To start trading in the financial market, it is not enough to be mentally prepared for this activity and to find the right strategy. Trading will not be possible without an account.

We will discuss the ins and outs of opening a real account on the MetaTrader 4 trading platform. You will find out why this step is essential, how to get through it quickly and safely, and what important points to pay attention to.

What are real accounts?

A real account is a deposit that is used for real money such as US dollars, euros, and so on. The real account is the one that allows you to trade in the market.

It can be used to make trades that can subsequently generate profits for each user, depending on their knowledge and skills.

Such an account is opened with a brokerage company, which is the link between the user and the financial or stock market.

To start trading, a trader deposits his ounds into a real account and invests them in the selected asset such as currencies, securities, and so on. If the trades are profitable, his funds increase, if they are unprofitable, they decrease.

Profits can be withdrawn and used at one's pleasure. However, things are different when it comes to losses. ITomake up for losses, you need to predict the dynamics of the asset, open a position in time and make money if your forecast comes true.

Why do you need a real account?

- it allows you to make trades;

- it makes it possible to use services to increase trading efficiency;

- it is used to receive money from the user and to withdraw profits;

- it allows the trader to participate in broker promotions and contest programs;

- it provides access to the trading terminal's features;

- it keeps abreast of market news.

Generally, brokers offer users two types of real accounts:

- standard

- cent.

The main difference is that the second type of account measures the balance with cents, i.e. smaller units of currency. This allows you to trade with less capital and significantly reduces your trading risk.

Cent accounts are used by both newcomers and experienced traders to test new strategies or trading techniques.

MT4 overview

To make money in the financial market, you should not only choose a suitable strategy and gain knowledge but also find the right trading platform. MetaTrader 4 is the most widely used one.

It is a powerful and feature-rich platform, which is simple for beginners to use. It will also fulfill the ambitions of experienced traders.

This is the best option for those planning forex trading, as well as for those who prefer to trade CFDs, for example in the stock markets.

Therefore, before describing the process of opening a trading account in MT4, let's take a closer look at the platform.

MetaTrader 4 was developed by MetaQuotes. It is not only a platform for trading but also an information platform, which provides all the conditions for profitable market activity.

The MT4 platform was released in 2005. The previous versions are no longer available. Currently, traders use either MT4 or MT5.

However, MetaTrader 4 is the most popular one. It is also constantly being updated. There are some features of the platform:

- 30 indicators for technical analysis;

- accessibility via stationary and mobile devices;

- flexibility and high speed;

- 9 timeframes;

- 3 order execution modes;

- 2 market orders, 4 pending orders, stop order, and Trailing Stop;

- real-time charts;

- trading signals;

- user-friendly interface;

- scripts, plug-ins;

- message and news sending system;

- ability to copy trades of experienced traders, and use expert advisors.

Notably, MetaTrader 4 can be used on computers, laptops, or smartphones. The terminal is compatible with the most popular operating systems:

- Windows;

- Mac OS;

- Linux;

- iOS;

- Android.

How to open a real Metatrader 4 account

In general, global financial market trading consists of the following steps:

- the trader chooses a competent broker to start trading;

- the user analyzes the quotes and makes trades through the platform;

- if the trade is successful, he makes a profit; if not, he loses his money.

To put it simply, forex trading is impossible without a broker and a trading platform. Also, you can't trade without an account, because, as we mentioned above, that's where all financial asset operations take place.

It should be noted that a demo account can be opened directly from a trading platform, while a real account can only be opened by brokerage companies. The process may vary slightly from one company to another, but in general, it consists of a few simple steps.

To open a real MT4 trading account, you need to:

- Register and open an account with a brokerage company;

- Download the MetaTrader 4 trading platform on your device;

- Open the MT4 app

- Make a deposit.

Let's discuss these steps in more detail.

Step 1: Registration and opening of an account.

You should choose a brokerage company carefully. Do not choose the first option you find on the internet. In addition to the reputation and background, the following aspects should be taken into account:

- List of trading tools. The more there are, the wider the trading opportunities are. For example, at InstaForex, you can trade not only currency pairs but also stocks, indices, cryptocurrencies, and so on.

- Account selection. Top brokers have a number of options for traders. For example, InstaForex offers Insta.Standard, Insta.Eurica, Cent.Standard and Cent.Eurica accounts.

