How to start trading on the forex market? You can easily become a trader after you read the article “How to open a Forex account?.”

Meanwhile, we will explain how to open a demo account, how to use it, what traders it suits, and how long it is better to use it.

Accumulate capital

The global economy is rather volatile since the situation in the world is constantly changing. Currencies’ exchange rates, prices of shares of large companies and corporations never stay the same.

Is it good or bad? This depends on a person or organization and on the nature of these changes.

For example, public joint stock companies benefit from a rise in their shares. The fact is that higher share prices boost companies’ market cap, enhance their prestige, and improve financial position.

At the same time, increasing currencies boost the wellness of the countries they belong to and goods and services exporters.

If you think that you have nothing to do with these fluctuations, and it is impossible to earn money from them, you are wrong.

Any person can benefit from a change in an asset price. It does not depend on a rise or fall in the price. The key thing is to correctly predict the price movement.

This is the main idea of trading. People from all over the world bet on currencies and stocks. If their predictions come true, they receive an income.

This is the main principle of Forex trading, where currency pairs are the main trading instruments.

However, it is not a lottery or a casino, where everything depends on luck. In the currency market, it is important to predict the price and not to guess it.

Only in this case, trading may bring income.

Myths about Forex:

- The currency market business is a roulette. No, it is not true. Luck is of minor importance. Success depends on knowledge, skills, and the ability to analyze.

- Everyone makes a profit. According to statistical data, about 70% of traders increase their capital.

- Traders should be financially literate. Knowledge in this sphere is an obvious advantage but it is not the key to success.

- What to do if you are just planning to start trading and feel concerned about the lack of knowledge and skills? For this purpose, many companies offer demo accounts that we will talk about below.

What is a demo account in Forex?

Suppose you decide to open your own business and start painting cars. You have read a lot of useful information and passed training courses.

It is quite logical that you will first test your skills on a cheap and non-running car just in case something goes wrong.

You need the same practice on Forex. The fact is that a lot of theoretical material and webinars cannot teach you to implement the knowledge in practice.

On top of that, you risk your own money.

If experienced traders are able to evaluate all possible risks, newbies may face some problems. In other words, those who open a live account without practice may lose their deposits at the very beginning.

Most common mistakes among novice traders:

• consider losing positions as a complete failure, without realizing that they are a part of trading. Traders should not count the number of failures, but they should count the money they lost. The fact is that losses should be lower than income from profitable trades;

• do not close a losing trade on time, hoping that the market dynamic will change;

• open several orders at a time, without being able to actively monitor the process;

• invest all funds in one trade that looks very attractive;

• do not analyze their trading;

• ignore risks.

To avoid mistakes, traders may first polish their skills on a demo account.

What is the difference between a live and demo account on Forex? Trading on a demo account, you do not have to deposit real money.

Trading is performed by means of virtual money, including dollars, euros, etc. Traders decide what sum they need, and it appears on an account.

Demo accounts have the same functions as a live account. A demo account is almost an identical copy of a live one.

You can see the prices of currency pairs in a real-time mode. You can also open and close orders, monitor reports as well as do other things.

However, since money on your account is virtual, both losses and income are also virtual. You do not take risks and cannot spend your income.

Why should traders use a demo account on Forex?

• To learn market peculiarities;

• To avoid even small investments;

• To obtain experience and apply knowledge;

• To learn more about trading platforms;

• To polish skills in opening and closing trades;

• To test strategies and trading indicators;

• To try out the trading conditions of a brokerage company;

• To understand what is order, spread, and leverage;

• To master technical analysis and learn how to use its tools;

• To set charts;

• To adapt to the market and asset volatility;

• To get ready for various situations from a psychological point of view.

In other words, a demo account has numerous advantages, including zero responsibility and risks. It is an absolutely safe simulator.

If traders decide that this activity does not suit them, they can stop trading at any moment, regardless of their virtual balance.

However, traders should remember that when training on a demo account they are forming their trading habits and style, which is very important when trading on a live account.

When using a demo account, future traders are not as serious as they should be. What is more, some traders even succumb to excitement and forget about the chosen strategy.

If traders choose a chaotic approach and do not see a clear goal, they may start using the same scheme in real trading.

A habit is another reason why newbies continue trading on a demo account. The fact is that they simply cannot abandon such a safe approach.

Some other cons of using a demo account:

• the simulator may not take into account the current news. In real life, the asset price is affected by important economic events, whereas on a demo account such factors are ignored.

• Some kind of derealization.

• Underestimation of possible risks. Using unreal money, traders may underestimate the possibility of losses.

• Earned money cannot be spent at traders’ discretion.

