Raise your capital

The world economy is inherently volatile because nothing in the world stands still. Exchange rates and stock prices of major companies and corporations are changing constantly and endlessly.

This can be both good and bad and depends on what changes take place.

For example, public joint-stock companies benefit when their securities appreciate. This boosts companies' market capitalization, improves their image, and enhances their financial position.

The growth of the national currency favors the state to which it belongs, as well as the exporters of goods and services.

Don't think that this doesn't concern you and that you won't get any profit from the fluctuations.

Anyone can also benefit from changes in asset prices. It does not matter whether the price is rising or falling. The main thing is to predict the dynamics correctly.

This is what trading is all about. Users from all over the world place bets on currencies and stocks. If their forecast comes true, they make a profit.

Speculative trading in the forex market is based on this concept. The main instrument is currency pairs.

However, in contrast to the lottery or the casino, it's not all about luck. It is important in the foreign exchange market to predict the price, not to guess it.

Only then you can increase your initial capital.

Myths of Forex Trading

- Trading in the foreign exchange market is a game of roulette. It all depends on knowledge, skills, and the ability to analyze;

- Everyone profits. That is not true. According to statistics, about 70% of traders multiply their capital;

- You must have a finance degree. Knowledge in this area will be an advantage, but not a major factor in profitable transactions.

What if you're about to start trading and you're afraid your knowledge and skills aren't enough? That's exactly what the simulators are for. We will tell you about them below.

What is a demo forex account?

Let's say you have decided to start your own business and paint cars. Before you do this, you have read a lot of useful information and taken training courses.

It makes sense that just in case something goes wrong, you would test your first paint job on some cheap or non-working car.

You should practice forex trading as well. After all, besides reading a lot of theory and listening to webinars, you have to learn how to put it all in real trading.

Moreover, it's your money on the line.

While experienced investors assess potential risks, novice traders are not always able to do so. Those who immediately open a real account may lose their deposit at the start.

Common mistakes beginners often make:

- see losing trades as a total failure and do not realize that they are a part of trading. It is not the number of unsuccessful trades that matters, but the losses incurred. They should be lower than the profits from profitable trades;

- do not close a trade that is taking a loss in time, hoping that the dynamics in the market will change;

- open several orders at the same time and are unable to follow the process quickly enough;

- invest the whole deposit in a single trade;

- do not analyze their trades;

- ignore the risks.

To avoid mistakes, practical training can be done in a demo account.

What is the difference between a demo account and a live forex account? When you open a demo account, you do not have to transfer real money to your deposit in order to invest it in a trade.

You will trade with virtual money (dollars, euros, and so on). It is up to the trader to decide how much money he needs. This amount will be on a personal deposit.

Aside from that, a demo account is almost identical to a real one.

You can see the value of currency pairs in real-time, open and close orders, track reports, and so on.

As your deposit balance will be virtual, the profits and losses will also be virtual. So, you risk nothing. However, you won't be able to spend your own profits.

Purpose of demo forex account:

- to study the market;

- not to invest in trading;

- to gain experience and apply knowledge;

- to explore the trading platforms;

- to practice opening and closing trades;

- to test the strategy and trading indicators;

- to try out the trading conditions of a brokerage company;

- to understand the nature of orders, spreads, and leverage;

- to study technical analysis and learn how to use the instruments;

- to adjust the charts;

- to adapt to the market and the volatility of the assets;

- to prepare mentally.

Does this mean that a demo account has lots of advantages? It imposes no obligations on the trader and carries no risks. It also provides a completely safe training session.

If trading is not to your liking, you can give it up at any time, whatever the virtual balance is.

However, there is more to this than meets the eye.

When you use the simulator, your trader's habits are formed. They are the basis of your future trading style. This is very important in Forex trading.

When trading with virtual money, the player subconsciously takes the trades less seriously. Sometimes he may even succumb to gambling and stop using the chosen strategy.

If your trading is chaotic and has no objective, the same is likely to happen in a live account.

Another difficulty is habit formation. Trading with virtual money easily becomes addictive. So, giving up such a win-win experience can sometimes be very difficult.

Other disadvantages of simulator:

- the news factor may not be taken into account in the simulator. In real life, important economic events affect asset values. This does not always apply in a demo account;

- derealization;

- risk mitigation. By trading with non-existent money, a trader may underestimate potential losses;

- the money earned cannot be spent at one's discretion.

Where to start?

Only training will help you succeed in any activity. Forex trading is not an exception.

