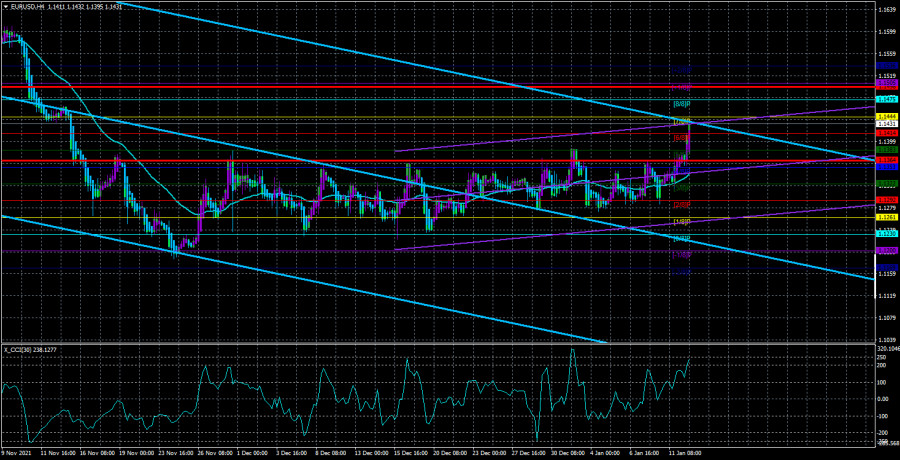

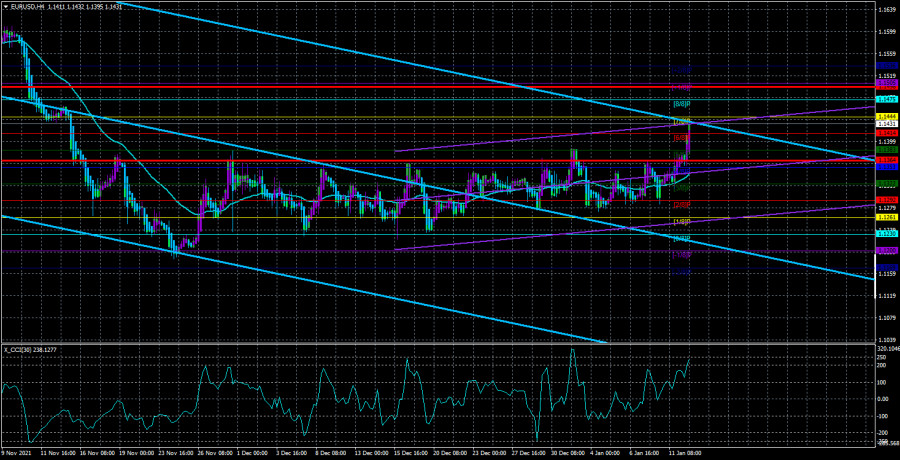

The EUR/USD currency pair continued to trade quite calmly on Wednesday. The key event of the day, from a technical point of view, was another consolidation of the price above the side channel 1.1230 – 1.1353. "Another" - because at least three times the price has overcome the level of 1.1353 over the past month and a half. Each time by only a dozen or two points, which did not allow it to continue growing. As a result, the pair spent these six weeks inside the side channel with a minimal upward slope. This bias persists even now, so we can even say that the pair have been getting more expensive all this time, but at a minimal pace. Thus, the technical picture of the 4-hour timeframe still does not change. The pair needs a clear and deep fixation of the price above the channel (or below) for at least a few days. In the first case, the European currency will have a chance to form a new upward trend. However, it is quite difficult to say how long it will be. Throughout the second half of 2021, we expected an upward trend to begin. The grounds were very simple. The Fed's quantitative stimulus program inflated the US money supply to an unprecedented size, which could not but provoke an increase in inflation, which we see now. The imbalance between the money supply of the EU and the US was constantly increasing and the entire growth of the dollar in 2021 looked just like a technical correction. Now the situation is changing, as the Fed is taking an increasingly "hawkish" position every day. A "hawkish" position is a "bullish" factor for the currency. Although an increase in the key rate this year may already be embedded in the current dollar exchange rate, the US currency may continue to be in demand based on the fact that the European Union does not even think about raising the rate. And inflation is accelerating there at the same pace, just a little late.

Jerome Powell limited himself to common or market-known phrases in the Senate.

