If you want to grasp the basics of what a trading robot is and how to use it, this article is for you.

You can read more about the platform in our article MetaTrader 4 tutorial.

What is a trading robot?

Trading robots for MT4 and other platforms allow traders to automate the process of trading. This means that the program can open/close trades instead of a trader but its settings are controlled by the account holder.

Nowadays, many traders prefer fully automated trading, and they make good profits with its help.

Trading robots have both advantages and disadvantages.

Advantages:

- No emotions

Some may perceive it as a drawback, saying that being alert and sensitive is a good thing for trading. However, no stress, no panic or negative emotions is something that does more good than harm; - Non-stop trading

A robot is never tired, and you don't need to restart it during the day.

This trading assistant can work around the clock if needed. The only thing it needs is a trading platform and a stable Internet connection.

A robot will always react to a signal as it detects all the changes and promptly closes or adjusts open positions;

- Smooth operation

Some may say that this is not entirely true because a robot is a program, so there is always a small chance that it can malfunction.

However, if we take a robot and a human, the first one is much less likely to make a mistake.

Experts say that even a small mistake is impossible. The only thing that can make a robot faulty is an error in the code itself. So, this needs to be taken seriously;

- Exposure

Unlike humans, the physical resources of a robot are almost unlimited.

One trader can monitor a maximum of a few markets at a time (if we are talking about an experienced trader). A robot, on the other hand, can analyze many markets simultaneously and make decisions; - Multitasking

Apart from analyzing the market, robots can also adjust to new information and build charts. This process is done simultaneously with analyzing numerous quotes; - Updates

Robots get outdated but regular updates help them stay up-to-date.

With new features appearing on Forex, MetaTrader robots adapt to them as well. You can add the desired function to your robot at any moment.

But as it usually happens, everything has its disadvantages. So does a forex trading robot.

Forex robots have the following disadvantages:

- Hard to create

It is not an easy task to write a trading program yourself.

First of all, this requires you to have coding skills. It may take a lot of time to study this topic in case you have no previous experience with coding. That is why many traders prefer to save their time and leave it to professional programmers.

Summing up: you need to be 100% sure in the algorithm you write, and it is better to test it before you start trading; - Constant updates

Forex is a constantly changing market. Algorithms that worked perfectly well today may turn out to be less effective tomorrow.

In other words, a trading robot needs to be updated on a regular basis so that it could adapt to the changing market situation; - Inaccuracies

Sometimes, forex robots can make mistakes. For example, it cannot always recognize that a minor fluctuation is not worth paying attention to. A trader wouldn’t react to it and that would be the right decision. Yet, a robot is unable to evaluate the emergency level of the situation;

- Force majeure

For example, an interrupted Internet connection or a broken computer can become a problem. With algorithmic trading, you should always keep in mind that such things can happen.

Forex MT4 Robot: Should you download or create it yourself?

As you already know, you can either download a trading robot or write it yourself. The second scenario is more time-consuming as it requires coding skills and time to understand the essence of programming.

It is a popular view that a ready-made robot that meets all your trading needs is the best solution.

Here is what you need to keep in mind if you decide to use trading robots:

- You already have some experience and knowledge of forex trading;

- You keep a cool head when trading and understand that it may not be the best idea to rely solely on a robot. Ideally, you should optimize your trading strategy with the help of these robots and stay tuned into the process yourself;

- You have studied the details of how robots and other automated assistants function and understand the main principles of algorithms;

- You had an opportunity to test the robot on a demo account where conditions are similar to regular forex trading;

- Try to use different robots so that you can compare their effectiveness and usability and choose the most suitable one.

Simple steps to set up a robot for MT4

Setting up a forex robot by yourself is not so difficult. To launch automated trading on your MT4 account, you need to:

- Download (or buy) a trading robot to your PC and save the file;

- Open the MT4 platform (or download it if you still haven’t done so) and sign in by giving your profile details such as the password and name that you used when registering with a broker;

- Find the downloaded file with the forex robot and drag and drop it to the MetaTrader 4 folder on your computer;

- Open the Navigator panel in MT4 and click Expert Advisors. Then click on + to see the name of the file with your robot;

- Drag the file to one of the charts. The installation is completed. One more step is left — the configuration of the trading robot;

