On Tuesday, the EUR/USD pair traded with an upward trend and low volatility. As we cautioned earlier, European reports had no sway over market sentiment. The ZEW economic sentiment indices appeared significant on the events calendar, but in reality, the market ignored even their noteworthy values. For instance, the ZEW index for Germany was 19.2 points, below the forecast of 32. Was this bad news? Yes. Did it cause the euro to plummet by even 20 pips? No. The ZEW index for the Eurozone was 17.9 points against a forecast of 35.4 and a previous value of 43.7. Was this bad news? Yes. Did the euro fall? No.

Thus, the market clearly shows that it is waiting for U.S. inflation data and is unwilling to make important decisions before that. Everyone is talking about U.S. inflation this week because it will determine whether most market participants will again be wrong in expecting the Federal Reserve to cut rates by 0.5% on September 18. To jump ahead, we expect a maximum reduction of 0.25%. Even that is only because there has been so much talk about a Fed rate cut over the last seven months that the Fed might be tempted to lower rates to please the market.

According to forecasts, U.S. inflation stands at 3% and could slow to 2.9% in July. In our view, a Consumer Price Index of 2.9% does not justify the FOMC starting to ease policy. If the U.S. economy were contracting or showing slight (formal) growth quarter by quarter, it could be assumed that the Fed might intervene to save the economy by lowering rates. However, the U.S. economy is growing at a strong pace, and examples from the U.K. and the E.U. show that central banks are not ready to intervene if there is any growth.

Let's focus on the U.S. labor market, which was written off last spring. Yes, the recent Nonfarm Payrolls and unemployment figures have been disappointing. However, in half of the cases, they are disappointing only against overly optimistic forecasts. Yes, the figures are less favorable than desired, but what values did the market expect if the Fed continued holding rates at their peak level? Jobs are being created steadily, unemployment is rising very slowly, and the central bank needs to cool the labor market to prevent rising wages and demand.

Therefore, the panic and hype in the market surrounding Fed rates seem unwarranted. From our perspective, the Fed has the capacity to maintain rates at their peak until December. However, it's worth noting that even a slight dip in inflation in July could trigger a sharp decline in the U.S. dollar, a pattern we've observed in recent months.

The EUR/USD pair remains within the horizontal channel of 1.0600-1.1000 in the 24-hour time frame, so we still lean more towards a downward movement than an upward one. A price consolidation below the moving average might indicate the start of a new downward phase.

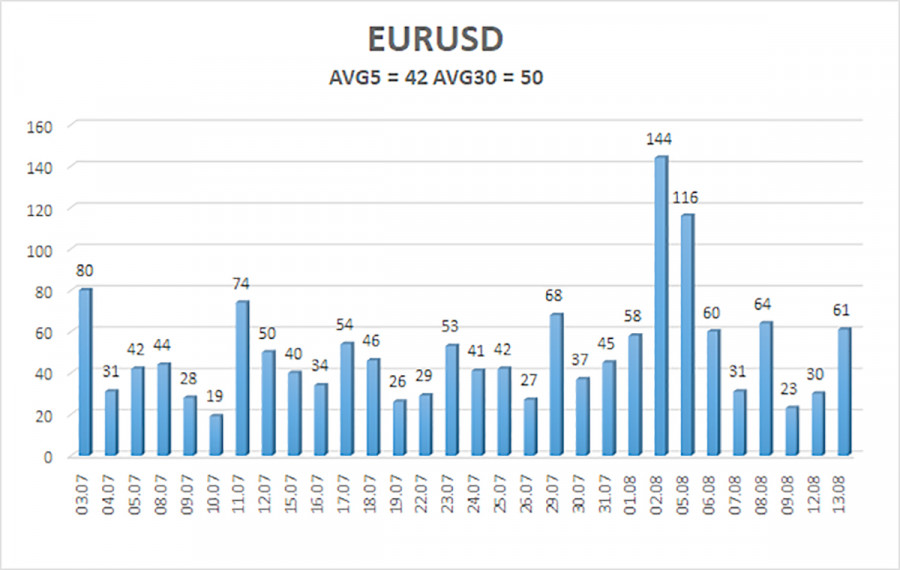

The average volatility of EUR/USD over the past five trading days as of August 14 is 42 pips, which is considered low. We expect the pair to move between the levels of 1.0920 and 1.1014 on Wednesday. The upper channel of the linear regression is directed upwards, but the global downtrend remains intact. The CCI indicator entered the overbought area for the third time, which warns not only of a possible trend reversal to the downside but also of how the current uptrend is entirely illogical.

Nearest Support Levels:

- S1 – 1.0925

- S2 – 1.0864

- S3 – 1.0803

Nearest Resistance Levels:

- R1 – 1.0986

- R2 – 1.1047

- R3 – 1.1108

We recommend checking out other articles by the author:

Review of GBP/USD on August 14; The pound's rise is deceptive

Trading Recommendations:

The EUR/USD pair maintains a global downward trend and has begun a downward correction in the 4-hour time frame, which could mark the start of a new phase of the downtrend. In previous reviews, we mentioned that we only expect declines from the euro. We believe the euro cannot start a new global trend amid the European Central Bank's monetary policy easing, so the pair will likely fluctuate between 1.0600 and 1.1000 for some time. For now, it looks like the price has bounced off the upper boundary of the horizontal channel and is heading towards the lower boundary. Unfortunately, we constantly observe the dollar falling where it shouldn't.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.