The EUR/USD currency pair resumed downward movement on Wednesday but traded with the same minimal volatility. As is tradition, we will not consider the results of the Fed meeting in this article, nor the market's reaction to them. We believe that often, in the first two hours after the Fed's announcement, the market trades impulsively and illogically. It is not uncommon for us to observe movement in one direction immediately after the Fed meeting, and then, over the next 10–20 hours, the pair returns to its original positions. Therefore, we believe it is necessary to let the market settle down, analyze all the information received, and see how the market's reaction has affected the current technical picture.

Fortunately, on Wednesday, the Fed meeting and Powell's speech attracted the market participants' attention. Christine Lagarde, who has not been speaking frequently lately, announced at a conference in Frankfurt that inflation in the European Union will likely continue to decline. Her speech was extensive, but there were a few important market points. It was important for the market to understand the ECB President's attitude towards inflation and monetary policy. Lagarde's statement about expecting further disinflation allows us to continue to expect the first easing in June. The European currency slightly depreciated on this event, but as we have said many times, volatility is very low right now. And, as we can see, not even really important events and publications can influence it.

What's next? The Fed left the key rate unchanged and will not begin the monetary policy easing cycle until June. Moreover, even regarding June, we would have doubts. The reason for this is the inflation report for February, which, although it reflected traders' expectations, still turned out to be negative for the Fed and positive for the dollar. Inflation in the US has remained the same since June of last year, when it reached the 3% mark. Thus, we are certain that with this indicator falling below 3%, Jerome Powell and his colleagues will start talking about rate cuts.

To be more precise, they can talk about it, of course, but in the most general and indefinite terms. Since confidence has not increased over the last 8–9 months, we see no reason to ease monetary policy in June.

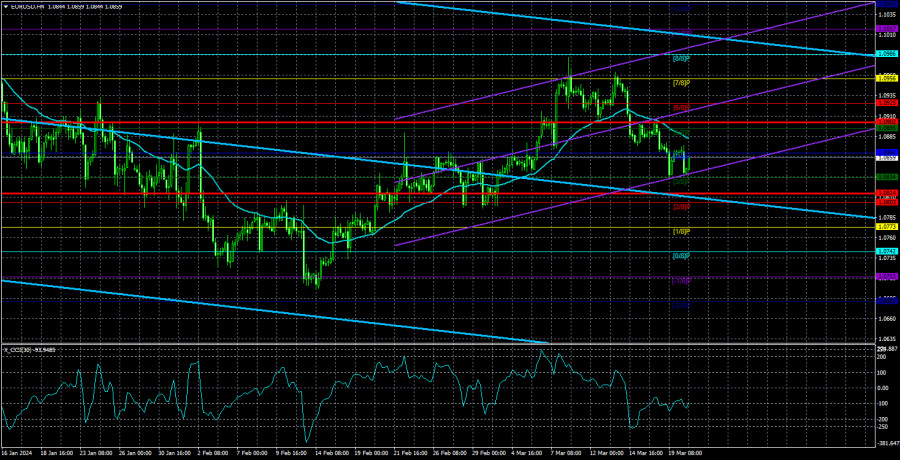

As for the technical picture (we do not consider the pair's movements on Wednesday evening), the pair remains below the moving average line, which allows us to count on further movement to the south, which is logical from all sides. On the 24-hour TF, the pair has currently hit a critical line, so the further decline of the euro and the rise of the dollar will depend on whether this line is overcome. In the first case, the minimum target for the decline will be the last local minimum - 1.0695. But we see this level only as an intermediate target.

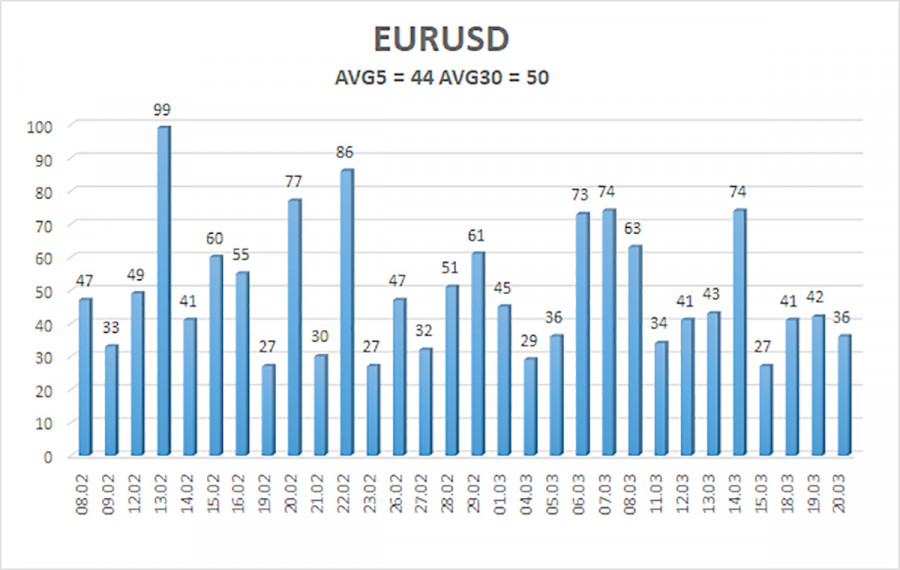

The average volatility of the EUR/USD currency pair over the last 5 trading days as of March 21 is 44 points and is characterized as "low." Thus, we expect the pair to move between the levels of 1.0814 and 1.0902 on Thursday. The senior linear regression channel points downward, so the global downward trend remains intact. The oversold condition of the CCI indicator indicates the need for an upward correction, but we still expect a decline in the European currency.

Nearest support levels:

S1 - 1.0834

S2 - 1.0803

S3 - 1.0773

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0895

R3 - 1.0925

Trading recommendations:

The EUR/USD pair continues to stay below the moving average line. Thus, it can remain in short positions, with targets at 1.0814 and 1.0803. If the market finally abandons similar dollar sales, then the American currency may rise only in the near future to the 7th level. And from the perspective of several months - up to 1.0200. After a sufficiently long rise of the pair (which we consider a correction), we see no grounds for considering long positions. Even with the price consolidating above the moving average.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, the trend is strong right now.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold region (below -250) or overbought region (above +250) indicates that a trend reversal in the opposite direction is approaching.