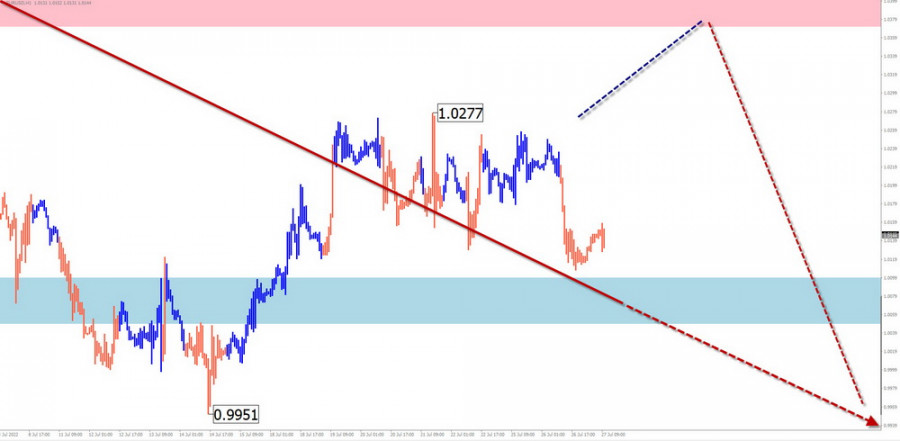

EUR/USD

Analysis:

The downward trend continues in the market for the main pair of the European currency. The unfinished section of the dominant wave has been counting since the end of May. The price has reached the support level of the weekly chart scale. For the current month, the quotes formed a counter correction, which has not been completed yet.

Forecast:

In the upcoming weekly period, the sideways vector of price movement in the range between the nearest zones is expected to continue. Moreover, pressure on the support zone is possible at the end of the current five-day period. A change of direction and a resumption of price growth are likely next week.

Potential reversal zones

Resistance:

- 1.0370/1.0420

Support:

- 1.0100/1.0050

Recommendations:

There are currently no conditions for trading activity on the euro market. After the appearance of reversal signals in the area of the support zone, short-term purchases will become possible. A conservative tactic would be to refrain from entering the pair's market until the end of the upcoming price rise, with the search for sell signals in the area of the resistance zone.

USD/JPY

Analysis:

The upward trend continues to develop in Japanese yen major pair market. Within the framework of the last unfinished section of June 16, quotes over the past two weeks have been forming the beginning of a wave zigzag correction.

Forecast:

The general sideways course of the pair's movement in the coming days is expected to continue. Until the end of the week, you can expect the price to rise in the area of the resistance zone. At the beginning of next week, the probability of a reversal and resumption of the downward course increases. The support zone shows the lower limit of the weekly course of the pair.

Potential reversal zones

Resistance:

- 137.50/138.00

Support:

- 133.60/133.10

Recommendations:

Short-term yen sales will be possible in the coming days. Limiting transactions to individual trading sessions with a reduced lot is recommended. It is recommended to focus on the search for buy signals in the area of the support zone.

GBP/JPY

Analysis:

The upward trend wave continues in the cross-pound market against the yen. The last unfinished section of the movement counts down from May 12. A flat corrective figure has been developing within its framework in the last two months, resembling a "pennant."

Forecast:

By the end of the week, it is possible to continue the attempt to reduce the price and the support zone. On Friday or at the beginning of next week, the probability of a reversal and a resumption of the price rise increases.

Potential reversal zones

Resistance:

- 168.50/169.00

Support:

- 162.00/161.50

Recommendations:

In the coming days, sales on the pair's market can be quite risky. It is optimal to refrain from entering the pair's market until the confirmed buy signals appear in the area of the support zone.

USD/CAD

Analysis:

On the Canadian dollar chart, the upward wave leading the report since May last year has not been completed. In the structure of the last section from June 7, the middle part of the wave structure (B) is formed in the form of a stretched plane.

Forecast:

The downward movement vector is expected to be completed by the end of this week. Further, in the area of the support zone, you can count on the formation of a reversal. At the beginning of next week, the probability of resuming the bullish course of the pair's price fluctuations increases.

Potential reversal zones

Resistance:

- 1.3180/1.3230

Support:

- 1.2830/1.2780

Recommendations:

There is no potential for selling the Canadian dollar. It is recommended to monitor all emerging reversal signals for the purchase of the instrument.

GOLD

Analysis:

In the short term, the bearish wave of March 8 sets the direction of the gold movement. This section of the movement completes a larger descending wave structure. The price has reached the boundaries of strong resistance, along which a correction of the wrong kind has been developing since June.

Forecast:

The upward movement vector is expected to be completed by the end of this week. In the area of the resistance zone in the flat, you can wait for the formation of a reversal. The beginning of the decline is more likely next week.

Potential reversal zones

Resistance:

- 1750.0/1765.0

Support:

- 1680.0/1665.0

Recommendations:

Buying gold in the coming days can be risky and lead to deposit losses. It is recommended to refrain from entering the instrument's market until confirmed signals for sale appear in the area of the resistance zone.

Explanations: In the simplified wave analysis (UVA), all waves consist of 3 parts (A-B-C). On each TF, only the last, incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Attention: The wave algorithm does not consider the duration of the movements of the instruments in time!