The GBP/USD currency pair was traded with low volatility on Tuesday but still managed to move upwards, while the euro currency stood still and decreased more than it grew. Thus, even on a completely empty Tuesday, the pound sterling found reasons to start moving north again. The price has re-fixed above the moving average and is still very close to its local maximums, which also coincide with the annual maximums. The British currency still cannot correct down properly, which is especially visible in the 24-hour timeframe. Occasionally, there are downward corrections on the 4-hour timeframe, but in most cases, they are purely formal.

The logic of the movements needs to be improved. Two weeks ago, when the Bank of England unexpectedly raised the rate by 0.5% for many, the pound did not grow. But yesterday, when it was a holiday in the States, it added about 40-50 points. The British economy is still weak and is holding out with the last of its strength not to slide into a recession. US GDP exceeds forecasts by 0.7% and shows a value of +2% q/q. The Bank of England's rate continues to rise but is still lower than the Fed's. The British regulator can raise the rate several times but will likely stay within the Fed's rate. All this suggests that even if the dollar doesn't have strong reasons to grow now, it certainly has no reasons to fall. However, in most cases, we continue to observe the pair's growth.

Only business activity indices in the manufacturing sectors can be highlighted for the first two days of the week. In the US and UK, the indices fell synchronously for June and have long been below the "waterline" of 50.0. Again, the pound did not have an advantage over the dollar due to macroeconomic statistics.

Thursday and Friday promise to be "stormy"!

The week's most important events are concentrated in its last two days. Today, of course, the Fed's minutes will be published. In the European Union and Britain, the second estimates of business activity indices for June will become known, but all these are secondary data. It is unlikely that the Fed's minutes will surprise traders who are already confident in a rate hike in July, as well as after Jerome Powell's five speeches over the past weeks, in which he laid everything out. Therefore, the main movements are planned for Thursday and Friday, when the ISM, ADP, unemployment benefit claims, the number of job openings, NonFarm Payrolls, and the unemployment rate will be released in the US. As we can see, almost all reports are related to the labor market, which the Fed continues to monitor closely, and which has a priority for the regulator and the market.

However, even if the reports are disastrous (which is currently hard to believe), the Fed will not change its plans to raise the rate. And for the GBP/USD pair, it doesn't matter at all. The pound grows for a reason and without. If statistics from overseas turn out to be weak, it will merely get a new reason to grow against the dollar. If the statistics from the US turn out to be strong, we will see a new pullback down, a maximum of 100 points, and the Fed's position on the rate will not change. Thus, the market's local reaction could be significant. In the medium term, these reports will not affect the situation in the market.

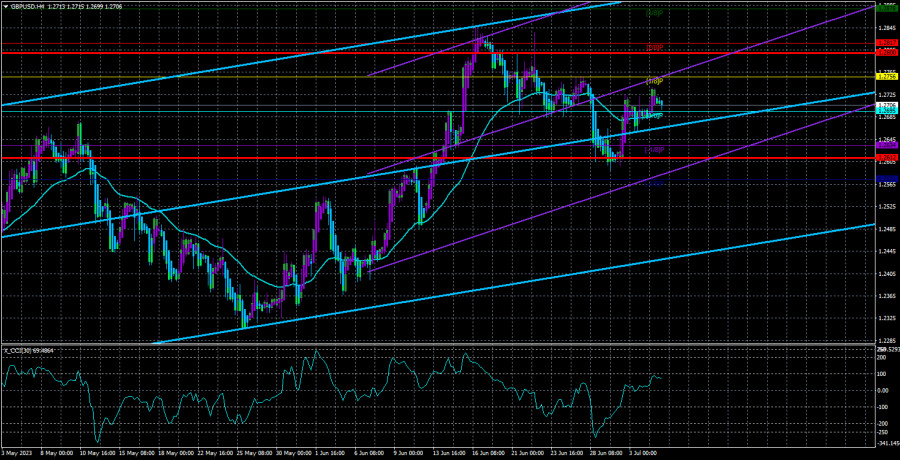

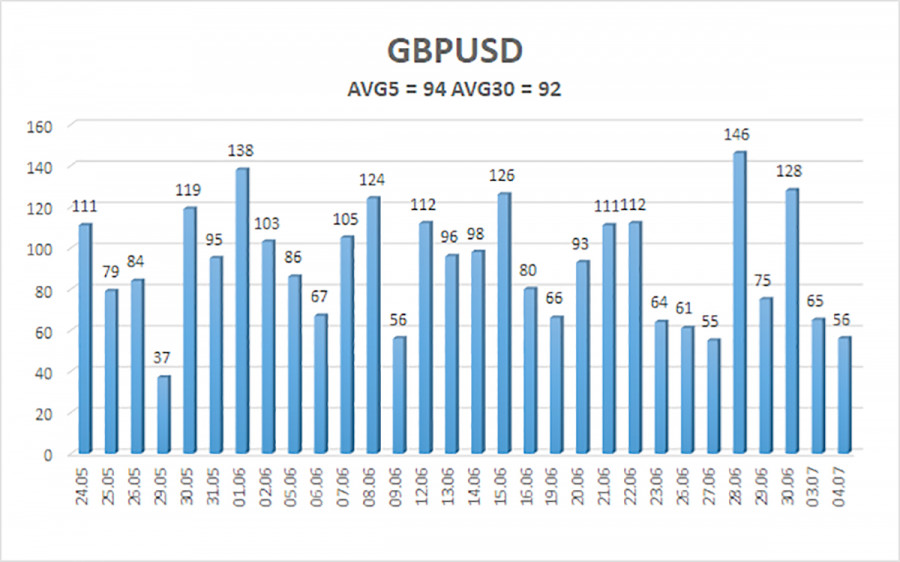

The average volatility of the GBP/USD pair over the last 5 trading days is 94 points. For the pound/dollar pair, this value is "medium." Therefore, on Wednesday, July 5, we expect movement within the range limited by levels 1.2612 and 1.2800. The Heiken Ashi indicator's reversal down signals a possible new downward movement wave.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

R3 – 1.2878

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe has been fixed above the moving average. Currently, long positions with targets of 1.2756 and 1.2800 are relevant, which can be opened in case of a price rebound from the moving average or the Heiken Ashi indicator turning upwards. Short positions can be considered for price fixing below the moving average with targets of 1.2634 and 1.2596. The probability of flat or low volatility remains high.

Illustration explanations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term tendency and the direction in which trading should now be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means a trend reversal in the opposite direction is approaching.