The EUR/USD currency pair traded again on Monday in a sluggish, low-volatility mode after the crazy second half of last week. Naturally, the market calmed down after the US inflation report, which showed an increase of 3.5%. Recall that inflation is the main indicator for the Fed when determining monetary policy. Neither market expectations, expert forecasts, nonfarm payrolls, nor the unemployment rate matter. It is important to understand this because many traders have been wrong several times, expecting policy easing first in March and then in June.

As the consumer price index in the United States rises, the question of the Fed rate cut may be postponed indefinitely. Specifically, to "indefinite" because no one knows when inflation will return to at least 3%, achieved last year. Thus, the Fed will only discuss easing monetary policy if inflation starts approaching the target mark (between 2% and 2.5%). Therefore, all traders who think a rate cut is imminent should stock up on popcorn and prepare for a long wait. And the longer it lasts, the stronger the US dollar may grow.

We have repeatedly said earlier this year and at the end of last year that market expectations for a Fed rate cut are too high. It is becoming obvious that the American regulator intends to refrain from following any plans and act decisively according to the situation. So until inflation decreases, there's no need to consider when monetary policy easing begins.

At the same time, in the Eurozone, everything is ready for the first rate cut. Inflation has dropped to 2.4%, and most ECB officials are already openly stating that the rate cut will begin in June. Of course, formulations like "high probability," "likely," "if the downward trend in inflation persists," and so on are used. However, we all understand that the probability of monetary policy easing in June is currently 80-90%. The consumer price index in the Eurozone could theoretically accelerate in April or May, which would prompt the regulator to delay easing. But in any case, the ECB is much closer to a rate cut than the Fed. And the ECB rate (for those who don't remember) is 4.5%. The Fed rate is 5.5%. Thus, the interest rate divergence will only increase in 2024, which should benefit the US currency.

On Monday, Bank of France Governor Francois Villeroy de Galhau said the ECB is ready to cut rates in June "provided that no unpleasant surprises occur." He also noted that the June cut will not be the only one; by the end of the year, the ECB may lower rates several more times. Recall that some experts believe the Fed will be ready for easing no earlier than the end of the year. By that time, the ECB rate may even drop below 4%. Thus, as before, we expect only the strengthening of the US currency. When the Fed begins to ease policy, the dollar will undoubtedly depreciate. But until that moment, it's still very, very far away.

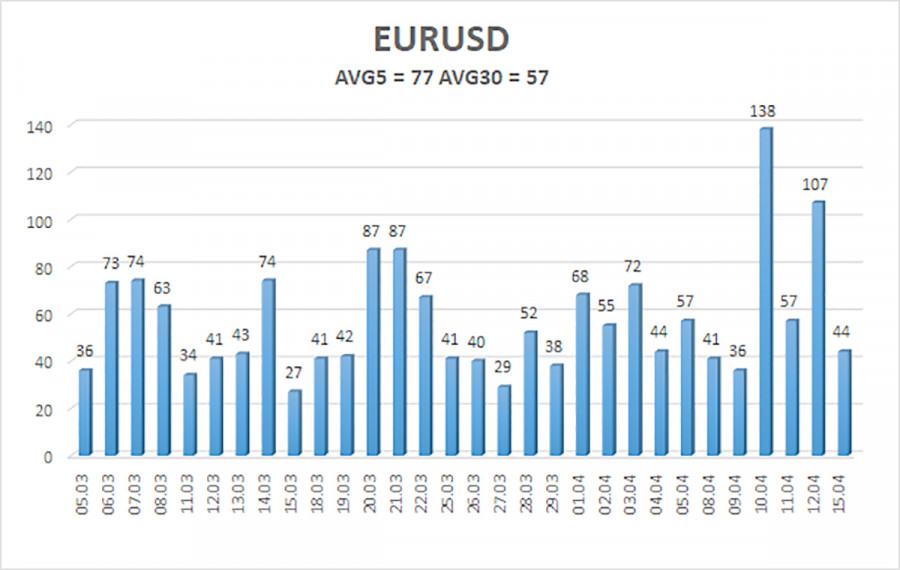

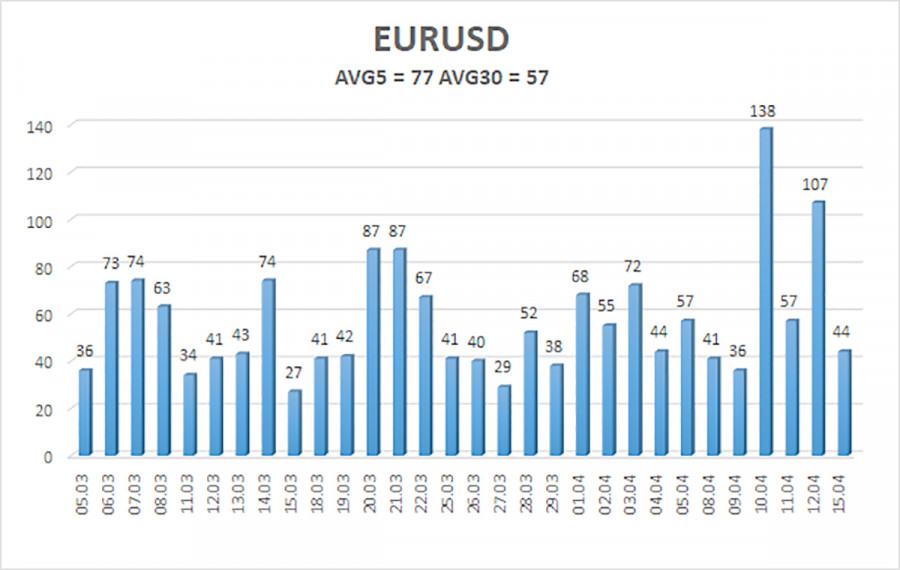

The average volatility of the euro/dollar currency pair over the last five trading days as of April 16 is 77 points, characterized as "average." We expect movement in the pair between the levels of 1.0560 and 1.0714 on Tuesday. The senior linear regression channel is sideways, but the downward trend persists. The CCI indicator has entered the oversold territory, but we expect only a slight upward retracement. It may start after a few days.

Nearest support levels:

S1 – 1.0620

Nearest resistance levels:

R1 – 1.0681

R2 – 1.0742

R3 – 1.0803

Trading recommendations:

The EUR/USD pair has resumed its downtrend, as we expected. The European currency should continue to decline almost in any case, so we continue to consider sales with targets at 1.0620 and 1.0560. Buying is impractical even if the price consolidates above the moving average line. The fundamental background now suggests that only a rise in the dollar can be expected.

Illustration explanations:

Linear regression channels - help determine the current trend. The trend is strong now if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into oversold territory (below -250) or overbought territory (above +250) means a trend reversal in the opposite direction is approaching.