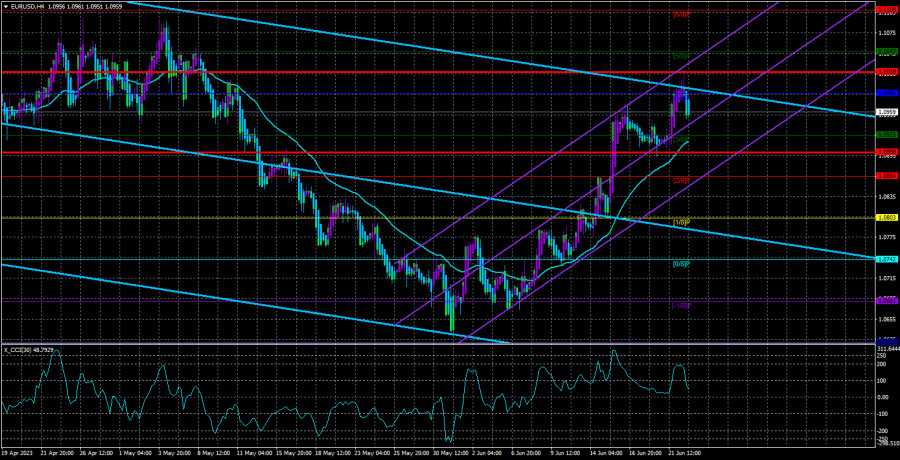

The EUR/USD currency pair showed continued upward movement on Wednesday and Thursday, indicating a decline in the American currency. While there is some logical reasoning behind the euro's movements as it corrects against a month-long decline, the British pound has completely lost touch with reality, but we will discuss that later. It's important to note that the technical outlook has remained unchanged over the past two days. The pair has resumed its growth without any substantiating factors. Among the significant fundamental and macroeconomic events, we can only mention Jerome Powell's two speeches in the US Congress, which we'll discuss below. The market didn't receive any reasons to sell the US currency. However, data can always be interpreted in favor of one's interests.

Therefore, the pair remains above the moving average line, indicating the continuation of the upward trend. It is difficult to predict how long this corrective upward movement will last. Nevertheless, the market believes that the ECB's interest rate will continue to rise indefinitely, seemingly unconcerned about the Eurozone economy. Time will tell if this is the case. The market's high expectations for the ECB rate are the only factor that could drive further growth in the euro. If the market believes the rate will increase from 4% to 5% or 5.5%, the euro could continue to rise. However, assessing the probability of such a scenario is up to you.

Despite the euro currency pair's strong overbought condition and the CCI indicator, the decline has not started yet. In the 24-hour timeframe, the pair surpassed the Ichimoku cloud and the 50.0% Fibonacci level, providing additional technical reasons for further growth recently.

What did Powell say in Congress?

We intentionally didn't cover Powell's speeches in the US Congress yesterday, as another speech will be held before the Senate. Now that both speeches are behind us, we can draw certain conclusions. First and foremost, it's important to note that the Fed Chair did not provide specific details. All his statements need to be examined closely to find any new meaning. Powell mentioned that in June, the Fed decided to pause rather than end the tightening cycle, implying at least one more rate hike. He also noted that all monetary committee members consider further tightening of monetary policy necessary. Therefore, Powell's rhetoric can be described as "hawkish" since he discussed further tightening instead of ending it. So why did the dollar fall?

It's important to remember that almost any event can be explained retrospectively. For instance, if the dollar falls on "hawkish" statements by Powell, one can always argue that they were "not hawkish enough" or that "the market expected more assertive statements." What exactly should Powell have said? "I promise to raise the rate three more times by the end of the year." In other words, what does the market expect? Under what words could Powell have caused the dollar to rise? Perhaps only under extraordinary ones. The American currency has had no chance to rise in the past few days.

Regardless of how Powell expressed himself, the market would still perceive his speech as "insufficiently hawkish," even though the Fed's rate is higher than that of the ECB or the Bank of England, whose currencies have been strengthening against the dollar for the past 10 months. Therefore, we believe that the dollar fell undeservedly once again, especially considering the ECB's extremely low chances of raising its rate to 5% or 5.5%, which, as we can now see, also do not guarantee a significant decline in inflation (following the example of the Bank of England). Meanwhile, the Eurozone economy is experiencing two consecutive quarters of negative growth.

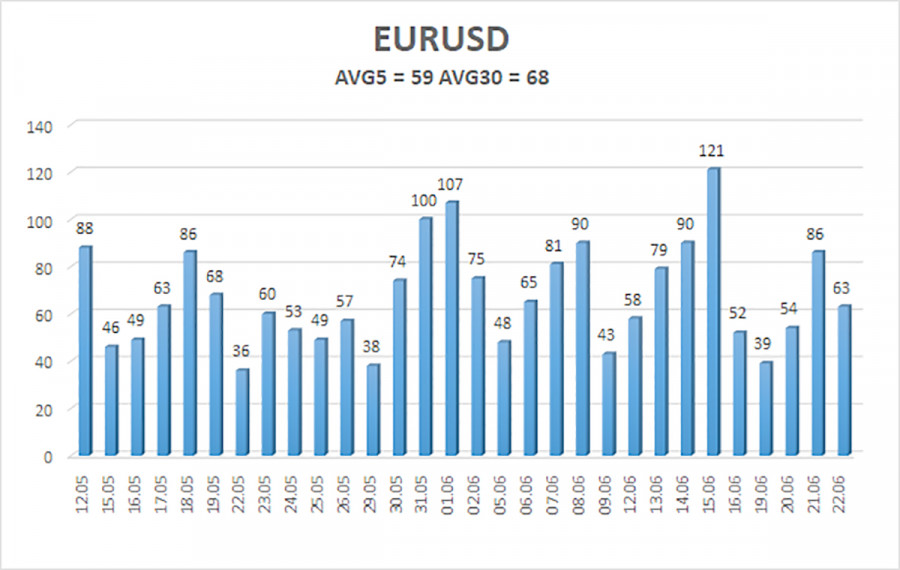

As of June 23, the average volatility of the EUR/USD currency pair over the past five trading days is 59 pips, characterized as "average." Consequently, we anticipate the pair to move within the range of 1.0900 and 1.1018 on Friday. If the Heiken Ashi indicator reverses back upwards, it would indicate a resumption of the upward movement.

Nearest support levels:

S1 - 1.0925

S2 - 1.0864

S3 - 1.0803

Nearest resistance levels:

R1 - 1.0986

R2 - 1.1047

R3 - 1.1108

Trading recommendations:

The EUR/USD pair continues to remain above the moving average line but is undergoing a correction. It is advisable to consider new long positions with targets at 1.0986 and 1.1018 in case the Heiken Ashi indicator reverses upwards. Short positions will become relevant again only if the price consolidates below the moving average line, with targets at 1.0864 and 1.0803.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels move in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an approaching trend reversal in the opposite direction.