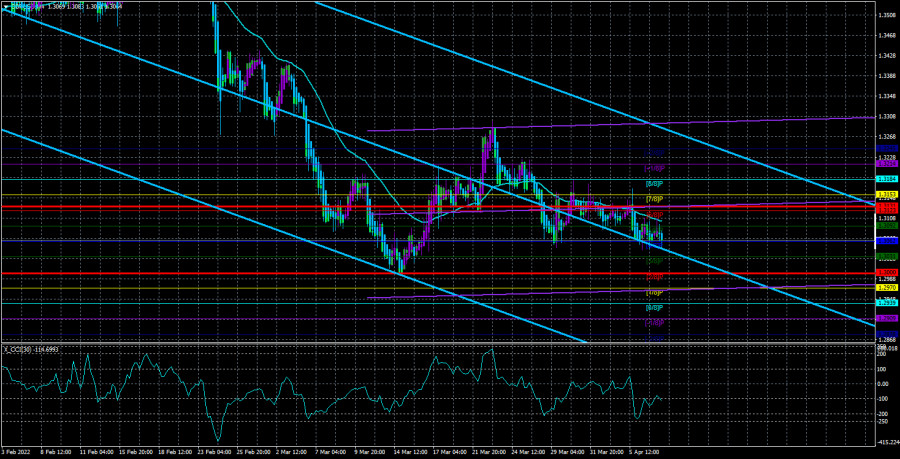

The GBP/USD currency pair on Thursday continued to tread not far from the Murray level of "4/8" - 1.3062. The pair has already tried to overcome this level once, but unsuccessfully. After that, it adjusted by an "unrealistic" 100 points, failed to overcome even the moving, and eventually fell back to the level of 1.3062. It can be seen that at this level, traders are already afraid to sell the pound further since it is already near its 15-month lows. However, if new "complications" arise in Ukraine, then the pound will fly down very quickly and cheerfully. So far, there has been some relative calm in Ukraine. The fighting does not stop, but still has not the same intensity as a few weeks ago. Therefore, the foreign exchange market froze, waiting for the situation to develop.

At the same time, the UK continues to put pressure on Russia. According to the latest information, London is going to send armored vehicles to Ukraine. We are talking about Mastiff and Chakal, which can be used for patrolling and small-caliber battles. In addition, London is going to send new batches of anti-tank missiles and anti-aircraft guns to Ukraine. To top it all off, London insists on the refusal of the European Union to import oil, gas, and coal from Russia. Yesterday, a scandal about this almost broke out in the European Parliament after the former Prime Minister of Belgium, and now MP Guy Verhofstadt, said that since the beginning of hostilities in Ukraine, the European Union has paid Russia 35 billion euros for oil and gas and helped Ukraine with 1 billion euros. Moreover, the European Union refused to impose an embargo on coal imports immediately, this restriction will start working only in August. In general, so far the European Union has no consensus on the dilemma of "helping Ukraine or buying hydrocarbons in Russia." That is why Biden and Johnson continue to criticize the European Union, which cannot take a clear position on this issue.

Fed minutes: a strong rate hike, a reduction in the Fed's balance sheet.

It should also be noted the latest Fed minutes, which were published on Wednesday evening. Let's say right away: its content did not become some kind of revelation or surprise for the markets. Yes, the dollar "stirred up" a little after its publication, but traders calmed down very quickly, and the euro and the pound refrained from new falls against the dollar. Nevertheless, it should be noted that the loops on the necks of the pound and the euro continue to tighten. This time it became thoroughly known that already in May, the sale of treasury and mortgage bonds from the Fed's accounts for $ 95 billion per month could begin. If such rates are maintained, the Fed's balance sheet will decrease by about $1.1 trillion per year. This means that it will take 8 years to completely get rid of all securities.

However, the time is not important, the trend is important. And the trend now is that the Fed continues to strengthen its "hawkish" rhetoric. And this rhetoric increasingly indicates that the Fed will soon begin active actions instead of constant threats. This is exactly what the stock market, the cryptocurrency market, and other risky assets were afraid of. But this state of affairs is only to the advantage of the dollar. What is the current situation? The euro and the pound are falling due to the geopolitical conflict in Ukraine and due to the weakness of the positions of the Bank of England and the ECB in monetary policy issues. And the dollar is growing because of the strength of the Fed's position and because it has the status of a reserve currency. It turns out a double effect. And with such a fundamental background, how can we expect the strengthening of European currencies? To top it all off, it should be noted that the United States is going to refuse any G-20 summits if delegations from Moscow are present at them. This was stated yesterday by Finance Minister Janet Yellen.

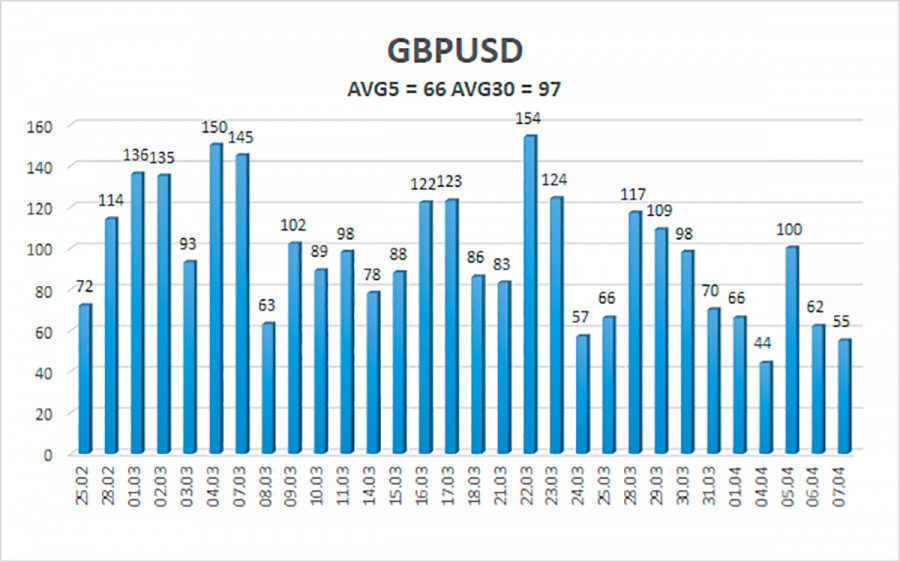

The average volatility of the GBP/USD pair is currently 66 points per day. For the pound/dollar pair, this value is the average. On Friday, April 8, therefore, we expect movement inside the channel, limited by the levels of 1.2999 and 1.3131. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement, but the pair needs to gain a foothold below 1.3062 to continue falling.

Nearest support levels:

S1 – 1.3062;

S2 – 1.3031;

S3 – 1.3000.

Nearest resistance levels:

R1 – 1.3092;

R2 – 1.3123;

R3 – 1.3153.

Trading recommendations:

The GBP/USD pair continues its downward movement in the 4-hour timeframe. Thus, at this time, sell orders with targets of 1.3000 and 1.2970 should be considered if the pair is fixed below 1.3062. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3153 and 1.3184. At this time, the probability of a flat is high.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.