Modern platforms provide ample opportunities for trading on stock exchanges and Forex, including the use of one or several accounts, copy trading, and PAMM investing.

Automated trading, or trading with the help of robots, has been gaining more popularity lately.

Read more about such programs as well as their advantages and disadvantages in the article “Automated Forex trading.”

Automated trading on stock exchange

Trading robots are now commonly used. Some of them are for free and others are charged, with prices varying significantly.

Users, especially beginners, may find it difficult to choose a trading robot. They usually pick those that are either more advertised or cheaper.

Savvy traders, however, favor another approach, saying traders should not rely on expert advisors without actual trading experience and understanding of their goals and strategies.

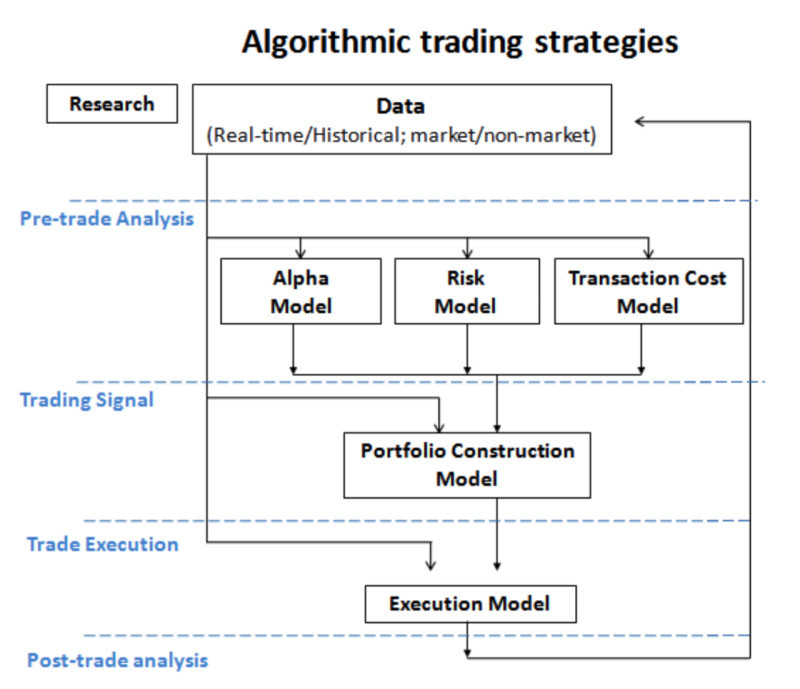

An expert advisor is a computer program with a strict algorithm. By performing a certain sequence of actions, it can analyze the market and make transactions.

At the same time, a trading robot is unable to develop a strategy itself as it is not written in its program.

Therefore, it is important to learn the basics of trading before using an expert advisor.

Trading strategies also require special attention. By picking a suitable one, you will be able to determine possible risks, desirable profits, and so on.

The next step is to explore trading robots, their capabilities, features, and types. It is important that you know how they work as well as their mechanisms for making transactions.

You can select an appropriate expert advisor as soon as you have developed your trading strategy.

It may well be that neither of the robots will meet your expectations.

In such a case, you can create one yourself using special programs or ask a professional to do that for you.

As a rule, you will have to pay for the development of a trading robot. Nevertheless, it is up to you to find a beginning programmer seeking experience who, at your request, may agree to create a robot for free.

Main advantages of trading with expert advisors

Let’s now take a closer look at the benefits of trading with expert advisors.

Firstly, unlike people, trading robots can withstand emotional pressure, fatigue, fear, stress, etc.

A robot can work round the clock without feeling tired. It does not need to take breaks to eat or do other important things.

Expert advisors also do not carry out trades being emotionally overwhelmed or impulsively. It operates according to a strictly defined algorithm.

Robots do not suffer from stress or have an instant desire to recoup losses after several unprofitable trades.

Secondly, an expert advisor can save you a lot of time. Meanwhile, it takes people ample time to analyze data and make a decision.

The program can accurately process a large amount of data at high speed, which is an uneasy task for a human brain.

Now a trader can go for a walk or to a gym, while a robot will do all the necessary work.

Thirdly, given a great variety of trading robots, it is now possible to pick the one that would suit you the best.

If you still cannot find a suitable expert adviser, you can try to create one yourself or turn to a professional.

Lastly, with properly designed and functioning robots, you can earn more than when making transactions manually.

