Currently, more people are trying to conquer new heights of the forex market. Read the article "How to open a Forex account: live, cent or demo" and get the information on how to start trading on Forex and whether it's easy to generate profits.

We will only discuss the details of the cent account: its purpose, what category of traders it suits and how to trade it.

Concept

It might be difficult for beginners to grasp the concept of a cent account, to realize its purpose, and what category of traders it suits. Therefore, first let’s reveal its essence.

The name speaks for itself. A cent account measures the balance in cents.

For example, you replenished your deposit with $30. That amount is calculated as 30 units on a standard account.

As for the cent account, you will have 3,000 currency units. It is obvious that 1 USD equals 100 cents.

In this case, traders subconsciously get used to trading large sums.

However, the key point is conversion of large currency units into smaller ones as well as cost of lots and potential risks that are lower in case of cent accounts.

Let's give an example.

You have a cent account and plan to invest in the EUR/USD pair.

You opened a 0.1 lot buy trade. The exchange rate was 1.0499 at the start and 1.0513 when you closed the trade.

It turns out that the pair has risen by 14 pips. Therefore, the cent account profits will total 14 cents, i.e. 0,14 USD.

In case of a standard account, you could have earned $14 with the same lot size, i.e. 100 times more.

However, if the pair had dropped, traders incurred 100 times less losses on a cent account.

If the EUR/USD pair fell by 14 pips, you would lose 14 cents on a cent account and $14 on a standard one, in case of 0.1 lot size in both cases.

The point is the pip value, which is different in two cases.

It is shown in our table.

The pip value for different account types

| Account | Pip value when trading 0.1 lot, $ | Pip value when trading 1 lot, $ |

| Cent | 0.01 | 0.1 |

| Standard | 1 | 10 |

In this case, we have discussed a very slight price variation of currency pairs. Sometimes, the price can change by 100 and even several hundred pips during a day.

In this case, profits or losses on a cent account with a trade volume of 0.1 lot will be from 100 cents, while they will be from $100 on a standard account.

Purpose of cent account Forex

Earlier, when speculative trading on Forex was gaining momentum, players should have a deposit worth thousands of dollars. There were no odd lots and leverage was limited to 1:100.

Moreover, to follow the rules of risk management, it was necessary to have a more considerable sum. Therefore, it was the reason why the access to the currency market for many traders was limited.

Currently, the situation has changed dramatically due to the rapid development of brokerage companies. You can enter the forex market even with $10, opening a cent account.

Another key point is that beginners often feel fear and uncertainty when they start trading.

It is not surprising, as they can lose their savings if they incur losses. Therefore, not to risk a large sum of money, you can open a cent account.

Why to open a cent account:

- To practice trading on Forex. It is a good option for beginners due to risk minimization. Moreover, experts recommend start trading on Forex with a cent account. In addition, this option is suitable even for those traders who do not have a large initial capital;

2. Not to lose large sums of money when trading. In most cases, the minimum trade volume on a standard account is 0.01 lot, while it is 0.1 lot on a cent account. If we convert these sums into US dollars, we will get $1,000 and $100 respectively. In case you use leverage, the deposit will be even smaller;

3. Prepare for trading with huge sums. Traders can suffer real losses and generate real profits, prepare for trading, realize the essence of it;

4. To test the trading platform. This is relevant if traders did not practise to trade in a demo account;

5. To practise trading strategy. If you want to apply it when conducting a $10,000 trade, then it is advisable to try using this strategy on a cent account, depositing it only with $100 (10,000 cents).

Therefore, you will lose $100 instead of $10,000 in the worst-case scenario. Remember that your profits will also be measured in cents, not in USD;

6. To test a trading idea. Let’s assume that after a significant economic event the market trend has changed, and you are confident that the price will rise.

