On Wednesday evening, the EUR/USD pair experienced highly volatile, mixed movements, which were expected. Initially, the dollar fell, then rose, and by Thursday, it was almost entirely down again throughout the day. We had warned that after such a significant event as the Federal Reserve meeting, it's best not to rush to conclusions. It's necessary to wait for the market to calm down and stabilize. As a result, it was difficult to say what the market's final reaction had been even by midday Thursday. The reason was that the Fed meeting occurred Wednesday evening when most European banks and trading platforms were either closed or preparing to close. Therefore, it was logical to expect a reaction from European market participants on Thursday morning. However, the market is currently experiencing a "swing" effect. We believe waiting a little longer is best, as the dollar could return to its original levels.

The Fed made the most dovish decision, but at the same time, one that market participants had anticipated. Therefore, it's hard to say that they were caught off guard. Since the beginning of the year, the market has been expecting the Fed to start easing monetary policy at any moment. In the last month, it had expected a 0.5% rate cut. So, when the Fed announced its decision, the U.S. dollar could have strengthened, as even the most dovish scenario had already been factored in. However, the market again solved this puzzle in its way. The logic is quite simple: why buy the dollar if it's constantly falling, and there's now another formal reason to sell it? Nevertheless, we reiterate that we still can't fully trust the sustained decline of the U.S. dollar. Even if it continues, calling this movement logical is inaccurate, especially since the European Central Bank is also lowering its key interest rate.

At the press conference, Fed Chair Jerome Powell stated that inflation has eased substantially enough to gradually stop having an impact on it, and the primary focus for the U.S. central bank is maintaining a low unemployment rate and preventing further "cooling" of the labor market. According to the "dot-plot" chart, the rate will be lowered by 0.5% by the end of the year, by 1% in 2025, and by 0.5% in 2026. It's worth noting that the "dot-plot" projection for 2026 aligns with previous forecasts from Fed officials. On average, the rate is expected to drop to 2.9%.

Thus, we cannot say that the results of the Fed meeting were more dovish than the market expected, and Powell was not softer than traders anticipated. Market participants received exactly the outcomes they were expecting. Yes, some traders expected only a 0.25% rate cut, but it's important to note that the dollar started falling actively a week before the Fed meeting, and the dovish results from the ECB meeting triggered... a rise in the euro. So, no matter how you look at it, the dollar is falling again without much justification. It falls ahead of important events due to "anticipation pricing" and falls afterward, despite the "anticipation pricing."

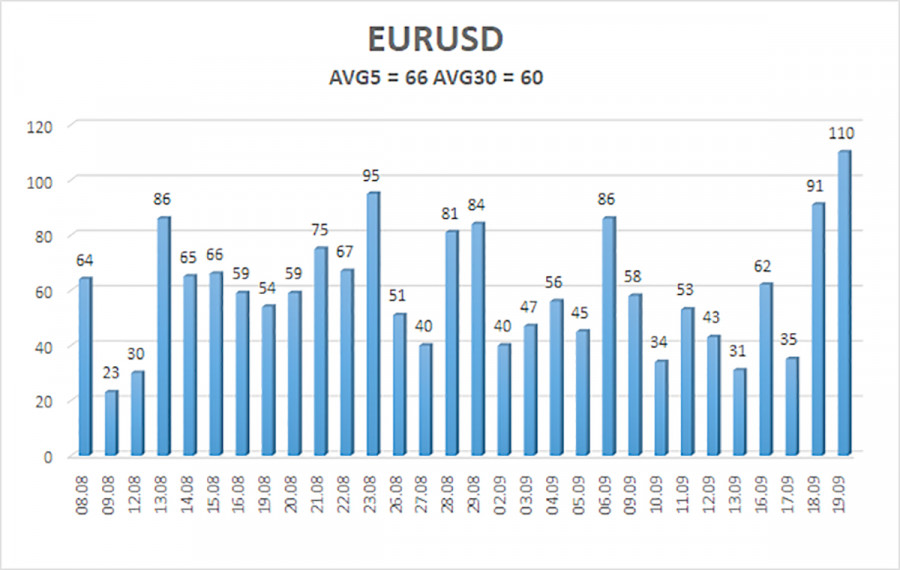

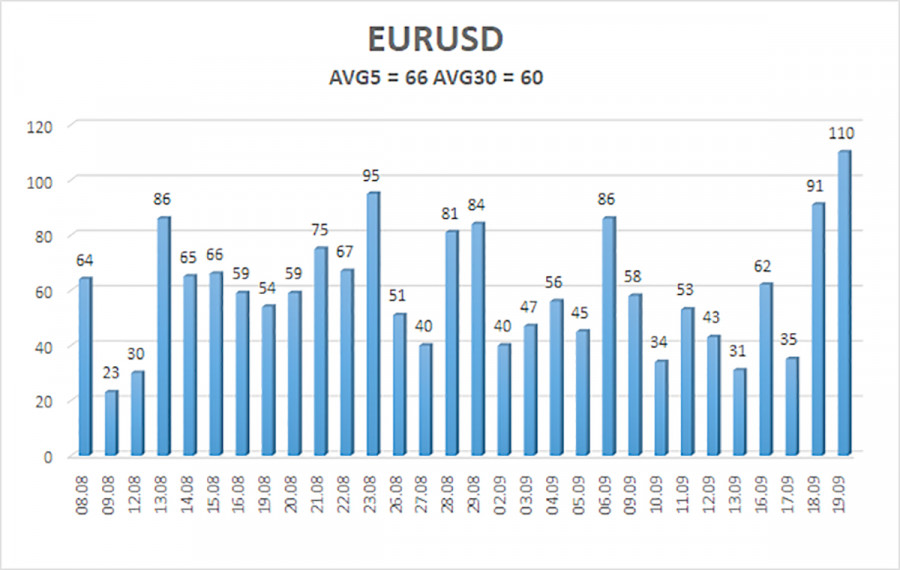

The average volatility of EUR/USD over the past five trading days as of September 20 is 66 pips, which is considered "moderate." We expect the pair to move between the levels of 1.1089 and 1.1221 on Friday. The upper linear regression channel points upward, but the overall downward trend remains intact. The CCI indicator has entered the overbought area three times, warning of a possible trend reversal to the downside and the illogical nature of the recent growth. However, we have only seen a mild correction so far.

Nearest Support Levels:

- S1 – 1.1108

- S2 – 1.1047

- S3 – 1.0986

Nearest Resistance Levels:

- R1 – 1.1169

- R2 – 1.1230

- R3 – 1.1292

Trading Recommendations:

The EUR/USD pair has resumed upward movement, although it has not yet broken the latest local high. In previous reviews, we mentioned that we expect only a decline in the euro in the medium term, as the new growth would seem absurd. There is a possibility that the market has priced in all or nearly all of the future Fed rate cuts. If this is the case, the dollar has no more reasons to fall. Short positions can be considered if the price consolidates below the moving average, with targets at 1.0986 and 1.0925. If you are trading based purely on technical analysis, long positions remain relevant until the price consolidates below the moving average.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are pointed in the same direction, this indicates a strong trend.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entry into the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction is approaching.