On Thursday, the GBP/USD currency pair started moving lower again. In our previous post, we stated that a consolidation above the moving average by 10–20 points is not an indication that the trend should be changed and that we should instead wait for the slide to resume. Even without the assistance of the nonfarm payroll and unemployment data in the United States that would be released on Friday, this prognosis was fulfilled the very next day. In general, we've already stated that there are many causes for the current decline in the value of the euro and the pound. The ECB and BA should not have slowed down the tightening of monetary policy after the December meeting because inflation is still quite high and has only slowed down once. This is where it all began. Nevertheless, the euro and the pound continued to rise through inertia for a while. However, the situation is now shifting to the contrary, and the market is beginning to take into account all of the elements, not just the euro's and the pound's favorable characteristics.

Additionally, it might be said that the global epidemiological situation's deterioration is a factor supporting the dollar. Keep in mind how much the US dollar increased at the start of the pandemic. It's also unlikely that rumors of a severe and protracted recession in the British economy would be seen as a plus for the pound. According to the technical picture, the pound has amazingly increased by 2,000 points in just 2.5 months. Everything, absolutely everything, points to the pair falling, which it currently is. The Fed's protocol, along with favorable data this week from elsewhere, served as the "cherry on top." If the market continues to see positive non-farm data, low unemployment, and a stable ISM services sector index, the US dollar may strengthen even further. After that, we must wait for a protracted period of consolidation because the market has already determined what the ECB, Fed, and BA rates are most significant for. As a result, the geopolitical and epidemiological context will be highlighted. The pound may trade on the "swing" basis for several months if these two elements do not significantly deteriorate, but on a 4-hour TF, there will only be movements of 400–500 points in each direction.

The ideal way to round up the week is with NonFarm Payrolls.

I want to say right now that this week's market surprised us a little bit. We had hoped the flat would stay a little while longer, but traders jumped right into the fray at the start of the year. At least three volatile days have already occurred this week, and today might be the fourth. The macroeconomic backdrop for Friday is the best of the week. Today, the pound may advance even further if it has previously advanced by 130 to 180 points. The key question right now is what the nonfarm will be. We want to emphasize once more that although this indicator has been declining for almost a year, it has not dropped below its "normal" level. Non-farms surged up after the Fed pushed the economy with low rates and the QE program following the pandemic; now, instead of decreasing in the strict sense of the word, they are merely returning to their regular values. We estimate that this indicator typically registers 200–300k new positions per month. 200-220 thousand is the predicted number for December. Between 200 and 300 thousand over the past four months. The most recent reports showed results above expectations. From our perspective, all of these data suggest that the value of Non-Farms won't fall below 200,000 tomorrow. Of course, it might be anything, but the market ought to see any worth over $200,000 favorably.

The same is true with unemployment. It wouldn't be disastrous if it suddenly increased to 3.8% (just stronger), given 3.5% has been the minimum during the past 50 years. Market participants are unlikely to think that the 3.5% unemployment rate is the only issue that could affect dollar purchasing. Therefore, we think that the currency will keep rising if the American numbers do not fail today. If it fails, the value of the dollar may decrease locally, but it will then start to rise once more.