Reasons to open a demo account:

- To gain new knowledge and to apply existing one;

- To train;

- To test new trading strategies, techniques, and methods.

Those players who have used a demo account stand a good chance of increasing their deposit in the future.

Three elements of the training process:

- Emotional. A demo account can help you understand your emotions about profitable and unprofitable trades.

This is important to know before you start real trading. After all, emotional instability can ruin even the smartest trading plan;

2. Cognitive. Do you think you have learned enough about trading strategies, signals, and charts?

Then a demo account is a great way to test it all out without risk. This is the only way to understand which trading instruments are best suited to you and which should not be used;

3. Organizational. Forex trading is available 24 hours a day, five days a week.

Once you have tried out different periods, you will find the best ones for you. It is important to take into account your main job, as well as your own biorhythms.

You should start by creating your own trading plan.

Although the account will be training, you need to have a plan. It should answer the following questions:

- Which asset will you work with? e.g. EUR/USD, EUR/CAD, and so on;

- What strategy will you use? What signals will you choose to open and close trades?

- How often and how much time per day or week do you plan to trade?

- What risks will you take?

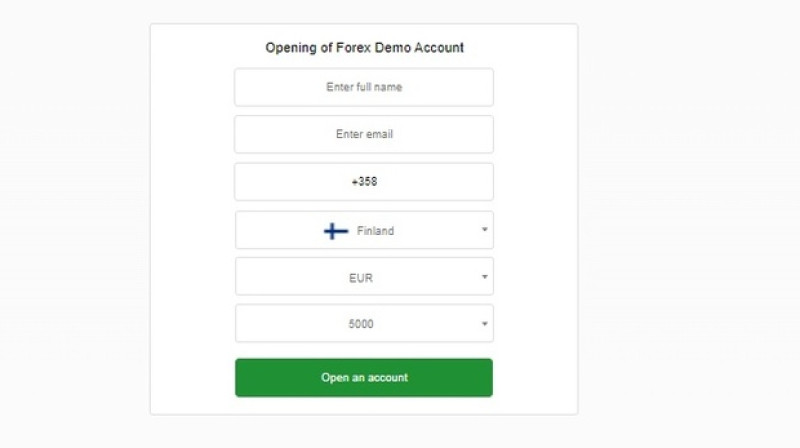

When the trading plan is ready, you need to open a demo account. You can do this through a brokerage company or directly in the trading terminal.

Almost all brokers offer a demo account. Their websites also provide detailed instructions on how to use it.

As a rule, a trader chooses the broker with which he or she plans to trade after training.

When choosing a brokerage company, you need to take into account:

- reputation and user feedback;

- how to make deposits and withdraw profits. This is important if you plan to continue working with the company after the training period is over;

- the list of trading instruments;

- the size of commissions and spreads. You will need this in real trading;

- responsiveness of the support service;

- the trading terminals used.

- Complete the registration form. At this stage, choose the account currency and also specify the amount of the virtual deposit;

- Receive the login and password by email;

- Install the terminal and log in.

The most common trading platform is MT4. So, let's look at how to create a demo account using it as an example.

To open a demo account, the following actions are required:

- Install MetaTrader 4 on your device (PC, smartphone, etc.);

- Open the downloaded software and select "create a demo account" in the menu;

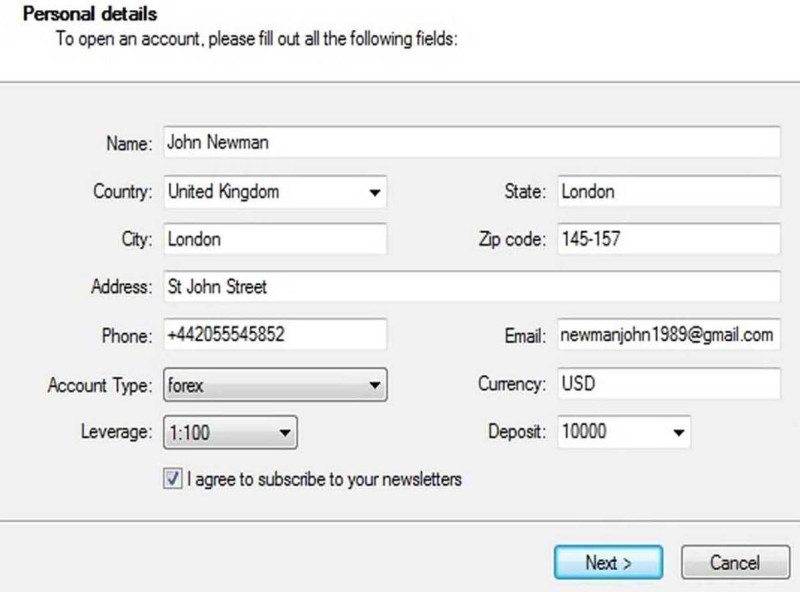

- Fill in the registration form. The system will ask for personal details, as well as an account currency, amount, and leverage size.