What is a demo account in Forex: How to start

Like in other businesses, in Forex, success comes to those who practice a lot.

Why should traders open a demo account?

1. To receive new knowledge and put it into practice.

2. To hone skills.

3. To test new strategies, approaches, and methods in trading.

Those speculators who are well-prepared for real trading thanks to a demo account have every chance to increase their deposit in the future.

Three components of a trading process:

1. Emotional. A demo account may help traders understand what emotions they will have in case of success or failure. Before switching to real trading, it is very important to learn what emotions you may experience. The fact is that psychological facotr may destroy even the best-laid plan.

2. Cognitive. Have you already learnt a lot about strategies, signals, and charts?

If the answer is “Yes”, a demo account is a perfect opportunity to put your knowledge into practice without risks. You will understand what trading instruments suit you most and what instruments it is better to avoid.

3. Organizational. Trading on Forex is performed 24/5. Trying various sessions, you will be able to choose the one you like more. However, you should take into account your working schedule and personal biorhythms.

So, how to start trading? First thing first, you should come up with is the creation of a personal trading plan.

Although a trading account is not real, traders still need a plan that answers the following questions:

• what asset to trade, for example, EUR/USD, EUR/CAD, etc;

• what strategies to use and what entry and exit signals to apply;

• how often and how much time a day or week you may spend on trading;

• what risks you are ready to face.

Once you have a trading plan, it is high time to open a demo account. There are two ways to do so: via a brokerage company or directly on a trading platform.

Almost all brokers offer a demo account. On their official websites, traders may find detailed instructions on how to use them.

As a rule, traders select a broker they are planning to work with after the training process.

When picking a broker, traders should take into account the following factors:

• a company’s reputation and users’ reviews;

• ways to deposit and withdraw funds. It is really significant if traders are planning to continue working with the company after polishing their skills on a demo account;

• a variety of trading instruments;

• the size of commission rewards, and spreads. Traders will need this information when trading on a real account;

• efficiency of the support service;

• a trading platform.

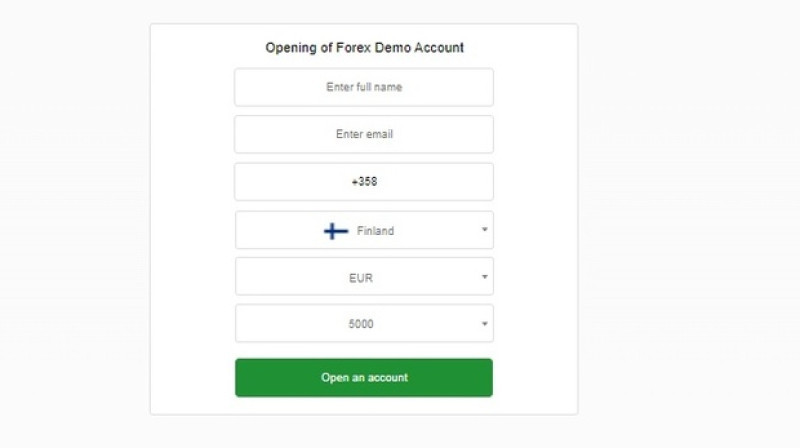

How to open an account

1. Fill in the registration form. Choose a currency of your account and specify the sum of a virtual deposit;

2. Receive a login and password via email;

3. Install the trading platform and authorize.

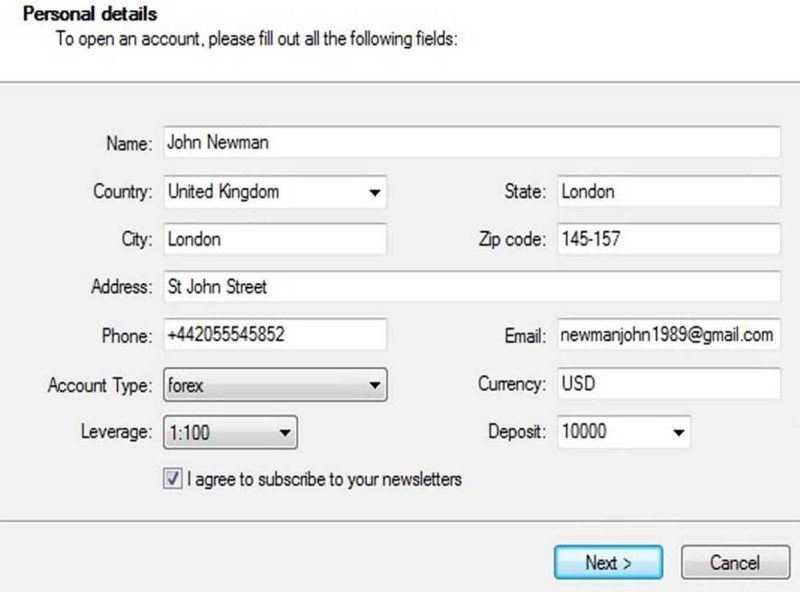

MT4 is the most popular trading platform. Let’s take a look at the demo account opening on the MT4 platform.