However, your trading strategy does not give any clear signals. You can take a risk and apply this idea on a cent account;

7. To evaluate trading conditions of a brokerage firm, taking into account spreads, commissions, etc.;

8. To experiment with trading tools. For example, you have been trading the EUR/USD pair for a long time, and you have recently focused on the USD/JPY pair

9. To use trading advisors. In this case, robots will trade for you.

It can be risky to let robots trade in a standard account. However, cent accounts will be suitable for this purpose;

10. To learn to manage money, i.e. assess the risks in trading. It is obvious that you must not risk more than 1-2% of your deposit in one trade.

In case you incur losses, it will be extremely difficult to recover even the initial capital.

For example, after losing 50% of available funds, it is necessary to double the balance, i.e. by 100% to return the initial sum. Even successful and experienced traders seldom manage to do it.

Examples are given in our table

Deposit recovery to breakeven after losses

| Losses | 10% | 20% | 30% |

| Profit recovery | 12% | 25% | 43% |

Therefore, cent account are suitable both for beginners and experienced traders. In the first case, it serves as a simulator, and in the second case, it is used for testing a new trading strategy.

A cent account is undoubtedly very similar to a demo account. They both are necessary mainly for training, smooth start and testing new trading strategies.

However, there are differences between these accounts too:

- a trading is conducted with virtual money on a demo account; losses and profits are not real either;

- a demo account carries no risks, while they are minimal on a cent account;

- it means the real market versus the virtual one.

So, which account is better for beginners: a demo account or a cent one? In fact, they don’t have to choose.

It is advisable to start trading with a demo account and then turn to a cent account.

Cent account Forex: How to open?

To make money on Forex, first you should choose a brokerage company. A broker will work as an intermediary between a trader and the forex market.

After choosing the broker, you should open an account with him. However, how to identify a cent account?

It is easy. As a rule, it is implied by its name.

For example, InstaForex has Cent.Standard and Cent.Eurica accounts. The only difference between them and the standard ones is the trade volume; in other respects, the trading conditions are almost identical.

Some of you probably wonder why brokers provide access to such accounts if clients with modest capital are less attractive. It is obvious that the brokerage firms earn their income also from the commission, which amount depends on the trading volume.

The point is that novice traders practising trading with a cent account can become major players in the near future. Therefore, brokers give them a chance to start trading without huge risks to reach a new level.

However, not all brokers offer beginners this type of account. Only the classical trading option for traders with huge sums is available in some cases.

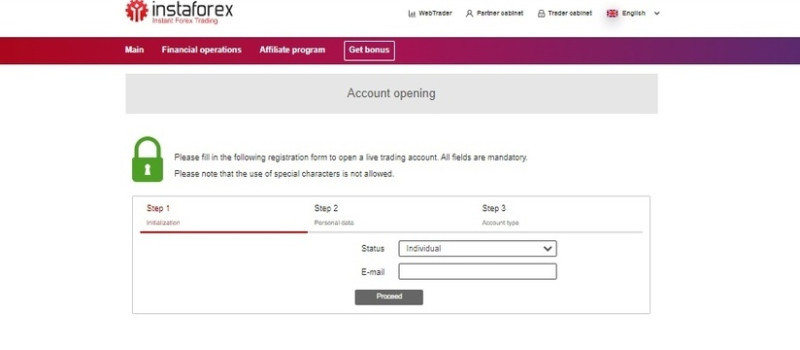

How to open a cent account? The process is the same as for the standard account.

To open a cent account, you need:

1. Read the public offer agreement on the broker's website. It contains all the rules of operations. Therefore, it is advisable to examine it carefully;

2. Complete the registration:

- initialize;

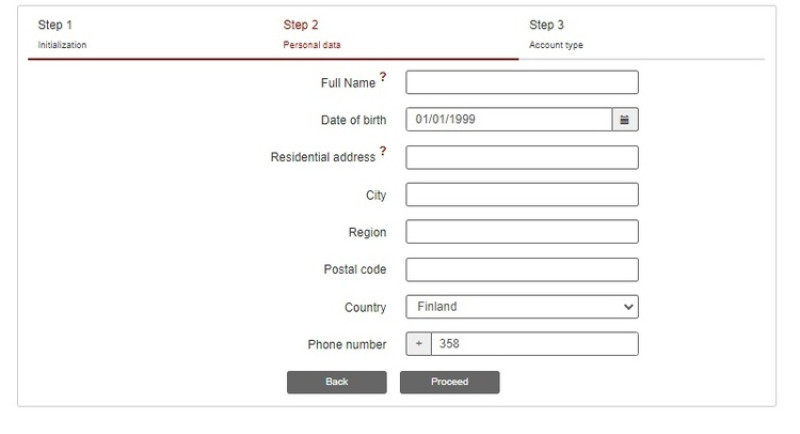

- fill in your personal details;

