The EUR/USD currency pair rose sharply on Tuesday. The growth of the European currency amounted to 140 points even before the start of the American trading session. In principle, given that no important macroeconomic events were scheduled for Tuesday, the conclusion is almost self-evident: it's about geopolitics. In the last month, it is due to the geopolitical factor that the pair can travel considerable distances in any direction. So, what happened on Tuesday? Another round of talks between Moscow and Kyiv took place in Turkey on Tuesday. Its results can be evaluated in different ways, however, given the fact that not only the euro and the pound have increased in price, but also the Russian ruble, you can say without hesitation that there was progress in the negotiations this time. And substantial. Or the markets regarded all the information received as the presence of significant progress. One way or another, all risky currencies rose strongly on Tuesday, and now we can only hope that a truce is possible and will be reached in the near future.

How has the technical picture changed on the 4-hour TF? First, the pair has consolidated back above the moving average line. Second, volatility has increased. Third, it is too early to draw any conclusions. The agreement has not been signed yet, and it may take several weeks to finalize it. The military operation in Ukraine continues, and no one knows when the withdrawal of Russian troops will begin or whether it will begin at all. Yesterday's upward spurt of the pair may end very quickly, and it will be replaced by an equally strong fall if negotiations break down or the parties fail to agree on all the cornerstones. In any case, negotiations will continue today, and we can count on receiving new information on this issue. In the meantime, you should close your eyes to the technical picture. The market is again very exciting, so there is no question of any measured trading now.

Interim results of the negotiations.

Naturally, now it makes no sense to talk about anything else except negotiations. Yesterday, it became known that Ukraine is ready to abandon the idea of joining NATO, agrees to non-aligned and non-nuclear status, but at the same time wants to receive security guarantees from five or six major countries in return, some of which should be nuclear. In addition, the Crimean issue is proposed to be resolved through a bilateral negotiation process, which will take 15 years. The issue of the ownership of Donbas will also be resolved through a negotiation process personally between the presidents of Ukraine and Russia. If these issues are resolved, then Russian troops can return to the positions they occupied until February 24, 2022. Next, an all-Ukrainian referendum on non-aligned and non-nuclear status will be held. Further, if the people of Ukraine approve these two statuses, a treaty will be signed, and then its ratification by the guarantor countries of security will take place.

As you can see, there are a lot of "buts" in this list of conditions and items. The item "national referendum of Ukraine "immediately catches the eye". And what if the Ukrainian people speak out against the idea of abandoning NATO and nuclear weapons? Earlier, Kyiv had already concluded a security treaty in exchange for nuclear disarmament. As practice shows, it did not save Ukraine from a full-scale war at all. The point with Crimea is completely incomprehensible. What does it mean that the fate will be decided through bilateral negotiations over the next 15 years? That is, during this time, Moscow can abandon Crimea? There are even more questions about Donbas. This issue should be resolved between Vladimir Putin and Vladimir Zelensky. It turns out that two people will decide the fate of a huge territory? And if the people of Ukraine or the people of Russia disagree with this decision? A new war? In general, the market has experienced a surge of optimism, and it should be noted that there is indeed a reason for this. But we think it's too early to open the champagne. In any case, we must first agree on all issues, and then celebrate the completion of the military operation.

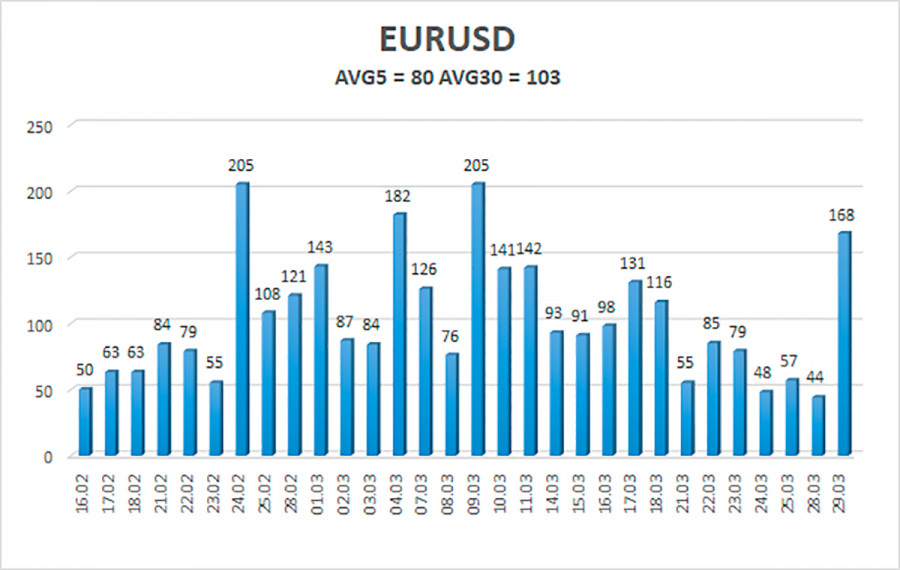

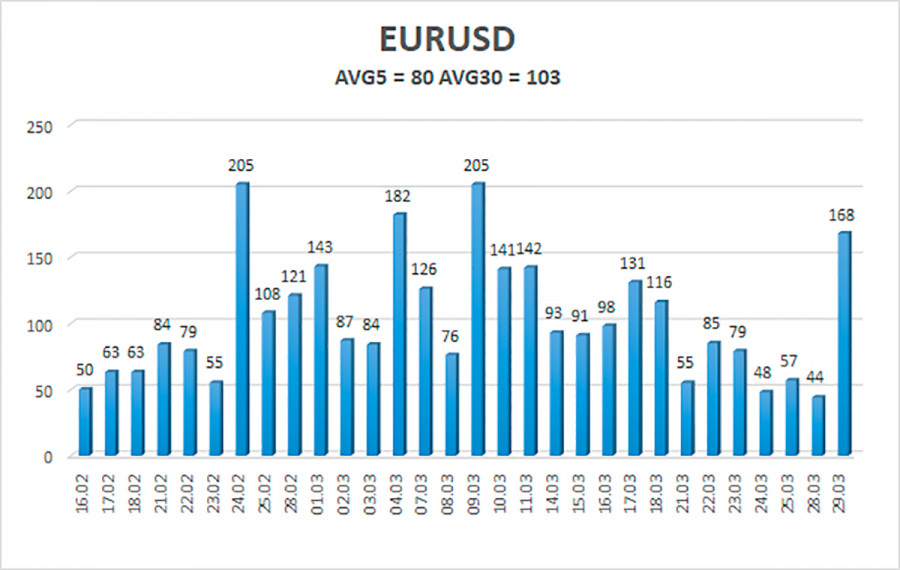

The volatility of the euro/dollar currency pair as of March 30 is 80 points and is characterized as average. Thus, we expect the pair to move today between the levels of 1.0996 and 1.1155. A reversal of the Heiken Ashi indicator upwards will signal a new round of downward movement.

Nearest support levels:

S1 – 1.0986;

S2 – 1.0864;

S3 – 1.0742.

Nearest resistance levels:

R1 – 1.1108;

R2 – 1.1230;

R3 – 1.1353.

Trading recommendations:

The EUR/USD pair has risen to the level of 1.1108 for the third time in recent weeks and again failed to overcome it. Thus, now we recommend considering new long positions with a target of 1.1230 if the price overcomes 1.1108. Short positions should be opened with a target of 1.0864 if the pair is fixed below the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching