As financial markets were getting more diverse and complex, new trading activities appeared along the way. In the Types of Trading article, you can learn about the most popular trading methods nowadays.

And now let's delve into the topic of quantitative trading. What is it about and who is it for?

What is quantitative trading?

The majority of traders agree that to be successful, you need to correctly identify the direction of the price and possible reversal points. They use technical or fundamental analysis for this or combine the two methods.

Technical analysis is mainly based on finding patterns on the charts. The analysis of previous patterns suggests that they may reoccur in the future as the market tends to move in cycles.

In the case of fundamental analysis, predictions are made on the basis of important economic events and news.

The third approach differs from the two discussed above. It is based solely on mathematical models and statistics that constitute a trading algorithm.

Traders have surely come across articles devoted to quantitative trading. This notion includes various strategies based on quantitative analysis.

Quantitative analysis consists of trading strategies that rely on mathematical computations and number-crunching. Their main goal is to identify all available trading opportunities and choose the most profitable of them.

Computers can process huge amounts of data and develop various trading methods that can be applied to financial markets.

So, quantitative strategies combine the following disciplines:

- mathematics;

- statistics;

- programming.

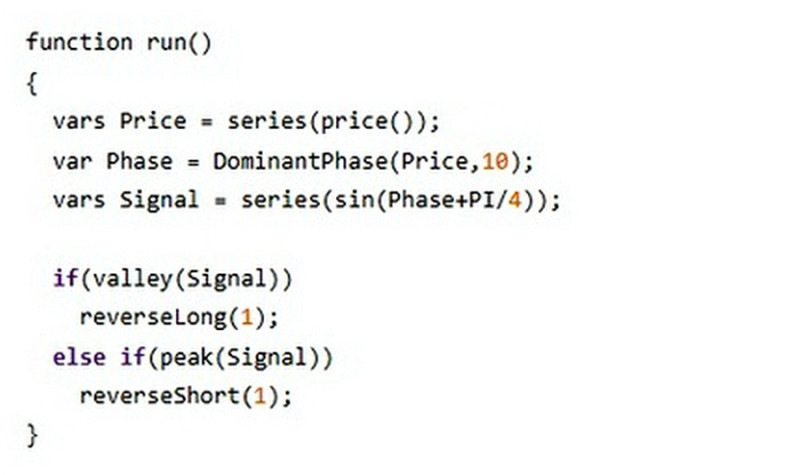

In practice, these are ready-made strategies that are fully automated and written in С++, Java, or other programming languages.

You need special software such as MATLAB to run these programs.

Quant trading is widely used by institutional traders such as hedge funds and banks. These institutions have been using a quantitative approach since the 1980s.

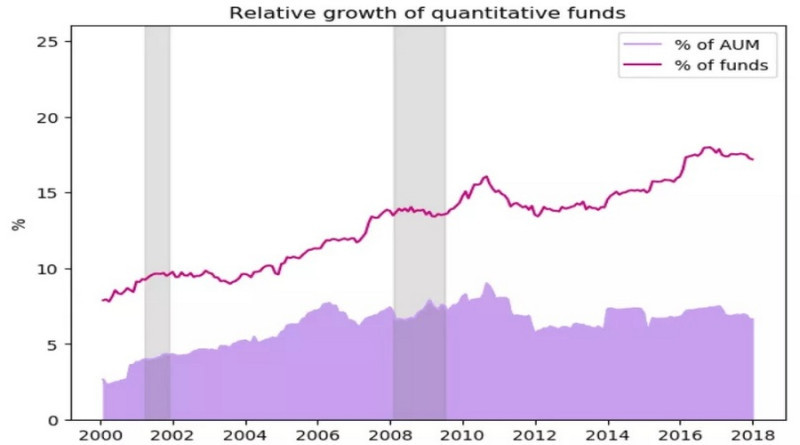

The growth dynamic of such quant funds is displayed on the chart below.

Unlike retail traders, financial institutions have more capital at their disposal. Besides, they employ experts in mathematics, statistics, and programming who create and improve trading algorithms that make a fund a market leader.

Quantitative trading relies on various data, and more data means better results. An accurate forecast increases the chance of getting profit.

Here is a simple example of what an algorithm is based on.

At 10 am, the price of a security was $15. At 12 pm, it rose to $15.5. So, we see a 3% increase.

Apart from price movements, we can evaluate other characteristics such as trading volume.

So, a combination of these two aspects is a good basis for analysis and an accurate forecast. The only thing is that such an approach may be rather time-consuming.

That is why all these steps are automated and done by a special trading program that needs to be pre-set only once at the very beginning.

Quantitative trading implies using strategies with a positive mathematical outcome, that is, the ones that show a result above zero. Over time, such algorithms will ensure stable and solid profit.

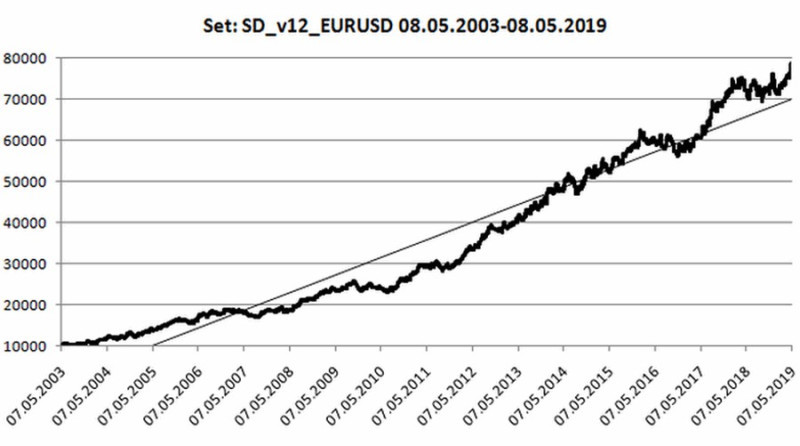

On the chart below, see the evaluated profitability that a quantitative trading program may bring. This value is rising with each year.

As you can see, the expected profit went up from zero and has increased by 8 times over 16 years.

How it all started

Quantitative trading is a milestone in the development of trading. The technique has been improving with time, giving way to more advanced modifications.

It all started with intuitive trading when traders relied solely on their experience and observation.

They evaluated the market situation, the demand-to-supply ratio, the prevailing trend, and other aspects. Based on this, they looked for the best points to enter and exit the market.

This method later gave way to systematic trading which involves looking for market patterns.

For this, traders used technical indicators and chart formations. At this stage, trading started to get more automated.

The rise of algorithmic trading which implies the use of trading robots made it possible to fully automate the process. Expert advisors and mathematical algorithms took on the most difficult, routine work, making it possible to implement high-frequency trading.

Quantitative trading is the most recent stage of this evolutionary chain. In this type of trading, specialists use mathematical principles to identify specific patterns that will be later used in formulas and codes for processing market data.

Why conventional trading methods are losing their popularity:

- Ample sources of information. In the early days, traders would just check economic news and corporate earnings reports to analyze the fundamental background. Today, there are way too many sources of information. Retail investors simply cannot process this huge amount of data;

- Regulation tightening. A few decades ago, institutional investors used to take advantage of insider information to reap more profit. Yet, stricter legislation stopped the use of illegal practices. Violators could face fines and even imprisonment;

- Efficiency. Even several hundred experienced traders will be less efficient than one powerful computer.

These algorithms require no human involvement and process information faster with more accuracy. This is why quantitative funds are getting more popular than ever before.

However, this does not mean that traditional trading methods are going into oblivion. In fact, many market players still prefer them to novel techniques.

The main reason behind this is that quantitative trading is available mostly to hedge funds and large financial institutions. Besides, the difference in profitability of the above-mentioned methods is not that big.

What is the difference between algorithmic and quantitative trading?

Some newcomers think that algorithmic and quantitative trading mean the same. Actually, they are not completely wrong as both types of trading come hand in hand with each other:

- a team of quant traders develops a trading strategy;

- algorithmic traders make it automated so that no manual interventions are required.

Yet, the two approaches differ in the following ways:

1. Algorithmic trading mainly relies on technical analysis which serves as the basis for developing strategies.

As a rule, it involves various sets of indicators that help determine market patterns and make a more accurate forecast.

Meanwhile, quant traders analyze the market on a different level and utilize big data volumes. Apart from price and trading volumes, the quantitative approach also considers correlation between several instruments and takes into account various scenarios;

2. In algorithmic trading, bots are used to enter and exit the market, while a quant strategy looks for the best possible trading opportunities;

3. The main factor for success in quantitative trading is a highly liquid and volatile market. Yet, in algorithmic trade, this is not a necessary condition;

4. Unlike the quant approach, algorithmic approach can not be applied to all markets and assets.

So, the two methods can complement each other while still having some major differences.

Jim Simons’ story of success

American investor Jim Simons is believed to be the founder of quantitative trading. Being a talented mathematician, he taught mathematics at several US universities. At one moment, he decided to take a different career path.

Before his career in finance, he served as a codebreaker for the US National Security Agency.

This is when he mastered the skill of creating mathematical models that aim to identify patterns in the bulk of various data. He was inspired to launch his own hedge fund since he had the necessary expertise and money.

In 1978, Jim Simons rented an office and opened an account with one of the brokerage companies. He realized that standard forecast methods do not always bring the desired result.

So, he began creating models based on mathematical computations to understand the principles of price formation in financial markets.

This approach turned out to be highly effective. Soon, Simons started to build a team of specialists in programming, mathematics, and physics to work at his fund.

Ten years later, he established the Medallion Fund which was running solely on a quantitative trading model. The fund traded currencies and futures.

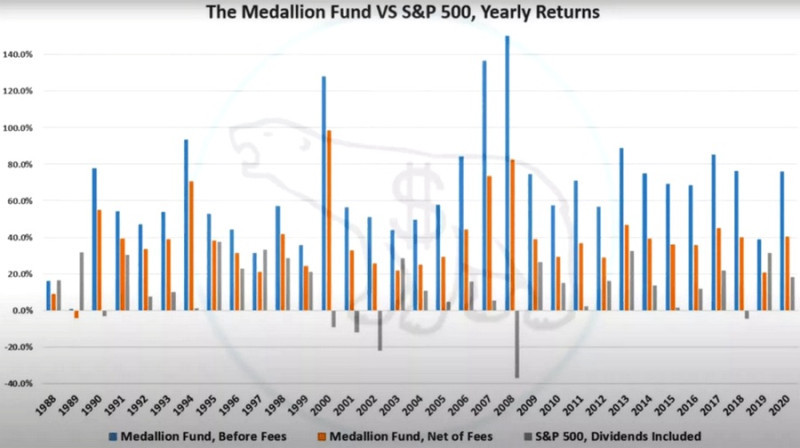

The chart below displays the impressive performance of the Medallion Fund compared to the S&P 500. With its 40% return, the Medallion Fund outperformed the famous Soros Fund with a return of 32%.

The Medallion Fund trading strategies are kept secret. Actually, many institutions like this do not disclose their trading methods.

According to some sources, Medallion makes around 400,000 trades per day which is nearly 17,000 per hour. A position is held open from 1 hour to 1 month on average.

Quantitative strategies

Most quantitative strategies share similar features with algorithmic trading. Let’s discuss the most widely spread quant-based types of trading:

- Arbitrage trading seeks to buy or sell an asset on different trading floors in order to cash in on the price difference. For example, you can buy an asset on one exchange at a lower price and sell it at a higher price on another exchange;

- High-frequency trading (HFT) is characterized by a large number of orders executed within seconds. It aims to detect a triggering factor and use it to get instant profit. The ultra-HFT method employs even higher speed but is not so common among quant traders;

- Trend trading strategies are focused on defining a trend and predicting the future trajectory of an asset. They look for optimal points for opening and closing positions;

- Low-frequency trading implies holding a position beyond one trading session, which means keeping it overnight;

- Countertrend strategies attempt to make gains by trading against the current trend.

All these methods have stood the test of time and proved their effectiveness. Besides, they have been tested on various markets and trading instruments.

With the help of quantitative techniques, hedge funds diversify risks to minimize potential losses. That is why quant funds are believed to be more efficient and profitable than traditional funds, with an annual return of 4.2% and 3.3% respectively. These are average estimates that still reflect better performance of algorithmic funds.

Stages of development

As we have already mentioned, quantitative strategies are developed by specialists in different fields. Depending on the level of complexity, it may take from one month to one year to develop a strategy.

Regardless of the development time, each strategy involves serious computing power and the use of big data.

The development process consists of several stages:

1. Strategy identification. Developers suggest an idea that in theory can be implemented for effective trading.

They conduct research to find a strategy. Quite often, they go through online sources such as blogs, articles, and interviews with successful traders.

