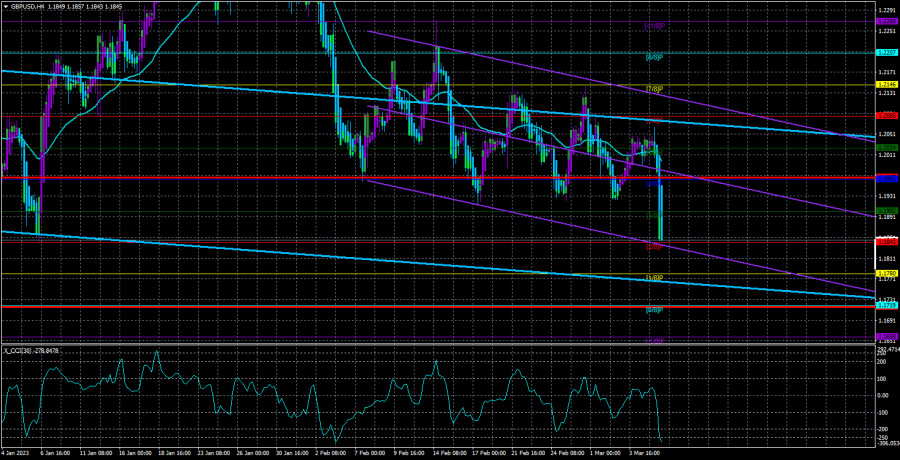

The GBP/USD currency pair also began a decline on Tuesday, which few predicted. In addition, we anticipated that the decrease would occur gradually rather than rapidly. The pair had been in "swing" mode for several weeks, but yesterday it managed to break through the level of 1.1932, which served as the bottom border of the side channel in which the "swing" was realized. If you look closely at the chart above, you will note that even in flat conditions, each succeeding price peak was lower than the one before it. The price attempted to break through the 1.1932 level at least three times, each time rebounding off it by a smaller distance. That is why we have consistently stated that we expect the pair to collapse again.

The British pound is still overbought, as seen by its 2,100-point increase in just three months towards the end of the previous year. The British pound frequently increased irrationally and too rapidly reversed a two-year decline by 50%. There aren't many reasons right now that could help the pound rise and the ones that did earlier have long since been figured out by traders. Hence, a new decline in the value of the pound was inevitable. The only uncertainty was the exact commencement time. Although we could not fully rule it out, we did not anticipate it to begin yesterday. Jerome Powell didn't mention anything fundamentally new in Congress. The mood of market participants is undoubtedly affected whenever the head of the Fed publicly states his willingness to speed up the tightening of monetary policy once more, but as we previously stated, everything has been leading up to this for a very long time. If the market did not understand this, then everything makes sense, because it received grounds for additional dollar purchases "straight in the forehead" yesterday.

The pair fell to the crucial Fibonacci level of 38.2% (1.1842) on the 24-hour TF. The likelihood that the pair will continue to decline will increase with a confident passing of this level, which from our perspective would be quite rational. Additionally, near the level of 1.1842, the Senkou Span B line ran for a while, which had only recently moved higher. As a result, overcoming 1.1842 will allow bears to fall further. Then, the targets will fall between 1.13 and 1.15.

What is the British pound currently capable of?

This week in the UK, there won't be many particularly significant publications. Of course, we're referring to the GDP and industrial output numbers that will be released on Friday. These are viewed in the same way as Jerome Powell's congressional speeches. If there is no "surprise" or outright surprise, there will almost certainly be no reaction. It is a fact that the GDP data will be released monthly rather than quarterly, and that the report on industrial production has not recently piqued the curiosity of traders.

It is also challenging to anticipate support for the pound from US news and events. Powell is unlikely to modify his rhetoric today when he speaks in the same Congress but before a different committee. What else is in store for us this week? Only the nonfarm and unemployment reports from Friday. It is doubtful that unemployment will increase, at least not much. Therefore, a 0.1% increase will not justify selling the dollar. The Nonfarm data for February might even fall short of expectations, but all will depend not on the actual number but rather on the projection and how closely the actual figure corresponds to it. Consequently, even if the projection is overly optimistic, it will still cause the dollar to increase. The British pound can only increase if Non-Farm Payrolls have a dreadful value. And not for long, because the market is already expecting the Fed to tighten its monetary policy or accelerate rate hikes. And this is the most "bullish" aspect that can exist, negating all the others. Thus, we do not anticipate significant growth of the pair in the foreseeable future. When Andrew Bailey releases a "hawkish" report, perhaps something will change. We do not currently see any way that the "bearish" market sentiment can change to "bullish," whether it is before or after the Fed and BA's next meetings. You need to make a small adjustment after yesterday's collapse, but the Heiken Ashi indicator should identify the corrective and not try to predict when it will start.

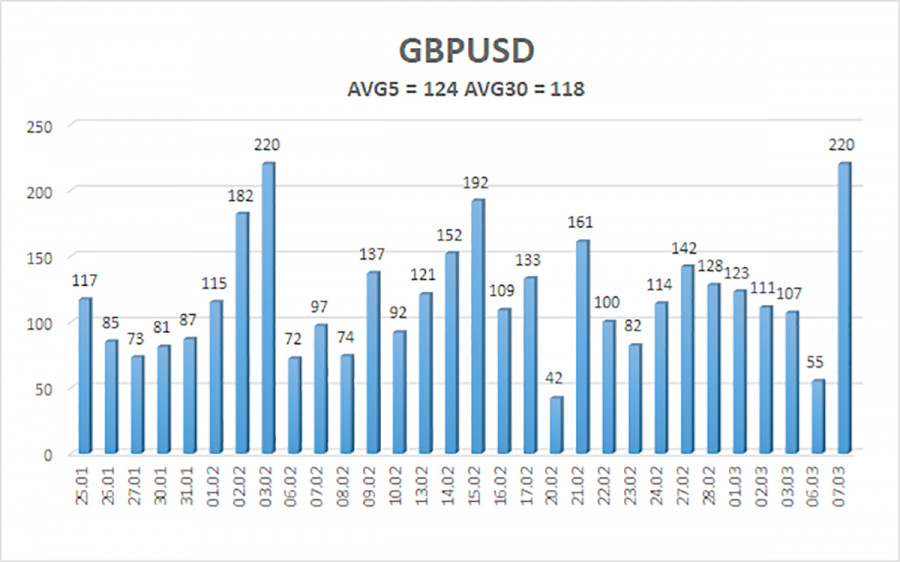

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 124 points. This value is "high" for the dollar/pound exchange rate. As a result, on March 8 we anticipate movement that is contained inside the channel and is limited by levels 1.1719 and 1.1967. A round of upward corrective is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.1841

S2 – 1.1780

S3 – 1.1719

Nearest levels of resistance

R1 – 1.1902

R2 – 1.1963

R3 – 102024

Trade Suggestions:

In the 4-hour timeframe, the GBP/USD pair once more stabilized under the moving average. Unless the Heiken Ashi indication turns up, you can continue to hold short positions with targets of 1.1780 and 1.1719. If the price is stable above the moving average, long positions with targets of 1.2024 and 1.2085 may be taken into account.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which to trade right now are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.