The EUR/USD currency pair showed no interesting movements on Wednesday. Business activity indices in the European Union and the United States provoked a significant dollar decline days earlier, although we did not expect such a strong market reaction. However, this "strong reaction" amounted to a total of 73 points of volatility for the pair, which is not too much. Nevertheless, against the backdrop of daily fluctuations in the range of 40–50 points, even such a movement seemed impressive.

We still expect the strengthening of the American currency against any fundamental and macroeconomic background. Yesterday, the price closed above the moving average line, and now, a corrective uptrend may continue for some time. However, this correction does not negate the presence of a global downward trend on the 24-hour TF (timeframe). It does not negate the fact that the market has overestimated the Fed's ability to lower rates in 2024. It does not negate the fact that the ECB will be the first to lower rates, not the Fed. However, one should not expect the dollar to rise indefinitely either. We believe that, minimally, the EUR/USD pair should fall to the level of 1.0450. In reality, there will likely be a decline to the range of 1.00–1.02, where the decline of the European currency may be complete.

Yesterday, it became known that if Donald Trump is elected President of the United States, he intends to deliberately work on weakening the American currency. It is worth recalling the details of Trump's previous term. Four years ago, the former US president repeatedly stated that he did not need a strong dollar. Trump's associates believe that American exports need to be made more competitive. It is also worth noting that during Trump's first presidential term, the dollar hardly weakened. However, it did not rise either. If Trump becomes president at the end of the year, a global trend towards the weakening of the American currency can be expected.

It is at the end of the year that the Fed may begin to soften its monetary policy, so immediately, two global factors will indicate a decline in the American currency. Therefore, traders who wanted to know and understand when the dollar might start a new global downward spiral have now received an answer to their question. Dollar declines can be expected in the fourth quarter of this year. By that time, the targets in the range of 1.00–1.02 may already have been achieved, so the downward trend will be considered completed.

However, at the moment, the downward trend is not complete, and when the Fed will start lowering rates is not certain. After all, we and other analysts are now talking about the end of the year as a period when the Fed's rate will definitely start to decrease. But in reality, everything may be different. For example, in January, the market was confident that the first easing would occur in March. As we can see, nothing like that happened. It won't happen even in June, so talking now about the first easing in December (for example) is like fortune-telling. If inflation in the United States does not slow down, we will not see any easing of monetary policy even in December. In this case, the dollar will have additional reasons to rise, but we still believe that by the end of the year, the Fed will manage to solve the problem of excessive price pressure.

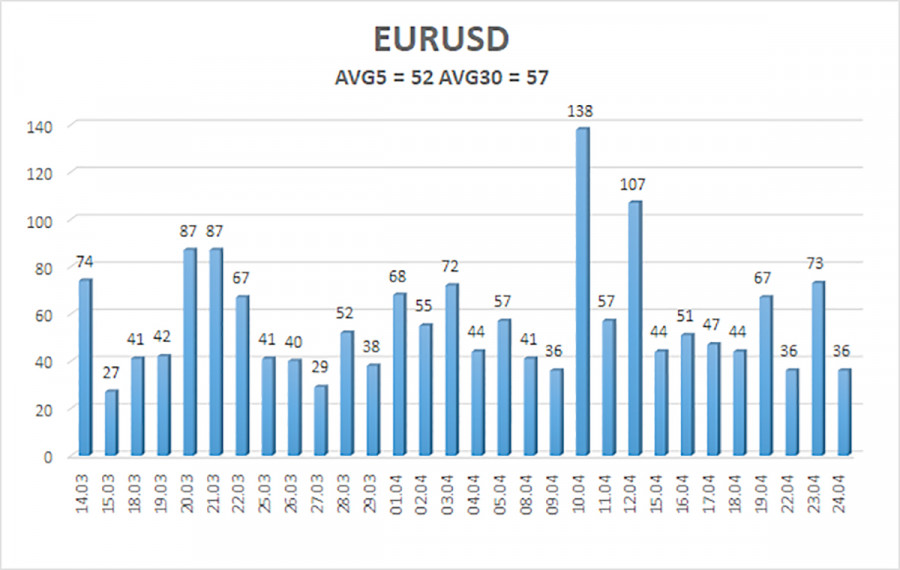

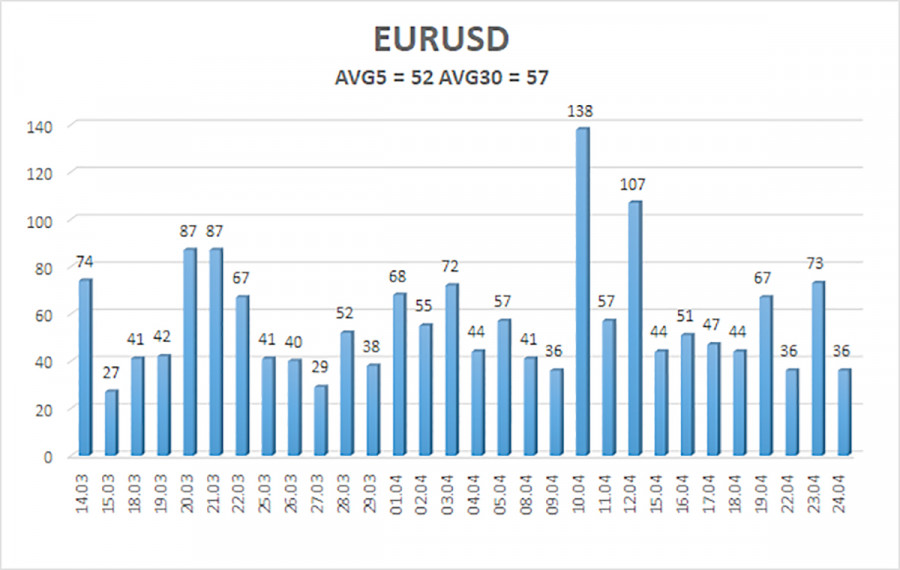

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 25 is 52 points and is characterized as "low." We expect the pair to move between the levels of 1.0634 and 1.0738 on Thursday. The senior channel of linear regression has turned downward, indicating a global downward trend. The CCI indicator entered the oversold zone, but we expect only a small upward retracement, which may already be completed.

Nearest support levels:

S1 – 1.0681

S2 – 1.0620

S3 – 1.0559

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0803

R3 – 1.0864

Trading recommendations:

The EUR/USD pair has resumed and maintained a downward trend, as we expected. The European currency should continue to decline in almost any case, so we continue to consider sales with targets at 1.0602 and 1.0559. Buying is considered impractical even if the price is above the moving average line (as it is now). The fundamental background at this time is such that one can expect growth only from the dollar. Corrections are possible on technical grounds, but trading downwards now is the most appropriate strategy.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.