- Size of spreads. The smaller it is, the better;

- Support service operation;

- Ability to use leverage;

- Analytical and training resources for users;

- Promotions and bonus systems;

- Quality of order execution;

- Possession of license. It ensures your security;

- Variety of trading platforms. As a rule, reputable companies offer several options.

Когда брокер выбран, нужно создать у него аккаунт и открыть счет. У некоторых компаний эти два шага объединены в один.

Once you have chosen a broker, you need to create a profile and open an account. Some companies combine these two steps.

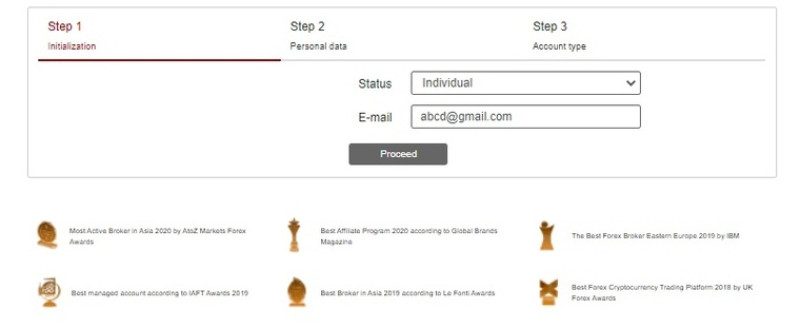

- Registration process with InstaForex:

- Reading public offer agreement;

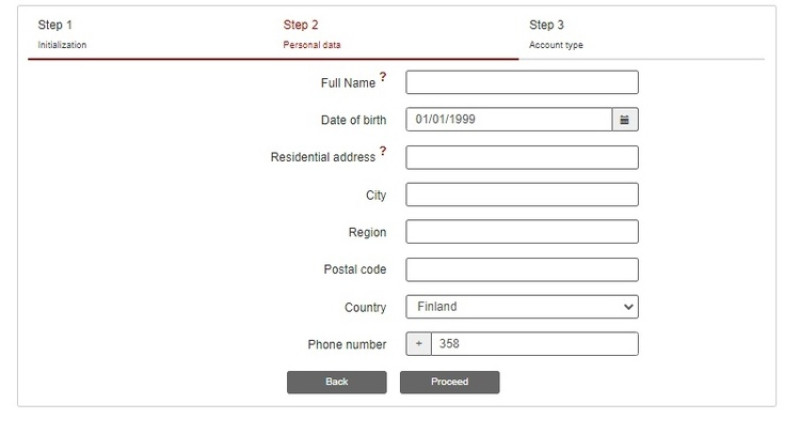

- Completing registration form: initialization, entering personal data, selecting the type of account;

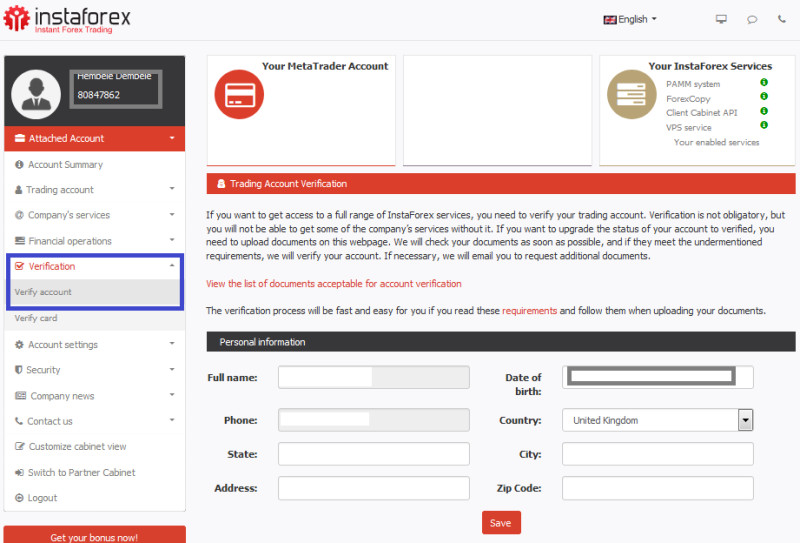

- Verification. It is not obligatory. However, without verification, some functions will not be available. To pass this step, you need to upload a photo of your ID.

