The GBP/USD currency pair also showed a significant decline on Wednesday. Let's remind you that volatility for the GBP/USD pair has remained low for several consecutive months, so yesterday's movement of 200 points looks overwhelming. However, at the moment, nothing has fundamentally changed in the technical picture of the pair.

So, the pound fell, and the dollar rose, but what did it change? In the global plan, absolutely nothing. The pair, as it was in a flat during the 24-hour timeframe, remains there. Yesterday, we doubted that the dollar would be able to show any growth at all, even if inflation accelerated in the US in March. As we can see, our concerns were unfounded. However, last week, the market confidently ignored data on the labor market, unemployment, business activity, and job openings, which also should have triggered the strengthening of the American currency. Therefore, despite the dollar's rise yesterday, overall movements remain illogical. What logic can we discuss if the pair has been in a sideways channel for 4 months? During this time, there have been several meetings of the Fed and the Bank of England, many important reports have been released, and numerous speeches by important officials have taken place. But all these events could not force the market to take the pair out of the flat.

Thus, we saw a predictable decline yesterday, and today, we can see a new illogical rise. As long as the price does not leave the channel, with approximate boundaries at levels 1.2500 and 1.2800, discussing any trend or tendency is pointless. The pound's decline may end as quickly as it began. Let's remember that last Friday, on strong non-farms, the dollar also sharply rose and then lost all its "hard-earned" gains in two hours. Therefore, we are sure that no global conclusions should be drawn based on a single report.

Now on the horizon are the meetings of the Bank of England and the Fed. Both central banks will leave key rates unchanged with a 100% probability, but at the same time, the rhetoric of the American regulator may tighten again. There are no grounds for the Fed to lower the rate, even in June. There are no grounds to expect a slowdown in inflation to at least 2.5% either. We firmly believe that Powell and the company must consider additional tightening now. Naturally, such a state of affairs should only provoke the strengthening of the American currency. But the market still refuses to buy it and cannot even consolidate below the 1.2500 level. Therefore, strengthening "hawkish" expectations and sentiments means nothing in the case of the GBP/USD pair.

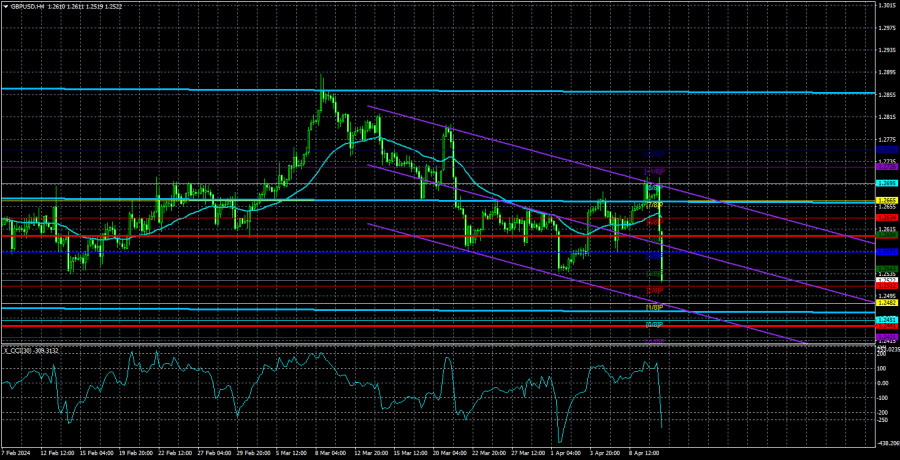

From a technical point of view, the price dropped below the moving average, but it can change direction every day in a flat. This says nothing.

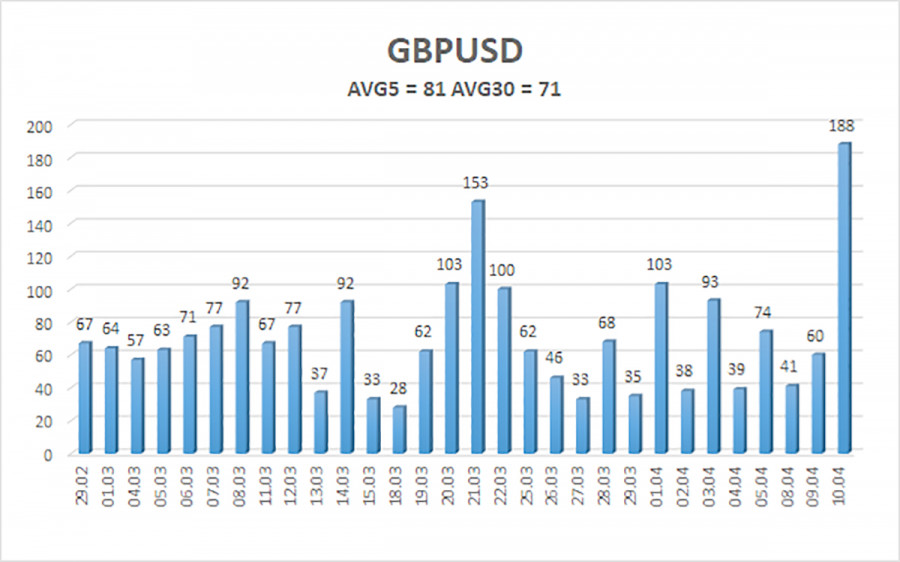

The average volatility of the GBP/USD pair over the last 5 trading days is 81 points. For the pound/dollar pair, this value is considered "average." Therefore, on Thursday, April 11th, we expect movements within the range limited by levels 1.2441 and 1.2603. The senior linear regression channel is still sideways. Thus, there are no questions about the current trend. The CCI indicator entered the oversold zone last Monday, triggering a new pair rise. However, the key now remains flat in the 24-hour timeframe. It is from it that any transactions should be based.

Nearest support levels:

S1 - 1.2512

S2 - 1.2482

S3 - 1.2451

Nearest resistance levels:

R1 - 1.2543

R2 - 1.2573

R3 - 1.2604

Trading recommendations:

The GBP/USD pair continues to trade in a flat on the 24-hour timeframe, which is the most important thing. We still expect movement to the south, but below the level of 1.2500, the pair has not been able to break out for 4 months already. Therefore, the flat must be completed first, and only then should the technical picture be analyzed for trading signals to form a new trend. And yesterday's decline in quotes by 200 points fundamentally changes nothing yet. Purchases of the pair are possible if the price fails to overcome the lower boundary of the sideways channel. Then the target will again be the level of 1.2800. But we believe that the time to end the flat has come.

Illustration notes:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.