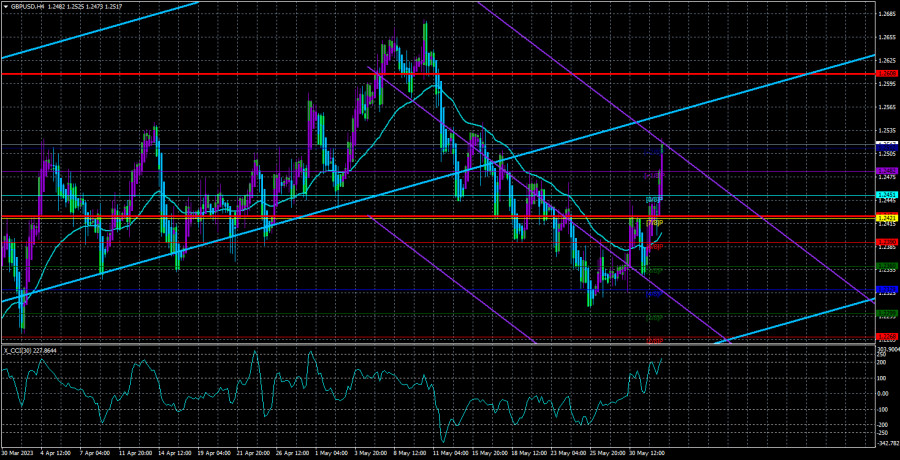

The GBP/USD currency pair calmly continued its upward movement on Thursday. And we are forced to state that the rise of the British currency is once again completely illogical. The market is returning to its favorite activity of the past few months - buying the pound regardless of its fundamental background. And if that's the case, we can do nothing about it. It is worth noting that at the same time, the euro continues to trade below the moving average and shows no signs of growth. At most, a correction may occur soon due to the CCI indicator entering the oversold area. In other words, the pound and the euro do not correlate this week, which always raises questions.

The fundamental background has indeed been very different for these pairs. We have received diverse news, statements, speeches, and reports from the European Union. The market has not yet figured out which of this data is primary and which can be disregarded. However, at the same time, from the UK, we have only received the report on business activity in the manufacturing sector for May in its final assessment. This secondary indicator could not have caused a strong British currency rise yesterday. What could be the problem?

We can only assume one thing. The market believes that the ECB is approaching the end of its tightening cycle. Still, at the same time, it expects several more rate hikes from the Bank of England, which puts the British pound in a more favorable position than the dollar or the euro. It is worth noting that the probability of an interest rate hike by the Federal Reserve in June has sharply increased this week, as several members of the monetary committee have expressed their readiness to support a "hawkish" decision without pausing. But yesterday, Thomas Jefferson and Patrick Harker, on the contrary, spoke in favor of a pause, which further confused traders. If the market is confused, seeing flat or cautious movements would be more logical. However, the pound is rising again like yeast.

Therefore, the issue lies in the CCI indicator entering the oversold area and maintaining a bullish sentiment in the market. The pound should resume its decline, but strong bearish signals are now needed, which are currently lacking.

Nonfarm payrolls and unemployment can pleasantly surprise the market. On the last trading day of the week in the United States, the publication of the nonfarm payroll reports is scheduled. Since the British pound is rising again for unclear reasons, these reports are intended to set everything straight. The dollar may resume growth if they show good values (not below forecasts). If the values are weak, the pound may rise even stronger in joy. And it doesn't matter that globally, it should decline by another 500-600 points to contemplate new growth. It is worth noting that we did not receive any "hawkish" signals from the United States this week. And if so, there are no strong reasons for the pound to rise.

On Thursday, the ADP report on changes in the number of private sector employees in the United States showed a higher value than expected - 278,000 against the forecast of 170-200. However, this report is rarely perceived by traders as important. They usually prefer to wait for the Nonfarm Payrolls. Moreover, the nature of the ADP and NonFarm reports rarely coincides. Thus, today's NonFarm report may be weaker than the forecasts (180-190 thousand), and the bulls will have a new legitimate opportunity to buy the pound and sell the dollar.

Therefore, the week may end unexpectedly. The fact that the euro and the pound are already trading in different directions causes surprise, but the current week shows that there have been and will be surprised. Volatility has started to rise again, but at the same time, frequent corrections and pullbacks occur. It is worth noting that there are better types of movement for trading in the 4-hour timeframe.

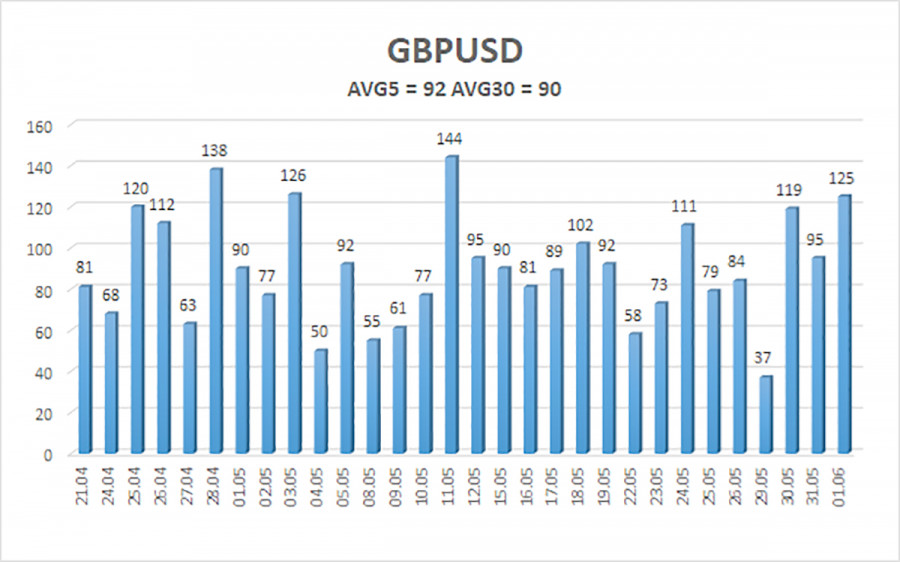

The average volatility of the GBP/USD pair over the past five trading days is 92 pips. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, June 2nd, we expect movement within the channel bounded by the levels of 1.2424 and 1.2608. A downward reversal of the Heiken Ashi indicator will signal a correction against the recent upward trend.

Nearest support levels:

S1 - 1.2482

S2 - 1.2451

S3 - 1.2421

Nearest resistance levels:

R1 - 1.2512

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair has settled above the moving average line, so long positions with a target of 1.2608 are currently relevant, which should be held until the Heiken Ashi indicator reverses downwards. Short positions can be considered if the price consolidates below the moving average with targets at 1.2360 and 1.2329.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels are directed in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates an upcoming trend reversal in the opposite direction.