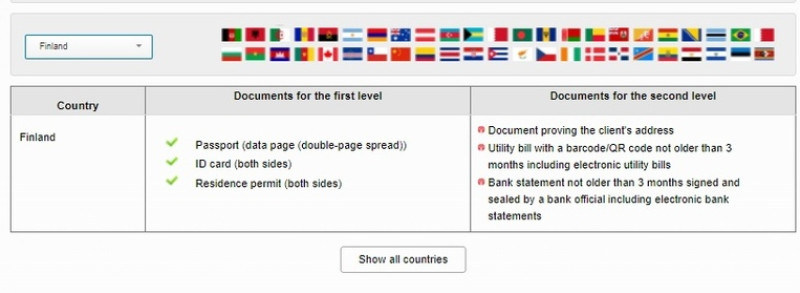

The brokerage firms may require the following documents:

- photo or number of a passport or other ID;

- tax ID;

- proof of address;

- proof of income.

Every broker has its own list of documents. Don't think they are required to control you excessively.

If a brokerage company has a license, it means that it operates by the law. This ensures that your personal data, as well as photos of documents, will only be used for their intended purpose.

In addition, trading is directly related to finance. Every foreign exchange market participant should realize that user identification is essential in this case.

It is important to pay attention to the document requirements of the broker. We will discuss this below.

Step 2: Installing MT4 on your device

It is easy. The broker will provide you with a link to download the platform and redirect you to the trading platform website. The user will be given detailed information on how to complete this step.

At this stage, the trader should decide on which device they will be trading and choose the appropriate operating system when downloading.

Another important point is the operating system requirements. For example, InstaForex MT4 is available for Windows 7 or higher, Android, and iOS 4 or higher.

When you have downloaded the file, you need to open it and run the installation. A platform shortcut will then appear on the desktop of your computer or smartphone.

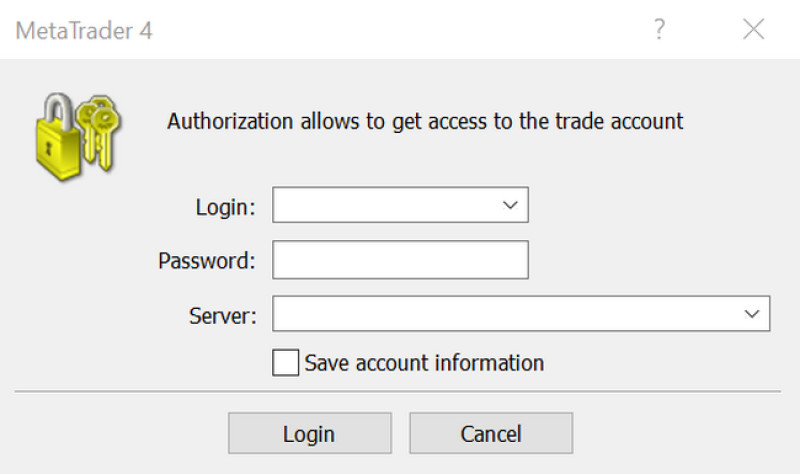

Step 3: launch the platform and authorization.

To start, click on the platform icon on your device and log in to the trading platform. After that, in the window that appears, enter the account number and password that you received by email when registering with the broker, as well as the server of the brokerage company.

Once you have done all this, the account is linked to the trading platform. From then on, all the MT4 services will provide the user with smooth trading.

Before starting to trade, you will need to click on the 'File' tab at the top of the terminal, log in to your account and then enter your login and password.

Step 4: Deposit replenishment

As it is not possible to trade with zero balance, you have to add money to it. To do this, you need to log in to your client area on the brokerage company's website and select the appropriate command.

You can send money with a bank card, a transfer, via a payment system, and so on. It all depends on which options are supported by your broker.

You may be wondering how much money you need to trade on MetaTrader 4. It does not depend on the conditions of the platform but the personal financial capacities of the trader and the requirements of the brokers.

The minimum deposit is usually less than $100. InstaForex offers a minimum deposit of $1 for all types of real accounts.

Brokers usually set a maximum limit only on cent accounts. On classic accounts, there is usually no limit and the amount depends only on the financial possibilities of the player. For example, InstaForex has a maximum deposit size of $1,000 on a cent account, while there is no upper limit on a classic account.

