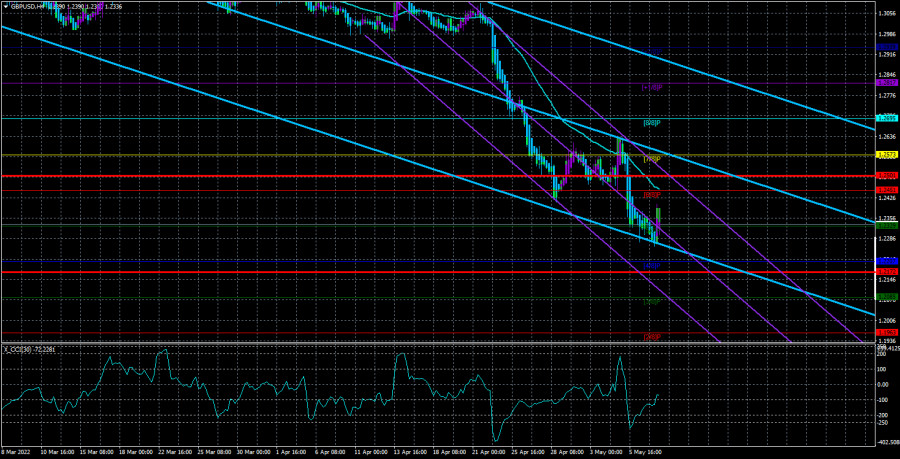

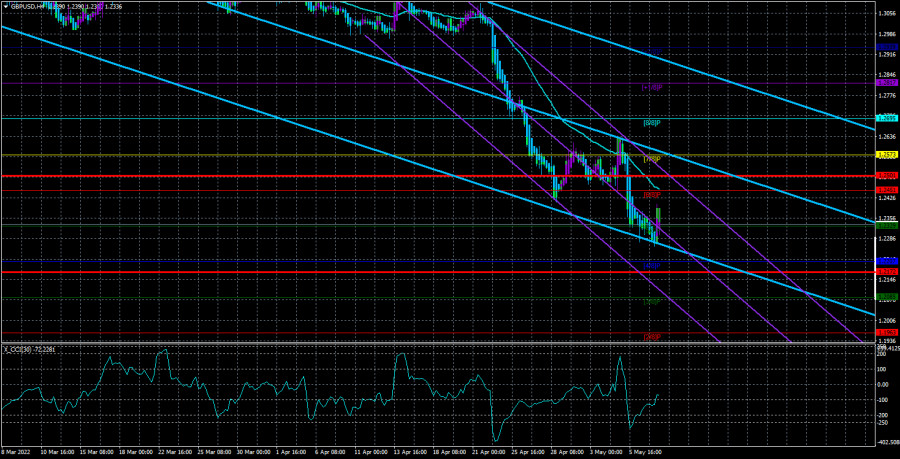

The GBP/USD currency pair began a sharp rise on Monday, almost out of the blue. On the first trading day of the week, no important macroeconomic or fundamental events were planned, so there was absolutely nothing for traders to react so zealously during the day. Nevertheless, the pound has started to grow and if this movement does not end today, then there is hope for the end of the downward trend. Or at least the formation of a strong upward correction, which we have been waiting for for a long time. As we said earlier, the fundamental background of the British pound is not as bad as that of the euro currency. However, last week, as soon as BA raised the rate for the fourth time in a row, the pound collapsed like a stone, which, at least (and, at most, too), is illogical. Plus, the pound/dollar pair has not seen a correction for a very long time, and no currency can move in the same direction all the time. Therefore, we would say that a turning point is coming in the foreign exchange market when traders have already worked out all the sanctions, the geopolitical conflict in Ukraine and its consequences for Europe, and possible energy and food crises. Now it's time to at least fix the profit on short positions.The technical picture remains unchanged so far. In the near future, the price may consolidate above the moving average line, but both channels will be directed down for some time. However, there is nothing wrong with this, because any trend starts small. On the 24-hour TF, yesterday's growth of the pound cannot yet be considered the starting point for a new upward trend, although the price has rebounded from the support level of 1.2267.

The West continues to impose sanctions on everything it sees.

Yesterday, it became known that the United States imposed new sanctions on Russia. This time they touched upon several heads of financial organizations. In particular, the "black list" included the heads of Gazprombank and Sberbank. In addition, several companies were banned from providing accounting and consulting services. The European Union has not yet introduced the sixth package of sanctions, but there is no doubt that it will do so in the near future. The EU is also going to deal another blow to the Kremlin and ban the insurance of ships carrying Russian oil. According to experts, this step could become a serious obstacle to oil exports from the Russian Federation and block access to the world oil market. It is noted that some "maritime" EU countries are concerned about this, as they have existing contracts with large oil companies for the supply of Russian oil.