Just four steps to open a demo account:

1. Install MT4 on your device, namely PC, smartphone, etc;

2. Open the downloaded program and select “Open demo account”;

3. Fill in the registration form. The system will ask you to specify personal data as well as your account currency, sum, and leverage. By default, the leverage is 1:100, the currency is USD, the sum is 10,000 units;

4. Confirm the registration.

You will receive a login and password, which you will have to indicate when opening the platform. Safe them as it is difficult and sometimes impossible to restore the data.

You do not need verification to open a demo account. That is why the registration process will take just 5 minutes. Once everything is done, start trading.

How to trade on demo account

After you download the trading platform and open a demo account, it is time to start trading.

At first blush, a variety of sections, instruments, and charts may shock you. However, it is not as difficult as you might think.

How to trade on a demo account:

1. Open the trading platform installed on your PC or smartphone;

2. Enter your login and password that were sent to your email after registration;

3. Select a trading instrument, for example, the EUR/USD currency pair;

4. Initiate an order: a sell one, if the asset is expected to decline, or a buy one, if the asset is predicted to rise;

5. Once the price hits the target, close the order.

We have already mentioned that not all trades on Forex are profitable. Even forecasts provided by experienced traders may be misleading.

That is why it is essential to manage your funds when trading on both demo and live accounts.

Money management includes the following:

• reasonable usage of leverage. The most popular size of leverage is 1:100, but newbies should apply a smaller one, for example, 1:20;

• application of Stop Loss. This order is designed to limit losses and close a position when a price hits a particular level;

• application of Take Profit. It is an order that limits profit.

When to switch to live account

A demo account is a good practice before you start real trading. Both demo and live accounts have much in common, except for virtual money.

To benefit from a demo account, you should follow some rules:

• create a trading plan and alter it if necessary;

• keep a record of your own mistakes;

• analyze results of all trades, including profitable and losing ones.

If you learn to evaluate and alter your strategy according to the market conditions, it will mean that you have successfully finished your training course. How much time should a newbie trade on a demo account and when is it time to switch to a live one?

Some traders prefer setting particular goals, the achievement of which will indicate their readiness to start a real trade. For example, some traders wait until they increase the initial capital by 20%, others – until they perform 40 profitable trades or train for 5 months in a row.

Conditions for switching to a live account:

1. If traders prefer small time frames and regularly practice intraday trading, 2-3 months will be enough to switch to a live account. In case of scalping, the training period could last only one month;

2. When traders have a stable income during 2-3 months;

3. If profit from successful positions covers losses during several months;

4. When trading stops causing concern and dissatisfaction with the result;

5. If traders closely follow their plans.

In any case, the decision to start trading on a live account should be taken only by a trader. The above-mentioned conditions are just examples.

To understand whether you are ready to start trading on a live account or not, answer the following questions:

1. Are you psychologically ready for both gains and losses?

2. Are you sure of your trading strategy?

3. Does income exceed losses?

4. Have you learnt to risk just 2-3% of your deposit?

5. Are you a confident user of the trading platform?

If you answer “Yes” to all the questions and do not have any doubts, it means that you have successfully completed your training.

Who should trade on a demo account?

It is common knowledge that beginning traders need simulators.

Using a demo account, traders will have an opportunity:

• to gain access to the trading platform and currency market;

• to get knowledge about the platform’s functions;

• to test their knowledge and trading plans;

• to perform trades, without investing personal funds.

At the same time, a demo account may help even experienced traders. It could be used in the following cases:

1. to test a new trading method;

2. to learn how to trade a new trading instrument;

3. to check the effectiveness of different-sized leverage;

4. to learn new trading signals.

However, even professional traders may lose control when using virtual money. If on a demo account, unreasonable risks lead to disappointment, on a live account, they lead to financial losses.

In this case, traders should remember that on a live account, virtual losses turn into real ones.

Regardless of an account type, trading should be performed according to the risk management rules. Otherwise, trading may turn into gambling with an unpredictable result.