This is enough to build the basis for a sound trading technique.

At this stage, developers choose the frequency of trading. This can be high frequency (HFT), ultra-high frequency (UHFT), or low frequency (LFT).

2. Formalization of the idea. This is when the algorithm of a strategy is written.

3. Backtesting means a test of a trading system based on past historical data. In other words, the effectiveness of a strategy is evaluated in relation to previous market situations.

Backtesting is run on special software platforms. The main purpose at this stage is to prove that the tested strategy is viable.

However, due to some factors, the results of backtesting and operating in real life can differ.

For example, there is always a chance that the used data is inaccurate. To avoid this, some quant developers use information from multiple providers and then compare it.

Another possible factor is related to corporate processes. If we take securities, for example, dividend payments and splits of shares can bring confusion to historical data analysis.

The second stage ends with the assessment of the trading strategy. It is based on the maximum drawdown in the value of an asset which is represented by the biggest decline from a high to a low on the asset’s chart.

The Sharpe ratio is another method for measuring risk-adjusted returns;

4. Testing of the implementation system that transmits an algorithmically generated trade to a broker. This process can be fully automated or done manually.

For example, in high-frequency trading, the process is fully automated.

At this stage, different trading costs such as taxes, fees, and commissions are considered. Ideally, they should be minimal.

Trading costs are not a defining factor but they still need to be factored in when evaluating a strategy.

5. Forward performance testing measures the effectiveness of a trading system in real-life conditions. For this purpose, a demo account is usually used. Then, the strategy is tested on a live account.

A brokerage company is an important element here. Indeed, trading conditions directly influence the would-be profits. Spreads and slippage are also considered at this stage as they can affect the strategy performance.

6. Risk management. It is about force majeure events such as a server failure or unforeseen circumstances on the side of a broker, for example, bankruptcy.

At this point, developers evaluate all possible circumstances that can interfere with a trading strategy or even stop it from working.

This stage involves some basic rules of risk management and conditions for psychological well-being.

7. Testing the strategy in tandem with other existing trading methods, meaning that the new strategy performance is compared to that of the previously created strategies. Besides, developers evaluate whether these strategies can be effectively combined.

8. Deployment of a strategy if it proved to be successful in the previous stages.

We are talking about the creation of a single strategy. In quantum trading, however, dozens and even hundreds of strategies are used.

When all of them have been tested, a strategy portfolio is built. It is used in trading for as long as it stays effective. When its performance decreases, strategies are updated and adjusted.

In this case, the updated algorithms must go through all the stages of testing, from the initial presentation to trading in live markets.

Development principles

As you can see, it takes a lot of time, money, and effort to create a single quantitative strategy. And when it comes to a portfolio of strategies, the process becomes even more complicated.

Certain principles must be observed to develop quant strategies that differ from other trading methods.

- Multiple algorithms should be involved at once. One of them will be responsible for time intervals, another one will look for patterns, and so on;

- Proper choice of assets. Quantitative strategies are best suited for high-liquid assets, such as shares;

- Diversification. Traders are advised to use technical tools with various levels of correlation;

- May not be good for all markets and trading instruments. The strategy is effective when trading shares and less effective when trading currencies;

- The strategy needs to be adjusted to market conditions. In case of considerable changes in the market, the strategy has to be readjusted to stay effective.

All in all, any quantitative strategy implies working with high liquidity and a set of tools. Yet, the development stage is just the first step toward profitable trading.

Financial markets are by nature volatile and subject to unpredictable turns. That is why any method needs to be modernized and adjusted from time to time. Otherwise, all investments in strategy development will be in vain.

Who are quants?

Quantitative strategies are created by experts in various disciplines. These specialists are usually employed by hedge funds, large financial institutions, and investment banks.

To get the desired position, quant traders must provide education certificates, show relevant work experience, and so on. This is a highly competitive industry with great career opportunities.

Quantitative traders, or quants, should possess the following skills and backgrounds:

- training or work experience in finance, programming, or mathematics. Some companies will only consider candidates with a degree;

- advanced computer skills and a good understanding of at least one programming language;

- good knowledge of popular trading systems, including automated ones;

- experience with big data processing;

- analytical and research skills;

- determination and innovative mindset.

Some large hedge funds admit that some of their employees have never been involved in trading and are not familiar with the basics. For example, they do not know what Dow Jones or the S&P 500 are and what shares they are comprised of.

