Yesterday, EUR/USD rebounded from the Murray level of 1.0681 for the third time, leading to the third wave of the bullish correction. We previously warned you that the correction could easily last a couple of weeks. The market has already processed all the major events of June, so it is also necessary to take a break. This week, there has been virtually no fundamental or macroeconomic background. There were no significant speeches, and macroeconomic information only started to become available on Thursday, and it's hard to consider them important.

We also said that we should not expect too much from the GDP reports and orders for durable goods. GDP is published quarterly in three estimates. By the time the third estimate is published, the market already has a more or less clear expectation of what the figure will be. In fact, the American economy grew by 1.4% in the first quarter of 2024. There can be a multitude of completely opposing thoughts and judgments on this figure.

Let's start with the fact that the second estimate showed economic growth slowing to 1.3%. Therefore, the final value turned out to be higher, which should have triggered a rise in the dollar, right? The forecast for the third estimate was 1.4%, so should there have been no market reaction at all? 1.4% is a figure after a decline over two quarters from 4.9%. This clearly indicates a significant slowdown in the American economy. Does this mean that the dollar should fall if the US economy is cooling off? At the same time, 1.4% growth is several times more than the best recent figures in the UK and the Eurozone. Does this mean that the US economy is in much better shape and that the dollar should rise?

As we can see, there can be a huge number of opinions. We have long stated that the American economy is stronger than the European or British economies in one way or another. The key factor is monetary policy, as it directly influences the distribution and redistribution of monetary masses. The GDP report itself is not particularly important; reactions occur only in the event of resonant and unexpected values for the market. Therefore, we generally did not expect any market reaction. At most—a weak one.

Ultimately, the dollar slightly depreciated, but economic reports did not play a key role in its decline, instead it was the technical level of 1.0681, which is where the third rebound took place. Obviously, bears are not ready for new sales yet, and the price cannot just stand at the level of 1.0681. Therefore, we are witnessing a new cycle of the bullish correction.

At the same time, the downward trend persists both on the 4-hour and the 24-hour timeframes. Therefore, in a long-term perspective, we can expect the euro to fall. And this will only end when the fundamental background changes drastically or the global downtrend ends in an obvious way. So far, we have not met either the first or the second condition. Therefore, there is no reason for panic; everything is going according to plan.

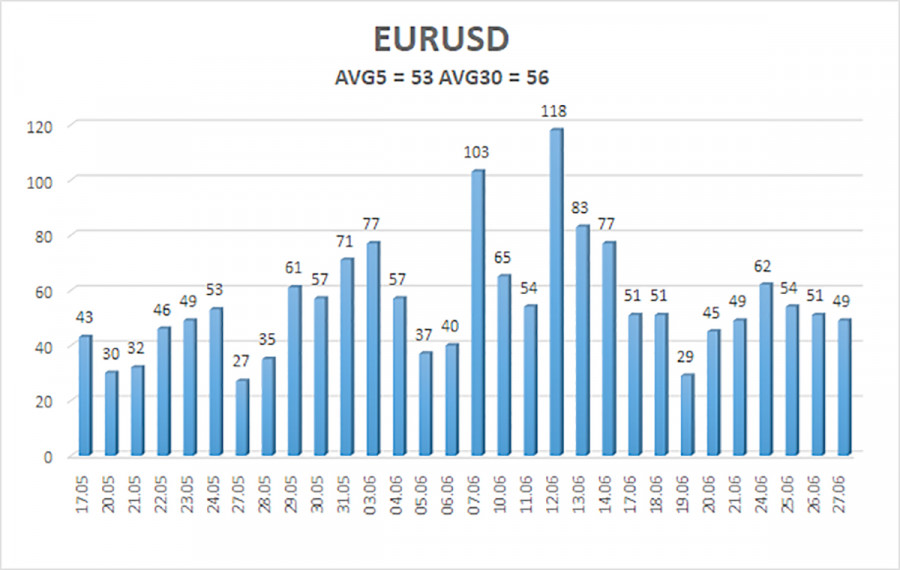

The average volatility of the EUR/USD pair over the last five trading days as of June 28 is 53 pips, which is considered a low value. We expect the pair to move between 1.0654 and 1.0760 on Friday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but it has already been worked out by an upward pullback.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and the price is located below the moving average on the 4-hour timeframe. In previous reviews, we said that we are waiting for the continuation of the downward trend. At this time, short positions with the targets of 1.0681 and 1.0620 are still valid. The third consecutive bounce from 1.0681 provoked another round of the bullish correction. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth. But the price may rise for some time as part of the correction. We don't consider consolidations above the moving average as buy signals.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.