The GBP/USD currency pair resumed its upward movement on Friday. The U.S. economic data released was not strong enough to support the dollar, contributing to its ongoing struggles. The Non-Farm Payrolls report indicated that only 151,000 new jobs were created outside the agricultural sector, falling short of the expected 160,000. Additionally, the unemployment rate unexpectedly rose from 4.0% to 4.1%. On a positive note, average wages increased by 4%. Given that the dollar had been declining throughout the week, this data is likely to trigger another wave of depreciation.

However, it's important to highlight a few key points. The growth of the British pound seems to be largely driven by the situation regarding the U.S. dollar rather than specific developments in the UK. Last week, only two reports on business activity indices were published in the UK, which could not have theoretically caused such a significant movement. While U.S. statistics were underwhelming, they also did not justify the extent of the dollar's decline. Furthermore, on Friday evening, Jerome Powell reassured the market that the Federal Reserve would not speed up the pace of rate cuts. Fundamentally, the economic situation remains unchanged. The market seems to be reacting to fears related to Trump, the potential downturn in the U.S. economy, and general uncertainty.

Donald Trump has started his second presidential term at full speed. He has accused half the world of unfair treatment of the U.S., imposed tariffs against China, and repeatedly stated that he is "about to impose tariffs" against the EU, Canada, Mexico, Japan, and the UK. Moreover, Trump wants to withdraw the U.S. from the UN and NATO. Everyone understands that Trump's tariffs will be met with retaliatory tariffs. And how will they impact the U.S. economy if, for example, Canada has already begun boycotting American goods? People are refusing American products on principle, not because of tariffs or sanctions. They dislike having a neighboring country dictate its terms.

And this is without mentioning Trump's ambitions to annex Canada, buy the Panama Canal, or acquire Greenland. It all sounds more like a surreal dystopian novel than reality. Naturally, demand for the U.S. dollar is declining simply because of Trump. Trump may benefit from the dollar's decline, as he seems to have accepted that Powell will not follow his lead and cut rates as aggressively as he would like. However, if this is indeed Trump's grand plan, the market will eventually figure it out. Meanwhile, the U.S. economy could suffer irreparable damage due to widespread boycotts of American goods. Even Tesla electric cars are now being boycotted in many countries, as people are refusing to buy Elon Musk's cars due to his support for Trump.

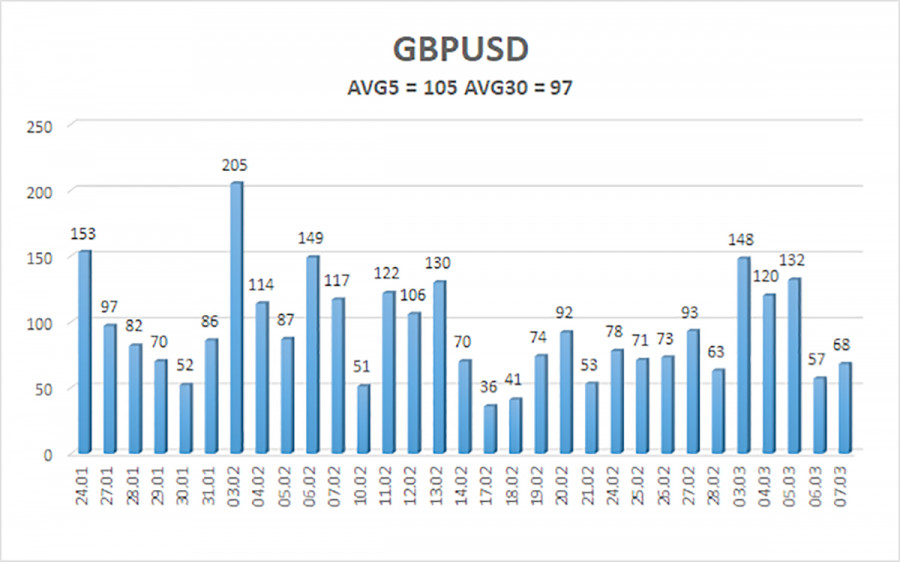

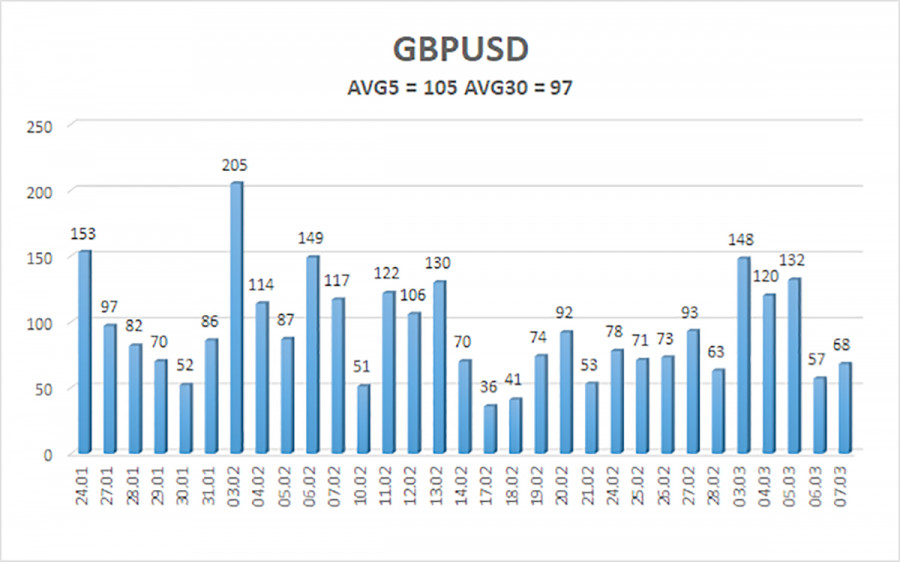

The average volatility of the GBP/USD pair over the last five trading days is 105 pips, which is considered "average" for this pair. On Monday, March 10, we expect movement within a range defined by the levels of 1.2815 and 1.3025. The long-term regression channel has turned sideways, but the overall downward trend remains visible on the daily timeframe. The CCI indicator has recently stayed out of overbought and oversold areas.

Nearest Support Levels:

S1 – 1.2817

S2 – 1.2695

S3 – 1.2573

Nearest Resistance Levels:

R1 – 1.2939

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downtrend. We still do not consider long positions because we see the current upward movement as a correction that has turned into an illogical, panic-driven rally. If you trade purely based on technical analysis, long positions could be considered with targets at 1.2939 and 1.3025 if the price remains above the moving average. However, sell orders remain much more relevant, with targets at 1.2207 and 1.2146, as the upward correction on the daily timeframe will eventually end. The British pound appears extremely overbought and unjustifiably expensive, but Trump continues to push the dollar into freefall. How much longer this dollar collapse will last is difficult to predict.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.