The default leverage will be set to 1:100, the currency will be USD and the amount will be 10 thousand units;

4. Confirm registration.

You will receive a username and password by email. They will be used whenever you use the terminal. Keep them in a safe place, as they are difficult to recover.

You do not need to upload verification documents to create a demo account. Therefore, it will take about 5 minutes. When everything is done, you can start trading on the simulator.

How to use it?

Once you have downloaded the trading platform and opened a demo account, you can start trading.

If you use the terminal for the first time, the abundance of sections, tools, and charts may surprise you. However, you will get used to it later.

How to trade with a demo account:

- Open the trading platform installed on your PC or smartphone;

- Enter the login and password that were sent in the email during registration;

- Specify an instrument. For example, select the EUR/USD pair;

- Create a sell order if the asset is expected to be cheaper, or a buy order if it is expected to appreciate;

- Close the order when the target is reached.

We have already told you that not all forex trades are profitable. Even the predictions of experienced traders may not come true.

This is why it is important to manage your finances wisely, both in a demo account and a real one. Even though they are virtual.

Capital management implies:

- The correct way of using leverage. The most common leverage is 1:100. However, beginners should use smaller leverage, such as 1:20;

- Using a Stop Loss. This is an order whereby the trade will automatically close when the price of the loss reaches the level you specify;

- Using a Take Profit. This is also an order, but the limit is set on profits.

When should I start real trading?

A demo account is an important step on the way to real forex trading. Apart from the fact that trading is done with virtual money, it is almost identical to a live account.

To learn something new, it is important to follow simple rules:

- Follow the trading plan and modify it as required;

- Keep a record of your own mistakes;

- Analyze the results of both profitable and unprofitable trades.

If you can measure and manage your trading, then the practice has been fruitful. How long should I use the simulator? How do I know when it is time for a live account?

Some traders set specific indicators that will signal them to move on to real trading. For example, to raise your initial capital by 20%, make 40 profitable trades, or practice for five months.

What may indicate the end of the training period:

- If a trader uses short time frames and high-frequency intraday trading, two to three months of training may be enough. With scalping, this period can be reduced to a month;

- When you make a steady profit in a demo account over a period of two to three months;

- When profits from successful trades over a period of several months cover losses from unprofitable trades;

- When trading is no longer about anxiety and dissatisfaction with the result;

- When the player strictly adheres to his own trading plan.

In any case, the decision to start real trading should be made by the trader himself. All the indicators listed above are just guidelines.

To find out if you are ready to open a live account, answer the following questions:

- Are you psychologically prepared not only for profits but also for losses?

- Are you confident in your trading strategy?

- Are profits from successful trades greater than losses from unsuccessful ones?

- Can you risk no more than 2-3% of your deposit?

- Are you fluent in using the terminal?

If you answered yes to all these questions, the training process was successful.

Who would benefit from it?

It is commonly believed that simulators are only for beginners. Mostly, that's the way it is.

With a demo account, a novice trader can:

- receive access to the trading platform and the foreign exchange market;

- learn the functions of the terminal;

- test your knowledge and trading plan;

- make trades without investing your own money.

At the same time, the account can also be useful for successful players with a lot of experience. It can be used in the following cases:

- to test a new trading methodology;

- to use a new trading instrument;

- to test the effectiveness of leverage of a different size;

- to study new trading signals.

Notably, even a professional player can lose control when dealing with a virtual balance. On a demo account, unreasonable risk will lead to disappointment, while in reality, it will lead to financial loss.

The only solution is to ignore the fact that you only have virtual money at your disposal.

Regardless of the account type, you should trade with strict adherence to risk management rules. Otherwise, trading will turn into a game of chance with unpredictable results.

Stock market demo account

Forex is a foreign exchange market. The stock market is where securities of big companies and corporations are traded. These can be stocks, bonds, and so on.

You may have heard of the famous American investor Warren Buffett. He has been investing in stocks for many years. He is one of the richest men in the world. His fortune is estimated at $113bn.

To make a profit on a stock, you have to buy it as cheaply as possible and sell it as expensive as possible.

