Even beginners on Forex can use this trading technique. First of all, it does not require you to be constantly glued to your computer. Secondly, it is a good way for newcomers to gain experience in market analysis.

Medium-term trading offers the opportunity to gain sound profits within a relatively short time interval. In this article, we will discuss the main features as well as the advantages and disadvantages of this trading style.

To learn more about other trading methods, read the article Types of Trading.

Medium-Term Trading

Medium-term trading, or swing trading, implies capturing gains from anticipated price swings that are caused by changes in fundamental factors, such as regulation, political and economic news, and so on.

At the same time, traders do not need to constantly monitor price movements. All they need to do is check the market daily, take notice of important news releases, and have a general idea of what influences the price of an asset in question.

Swing trading implies holding trades open over a couple of days, weeks, or sometimes months. The most essential thing in this trading technique is to find the correct entry and exit points.

When entry and exit points are defined inaccurately, traders risk buying high and selling low. This may result in losses or may stop you from getting the desired profit.

If an asset starts to depreciate, this does not necessarily mean that the trade should be closed immediately. In general, traders are not recommended to open or close positions under the influence of emotions or stress. They need to make such decisions with a cool head.

Swing traders utilize both fundamental and technical analysis. Although beginners can easily start off with this trading approach, they still need to grasp the basics of analysis reading.

To make profitable trades, you need to predict the trend of the asset and identify the phase it is going through. In other words, you need to understand whether a trend has just started to form, has hit its peak, or has reached exhaustion.

As a rule, trading in the medium term implies using 4-hour and daily time frames.

Which assets to trade in swing trading

One of the keys to success in swing trading is the right choice of an asset to trade. Not all assets can be traded in the medium term.

To be suitable for this trading style, an asset has to meet the following criteria:

- The volatility rate of an asset should be average or high. This will allow a trader to get profit while trading for several days.

- Correlation with other trading instruments and related industries makes it easier to analyze the asset.

- High liquidity is what helps you buy or sell an asset with gains at the right time. In this case, trading volume is a less important characteristic than volatility and liquidity.

- Keep it simple. Although swing traders have enough time to make a decision, it would be wise to keep this trading method as simple as possible. Therefore, it is better to avoid rare or exotic instruments that require complicated analysis.

The British pound meets all the requirements discussed above.

Futures and precious metals are also suitable for medium-term trading. Thus, silver is a very popular metal among swing traders.

It is highly volatile, with a fluctuation rate of about 80% within a year. In comparison, the volatility rate on Forex is around 20% in a year.

After gaining experience with silver trading, you can proceed with more expensive assets with higher profit potential, such as gold.

Swing Trading vs Day Trading

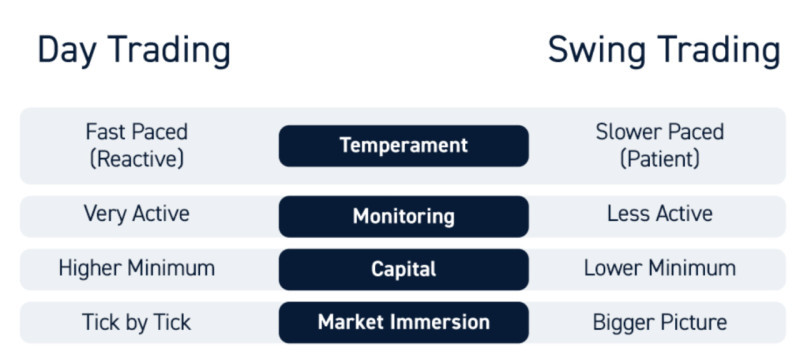

Day trading and swing trading are among the most popular trading strategies. They share some common features but at the same time, have some significant differences.

The main distinction between these two trading styles is the holding time for a position. Thus, in day trading, positions are opened and closed within one daily session, while in swing trading, positions are kept open for several days or weeks.

In medium-term trading, it is possible to trade several assets at once. In day trading, and especially scalping, traders are recommended to focus on one asset only.

The would-be profit is another factor to look at. Positions in swing trading are believed to be more rewarding than in day trading.

The main goal for intraday traders is to open as many trades as possible. Each trade can bring a profit of just a few pips which then build up to a certain amount.

