The GBP/USD currency pair also continued a fairly confident upward movement during Tuesday. Before the publication of the US inflation report. Unfortunately, as in the case of the euro currency, this growth can be recognized as a banal correction as part of a long-term downward trend since yesterday, the pair collapsed by 200 points. Nevertheless, the downward trend must end sooner or later, and each subsequent upward pullback gives additional chances for completion. It should be noted that the euro and the pound are trading almost identically again, which, from our point of view, somewhat facilitates the forecasting process. Although the September meeting of the ECB has already taken place, and the meeting of the Bank of England has been postponed for a week, both European currencies are moving almost the same. The current moment may be a "turning point" for a long fall in the euro and the pound. The euro currency updated its 20-year lows during this movement, and the pound – 37-year lows. However, we also believe that the market should not stop there, and yesterday's inflation report helped it greatly. Now the pound and the euro currency can resume the global trend and update their multi-year lows several more times. It turns out that one report destroyed all the hopes of the bulls, all the hopes of the euro and the pound, which had just begun to find their fundamental trump cards in the confrontation with the US currency.

Also, note that the pound sterling is now falling faster than the European currency. The market did not want to buy the pound in the last few days, but the euro pulled up the British currency. It is strange since it should have been the other way around. After all, the Bank of England has already raised the rate six times in a row. At the last meeting, it raised it by 0.5%, and, most likely, it will also raise it by 0.5% next week. But the ECB has only raised its rate twice. Therefore, the pound should grow stronger and fall less. It would help if you kept in mind the moment that the downward trend may end in the near future, which means you can also count on the long-term growth of the pound. But do not forget that the "bearish" mood could not disappear in a couple of days, and yesterday only confirmed this assumption. The pair is already below the moving average, so it can continue to fall.

Commerzbank believes that the pound may resume falling.

Meanwhile, many experts continue to voice their skeptical points of view regarding the pound. According to Commerzbank experts, postponing the BA meeting for a week is a positive moment for the regulator, as it will have more time to "digest" the inflation report for August and "make sure that it is not doing enough to slow it down." In the UK, inflation is now the highest among those countries we regularly survey. If inflation in the Kingdom is higher, the regulator should raise the rate more strongly and faster. However, we see that, in comparison with the Fed, the Bank of England is slow. It is this moment that can upset market participants and lead to a new fall in the pound.

Commerzbank also notes that the latest GDP report turned out to be weak, but it does not give grounds for the Bank of England not to continue raising the rate. But the unemployment report, which showed its decline to 3.6%, on the contrary, should allow the regulator to tighten monetary policy more confidently or even strengthen its monetary pressure. The bank also admits that the rate may rise immediately by 0.75% in September, although official forecasts indicate an increase of only 0.5%. If the Bank of England surprises and increases the rate more than the market expects, the pound may get a new boost to the growth it needs. The market may believe that the British regulator is doing everything to return inflation to the target level.

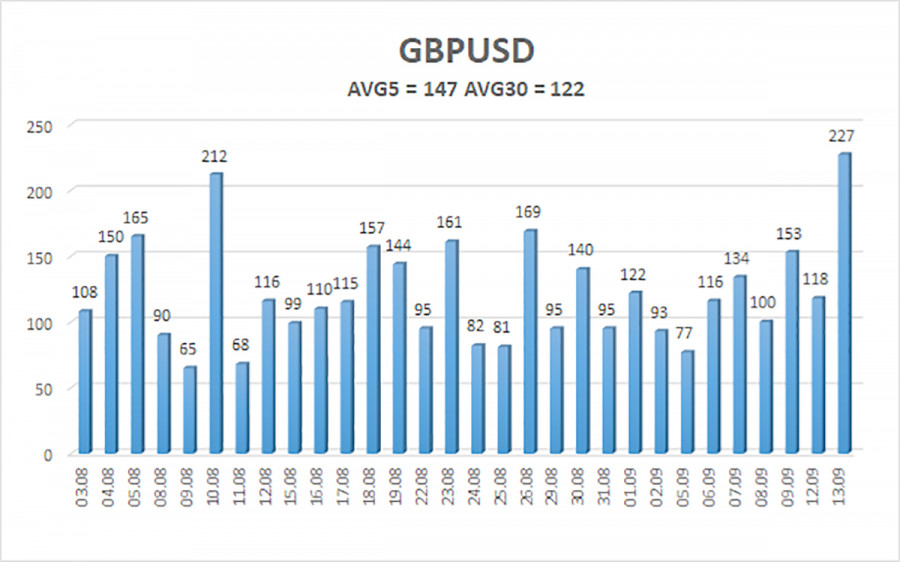

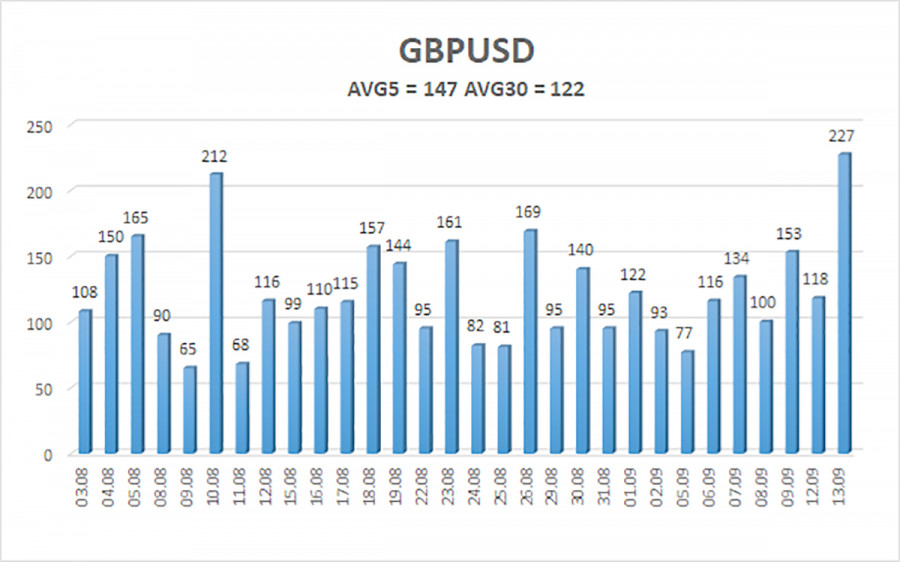

The average volatility of the GBP/USD pair over the last five trading days is 147 points. For the pound/dollar pair, this value is "high." On Wednesday, September 14, thus, we expect movement inside the channel, limited by the levels of 1.1389 and 1.1683. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.1536

S2 – 1.1475

S3 – 1.1414

Nearest resistance levels:

R1 – 1.1597

R2 – 1.1658

R3 – 1.1719

Trading Recommendations:

The GBP/USD pair has overcome the moving average on the 4-hour timeframe and may begin a new round of downward movement. Therefore, at the moment, sell orders with targets of 1.1475 and 1.1389 should be considered if the price manages to stay below the moving average line. Buy orders should be opened when fixed above the moving average with targets of 1.1683 and 1.1719.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.