Sometimes the quotes fall sharply although there are no signals of a downward movement. Perhaps the reason is a dividend gap. Let’s talk about it in detail.

If you want to learn more about how to predict market trends, please, read the article" Technical analysis patterns: main and reversal patterns". Find out how to trade efficiently and not rely on luck only.

Stock market features

The equity market is rather volatile. Sometimes it is extremely difficult to discern future trends. To some extent, this is good news as you can make good money on price fluctuations by buying shares at a lower price and selling them at a higher one.

However, the quotes may change so sharply and unexpectedly that investors do not have time to react in time to a decline or a rise in price. For example, no one could have predicted that the coronavirus pandemic would strike the world economy in 2020.

Transportation and logistics companies incurred huge losses, while the tech sector scored the biggest gains. Pharmaceutical companies, including those that have developed COVID-19 vaccines, also improved their performance.

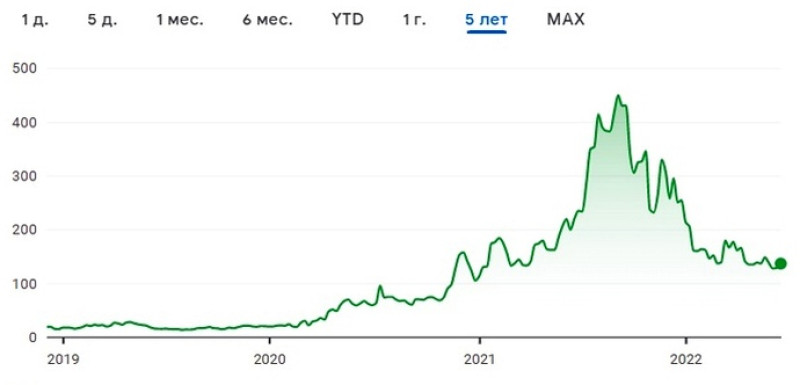

For instance, in 2020, the shares of the biotech company, Moderna, rose by more than 4 times.

As a rule, experienced traders hedge themselves better against sharp price swings. They react faster to the slightest price changes. On top of that, they predict more accurately potential changes in the quotes.

It is more difficult for beginners to identify trend reversals. Due to lack of experience, they lose money instead of making a profit from stocks.

In some cases, it is quite taxing to minimize risks. There are also situations when it is quite possible. In this article, we are going to discuss one of the situations that occurs quite often in the stock market.

What is the dividend gap?

Investors who have been trading stocks for quite a long time are well aware that a dividend gap is a great way to reap a profit. Such gaps occur regularly and it is quite easy to predict them.

In general, a gap means a sharp drop in an asset price. For example, yesterday the company's shares were trading at certain levels. However, the next day, the quotes are trading at completely different levels after the opening.

The price difference may be quite significant. On the chart, the trend line changes its direction abruptly.

Sometimes such price fluctuations may be triggered by unforeseen fundamental factors, whereas sometimes they are quite predictable. So, in the second option, we can talk about a dividend gap.

This term means a drastic decline in the value of the shares on the ex-dividend date - that is, on the day when it is no longer possible to receive dividends on the shares.

How does it work?

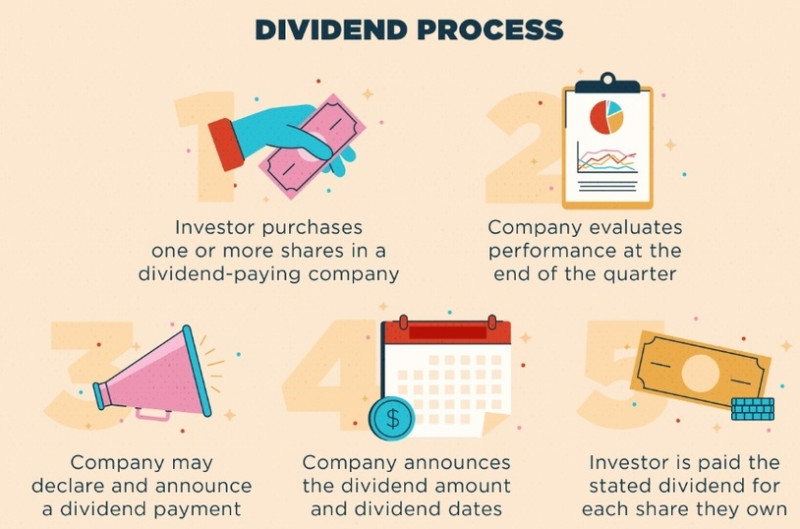

Let's start with an explanation of what dividends are and who receives them.