The UK did not stay away from this trend either. On Sunday, a new package of sanctions against Russia worth $ 1.7 billion was announced. As reported, this package of sanctions will affect the sphere of trade. Import duties will be imposed on a variety of goods, including palladium and platinum. Thus, Europe and America continue to restrict financial flows to Moscow to end the hostilities on the territory of Ukraine as soon as possible. So far, it turns out very badly, since the Kremlin is frankly not afraid of sanctions. Moscow has even stopped commenting on the new introduction of certain restrictions. The fighting, meanwhile, continues and there is no doubt that they will continue in the coming months or even years. However, their intensity and scope are slowly decreasing. Russian troops failed to reach the borders of the Donetsk and Luhansk regions but managed to capture Mariupol and Kherson. In recent weeks, there have been several local victories, but without serious progress inland. Thus, the conflict is sluggishly moving towards "Donbas 2.0". However, Kyiv openly declares that there is no "Donbas 2.0" will not be. As soon as Ukraine accumulates sufficient military power at the expense of Western weapons, the AFU will launch a counteroffensive and will fight until it completely liberates its lands. Including Crimea and Donbas. There may be several escalations only this year.

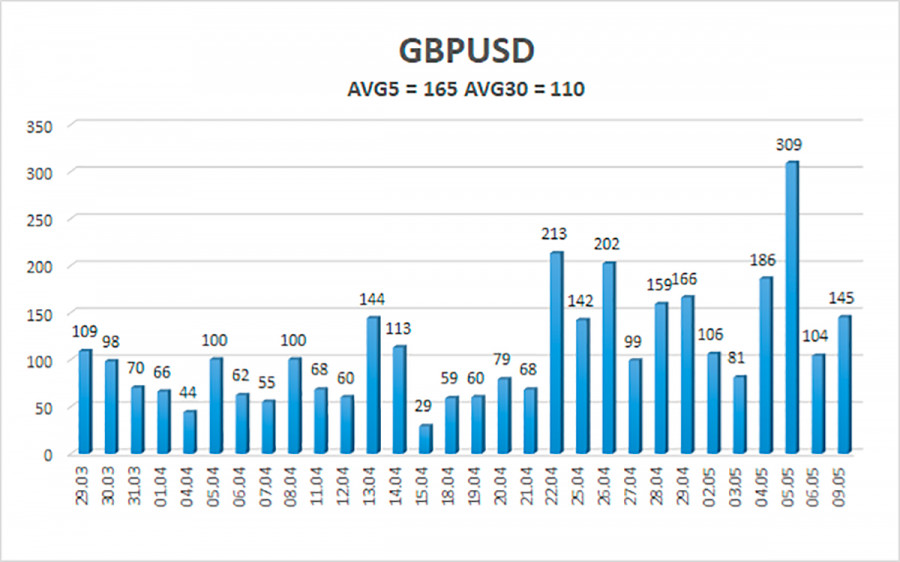

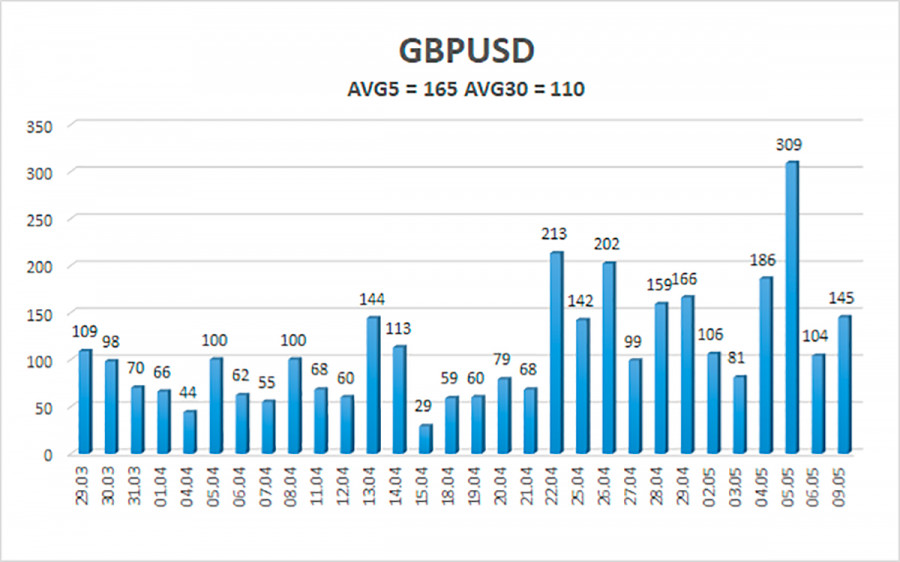

The average volatility of the GBP/USD pair over the last 5 trading days is 165 points. For the pound/dollar pair, this value is "very high". On Monday, May 9, thus, we expect movement inside the channel, limited by the levels of 1.2172 and 1.2501. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.2329

S2 – 1.2207

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2573

R3 – 1.2695

Trading recommendations:

The GBP/USD pair maintains a downward trend in the 4-hour timeframe. Thus, at this time, new ones should be considered for sale with targets of 1.2207 and 1.2172 after the reversal of the Heiken Ashi indicator down. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2573.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.