Read the article “What do you need for Forex trading” if you consider becoming a trader.

This article is about trading courses for beginners, their types, essence, and how to choose the best option.

Why training is important

Even if you have a degree in economics, understand all financial terms, and have start-up capital, this does not mean that you are ready to trade. The fact is that the basics of trading are not taught at universities, which means that you will have to train on your own or with the help of professionals in this field.

In fact, there are various useful sources for beginners:

- Books about trading;

- Information from open sources, including brokers' websites;

- Blogs, social networks of successful traders, trading forums;

- Lectures, webinars, and lessons from experts in trading.

You should have the background for the right start in financial markets. Otherwise, trading will bring disappointment and losses.

You should never stop training, even when you are already a trader. Always improve your skills, even if you are satisfied with the results you have already achieved.

Market conditions are constantly changing. So, traders have to review their old strategies or develop new trading algorithms. In addition, the technical conditions of trading are also being improved.

If you want to stay in the loop, you should train all the time.

Some novice traders may wonder how much time it takes to become a professional. Let's turn to scientific data.

In the early 2000s, Applied Cognitive Psychology published the results of an interesting experiment. It turned out that the highest-ranking chess players spent more time at the chess tables than their less successful peers.

Psychologist Anders Eriksson was also convinced that the effectiveness of any activity depends on how much time is spent on learning. After conducting a study on musicians, he came to the conclusion that it took them about 10,000 hours of music lessons to become professionals.

At the same time, less successful musicians spent on learning about 20% less time.

Later, other scientists confirmed Eriksson's experiment. They discovered that the brain needs 10,000 hours to fully process information and develop sustainable skills.

On the one hand, it may seem to be a lot of hours. However, you train while you trade. So, you do not have to train for days on end to start trading.

Courses classification

A course is a series of lessons aimed at developing certain skills and/or gaining knowledge. If you opt for a training course, you should know that they are abundant, including for beginners.

Unfortunately, they are sometimes offered by companies and individuals who have nothing to do with trading.

That is why it is important to find a suitable option. But we will talk about it later.

Anyway, there are different approaches to classifying training courses.

Depending on the target audience, they can be divided into the following types:

1. Beginner courses: they provide the basics of trading for those making their first steps or planning to become traders. As a rule, such training lasts a few weeks up to several months.

The duration of beginner courses depends on the frequency of lessons and the amount of information to convey to the audience.

Courses for beginners mostly consist of two blocks: theory and practice. They are usually held under the control of a coach;

2. Advanced courses: they are meant for experienced traders willing to level up. As a rule, these courses are held in the format of group sessions with successful traders as speakers.

After completing an advanced course, users gain in-depth knowledge of market patterns, risk management, trading psychology, strategies, and some additional trading tools that are difficult for beginners to comprehend such as heat maps, Fibonacci levels, and so on.

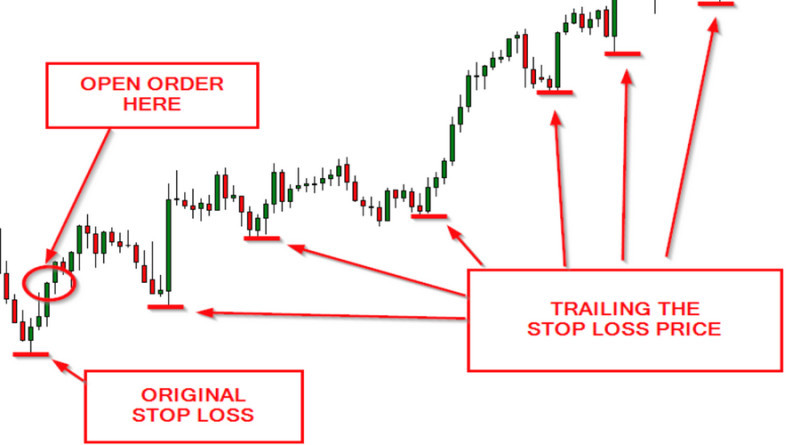

They also learn more about trading platforms and how to apply new indicators to asset charts, use trading statistics and a Trailing Stop, etc.;

3. Professional courses: they are meant for those traders for whom trading is the main source of income. Such courses are about deep in-depth exploration of trading strategies.

Practice is usually about:

- the use of professional tools in trading: testers and aggregators of trading strategies;

- a detailed analysis of trading strategies, determining the Sharpe ratio, and the use of the standard deviation;

- the development of personal trading strategies and their testing;

- the launch of algorithmic trading: designing trading robots, including HFT, and using algorithms to manipulate markets.

You should always start with the beginner course, and only then move on to advanced and pro options.

Another classification involves dividing courses into free and paid ones.

The first option is often meant for beginners. Participants do not have to attend all classes without exception. If you understand that the chosen course does not suit you, simply abandon it. It is free of charge anyway.

Brokers usually offer such courses. Also, they can be found on YouTube, social networks, blogs of professional traders, or on the Internet.