Yesterday, we already wrote about Jerome Powell's speech. The text of his speech was known in the morning, but we still have to consider a few theses. Jerome Powell confirmed the intentions of the US regulator to tighten monetary policy in 2021, but he also drew attention to high inflation and the labor market – two key goals of the Fed recently. Regarding inflation, Powell said that he was aware of its pressure on the most vulnerable segments of the population, and also said that his department would struggle with further, high price increases. Regarding the labor market, he noted that it is in good condition, but the tightening of monetary policy should not put pressure on its recovery. However, Powell put inflation in the first place in terms of importance. He said that the economy no longer needs the adaptive policy that has been carried out in the last year and a half. "However, the path to a return to pre-pandemic levels of rates will be a long one," the head of the Fed said. Powell also told the Senate that the impact of the next "wave" of the pandemic should be short-lived and non-destructive for the economy. "We expect that due to the restoration of supply chains, supply will catch up with demand, which will extinguish high inflation." Thus, Powell made it clear to the markets that the Fed is going to fight price increases, but at the same time is still waiting for the problem to begin to settle "by itself." The Fed Chairman also believes that a decision may be made this year to reduce the Fed's balance sheet, which has ballooned to almost $ 9 trillion during the pandemic. And this can happen much faster than after the recession in 2008-2009. We rate Powell's performance as "hawkish". Not a single "dovish" word was said, so the fall of the US dollar after his speech (albeit not strong) was still not related to it. We believe that the slight weakening of the US currency was a simple market "noise", nothing more. Based on this, we can conclude that dollar bulls are already fed up with purchases, so they may loosen their grip, which will still allow the European currency to rise in price at the beginning of 2022.

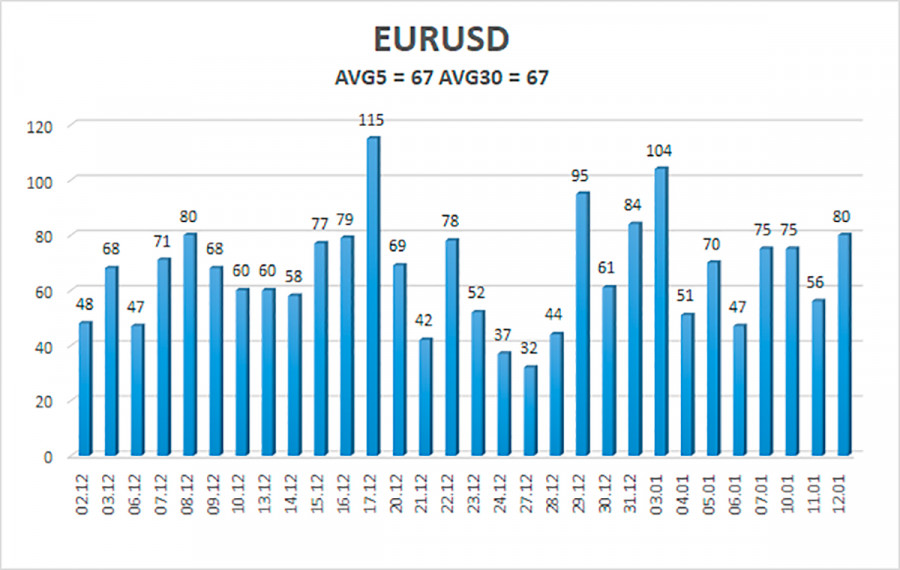

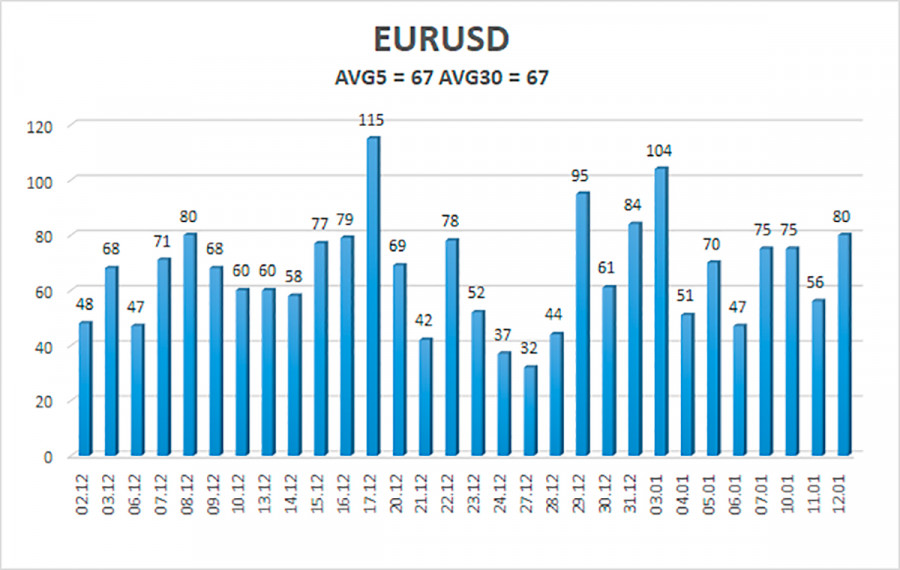

The volatility of the euro/dollar currency pair as of January 13 is 67 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1364 and 1.1498. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.1414

S2 – 1.1383

S3 – 1.1353

Nearest resistance levels:

R1 – 1.1444

R2 – 1.1475

R3 – 1.1505

Trading recommendations:

The EUR/USD pair finally got out of the side channel, as the level of 1.1353 was overcome. Thus, now it is possible to stay in long positions opened on the signal of overcoming this level, with targets of 1.1475 and 1.1498, which should be kept open until the Heiken Ashi indicator turns down. Short positions should be opened after the price is fixed below the moving average with targets of 1.1292 and 1.1261.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.