The EUR/USD currency pair took an early break on Friday due to the start of the Easter holidays worldwide. The Orthodox follow the Catholic tradition in celebrating them first. Last Friday was Good Friday, so the market was immobilized in the morning. No important macroeconomic statistics are typically published on holidays, but this time it was different. The US had planned to release non-farm payrolls, wages, and unemployment data. And from the morning, the question arose of how the market would react on a semi-holiday to these crucial reports. As practice showed, there was practically no reaction. Throughout the week, there were rumors that the US labor market was slowing down and unemployment was rising. We warned that most of the time, panic about the American economy is caused by the market and experts themselves. So far, everything is fine with it, and the dollar has a few reasons to fall. On Friday, it became known that the number of non-farm payrolls in March met expectations, and the unemployment rate dropped again. That is, the package of statistics is quite positive, and the dollar managed to rise by 40 points, but by the evening, it had lost all its hard-earned advantage.

Thus, only one thing can be said: the market once again ignored important statistics, needed to work them out properly, and the dollar did not grow in a situation where it had an excellent opportunity to do so. Perhaps this week, the market will come to its senses and start buying the American currency, which continues its relentless and baseless decline. But this is still being determined. The pair is still above the moving average line, meaning we don't have a formal sell signal. Therefore, the growth of the pair's quotes may resume at any moment. The euro should still show a new round of global correction. On the 24-hour TF, it is visible what we mean.

The European Union is celebrating.

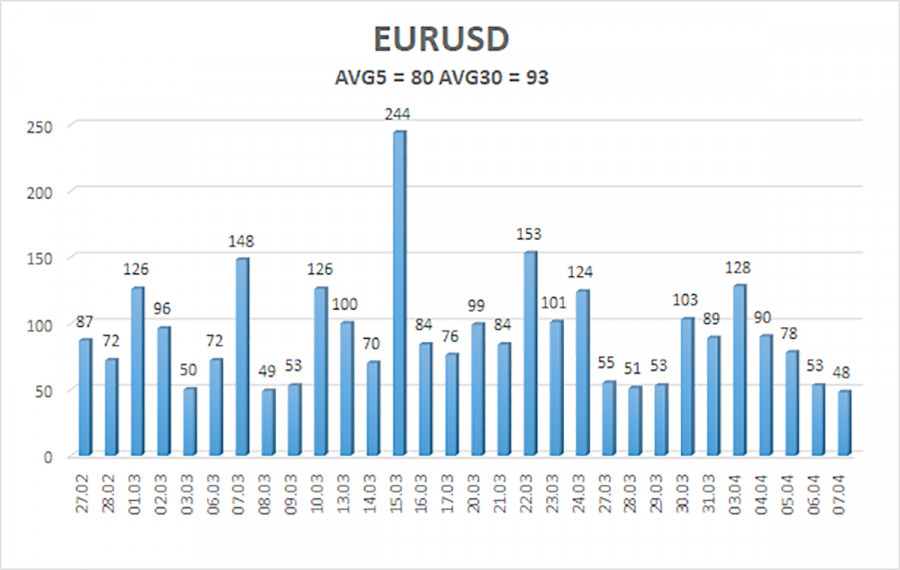

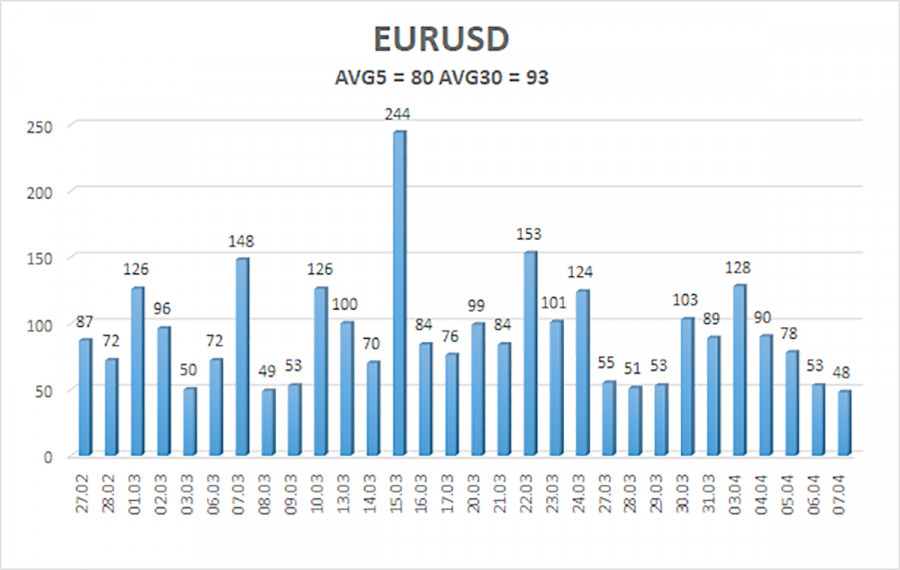

Last week was quite boring regarding macroeconomic and fundamental aspects. Volatility indicators fell almost to zero. And if there is no volatility, it does not matter whether the movement is trending or non-trending. It is impossible to trade when the pair moves from the daily minimum to the maximum of 40 points. Therefore, it would be nice to have important data this week so the market does not sleep and only eats Easter treats. However, this week's fundamental situation is no better than last week, even worse.

