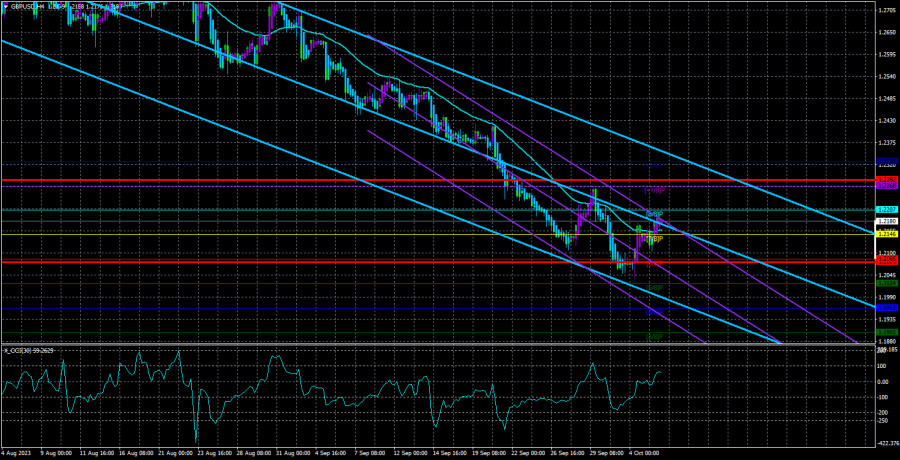

The GBP/USD currency pair also continued its upward corrective movement on Thursday and ended the day above the moving average line. Just like with the euro, this break above the moving average may turn out to be false, as it did a week ago. It should be understood that the market is not in a hurry to get rid of long positions in the dollar right now, just as it didn't rush to get rid of long positions in the euro and the pound a few months ago. In other words, we are currently witnessing the same downward inertial trend as we saw an upward one a few months ago. However, technical corrections must still occur. The CCI indicator entered the oversold zone three times, so we continue to expect a correction. We believe it should be stronger than the previous one, so the British pound has the technical potential to rise to the 23rd level or slightly higher.

Unfortunately, today everything will depend on macroeconomic statistics from across the ocean, which can easily disrupt the correction scenario. We remind all market participants that predicting the value of a particular report is practically impossible. The market's reaction to a specific report can be strange and illogical. And if several important reports are published at the same time, with one exceeding expectations but worsening compared to the previous month, another being neutral, and a third falling but not as much as expected, how can one predict the market's behavior based on such diverse data?

Predictions can only be made for longer-term or shorter-term movements. For example, after a bounce from a significant level, you can predict a movement in the opposite direction. Based on the fundamental background, you can predict the pair's movement over the next few months. And so far, everything is heading towards the continuation of the pair's decline, with or without a correction, with a target of 1.1844—the 38.2% Fibonacci level on the 24-hour TF. Further, the British pound may drop to the 12th level, but we consider that to be excessive.

Non-farms have been declining for a year and a half now. The first report today (in terms of significance) is the non-farm payrolls. Official forecasts suggest the creation of 170 thousand new non-agricultural jobs in September, but there are also forecasts indicating only 150 thousand. Recall that we have repeatedly mentioned the figure of 200 thousand as a kind of "golden mean," a "normal" indicator. Therefore, when payrolls did not meet the forecast earlier but still exceeded 200 thousand, we urged them not to panic and bury the dollar.

Now the situation is the opposite. Over the last three months, non-farms have shown the following figures: 105, 157, and 187 thousand. And during these two months, the dollar has been rising like crazy. Obviously, the dollar's exchange rate depends not only on non-farms, but as we can see, the overall trend still exists: for a year and a half, the rate has been rising, for a year and a half, non-farms have been falling, and for a year, the dollar has been falling. Today, we believe that non-farms could be below forecasts, so the dollar may come under pressure.

The unemployment rate jumped to 3.8% in August, which some Federal Reserve representatives called "normal," as the indicator is still very close to its half-century lows. We agree with this view, but today, unemployment may increase slightly. However, non-farms will take precedence, so the main market reaction will depend on them. Unemployment can only soften or amplify the effect of payrolls. In general, we would say that there are good chances today to see an increase in the pair. The British pound is still weak and has no grounds for growth, but it also cannot keep falling forever.

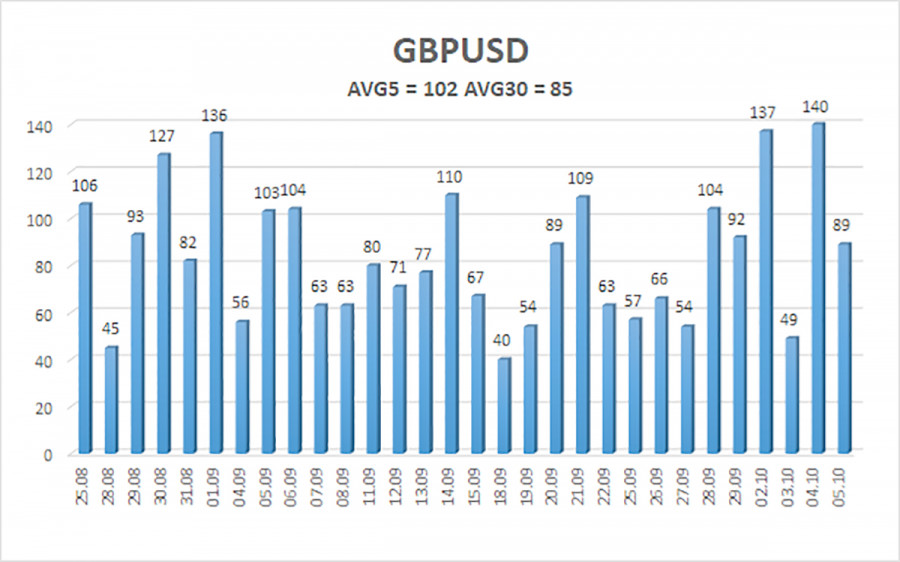

The average volatility of the GBP/USD pair over the last 5 trading days as of October 6th is 102 points. For the GBP/USD pair, this value is considered "average." As a result, we anticipate movement within the range defined by levels 1.2078 and 1.2282 on Friday, October 6. A reversal of the Heiken Ashi indicator downwards will signal a resumption of the downward movement.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has started a new phase of corrective movement. Therefore, at this time, you can consider new short positions with targets at 1.2085 and 1.2024 in case the price consolidates back below the moving average. Long positions can be considered now, with targets at 1.2207 and 1.2282 until the Heiken Ashi indicator reverses downwards.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are pointing in the same direction, it indicates a strong trend at the moment.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will move in the next 24 hours, based on current volatility indicators.

CCI indicator – its entry into the overbought territory (above +250) or oversold territory (below -250) indicates an approaching trend reversal in the opposite direction.