Dividends are regular payments to the shareholders of companies and corporations. Companies distribute corporate profits to shareholders, based on the number of shares held in the company.

Therefore, if the company is experiencing financial difficulties, it will hardly pay off dividends. Yet, even if the firm is doing really well, it may spend extra money on the expansion of its business as well as its modernization and so on.

When companies are mulling over dividend payments, they usually go through the following steps:

- The Board of Directors or the Supervisory Board makes a decision on the size of dividend payments. As a rule, it begins with 40% - 50% of the profit made by the company as specified in the regulations;

- The proposal is considered by the Board of Shareholders. The final decision is made at the shareholders' meeting by voting;

- Shareholders can receive dividends once a year, half a year, and so on.

You can get more detailed information about the dividend policy of a particular company or corporation on their official websites.

After the company sets the size of dividends and they are very attractive, investors begin to buy shares. It is important to understand that if you want to be eligible for the payment of stock dividends, you must buy the stock before the ex-dividend date.

The ex-dividend date for stocks is usually one day prior to the record date. In this period, a list of shareholders eligible for dividends is compiled. Traders can buy shares after the ex-dividend date but they will not receive dividends.

Nevertheless, it is not always necessary to purchase stocks prior to this date. Sometimes all you need is to buy shares in advance because it may take some time for the processing transaction.

For example, the T+2 mode, which is used by some exchanges, implies a period of two working days. For example, if the ex-dividend date is set for June 5, you need to buy stocks two days earlier. Make sure that these are working days on the exchange.

So, after the record date, a dividend gap takes place. The first sign of a dividend gap is a significant decline in the quotes.

What leads to dividend gap

Perhaps for some traders, it is not entirely clear why prices are falling during this period of time. Therefore, let's talk about it in more detail.

Here is a common example of when a dividend gap usually occurs:

1. Before a dividend gap, prices are steadily climbing, especially after companies announce the size of dividend payments.

If they are attractive, investors are more willing to add particular shares to their portfolio, bolstering demand and thereby their price.

However, some investors do not wait for the announcement and buy stocks much earlier. They calculate approximate dividends on their own after having studied the company's dividend policy and the previous results of its financial performance.

All this information can be obtained on the official website or on the Web. However, keep in mind that the Board of Directors has the right to recommend reducing payments or not giving them at all;

2. When the shareholders' register is formed, demand for shares decreases. Investors who aim to receive dividends no longer buy stocks.

In addition, market participants, who had purchased shares before the gap, start selling them. They have the right to get payments. So, they no longer need to keep assets in their investment portfolios.

When a boom is ebbing away, the price sharply declines and a gap takes place.

In the screenshot below, you can see the gap formed after the ex-dividend date, using the example of Carnival stock. The chart shows how drastically the quotes have tumbled after this date.

When do shares revive after gap

It depends. Sometimes prices normalize quite fast while sometimes they recover far slower. It can take days, weeks, or months.

Usually, the gap ends in 90% of cases. Hence, its prolongation occurs extremely rarely.

There are several factors that impact the extension of a dividend gap. Here are some of them:

- It depends on how sharply prices have declined. The steeper the decrease, the longer it will take to recover;

- How successful the company's financial performance is. The better the results, the more investors will be prone to buy its shares, thereby boosting the price;

- The trend that dominated the market before the ex-dividend date also matters. If it has been a bullish one for a fairly long period, then shares are likely to recover much quicker. If shares have been in the bears’ claws before the date, it will take more time for price normalization;

- Future dividend payments also play a great role. If traders expect a bigger payment, prices are sure to revive quicker;

- The state of the global and national economy may also influence recovery. Some political woes may also be an obstacle to the faster end of a gap.

Let's focus on how deeply shares may fall when a gap takes place. Borth shareholders and potential investors would be curious to find out the answer.

The following factors determine how prolonged a gap could be:

1. The size of dividend payments to shareholders. As a rule, extremely high payments trigger a strong gap.

Look at the chart of Gazprom shares in 2020. This is an illustrative example of a dividend gap;

2. Some changes in the company's structure or in the industry where this company operates. Positive shifts increase demand for shares and are able to smooth out the fall. Negative ones, on the contrary, aggravate it;

3. Macroeconomics: this factor directly affects demand and share prices.

You should always know that a dividend gap may not occur at all. For example, if the payments are minimal and do not cause price increases before the formation of the shareholders' register.

In this case, the stock market is trading according to the main trend without sudden price spikes. There is no gap on the chart.