Another method is to receive dividends. To do this, you also have to buy and hold securities in order to receive quarterly, annual, and other payments.

To avoid risking your own money at the start, you can also complete training in the stock market. Some brokerage firms and individual stock exchanges provide simulators.

For example, MOEX offers its own training server. All you have to do is submit an application and provide some details about yourself.

Once you have access to the server, you can feel yourself an investor and put money into the most attractive securities.

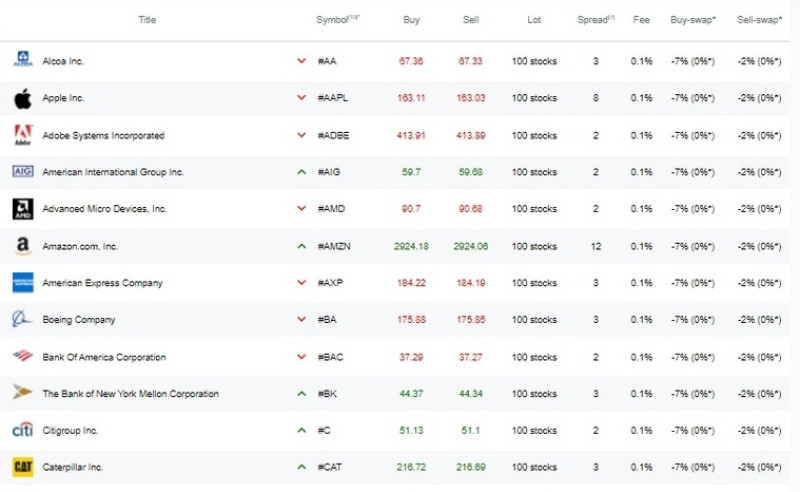

However, the most popular way to make money on stocks is through CFDs.

Features of CFDs:

- They are signed between the buyer and the seller;

- The brokerage company is the intermediary;

- Profit is made from the price change;

- There is no real buying and selling of securities.

How does this work? For example, a trader believes that the value of Apple stocks will increase. In that case, he enters into a buy contract.

If the value of the securities goes up, he makes a profit.

So, the main thing, in this case, is to predict the dynamics of the value. Will it go up or down? You can make money both on the upside and on the downside.

Advantages of CFD trading:

- Minimum deposit. The trader does not buy securities. The actual purchase of stocks could be expensive. For example, a share of Apple will set you back about $70.

- Income from a price decline. If an investor became a holder of securities, he would only benefit if their value rose;

- Accessibility. For trading and for Forex currencies the same terminals are used;

- Variety. It is possible to profit from a huge number of companies;

- Leverage. It can be applied in the trading process, increasing your financial capacity.

As with currency pairs, it is possible to practice stock trading by using a simulator. It can be opened at a brokerage company.

How to open a demo account with InstaForex:

Step 1: Register;

Step 2: Receive your account number and password by email;

Step 3: Install the trading platform and log in.

Except for the fact that the money on deposit is virtual, a demo account is almost the same as a real one. Here you can also monitor quotes in real time, read the news, and analyze your income and expenses.

Tips

Trading, like any other activity, has its own rules. They allow you to reach new heights, develop your skills and achieve your goals.

These rules apply both to live trading and to a demo account:

- You should trade using a reasonable amount of money. It is not a good idea to make a deposit with the last of your money.

- Focus on the amount of money you can put into your live account.

- It is better to use money that you don't mind losing in case of failure;

- You should only engage in trading when you are calm. Do not make decisions in a hurry or in times of anger or worry;

- You can compete with friends or acquaintances to measure your success in trading on a demo account;

- Using a demo account, it is better not to think that your account is not real;

- You should think about diversification. Beginners are better to start with a single asset, while experienced players should diversify their investment portfolios;

- Neither experienced traders nor beginners should invest all the money from the deposit in one trade, as it is very risky.

Conclusion

A demo account is a great way to start trading Forex and the stock market. It is easy to open and requires no real money to deposit. The service is absolutely free.

The trader chooses the amount of money to trade and uses the leverage that suits him best. He trades on a real terminal. So, when he switches to live trading, he may not even notice the difference.

An important point to grasp, however, is the outcome of the practice. Experienced investors believe that if you don't make a profit on a virtual deposit, there is a high probability that you won't make a profit on a real one either.

At the same time, successful trading on a simulator does not give a 100% guarantee that the same result will occur after the training is over.

Read more:

Cent Account Forex: How to Open?

Back to articles

Back to articles