As for medium-term traders, they open fewer positions but each of them can bring a profit of up to several hundred pips.

Besides, in swing trading, the leverage and rates are lower than in day trading.

This is because when holding positions overnight, swing traders risk facing a market reversal in the session next day. Such abrupt market swings can result in substantial losses.

As for the common features, both trading styles are based on price fluctuations rather than fundamental factors.

What is more, candlestick charts are used in both strategies. Therefore, day traders and swing traders primarily rely on technical analysis.

Swing Trading Strategies on Forex

This trading technique is great for working on Forex. It presents you with a good opportunity to earn substantial profit in a relatively short time.

Yet, you need a well-thought-through strategy to succeed. Beginners may find this difficult as they may still be struggling with following their own algorithms.

But more experienced traders already have a solution. They have developed and implemented various trading systems, many of which have stood the test of time and proved their effectiveness.

So, at the very beginning of their journey on Forex, traders can take advantage of already existing strategies. Later, they may develop their own trading approaches based on popular trading systems.

These are the most common strategies used in swing trading:

- The channel strategy is simple and is suitable even for beginners. All you need to do is build a channel on the chart between the three latest extremum points, for example, two highs and a low or two lows and a high. Then you need to trade strictly within the range and keep only one position open.

- The momentum pinball strategy can be used for trading any currency pair. It is based on defining the overbought and oversold zones in the market with the help of the oscillator indicator. If the indicator rises above 70, this signals that an asset has been overbought and it is the right time to get rid of it. If the indicator falls below 30, an asset is oversold and it is the right moment to buy it.

- The inside bar strategy does not require any indicators or additional tools for analysis. Here you need to read the price chart, and in particular, price bars. In this strategy, the inside bar of the bullish nature is used to open a buy position. It is then followed by a clear downtrend. By contrast, an uptrend that appears after a bearish bar pattern serves as a signal to open a sell position.

Pros and Cons

As any other trading method, swing trading has its advantages and disadvantages. Let’s see what they are.

Advantages:

- Saves your time. A swing trader does not need to monitor the market round-the-clock and watch the quotes in real time. They can just spend a few hours daily keeping track of important news which may influence the asset's value.

- Suitable for beginners. This trading style requires less time, so it can be done as a side hustle. Newcomers may have it as an additional source of income while still learning how to trade. Besides, when getting acquainted with this method, you can decide for yourself whether you like trading at all.

- No need to use several indicators. To succeed in swing trading, a trader simply needs to know how to identify the direction of the price and the current phase of the market. In other words, you need to recognize the beginning of the trend, its continuation and exhaustion.

- Suitable for trading several instruments. With enough time and proper skills, a trader can trade several assets at once, for example, currency pairs.

Disadvantages:

- Requires a large initial deposit. Positions in swing trading are subject to sharp losses, especially if high leverage is involved. To offset these losses, a trader needs to have a significant amount of money in his/her account. Traders, and especially beginners, are not recommended to use high leverage.

- Fees for holding positions overnight. If a trade is kept open for more than one day, brokers charge traders a fee called “swap” for each day of holding a position. Therefore, a longer holding period means higher rollover fees which eventually affect your profit.

- Risk of missing the best entry point. Since swing traders are not monitoring the process day and night, they can miss the best moment for entering the market. That is why they can sometimes lose favorable trading opportunities.

Swing Trading with Cryptocurrencies

Since this trading method seeks to capture price fluctuations, or swings, in the forex market, it is just as great for crypto trading. Despite losing its novelty, crypto is still a very volatile trading instrument which is both good and bad.

On the one hand, high volatility allows traders to maximize profits by capturing large market swings. However, extreme volatility carries risks.

The crypto market can be unpredictable. So, professional traders recommend monitoring a cryptocurrency for some time before trading it live.

To reduce risks, you can split your funds into two parts even when trading one crypto asset. Use the first part for long-term investment and the second part for swing trading.

Another way to avoid losses is to lock in part of the profit. This way, you won’t get the maximum possible profit but will definitely minimize losses.

Divide the traded amount into three parts. As the price of an asset goes up, take profit on each of the parts when the profitability rate reaches 10%, 20%, or 30%.