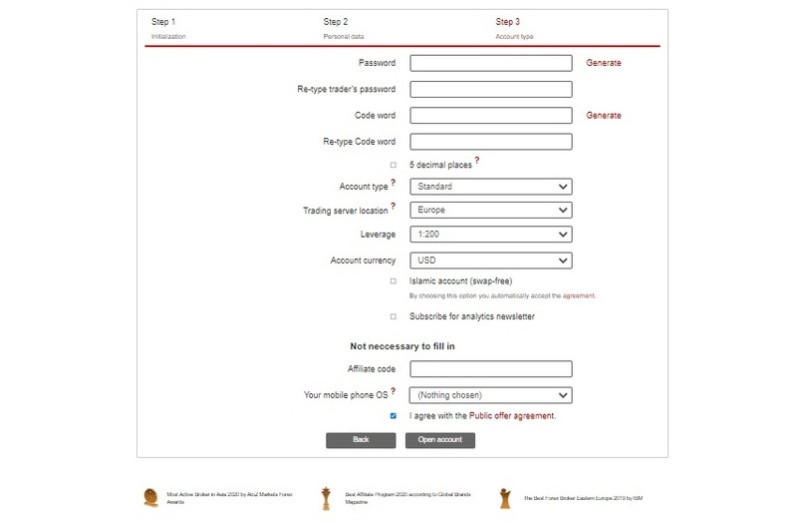

- select the account type: at this stage, you should note that it will be a cent account, as well as specify the currency and the amount of leverage;

3. Complete verification. It is required to confirm the data indicated in the previous stage.

This procedure is not mandatory for InstaForex broker. However, the account has limited functions without it;

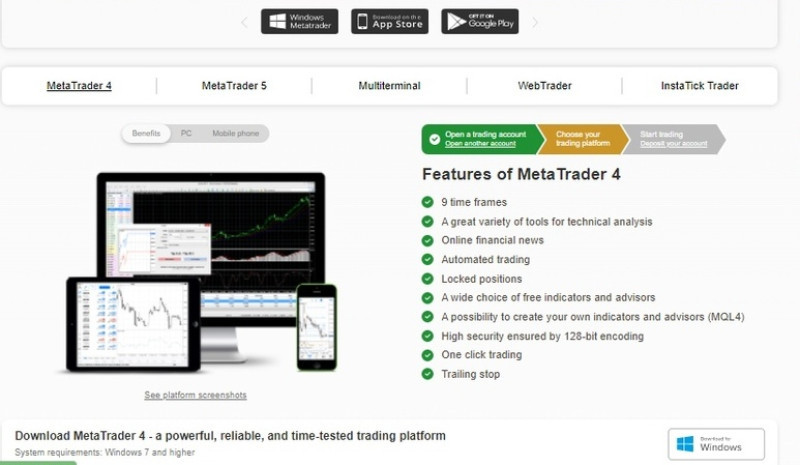

4. Install the trading platform;

5. Replenish the account.

Basic steps how to open a cent account with InstaForex broker:

In fact, this process does not take a lot of time. Another key point is: store your username and password safely.

How to use cent account Forex

In fact, trading in a cent account is almost the same as in a standard one. The main principle is to buy cheaper and then sell at a higher price.

When traders open a position in the currency market, it means that they place an order to buy or to sell.