Let's study an example. Let's say a dividend payment is 6% of the share price.

In this case, a dividend gap is likely to significantly exceed this level. Therefore, stocks will fall in price by at least 6%.

If the payment is worth 0.05% per share, the gap will be lower or there will be no gap at all. This case can be seen on the chart of Apple shares located below.

Some investors wonder how often gaps happen. The answer is simple. They usually coincide with the dividend payments.

Shares of some companies have a dividend gap every year as dividends are paid once a year. For other stocks, this period may be half a year or a quarter.

Notably, the timing of payments may be changed according to the financial performance of companies. More detailed information can be found on the website.

For example, Apple pays off dividends on a quarterly basis.

How to earn money on gap

We have already mentioned above that such a dividend gap is quite predictable. Investors know in advance that some shares are likely to tumble at a certain time.

Which steps should you take to earn money in this case?

There are several possible options. Each of them was developed by traders to make a profit on the gap.

- Option No.1 is to purchase stocks after the company has announced the size of payments but before the ex-dividend date takes place.

When the gap is closed, speculators sell off shares. This strategy allows them to make a decent profit amid a higher price as well as receive payments from the company.

You need to understand that sometimes it takes several weeks or even months to wait for the quotes to return to the previous level;

- Option No. 2 implies a more rapid profit. Unlike the first strategy, stocks are sold before the record date but at the closest possible date from it.

During such periods prices could be quite high due to increased demand.

In this case, traders do not receive dividends but they earn money quickly thanks to the price difference;

- Option No. 3 is to purchase shares during the gap period. We have already told you that at this moment, the prices are very attractive.

After that, investors need to wait for prices to rise. It is up to them to decide at which level they will place Take Profit orders as their profit will depend on it.

When prices climb, they sell shares.

The main drawback of such a strategy is that traders could wait quite a long time. In addition, by buying shares at the time of the gap, they are not eligible for dividend payments.

At the same time, they can reap a solid profit from the price difference.

When using any of the above options, you should comprehend that they could earn money only if the dividend gap is significant. Otherwise, trading may not bring the expected results.

How trend impacts dividend gaps

The market trend plays an important role. If you want to learn how to predict further price changes, you should read the article "Trend reversal and continuation patterns: detailed guide".

Now, let's explain the importance of the trend when it comes to the dividend gap.

If the prevailing trend is bearish and it persists before the ex-dividend date, shares are not attractive to investors. There may be several reasons for it:

- announced dividend payments are too small;

- the reputation and reliability of the company raises questions;

- negative fundamental factors, e.g. possible worsening of financial results.

An upward trend, on the contrary, indicates that the company's shares are in demand and it is expanding rapidly.

In the first case, a dividend gap is highly likely to be extremely small and speculators will hardly be able to reap a profit. On top of that, the gap may last for quite a long time.

In such a situation, the only way is to purchase shares some time after the ex-dividend date. After that, it is advisable to wait for the right moment to sell stocks.

Only in the second case, you can really make good money on the gap. The main thing is to choose a suitable strategy and make a trade at a proper moment.

As a rule, the gap is always closed in such cases, lasting about a month. You should acquire shares as early as possible, that is, to purchase them at the lowest possible price.

Hidden pitfalls

One needs to fathom that a dividend gap is an absolute guarantee of profit. It carries certain risks for market participants.

Here are some pitfalls that may unpleasantly surprise speculators, aiming to make money on a gap using the third strategy from our list.

1. The price will not drop to the expected level. We have already told you that ideally, a drop should exceed a dividend payment.

However, it does not always happen. There are situations when prices only slightly decrease. Shortly after, they quickly return to their previous levels.

Hence, the profit may be minimal or there will be no gains at all;

2. The price is likely to revive for a long time. A return to the previous levels could take much time and in the worst-case scenario, it will not come for the expected period of time.

If you sell stocks earlier, they will not bring the desired profit;

3. Adequate market reaction is also crucial. It may sound paradoxical but the normal reaction of investors may mitigate price swings during the gap period.

The fact is that savvy investors have already been used to price fluctuations after the ex-dividend date. They are in no hurry to sell off shares. As a result, other traders will not always be able to buy them at the most attractive price.

Conclusion

At first glance, a dividend gap may seem intimidating. However, a gap formed after the ex-dividend date may bring you solid gains.

There are three ways to multiply your capital:

- the price difference when buying and selling the asset;

- dividend payments;

- combo of the above-mentioned methods.

Hence, don’t be afraid of a dividend gap. Sooner or later it ends but with the proper strategy you may earn profit.

Back to articles

Back to articles