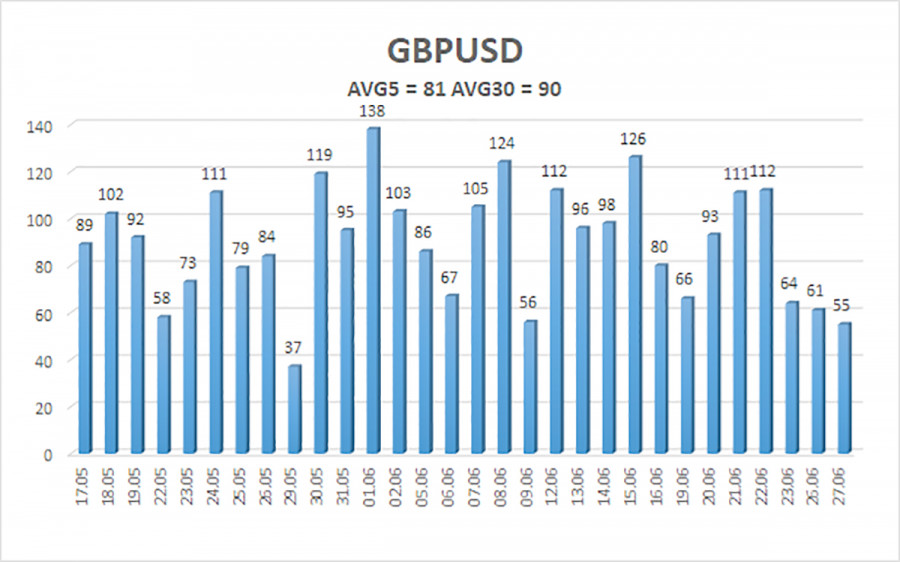

The GBP/USD currency pair continued to trade with minimal volatility on Tuesday. The chart below clearly shows the volatility values over the past 30 days. The average value has decreased significantly in recent months. It should be understood that 90 points represent two days at 120 points and three days at 70 points. Trading the pair during these "three days at 70" would be extremely inconvenient and difficult. The British pound has minimally corrected towards the moving average line but has not formed any signals around it. It continues to rise, but its prospects are still highly uncertain due to having already risen by 2500 points and still needing help to correct properly.

As we can see, last week, the Bank of England raised the interest rate by 0.5%, but the pound did not show any growth afterward. In other words, the British currency, which in 2023 takes any opportunity to rise, refuses to do so when it receives the strongest growth factor! Perhaps the market has already priced in all the Bank of England rate hikes? Its key rate has already risen to 5%, so how many more tightening measures can be objectively expected? How many of them have the market not yet "discounted"?

We did not expect such a strong rate hike from the Bank of England, but even in this case, the essence of the matter remains the same. The Bank of England is still close to completing its tightening cycle. Let's remind ourselves that the US dollar started to decline at the first signs of inflation slowing down. In other words, the market has already factored in almost all future rate hikes by the Federal Reserve in advance. We expect something similar from the British pound at the moment.

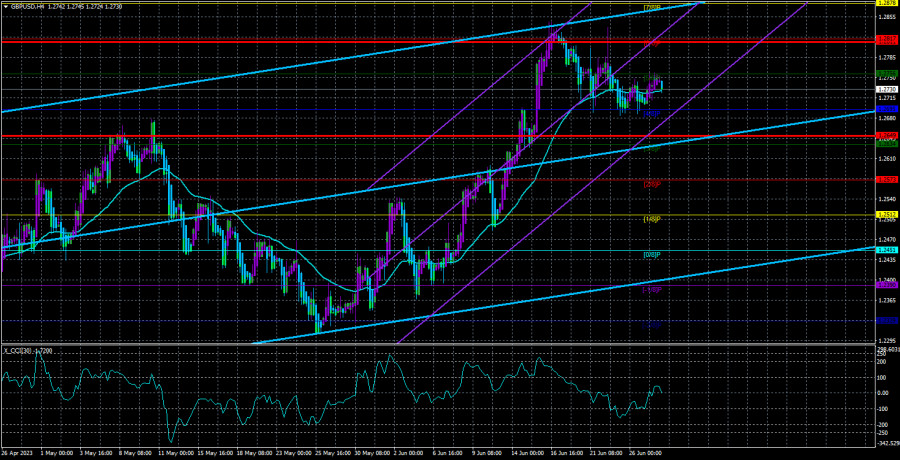

In the 24-hour timeframe, it is evident that there are almost no corrections within the current upward trend. Occasionally, the pair retraces from its local highs by 10-20%, no more. Therefore, we still believe that the pound is overbought and has risen too strongly, and we expect a decline.

The Chief Economist of the Bank of England may surprise the market.

There will be a few fundamental events in the UK this week. Today, the Chief Economist of the Bank of England, Hugh Pill, will deliver a speech, and it will be one of the first appearances by a representative of the British regulator after the regulator raised the rate for the thirteenth consecutive time. Thus, Pill's speech has the potential to be very interesting, but it should be noted that he may very well avoid discussing monetary policy. Therefore, it will all depend on what Mr. Pill communicates. Naturally, the market will await new information on how much more monetary policy tightening is planned in the UK.

Jerome Powell's speech should generate less interest among traders, as the head of the Federal Reserve has been speaking quite frequently lately, and the market more or less understands what to expect from the Fed in the upcoming meetings. The following can be expected: a rate hike of 0.25% is almost guaranteed in July, and then by the end of the year, at most, one more hike can be expected. Inflation in the US is declining at the highest rates, so raising the rate to 5.75% would be excessive. However, the Federal Reserve is in a hurry to suppress inflation and return to normalcy. And at the moment, the dollar is hardly reacting to all the efforts of the Fed. It has been falling for almost ten months in a row.

Thus, overall, the situation remains the same. The pound may continue to rise, but it has long been due for a downward correction of at least 500-600 points.

The average volatility of the GBP/USD pair over the past five trading days is 81 points. For the pound/dollar pair, this value is considered "average." Therefore, on Wednesday, June 28th, we expect movements within a range limited by the levels of 1.2649 and 1.2811. A reversal of the Heiken Ashi indicator downwards will signal a new downward movement phase.

Nearest support levels:

S1 - 1.2695

S2 - 1.2634

S3 - 1.2573

Nearest resistance levels:

R1 - 1.2756

R2 - 1.2817

R3 - 1.2878

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair continues to correct. Currently, long positions with targets at 1.2811 and 1.2817 are relevant. These positions should be opened if the Heiken Ashi indicator reverses upward with the price above the moving average. Short positions can be considered if the price consolidates below the level of 1.2695, with targets at 1.2649 and 1.2634.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair is expected to move in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates an approaching trend reversal in the opposite direction.