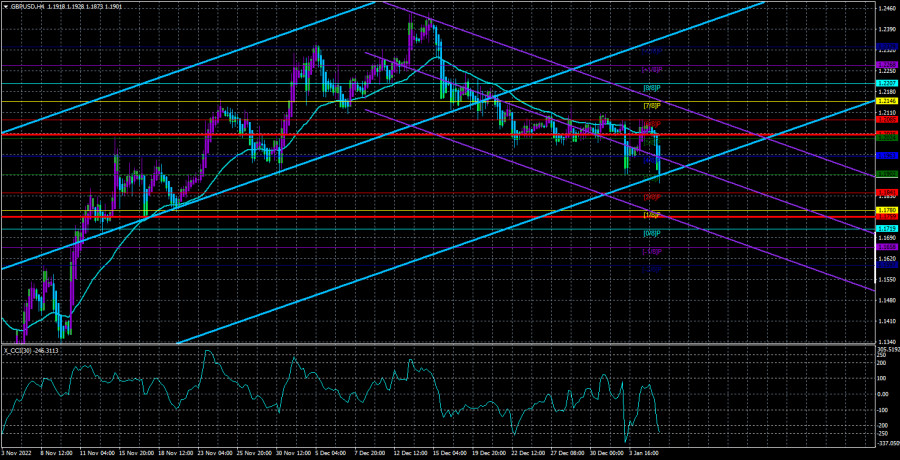

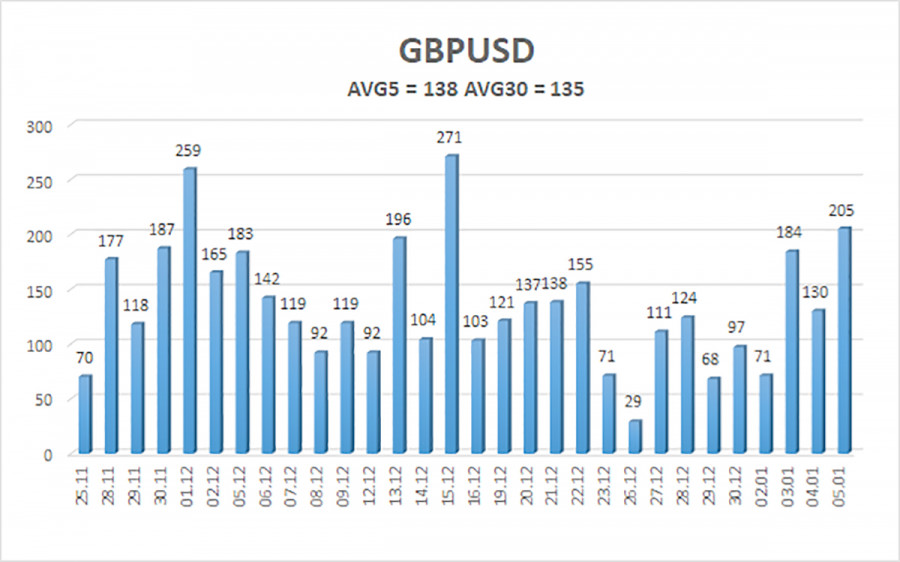

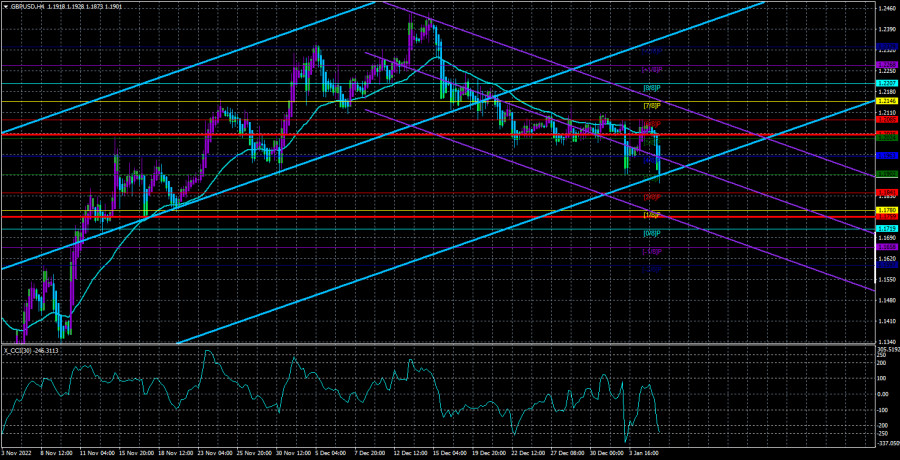

Over the previous five trading days, the GBP/USD pair has averaged 138 points of volatility. This figure is "high" for the dollar/pound exchange rate. Thus, we anticipate activity inside the channel on Friday, January 6, with movement being constrained by levels of 1.1759 and 1.2035. A new round of upward correction will begin when the Heiken Ashi indicator reverses to the upside.

Nearest levels of support

S1 – 1.1902

S2 – 1.1841

S3 – 1.1780

Nearest levels of resistance

R1 – 1.1963

R2 – 1.2024

R3 – 1.2085

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair finished its sideways pattern and started back down. Therefore, until the Heiken Ashi indicator turns up, you should hold short positions with targets of 1.1841 and 1.1759. Open long positions with targets of 1.2146 and 1.2207 if the price confidently consolidates above the moving average.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.