With money on deposit, a client can start trading and become a full-fledged participant of the forex market. The client is provided with charts for technical analysis, a set of indicators, a leverage service, and so on.

During trading, you can make deposits and withdraw profits.

If you have any problems or questions during the trading, you can always contact the support team of the brokerage company.

Types of real accounts

It was already mentioned that when opening a real trading account, the user needs to choose the type of account. It is necessary to ensure that the deposit meets all the trader's expectations and requirements.

This means that the trader has to decide whether to trade on a cent or a standard account. What is the main difference between them?

Firstly, the balance on a cent account is measured in cents, while the balance on a standard account is displayed in dollars.

Secondly, accounts have two different minimum lot sizes. For cent ones, it is usually 0.1, for classic ones it is 0.01.

Finally, the accounts have different pip values For example, a trade with 0.1 lot size in a standard account will cost $1, while in a cent account the price of the same trade will be 1 cent.

Therefore, a cent account requires less initial capital and less risk. However, the profit is also lower compared to a standard account. It is most often used by beginners. Experienced traders also choose it when they want to test a new strategy or a different asset.

However, there is more to come. Brokers offer different trading conditions for each type of deposit. These include:

- minimum deposit amount;

- list of assets;

- minimum and maximum transaction volume;

- spreads;

- commissions;

- execution type;

- margin;

- leverage, etc.

When choosing the best option, traders should base their choice on their own preferences and their financial capabilities. Keep in mind that the deposit should meet all your trading needs.

Why do you need to provide your personal information?

We have already mentioned that when you open a real account, you need to provide personal information about yourself. The list may include:

- full name and residential address;

- contact details: phone number, email;

- date and place of birth;

- marital status;

- employment details;

- tax records and so on.

This may likely cause some people to have doubts about the security of providing such data. However, you should be aware that this is a requirement for cooperation with a brokerage company.

There are no reliable brokers who do not require any documents or user data at all. So if you are offered such an option, there is a high risk that they are scammers looking for gullible clients.

If the broker has a license, third parties will not be able to obtain your personal information. Therefore, you can provide it to the company without any worries. This is regulated legislatively.

Why do brokers ask for customers' personal data?

- to provide financial services;

- to prevent money laundering and to comply with tax laws;

- to protect the rights and legitimate interests of all market participants.

A set of verification documents is determined by the brokerage company. For example, InstaForex has two levels of user identification. Each of them has its own list of documents, which can vary depending on the country of residence.

Another important point about opening a trading account is the document requirements. Before sending a photo or scan, make sure they meet the company's standards.

For example, InstaForex requires that the file should not exceed 25 Mb. The resolution of the image should be at least 400 pixels. The photo must be clear and not bear visible signs of unwarranted corrections or traces of image editing.

It is also important to check that the information in the documents matches the information you provide when registering with the brokerage company. For example, the name and surname must be identical.

The broker needs time to check and process the data received. It usually takes a few days. After that, the client will receive an email with the result.

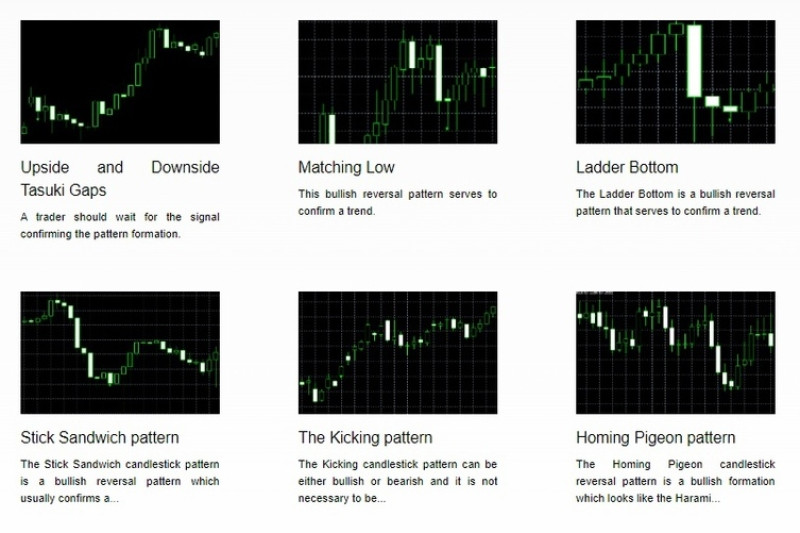

How to optimize MT4

After the trader opens a real account and login to the terminal, he gets access to all the features of this platform.