In other words, a trader opens a position of a certain trading volume but closes it in separate transactions. When the currency value starts to increase, and it looks like a good moment to close a trade, you should close only one-third of the trading lot to keep the profit.

Profits can multiply if the price continues to move up. In this case, you should proceed with trading the remaining part of the position.

If the uptrend is confirmed, you can always close the remaining part of the trade or the entire position to get even more profit. In case an asset starts to decline, you will only lose a part of your deposit when exiting the market.

Trading Recommendations

Swing trading is the second-most popular trading strategy after day trading.

To be successful in this trading activity, you should follow certain rules that we have outlined below.

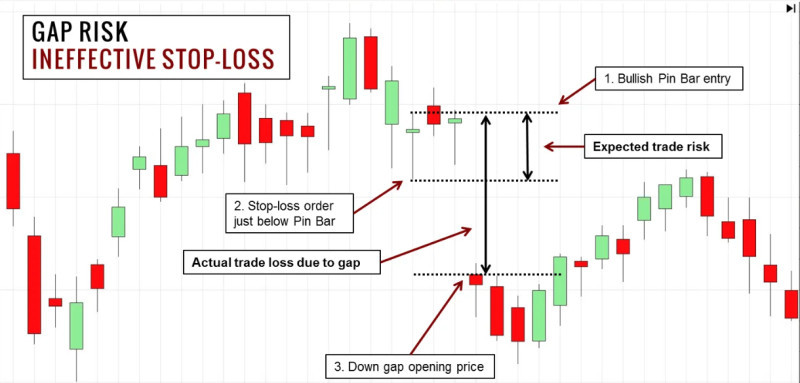

1. Although the medium-term approach does not require traders to be glued to their computers, they still need to keep in mind that any market, especially the highly volatile one, is prone to rapid and unpredictable changes. Therefore, it is important to place stop-loss and take-profit orders to close your trades automatically when the price reaches a certain level even when you are away from the trading platform.

2. Follow the rules of money and risk management. In swing trading, traders open fewer positions but each of them can bring a profit of several hundred pips. You can be tempted by the idea to put all your capital into a single trade but remember that you risk losing the entire deposit.

3. One of the tips for money management is to close a position partially. This will allow you to lock in the existing profit and earn more if the asset continues to rise.

4. Another piece of advice is to split your deposit into two parts and invest one of them in the long term. Do not touch this part under any circumstances. Use the second half of your funds for swing trading currencies or other assets.

5. One of the golden rules of risk management is to use low leverage. It should be much lower than that in day trading.

6. Combine technical and fundamental analyses. However, you may not need to delve into technical analysis. The main skill that you will need is to accurately define the trend and its phases.

7. Swing trading can be done in parallel with your full-time job. It can be an additional source of income and a way to get experience in this field without stress and an emotional roller coaster. Use this opportunity to learn trading, practice discipline, and widen your perspective.

8. Avoid entering the market ahead of economic or political news releases and close the existing trades. This will give you time to evaluate the market reaction to the fundamental events so that you can open new positions with this information in mind.

9. If you see a losing trade, it is better to close it and not leave it overnight. Not only will you suffer losses but will also have to pay the rollover fee.

Conclusion

In this article, we have discussed the main features of the swing trading strategy. It is a very convenient way of trading as it allows you to make a hefty profit in a relatively short time.

This trading activity can be done as a side hustle that brings additional income. It can also be used for learning the intricacies of trading and analysis.

When swing trading, you do not need to monitor the quotes in real time. So, it eliminates the stress and the hassle of day trading.

Among serious disadvantages is the swap fee that you have to pay for holding positions overnight. These fees may significantly reduce your potential profit or increase losses.

Therefore, it is essential to choose a proper type of asset. An instrument suitable for swing trading must be highly liquid and volatile.

Among such assets are currency pairs, cryptocurrencies, and precious metals, silver and gold in particular.

It is advisable to follow the rules of money and risk management. One of the key recommendations is to use low leverage.

Another way to manage your risks is to close a position in parts. As soon as the asset value goes up, you can partially close a position when the price reaches a certain level of profitability.

This will not guarantee you the maximum profit but will definitely save you from big losses.

Read more

Back to articles

Back to articles