You can combine automated and manual trading. For example, an expert advisor can make analyses and signals, while you can make transactions.

Main disadvantages of trading robots

Of course, trading robots also have disadvantages. Let’s now find out what they are.

Firstly, robots do not perform fundamental analyses, which may affect the price movement of an asset. Fundamental factors include news, global events, speculations, and so on.

In addition, expert advisers are often based on one or more indicators, which sometimes turn out to be false.

Secondly, positive reviews and expert advisers’ past success do not guarantee future profits. Market conditions may change, which ultimately affects the efficiency of a trading robot.

Oftentimes, outdated and inefficacious robots are available online. They are mainly inexpensive and do not bring profit. Meanwhile, reliable expert advisors are always expensive.

Remember that a super-profitable trading robot is never cheap. Therefore, before investing in one, read the reviews, or rather, test it on a demo account or quote history.

When your trusted expert advisor that used to operate accurately and efficiently starts bringing more and more losses, the only solution would be its optimization.

Thirdly, you need programming skills to create, set up, and use the robot correctly or a certain amount of funds to pay a programmer to develop one.

Lastly, with the constant use of algorithmic trading, users may lose their trading skills. They get used to the fact that the program does everything for them and stop thinking for themselves, analyzing the market, and making decisions.

The best trading robot - what is it?

The best trading robot is the one that suits your needs and strategy the most.

In this light, there are so many expert advisors because it is impossible to solve various problems using just one and the same program.

Therefore, a robot that opens long-term trades will not be the best for those traders who prefer scalping, and vice versa.

Here are the rules of how to select the perfect trading robot.

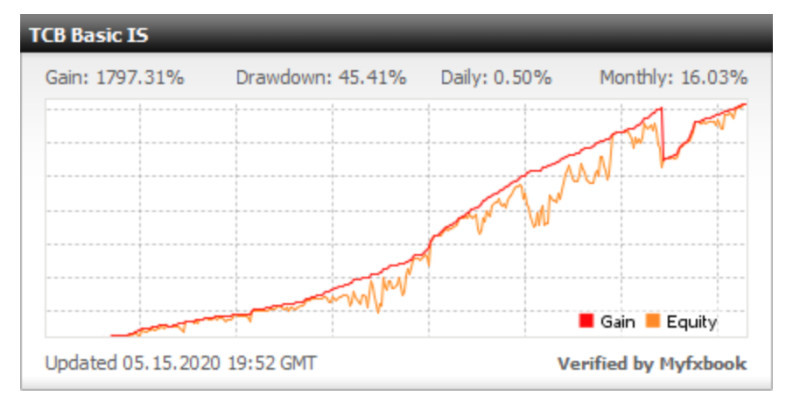

- Expected profit: profitability of good robots is 5% to 15% per month with medium and low risks. If you pick a robot with a return of more than 30% per month, this also implies serious risks of losing funds.

- Protection of the initial deposit: make sure the robot has special mechanisms to protect your investments. As a rule, these mechanisms include a stop-loss order, locking, and so on.

- Reliable broker: you should choose a reliable broker and then find out if it allows you to use the expert adviser of your choice. As a rule, well-known brokers and good robots raise no doubt.

- Robot cost: trading robots can cost $15 to $500, and sometimes even $1,000. However, expensive does not always mean better. Nevertheless, you should always remember that a good and efficient robot is never free.

- Additional services: research and compare companies that create and supply trading robots. With other conditions being equal, additional services, such as technical support, updates, a detailed user manual, etc. will be an advantage.

- Payment: working with legal entities and making payments to the account of an organization is seen to be preferable. This will help you get your money back if necessary. You can also transfer money to an individual’s bank card but at your own peril.

- Frequency of updates: clarify this point with developers in advance. The market does not stand still and conditions change, so the expert advisor should adjust and improve along with them. Updates should be released at least once every six months.

Final thoughts

In this article, we have covered the basic principles of automated trading. It has both its advantages and disadvantages.

You should carefully weigh all pros and cons before you start using trading robots.

You should also remember that there is no universal expert adviser that would suit all traders. The best robot is the one that meets all your needs and suits your trading style.

Make sure you know how to choose the best option from the huge number of existing robots. To do this, you should follow some of the rules that we have listed above.

If you still cannot find the ideal robot, you can develop one yourself or ask experienced programmers to do it for you.

Read more:

Auto Trading Software

Experience in automated trading on Forex and stock exchanges

Back to articles

Back to articles