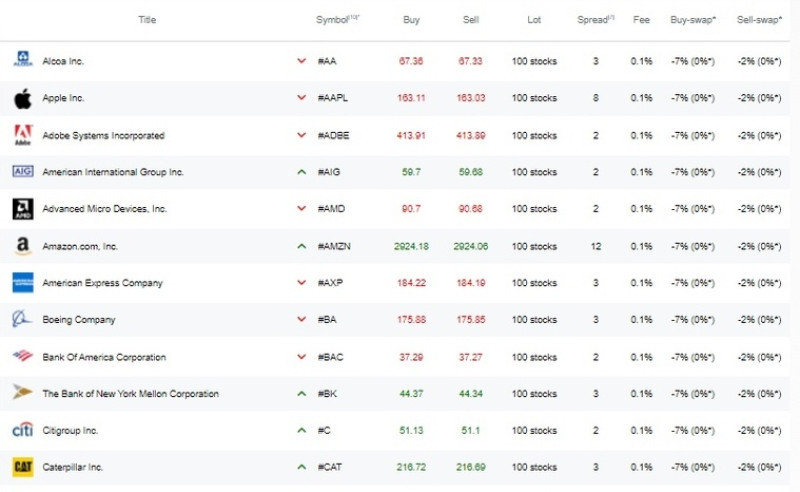

Demo account on stock market

While on Forex, traders open positions on currency pairs, on the stock market, they trade securities of big companies and corporations, including shares, bonds, etc.

You surely have already heard about famous US investor Warren Buffett, who has been investing in shares for many years already. He is one of the wealthiest people in the world, with a fortune of about $113 billion.

To gain profit from shares, you should buy them at the lowest possible price and sell them at the highest price.

Another method to earn money is to receive dividends. In this case, you should also buy shares and hold them to receive a quarterly, yearly, etc payment.

To avoid risks at the beginning of your trading career, you can take an educational course devoted to the stock markets. Some brokerage companies and stock exchanges offer simulators.

For example, the MOEX has developed its own educational server. You should just send a request, specifying a little personal data.

Once you receive access to the server, you may start acting as an investor and put your money in the most attractive shares.

However, the most popular way to earn on shares is to trade contracts for difference, CFDs.

Peculiarities of CFDs:

• contracts are signed by two parties – a buyer and a seller;

• brokerage company acts as an intermediary;

• profit comes from price changes;

• no real purchase and sale of shares.

How does it work? For example, traders suppose that Apple’s shares will rise. In this case, they open a buy order.

If the predictions come true and shares become more expensive, traders will receive income.

The key aim is to predict the price changes as they may either rise or fall. Notably, it is possible to make money on both increases and declines.

Advantages of CFD trading:

1. smallest possible deposit: traders do not have to buy shares. The real share price could be very high. Thus, one Apple share costs about $70;

2. income from dropping prices: if investors held shares, they earn only from their rise;

3. accessibility: investors can use the same trading platform as for currency trading;

4. variety: it is possible to make money on shares of a large number of companies;

5. leverage: investors may use leverage to enlarge their financial potential.

As in the case of currency pairs, you can practice stock trading using a demo account. It can be opened with a brokerage company.

How to open a demo account with InstaForex:

Step 1: Register;

Step 2: Receive an account number and password via email;

Step 3: Install a trading platform and authorize.

A demo account fully resembles a live one, except for virtual money. You can also monitor quotes in a real-time mode, read the news as well as analyze your income and losses.

What is a Demo Account in Forex: Tips

Trading, like any other business, has its own rules, which allow traders to achieve new goals and develop skills.

These rules are of vital importance whether you trade on a live or a demo account:

• invest reasonable sums. Do not deposit all your savings even in a virtual account. It is better to invest the sum, the loss of which will not be painful.

• trade only when you are emotionally stable. Do not make a snap decisions or when you are angry or nervous;

• organize a competition with your friends to evaluate your success on a demo account;

• try to forget that you are trading on a demo account. Imagine that the trading is real;

• do not forget about diversification. While newbies are better to trade only one asset, experienced traders should diversify their investment portfolio;

• do not invest all your funds in one trade regardless of its attractiveness. Both beginning and experienced traders should avoid such situations.

Conclusion

A demo account is a perfect chance to start your career in the forex and stock markets. It could be easily opened and does not require a real deposit. On top of that, this service is absolutely free. Traders choose a sum of the deposit and the most suitable leverage. Since trading is performed in a real trading platform, traders could hardly find the difference when switching to a live account. The key point is a result of a training period. Experienced traders are sure that if you do not gain success on a demo account, you are unlikely to become successful in real trading. However, profitable trading on a demo account does not guarantee the same result on a live account.

Read more:

Cent Account Forex: How to Open?

Forex Demo Account: How to Open?

How to Open a Real Forex Account on Metatrader 4

Back to articles

Back to articles