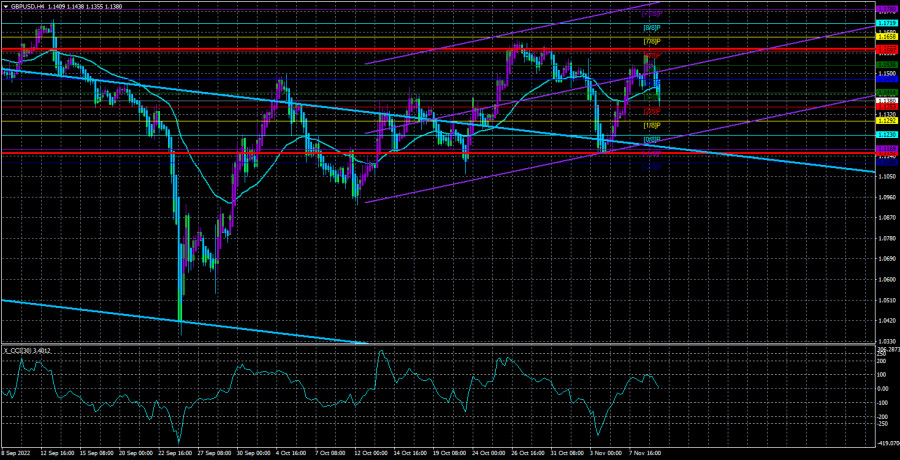

The GBP/USD currency pair also began to adjust on Wednesday but, at the same time, failed to overcome the moving average confidently. As in the case of the euro currency, the pair failed to update its last local maximum, so there are certain reasons to assume that the upward trend will be completed at this point. Recall that just a few days ago, the price overcame the Senkou Span B line on the 24-hour TF, which opens up good prospects for it. However, the fundamental and geopolitical backgrounds remain such that it is very difficult to believe in the pound's growth over a long distance. Moreover, we still believe that the growth of the British currency in the last few days was illogical. This week, there was no important macroeconomic event in the US or the UK. At the expense of what did the pound grow then?

Thus, we still believe that the pair's fall is more likely than its growth. Recall that bitcoin has been around the important $18,500 level for several months, bouncing 15 or 16 times. But in the end, when everyone thought growth had begun, he took "acceleration" before breaking through the "reinforced concrete" level. Therefore, we can observe something similar in currency pairs. Perhaps the movement we are seeing now is illogical and groundless – it's just an attempt by traders to drive the pairs higher so that they can sell at a more favorable rate. Recall that the UK and its economy are no longer just on the verge of recession. They already have one foot in this "swamp." This Friday, a report on GDP for the third quarter will be published, likely to turn out negative and will be the first in a series of failed reports. Thus, the pound has neither economic grounds for growth nor the support of the Bank of England nor geopolitical grounds.

Interim results of the US parliamentary elections

One of the most interesting recent topics has been the US Parliament's midterm elections. We want to make a reservation right away that the fall of the dollar is unlikely to be related to them since, at the moment, it is not even clear who will establish control over both chambers. Yes, the interim results speak in favor of the Republicans, but this statement is true only for the lower house. Currently, 199 seats out of 435 go to Republicans and 172 to Democrats. That is, the fate of 64 more seats is still unknown, and even the current leadership of the Republicans can be lost easily. Experts note that the second round of voting may be required in some states, which will occur no earlier than December. In some states, the votes have not yet been fully counted, and the results are very close, so the scales may tilt in either direction. Experts also believe that final results should not be expected in the coming days because counting millions of votes is not a fast process. There are states where the results are obvious, and all votes need not be considered for intermediate results. But such a picture does not develop everywhere.

As for the Senate, the Republicans are leading by a margin of 1 vote. However, the fate of 5 more senators remains unknown, so the Democrats can calmly level the gap here. Recall that with equal seats in the Senate, of which there are only 100, the decisive vote will remain with Kamala Harris, who is a representative of the Democratic Party. Therefore, Democratic senators need to get three votes out of the remaining 5 to win the election to the Senate. If Republicans win in the House of Representatives, they will be able to block some of the Democrats' decisions, but they will not be able to make their own decisions alone. Both ruling parties will have to negotiate with each other on all important issues, which is perhaps even good.

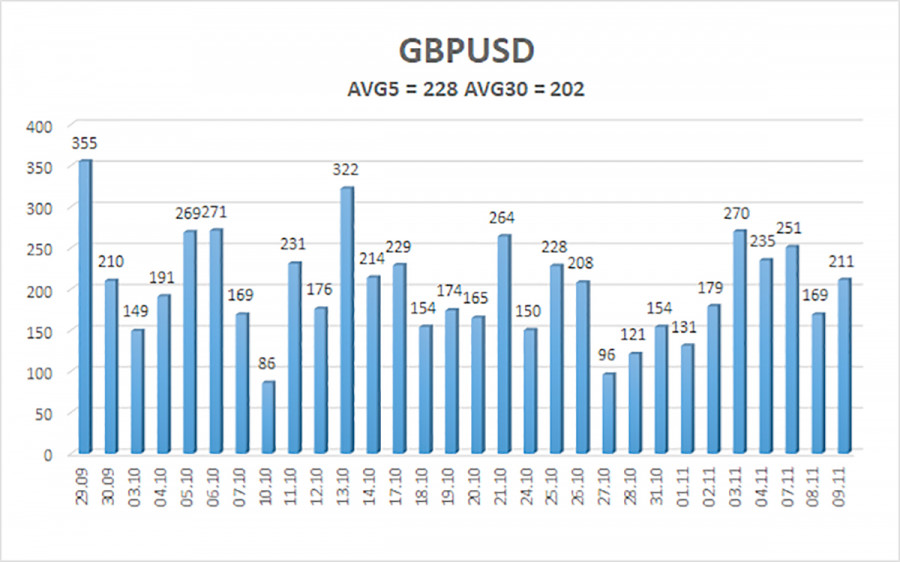

The average volatility of the GBP/USD pair over the last five trading days is 228 points. For the pound/dollar pair, this value is "high." On Thursday, November 10, thus, we expect movement inside the channel, limited by the levels of 1.1152 and 1.1607. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading Recommendations:

The GBP/USD pair has started a new downward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1230 and 1.1152 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average with targets of 1.1536 and 1.1607.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.