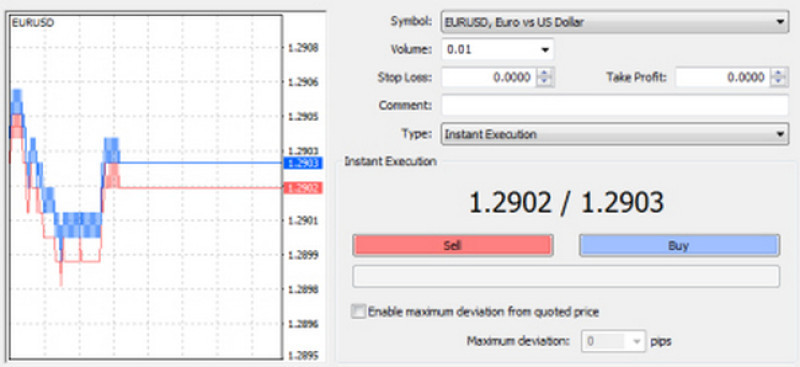

To open an order, you need:

- to click on the corresponding tab in the trading platform menu;

- to choose a currency pair;

- to indicate the trading volume measured in lots;

- to set Stop-Loss and Take-Profit orders, which limit profits and losses;

- to select the type of order: for example, instant execution, if you do not want to use a pending order;

- to press the buy or sell button.

After setting the order, traders should closely monitor changes in the exchange rate. The position can be closed in two ways: either Stop-Loss or Take-Profit orders are triggered automatically, or manually.

The second option implies a reverse trade of the same volume and the same currency pair. For example, if a position was opened to buy 0.01 lot for the EUR/USD pair, then traders should sell the same volume of the currency to complete the trade.

When the position is closed, traders need only to lock in profits or losses. It should be noted that they are measured in cents.

Major points in trading:

- A leverage allows you to borrow money from your broker and open a trade of a larger volume than your capital. The money is used immediately to conduct a trade and is returned to the broker when the trade is completed.

InstaForex offers traders a leverage up to 1:1000 for cent accounts. For instance, if you have only 100 cents on your deposit and use the leverage 1:100, you can open a trade for 10,000 units;

- A minimum deposit is the amount of money required to open a trade. InstaForex has a minimum deposit of only $1;

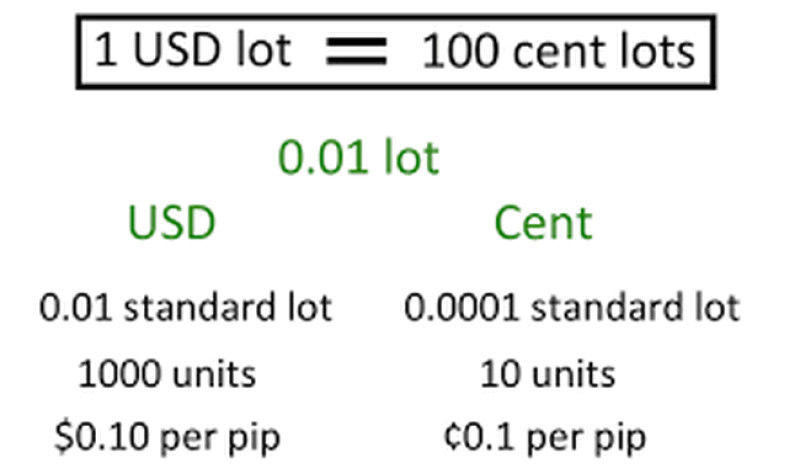

- A minimum trade size is the smallest volume that can be traded on a cent account.

For example, at InstaForex it is 0.1 lot. However, taking into account that Micro Forex is available on cent accounts, the minimum trade size equals 0.0001 standard lot;

- A maximum trade size is the largest available volume for trading, and if you want to trade with huge sums, you need a standard account.

InstaForex's maximum trade size is 10,000 lots;

- A margin call is the level of margin at which a trade can be closed by the broker. At InstaForex, it is equal to 30%.

In other words, if the deposit amount is lower than the specified level, the broker warns you that the trade may be closed automatically. However, it is enough to top up your account to avoid it;

- Stop out is the level of margin required to close a position automatically. At InstaForex it is equal to 10%.

Brokers have different trading conditions for cent accounts. Study them carefully before you complete registration and start trading.