However, the standard set of useful features can be extended. Many brokers are working on such developments to make the trading platform even more advanced and user-friendly.

For example, InstaForex offers technical indicators, which help to analyze the market in more detail and make forecasts more accurate.

Some InstaForex indicators for MT4:

- Ladder Bottom;

- Stick Sandwich;

- Kicking;

- Homing Pigeon;

- Breakaway.

To use additional indicators during the trading, you need to download them to your device and install them on your trading platform using the settings.

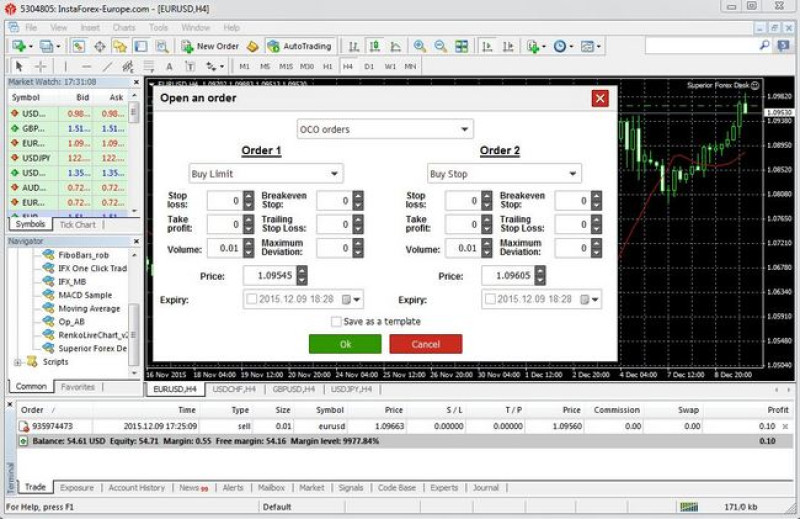

Moreover, you can extend the functionality of MetaTrader 4 by using special plug-ins.

For example, InstaForex offers its clients an order management tool, Superior Forex Desk. It increases the speed of trading, thereby ensuring higher efficiency.

For example, you can use this plugin to open positions with a single click, delete pending orders, see net positions, and so on.

You can download this plugin on the InstaForex website.

What you need to know before opening an account on MetaTrader 4

When we talk about a real account, we refer to real money that will be used to make trades. Profits and losses in the course of trading will also be real.

This means that by registering a real account, you become a full-fledged forex trader. Therefore, you will invest your own savings in trading.

As money is an important part of any person's well-being, there are some things to be aware of and consider before taking this step:

- Start trading with a demo account. This will allow you to get to grips with Forex, explore the MT4 trading platform, and test your strategy without any financial risk. It is also a great option to prepare yourself psychologically for real money trading. You can open a demo account directly on the MetaTrader 4 website or with a brokerage company;

- When choosing a broker, opt for a company that supports MetaTrader 4. For example, you can use InstaForex;

- You should carefully study the trading conditions of the broker you are planning to trade with. If you still have questions, contact the support team;

- Do not spend your last money on trades. It is better to deposit an amount that will not hit your pocket;

- Create an email account or use an existing one, and prepare all the documents for verification ahead of time. This will make opening a real account faster and easier;

- Set yourself up for successful trading. The emotional state is an important part of any activity, including trading.

Conclusion

As you can see, opening a real account is a necessary and fundamental step in trading on the financial market. MetaTrader 4 platform is a perfect instrument to achieve this goal.

At first sight, registering an account seems to be a simple and quick process. However, it is important to take your time and pay attention to three things:

- choose a reliable brokerage company;

- choose a suitable type of account based on the broker's trading conditions;

- specify your personal information correctly and save your access data.

By opening a real account, you can test your trading skills, appreciate all the advantages of the MT4 platform and take a close look at the features of the Forex market.

However, you should remember that trading on a real account is not only about real profits, but also about real losses. To avoid losing money at the beginning of the trading, every deal should be well-weighed.

Read more:

Cent Account Forex: How to Open?

Back to articles

Back to articles