The GBP/USD currency pair also showed very weak volatility on Friday, although there were several reports during the day that could have triggered decent movement. Industrial production in the US increased by 0.1% with lower forecasts, while the University of Michigan Consumer Sentiment Index showed a value of 76.5 with higher forecasts. Thus, there was an equal probability for the dollar to show both growth and decline. However, we didn't see either.

The pound remains at its maximum values for the last 7-8 months, and we continue to believe that it is unreasonably expensive and overbought. On the 24-hour TF, it is clearly visible that the upward correction has been delayed, but the market continues to look only towards purchases of the British currency, ignores many fundamental and macroeconomic factors, and the dollar can now count only on corrective growth. There are no sell signals on the daily chart. On the 4-hour TF, the price is below the moving average, but the past such consolidation has not yielded any dividends to the US currency. Therefore, the further growth of the dollar against the pound is not obvious.

In the new week, we will have two important meetings and one important report at once. In the UK, the value of inflation for February will be known. According to forecasts, the consumer price index will slow down to 3.5-3.6%, which can be considered a good pace of movement towards the goal. If this forecast comes true, the rhetoric of the representatives of the Bank of England may begin to soften, but, in our opinion, this will not happen. Even if inflation drops to 3.5%, this is still not enough to start discussing monetary policy easing in the coming months.

However, it should be remembered that the British economy has already slipped into a "technical" recession, so time is of the essence for the regulator. This means that the Fed has the ability to keep the rate at its maximum value for almost any amount of time. The Bank of England does not have such an opportunity. The longer the rates remain at the peak, the more the economy, which has been in crisis for 7 years already, will suffer. Therefore, members of the Monetary Policy Committee may begin to voice "dovish" hints.

The key will be the rate vote. If the number of "doves" increases from one to at least two, this may be a significant reason for the pound to finally start its long-awaited decline against the dollar. Of course, the inflation report itself may provoke a pound decline if it unexpectedly shows a value below 3.5%.

Since we are awaiting at least three important events, the results of which are practically impossible to predict, making a forecast for the next week is unwise. Technically, the pair may continue to decline, but the fundamentals can easily neutralize traders' not-so-strong desire. Reaction will have to be based on the situation. However, the aforementioned events will at least increase the volatility of movements. And this will already allow for more confident and optimistic trading, at least on lower timeframes.

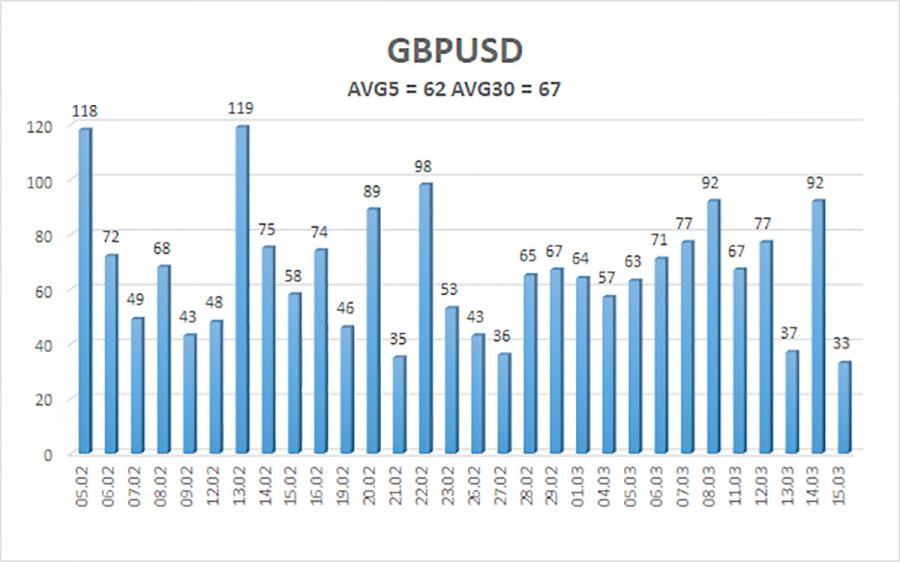

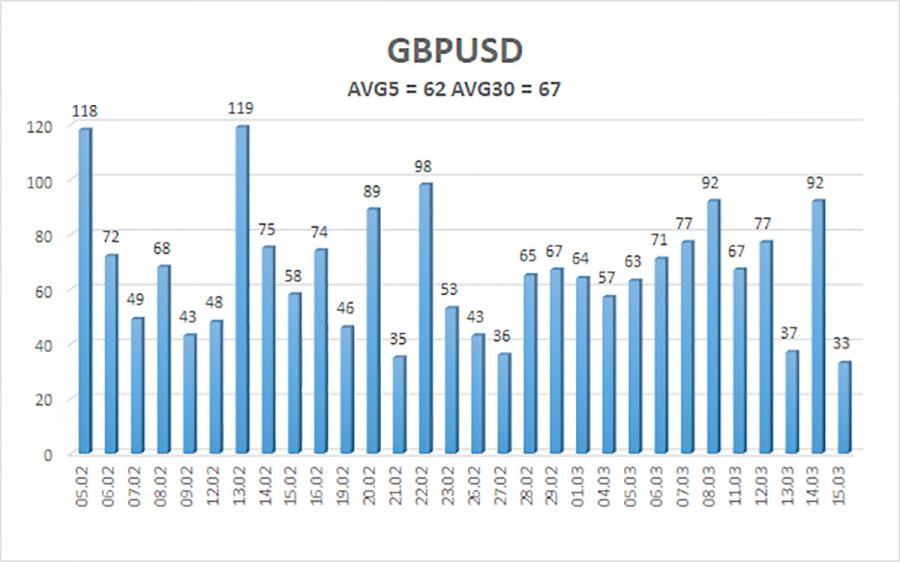

The average volatility of the GBP/USD pair over the past 5 trading days as of March 18th is 62 points. For the pound/dollar pair, this value is considered low. Therefore, on Monday, March 18th, we expect movement within the range limited by the levels of 1.2669 and 1.2793. The senior linear regression channel is still sideways, so there are no questions about the current trend. The CCI indicator has not entered the oversold territory lately, nor has it entered the overbought territory. The market is currently trading similarly, but traders may expect a new significant downward movement now.

Nearest support levels:

S1 - 1.2695;

S2 - 1.2634;

S3 - 1.2573.

Nearest resistance levels:

R1 - 1.2756;

R2 - 1.2817;

R3 - 1.2878.

Trading recommendations:

The GBP/USD currency pair has broken out of the flat and attempted to resume the upward trend. However, we still expect a resumption of movement to the south with targets at 1.2543 and 1.2512. The market continues to be extremely reluctant to buy the dollar and sell the pound, completely ignoring the fundamental and macroeconomic background. This week, it may easily interpret the received information in favor of the pound, even if it favors the dollar. Formally, considering long positions may be possible when the price is above the moving average, but currently, the long-awaited consolidation below the moving average has occurred. Therefore, we welcome any sales of the pair.

Explanation of illustrations:

Linear regression channels help determine the current trend. If both are directed in the same direction, it means the trend is currently strong;

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.