Yet, they are still good at developing powerful algorithms and trading various instruments. In quantitative trading, the whole process is based on mathematical and statistical data rather than fundamental or technical factors.

Quant traders enjoy various benefits in their work:

- They have direct access to the market and market quotes and can utilize various analysis tools;

- They make full use of computer technologies which involves using several programming languages;

- They have access to historical data to test the strategy;

- They can use their broker’s account in automated mode.

The average annual pay for quant traders varies between $150,000 and $600,000. The salary depends on the company (the highest salaries are paid by hedge funds) and the role of the specialist.

The duties of a quant trader usually include:

- identifying and creating a strategy and building an algorithm;

- testing and adjusting a strategy if needed;

- applying risk management rules;

- deploying a strategy and assessing its operation in combination with other methods;

- continuous search for new trading ideas.

Quantitative trading can be a lucrative job. However, it is a very complicated and painstaking process which asks for commitment, strong fundamental knowledge, inspiration, and time.

Pros and cons

Quantitative trading has its strong and weak points like any other strategy.

Advantages:

- Risk diversification. Thanks to quant strategies being used in various markets, the method is good for minimizing financial risks;

- No limits on the number of strategies included in a portfolio and the amount of data used. This means that everything depends on a trader, computing power, and the speed of data processing;

- Is not influenced by emotions when making a decision. Emotions often lead to financial losses, especially among beginners who lack experience.

Disadvantages:

- Limited availability. Retail traders do not have access to the data that institutional traders have. Besides, this type of trading requires some significant initial capital which is why mostly financial institutions are engaged in it;

- No guarantee. No strategy, including the quant one, can guarantee a win in every single trade. Sometimes hedge funds invest billions of dollars in the development of quantitative strategies and the analysis of data. But this does not exclude the risk of a possible loss. Even if the strategy proved to be successful when tested and put into practice, force majeure events cannot be ruled out. When market conditions change, previous patterns that worked before may ultimately fail;

- Complex process of development and upgrading. This means financial costs, development time, and the need to involve different specialists.

This is why quantitative trading, although being a highly efficient method, still could not drive other trading systems out of the market. Compared to quant trading, other strategies are more available and simple to use even though some say they have lost their relevance.

What retail traders need to know about quant trading

As was mentioned above, quant trading is mostly employed by large hedge funds. Individual traders usually cannot afford to hire a team of specialists and buy expensive equipment.

Yet, all market players, regardless of their financial state and training, can apply the principles of quantitative trading. Below are some recommendations to follow:

1. Test several trading ideas. Even if you do not plan to trade professionally, you still need to test a strategy before using it.

You can test it on a demo account. Another option is a cent account where your losses will be minimal in case of failure;

2. Automate your trading process. Due to high competition in the market, manual trading is losing its popularity.

Therefore, it is worth trying to automate the process of trading at least partially. In practice, even a semi-automated process significantly increases performance;

3. Profitability. Do not expect each single trade to be profitable. Even top professionals cannot achieve this.

We have mentioned the team of professionals built by Jim Simon. They worked for the Ren Tech Fund, the predecessor of the Medallion Fund. Even with a team of several dozen high-class specialists, only half of the fund’s transactions were profitable.

You may think that this result is not that impressive. Still, the fund earned a multi-billion dollar fortune, and its founder became one of the richest people on the planet;

4. Diversification is an important condition for minimizing all kinds of risks in trading. By applying different strategies and techniques when trading a variety of assets, you can prevent the loss of your entire deposit.

So, even if you are not a quant or the owner of a large hedge fund, you can still introduce elements of quantitative trading into your trading activity. You will not have to make additional investments or significantly change your trading plan.

Conclusion

Now let’s draw a bottom line. Quantitative trading is a special technique that involves:

- application of computer algorithms;

- use of mathematical models;

- research and development and work with a variety of big data.

This trading activity requires expensive equipment and access to a large amount of information. It also requires expertise in various disciplines. Quantitative trading is mainly used by large hedge funds as they have proper technical and financial conditions for this.

Individual traders can also apply the basics of this technique to boost their performance. Another way to get into this type of trading is to become a quant.

Remember that this is a highly competitive industry, and candidates are expected to have a certain set of skills and knowledge.

Read more

Back to articles

Back to articles