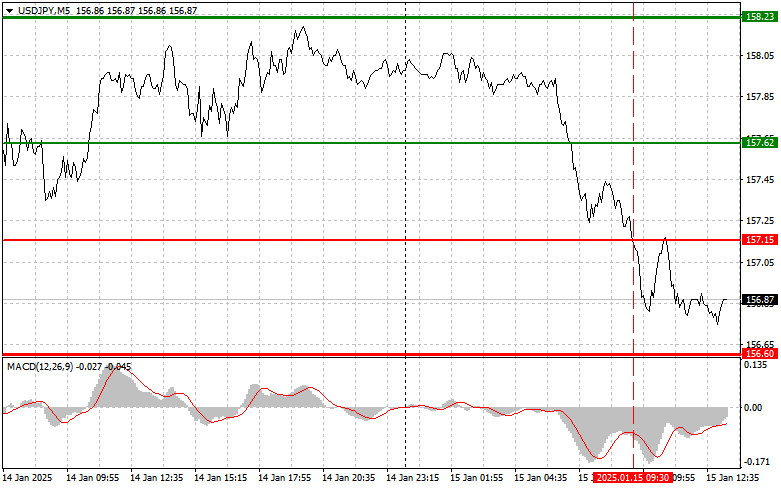

The test of the 157.15 price level coincided with the MACD indicator already moving significantly downward from the zero line, limiting the pair's downward potential. For this reason, I avoided selling the dollar and missed a good downward movement.

The apparent return of demand for the Japanese yen suggests that the Bank of Japan may no longer maintain its dovish stance in upcoming statements, reminding market participants of its plans for further rate hikes. However, upcoming key U.S. statistics could significantly increase market volatility. Data on the Consumer Price Index (CPI) and the core CPI (excluding food and energy prices) are expected. It's worth noting that USD/JPY has reacted unpredictably to U.S. data recently, so any weakening of the dollar against risk assets may not necessarily translate into similar weakness against the yen. Exercise caution when reacting to these reports.

Today's schedule also includes speeches by FOMC member John Williams, FOMC member Thomas Barkin, and Federal Reserve representative Neel Kashkari. Their statements promise to be informative and significant for financial markets. Each of these representatives offers a unique perspective on the U.S. economic situation, helping investors and analysts better understand future monetary policy.

- John Williams, as the president of the New York Fed, often emphasizes the importance of data-driven decision-making. His speech may include forecasts on inflation, unemployment, and measures the Fed plans to support sustainable economic growth.

- Thomas Barkin, the president of the Richmond Fed, typically focuses on regional economic aspects. His insights may shed light on current challenges facing the Federal Reserve in ensuring financial stability.

- Neel Kashkari, president of the Minneapolis Fed, is known for his more aggressive stance on combating inflation. He may discuss the necessity of tightening monetary policy to prevent economic overheating and maintain long-term stability.

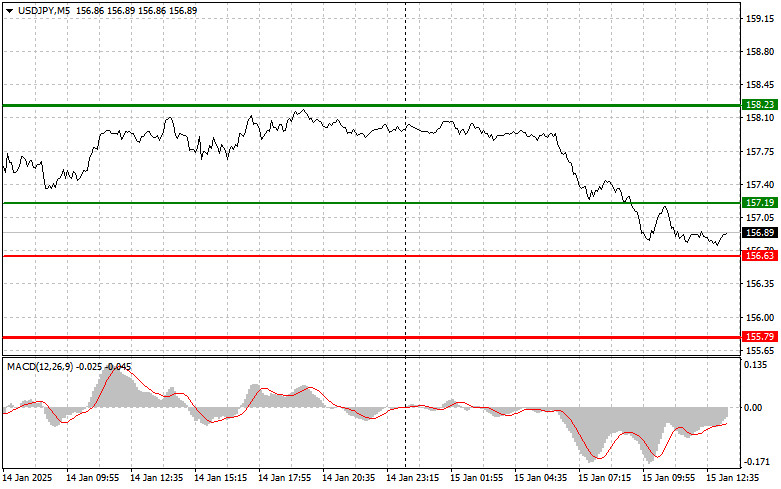

Intraday Strategy

I will rely primarily on implementing Scenario #1, even without specific MACD signals, as I anticipate strong directional movement.

Buy Signal

Scenario #1: Plan to buy USD/JPY at 157.19 (green line on the chart) with a target of 158.23 (thicker green line on the chart). At 158.23, I plan to exit purchases and open short positions, expecting a reversal of 30-35 points. A bullish move is only expected following strong U.S. data.Important! Before buying, ensure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of 156.63, and the MACD indicator is in oversold territory. This would limit the pair's downward potential and trigger an upward reversal. Expected targets are 157.19 and 158.23.

Sell Signal

Scenario #1: Plan to sell USD/JPY after breaking below 156.63 (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be 155.79, where I plan to exit sales and immediately open buy positions for a reversal of 20-25 points. Downward pressure is possible within the observed bearish trend.Important! Before selling, ensure the MACD indicator is below the zero line and just starting to decline.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of 157.19, and the MACD indicator is in overbought territory. This would limit the pair's upward potential and trigger a downward reversal. Expected targets are 156.63 and 155.79.

On the Chart:

- Thin green line: Entry price for buying the instrument.

- Thick green line: Estimated level for setting Take Profit or manually locking profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the instrument.

- Thick red line: Estimated level for setting Take Profit or manually locking profits, as further declines below this level are unlikely.

- MACD Indicator: Use overbought and oversold zones for market entry guidance.

Important Notes:

Beginner Forex traders should exercise extreme caution when making market entries. It's advisable to remain out of the market before the release of key fundamental reports to avoid sudden price swings. If you decide to trade during news events, always set stop-loss orders to minimize losses. Without stop-losses, you risk quickly losing your entire deposit, especially if trading large volumes without proper money management.

Remember, successful trading requires a clear plan, like the one outlined above. Spontaneous decisions based on current market conditions are inherently a losing strategy for intraday traders.