How long to trade

It is difficult to give a definite answer how long you should trade in a cent account.

It all depends on its purpose.

For instance, in case of experienced traders who use it to test a new trading strategy or idea, then they should determine this period themselves.

It is logical that in case a trading strategy is confirmed or disproved, a cent account is no longer necessary. How long it will take depends on traders’ skills, as well as the method itself.

Now let's discuss the option when this type of account is used by beginners. However, in this case, each situation is unique.

For example, some experts believe that 1-2 months of regular training is enough to apply the knowledge and skills into practice. Moreover, you should not focus solely on duration.

The major point is that profits must exceed losses. Only market players can determine this amount and how long it should last.

However, it is important not to go over the top. If traders have been trading in a cent account for a long time, their profits will remain low and their achievements will be very modest.

These aspects can be the reason for traders to give up trading.

When a cent account has fulfilled its function, it can be closed. Moreover, if it is not used for a long time, the broker will archive it.

However, some experts recommend keeping this account as a fallback option. We have already mentioned that in this way you can test new strategies, trading tools, etc.

Pros and cons

Forex trading is carried out in lots. Its standard size is 100,000 currency units. For example, it is 100,000 US dollars for the USD/CAD pair.

As for the cent deposit, then one lot is 100,000 cents, i.e. $1000.

Let’s provide a clear example. Assume that you want to open a 1 lot trade to buy USD/CAD.

If you do not use leverage, then you need a deposit of 100,000 cents.

In this case, the value of one pip will total 10 cents. If the pair rises by 10 pips, then your profits will be equal to 100 cents, i.e. $1.

In case the price drops by 10 pips, your losses will also be 100 cents, i.e.$1.

As for the standard account, both profits and losses would be 100 times higher. This is considered both the main advantage and disadvantage of cent accounts.

Advantages of cent accounts:

- low costs in trading;

- affordability;

- trading on the same trading platforms as in case of a standard account;

- risk management training;

- testing the feasibility of applied trading strategy;

- testing of trading techniques and strategies;

- evaluation of signals and indicators, chart analysis;

- low risks;

- psychological training, control of one’s emotions, stress resistance;

- many brokers provide bonuses for depositing an account.

Disadvantages:

- low profits. We have already mentioned that with the same lot size it is a hundred times less than on a standard account;

- low responsibility of traders: players often open risky trades as they realize the insignificance of losses. However, it is dangerous when you turn to trading from a standard account;

- developing habits of easy trading.

Recommendations

Despite trading in cent accounts carries low risks, real money is in question. This means that inappropriate actions can lead to losses and even to losing the deposit.

Therefore, if you plan to open a cent account, we advise you to follow basic rules when using it:

- Do not use it for trading with high risk strategies, such as scalping. It is not the best variant for beginners to practise trading, to analyse and manage money;

- Do not apply the maximum leverage. If you increase the trading volume, your potential profits as well as your losses will rise;

- Control your balance. The analysis of incomes and expenses, profitable and unprofitable trades will develop skills of finance management;

- Do not invest all money on your deposit in a single trade, the risk per trade should not exceed 2% of your capital;

- Do not expect rapid and substantial profits. You should consider this account as a training stage for trading with huge sums;

- Do not use aggressive trading style as it can lead to the loss of the dollar deposit.

Cent account Forex: Conclusion

A cent account is essential for traders who want to succeed on Forex.

After training to trade in a demo account, it is recommended to open a cent account to switch to a standard account later.

Only in this case, your first steps in trading will be sensible and will not result in disappointment due to huge financial losses. Why?

First, a small initial capital is essential for trading. In some cases, $10 or even $1 is enough to start trading.

Secondly, trading is carried out with minimal risks. A pip value can be as low as 0.1 cent, which protects your deposit even in case of strong currency price movements.

Taking into account all the obvious benefits, remember that cent accounts will not generate considerable profits. Moreover, traders can get used to risking in cents instead of dollars and then stick to this trading style in classical trading.

Read more:

Forex Demo Account: How to Open?

Back to articles

Back to articles