The economic calendar for the European Union this week:

Monday - nothing

Tuesday - retail sales

Wednesday - speech by Vice President Luis de Guindos

Thursday - inflation in Germany and industrial production

Friday - nothing.

Although the macroeconomic event calendar is not empty, what can theoretically wake traders from their slumber?

So, during the week, people should be ready for low volatility, illogical, chaotic, and unpredictable changes. If this is the case, trading the pair will be very difficult. At this time, some traders may hope for the price to consolidate below the moving average, but let us remind you that such consolidation, even in good times, only means that the trend may change direction. And now the pair can go below the moving average and resume growth within a few hours, as the dollar has fallen out of favor with market participants. In general, caution is the only advice under the current circumstances. If we see that volatility is zero or flat, it is better not to enter the market.

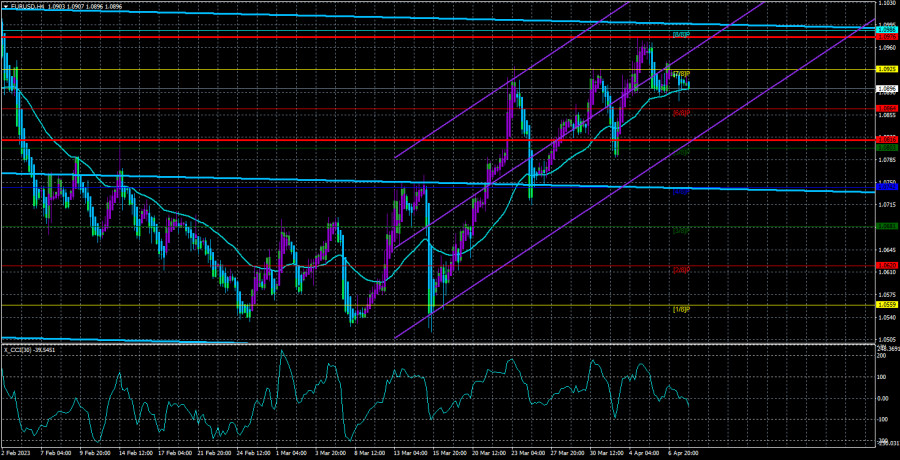

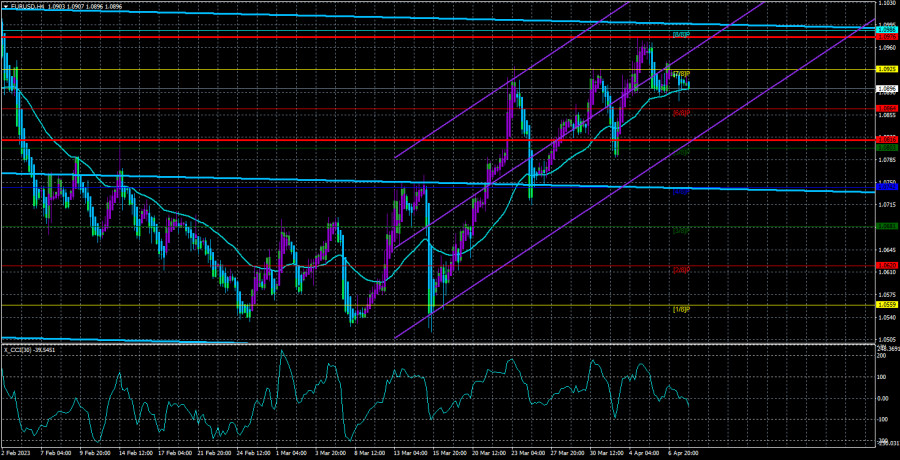

The average volatility of the EUR/USD currency pair for the last five trading days as of April 10 is 80 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0816 and 1.0976 on Monday. The reversal of the Heiken Ashi indicator back up will indicate a resumption of the upward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0803

S3 – 1.0742

Nearest resistance levels:

R1 – 1.0925

R2 – 1.0986

R3 – 1.1047

Trading recommendations:

The EUR/USD pair remains above the moving average line. New long positions with targets of 1.0976 and 1.0986 can be considered if the Heiken Ashi indicator is reversed upwards or if a price bounces from the moving average. Short positions can be opened after the price consolidates below the moving average line, with targets of 1.0864 and 1.0816.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is strong now if both are directed in the same direction.

Moving average line (settings 20,0, smoothed) - determines the short-term tendency and direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means a trend reversal in the opposite direction is approaching.