Analysis of Trades and Trading Tips for the Euro

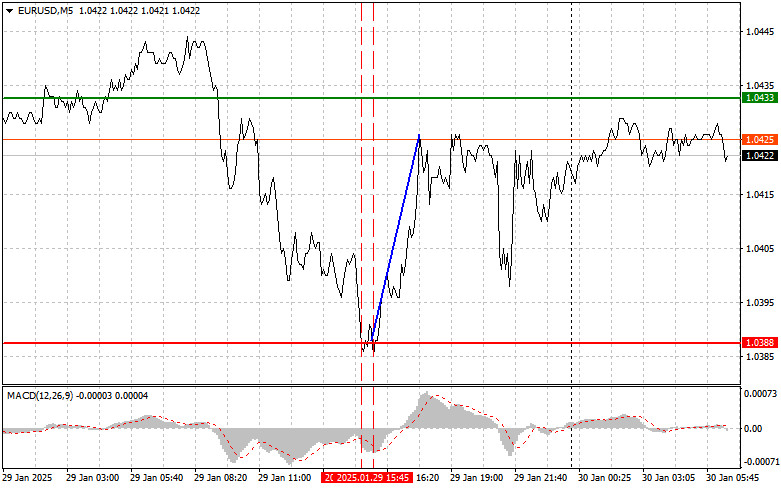

The first test of the 1.0388 level occurred when the MACD indicator had already moved significantly downward from the zero mark, limiting the pair's downside potential. For this reason, I did not sell the euro. However, the second test of 1.0388 shortly afterward coincided with the MACD being in the oversold zone. This allowed Buy Scenario #2 to play out, resulting in a 35-pip increase for the pair.

The euro remains under pressure, fluctuating within a narrow trading range, which indicates investor caution ahead of a series of key macroeconomic reports. Following yesterday's Federal Reserve meeting, where a wait-and-see approach was reaffirmed, many traders anticipated strong reactions in the forex market, but those reactions ultimately did not materialize.

Today, the key factors that could influence the euro's dynamics will be the eurozone GDP data. Investors are closely monitoring this data, as it could lead the European Central Bank to adopt a softer stance on interest rates. Additionally, the unstable political situation in some countries within the region adds to the uncertainty. If economic indicators confirm weakness, this could further pressure the euro, while optimistic data could help restore confidence in the currency.

Today, the ECB will announce its decision on the main interest rate, with a reduction to 2.9% expected. This decrease in the ECB's main interest rate could significantly impact financial markets, leading to fluctuations in both the euro exchange rate and bond yields. The measure is intended to stimulate the eurozone economy, which is currently experiencing a slowdown in growth. Additionally, the comments made by ECB President Christine Lagarde regarding the timing of any future rate cuts will be of great importance.

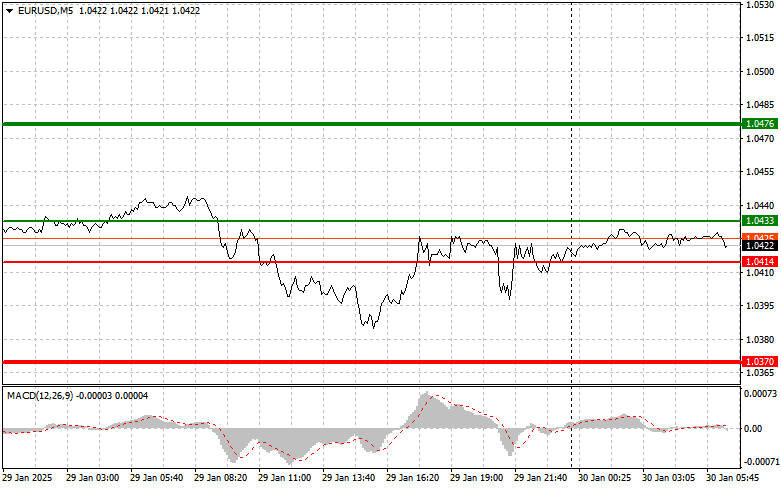

For my intraday strategy, I will focus on implementing scenarios No. 1 and No. 2.

Buy Signal

Scenario #1: Today, you can buy euros when the price reaches around 1.0433 (green line on the chart) with the goal of growth to 1.0476. At point 1.0476, I plan to exit the market and sell euros in the opposite direction, counting on a movement of 30-35 pips from the entry point. It will be quite difficult to count on euro growth in today's first half. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to grow from it.

Scenario #2: I will also buy euros today in the event of two consecutive tests of the price of 1.0414 when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reverse upward market reversal. We can expect growth to the opposite levels of 1.0433 and 1.0476.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.0414 (red line on the chart). The target will be the level of 1.0370, where I plan to exit the market and immediately buy in the opposite direction (calculating a movement of 20-25 pips in the opposite direction from the level). The pressure on the pair will return at any moment. Important! Before selling, make sure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the euro today if the price of 1.0433 is tested twice consecutively at the moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse downward market reversal. We can expect a decline to the opposite levels of 1.0414 and 1.0370.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.