EUR/USD

Analysis:

Quotes of the European currency continue to move in a descending trend. Currently, the price is trading within a range between intermediate support and strong resistance, which was breached downward two weeks ago. Since September 27th, an upward corrective zigzag has been forming. Its structure was not completed at the time of analysis.

Forecast:

In the upcoming week, the completion of the current downward trend of the euro exchange rate is expected in the area of calculated support, followed by a reversal. By the end of the week, we can expect a resumption of the price uptrend with an increase in the exchange rate towards the calculated resistance zone.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: Selling before the completion of the upcoming price uptrend may carry risks.

Purchases: Purchases will become possible with fractional lots after confirmation signals of a reversal appear in the support zone.

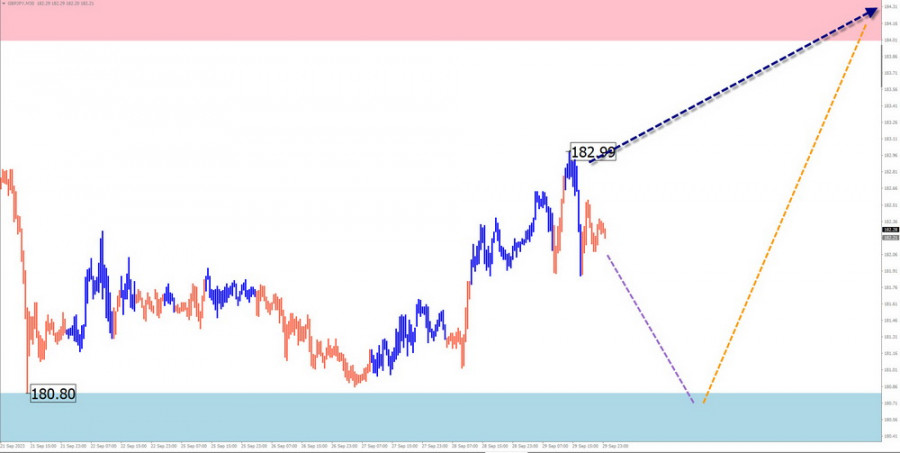

USD/JPY

Analysis:

The exchange rate of the Japanese yen against the US dollar continues to weaken in the major markets. The yen's rate is approaching record levels again. However, the structure of the current wave does not show completion. The current, unfinished wave segment dates back to July 14th. The lower boundary of the preliminary target zone for the entire current wave passes through the calculated resistance area.

Forecast:

At the beginning of the upcoming week, we can expect a continuation of the upward price movement, with an increase in the price towards the resistance levels. After that, a reversal and price decline are expected. The highest volatility is likely to occur after the release of news data.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: Conditions for such deals in the pair's market will arise after reversal signals appear in the resistance zone on your trading system.

Purchases: Purchases have limited potential and may result in losses.

GBP/JPY

Analysis:

Over the past two years, an upward wave has set the trend direction of the British pound relative to the Japanese yen. In the short term, the unfinished wave in the main trend has been moving since late July. The structure of this wave is nearing completion in its middle part (B), but it is not yet completed at the time of analysis.

Forecast:

In the coming days, we can expect a continuation of the downward movement with a decrease in the price towards the calculated support area. In the second half of the week, conditions for a change in direction and a resumption of the price uptrend are likely to form. The resistance zone represents the upper boundary of the possible weekly range of the pair.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: Sales will be possible with fractional lots during individual sessions with reduced volume. It is essential to consider the limited potential for decline.

Purchases: Transactions are not relevant until confirmed reversal signals appear on your trading system.

USD/CAD

Analysis:

The analysis of the weekly chart of the Canadian dollar shows the formation of an ascending wave zigzag since mid-July of this year. Price fluctuations over the last month and a half have formed the middle part (B). Since September 19th, an upward wave zigzag with reversal potential has been developing.

Forecast:

In the first days of the upcoming week, a general sideways price movement is likely, initially declining towards the boundaries of the calculated support. The second half of the week is expected to be more volatile. We can anticipate increased activity and a resumption of the pair's price uptrend.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: In the coming days, conditions for such transactions in the pair's market will not be present.

Purchases: Recommended for trading after corresponding signals appear in the support zone.

EUR/CHF

Analysis:

The trend direction of the EUR/CHF currency pair since the beginning of the current year has been a descending trend. The price has reached the support zone of a larger senior time frame. Since September 15th, an upward corrective movement has been forming, which is not yet completed at the time of analysis.

Forecast:

At the beginning of the week, there is a high probability of a flat price movement with a downward vector. A price decrease can be expected up to the support zone. On this stretch, we can anticipate a reversal formation and a resumption of the pair's price uptrend.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Purchases: Will become relevant after corresponding signals from your trading system appear in the support zone.

Sales: Possible during separate sessions with fractional lots. The potential for decline is limited by support.

GOLD

Analysis:

On the gold chart, the primary price direction since March of this year has been a descending wave algorithm. On a larger time frame, this section of the chart forms a corrective wave in the form of a shifting plane. Analysis of the structure shows its incompleteness at the time of analysis.

Forecast:

At the beginning of the upcoming week, the completion of the price pullback is expected. Then, we can count on the formation of a reversal in the support zone and a resumption of the pair's price uptrend up to the boundaries of the calculated resistance.

Potential Reversal Zones

Resistance:

Support:

Recommendations:

Sales: Due to the limited potential, high-risk sales may lead to losses.

Purchases: After your trading system confirms that signals appear in the support zone, you can use them.

Explanations: In simplified wave analysis (SWA), all waves consist of three parts (A, B, and C). In each time frame, the latest unfinished wave is analyzed. Dashed lines indicate expected movements.

Attention: The wave algorithm does not consider the duration of instrument movements over time!