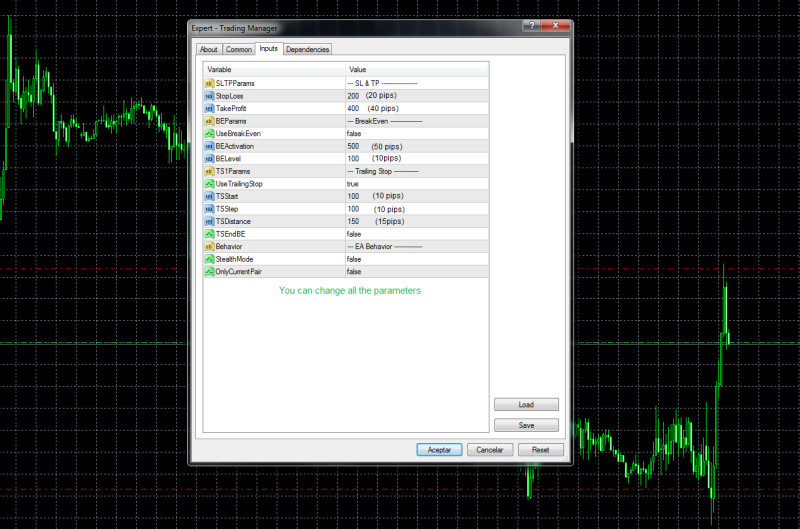

- You can do this in a pop-up window. Choose the desired parameters and enable automated trading (check the required line).

Here is a useful tip from us: test your forex robot on a demo account. This will allow you to see how this particular robot works and whether it suits you. Besides, you will be more confident to trade on a live account.

What makes a good Forex MT4 robot:

Experts agree that the key to success in automated trading is the right choice of a trading robot. It is also worth checking the reliability of the program provider.

Focus on your trading goals as this is your main criterion when defining whether this particular robot will suit you.

Below are recommendations on what to look for when choosing a robot:

1. Automation level

Almost all trading robots are designed for fully automated trading. That is, they trade on behalf of a trader by opening or closing orders.

This is exactly what most traders expect from a robot. However, some traders don’t feel safe leaving their accounts under the full control of a robot. They might appreciate a signal provider instead. For example, Quantum Al does not trade instead of a trader but sends him signals for potentially good trades.

2. Currencies available for trading

Some robots can trade during all trading sessions, that is, they can be used for trading any currency pair.

There are also forex robots that work only with particular currency pairs, mostly majors, such as GBP/USD.

They also have their advantages as they are more customized and have a narrow specialization, which allows them to be good at a particular currency pair.

3. Successful trading records

This is one of the most critical features of a robot.

The main idea behind any trading robot is to increase the number of winning trades.

Yet, different robots have different performance. Those who sell trading assistants will assure you that they are 95% efficient. But keep in mind that such results are far from reality.

Online reviews can help you check whether these promises are true.

4. Types of strategies

Every trader has his own strategy and trading style. The same is true about forex robots.

No two trading algorithms are the same. So before using automated trading, you need to figure out how this particular robot is functioning.

The strategy for gaining a small but stable profit is different from the one that implies reaping huge profits. Accordingly, the risk exposure is different as well.

5. Price

As practice shows, good robots are expensive, but most of the time they are worth their money.

Unfortunately, this is not always the case, and free robots can be no less useful than the paid ones.

6. Internet reviews

And finally, check out online reviews of a robot you want to use so that you see for yourself how it works and whether it is effective or not.

Final thoughts

Forex robots are perfect helpers for beginners.

Indeed, they can boost your trading and make it run 24 hours a day if you wish.

You should keep an eye on them from time to time, especially at the start of your way in algorithmic trading. This will allow you to understand their mechanism, be confident, and stay in control of the situation.

It would be reasonable to test your robot on a demo account first. Many brokers, including InstaForex, offer such an option. You can download a free demo account on our official website.

It is important to remember that even with automated trading you cannot avoid risks. Besides, it would be naive to expect huge profits on a regular basis. Professional traders understand that this is impossible.

Yet, such trading assistants can definitely help you customize your trading, especially if you find the one that meets your trading needs.

Read more

MT4 vs MT5: Explaining Difference

Metatrader 4: review from popular sources

MT4 Script Download on MQL4 and more

Back to articles

Back to articles