Such courses provide basic information:

- types of markets

- essence of trading

- analysis of asset prices

- risk management patterns

When it comes to paid courses, you will have to pay to participate. In such a case, you are promised high-quality information and presentation.

However, the fact that a course is paid for does not guarantee that it will meet the declared criteria and bring results.

In order not to waste money, you should make sure that a course is offered by a reliable provider and held by competent speakers.

The format is another way to classify courses:

- Private courses: the benefits of a face-to-face course are that you can ask questions, adjust the course plan, and train faster.

The main drawback of such a course is that it is usually paid and costs a penny; - Group courses are usually held for a group of 10 to 30 participants. In this case, you should not count on an individual approach and some gaps in knowledge may still remain.

At the same time, group courses are mostly free of charge or cheap. Another benefit of such a format is that you can compare yourself to other participants and hear their opinion on a certain issue.

The most popular formats of courses, including for novice traders, are:

- videos: they usually can be found on broker websites or the channels of professional traders. Their main advantages are interactivity and a convenient time for watching.

In this case, however, you can’t ask the speaker questions; - webinars: they usually take place online on conference platforms. You can participate in a webinar and ask questions from any corner of the globe. All you need is a stable Internet connection;

- seminars: they are akin to webinars in terms of content. The only difference is that seminars require your physical presence. Participants also can’t adjust their schedules.

At the same time, you get live contact with the speaker, which is psychologically beneficial, especially for beginners;

Another crucial aspect is that you can trade different assets and in different markets. Therefore, courses can also be classified according to this criterion. Thus, there are courses for beginners on Forex trading, crypto trading, stock trading, and so on.

Training courses based on asset types

| Course type | Universal | Special |

| Features | A universal course covers all aspects of trading and may last up to several months. | A special course is about trading certain assets: stocks, currency pairs, digital coins, etc. It can last from 2 weeks up to 2 months. |

Another classification is face-to-face and remote training. The first option is considered more effective for beginners, but it is a rare practice.

The popularity of face-to-face courses declined with the outbreak of the COVID-19 pandemic.

Remote training involves using Zoom, Google Meet, and other platforms. It is believed to be a more practical and universal way of training as it offers people from all over the world an opportunity to participate. Moreover, training language can be selected as well.

Trading courses for beginners

If you have just started building your trading career and are looking for a useful training course, you can take one offered by your broker.

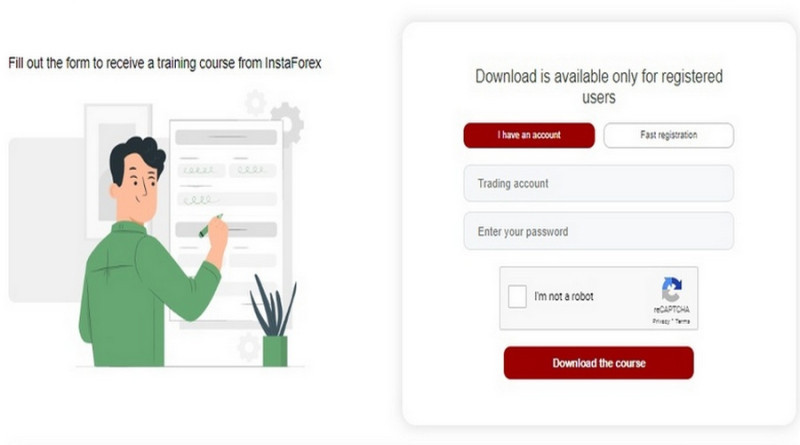

As a rule, every reputable and reliable broker provides its clients with such an opportunity. Let's take InstaForex as an example.

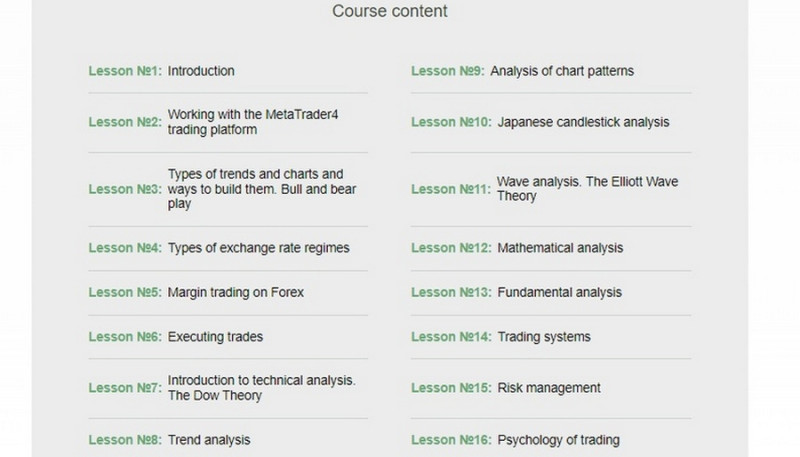

The company has developed an exclusive training course on Forex trading for beginners, comprising 16 lessons on various topics.

From the course, you will find out how to use a trading platform, read price charts, learn the basics of various types of analysis, trading psychology, risk management, and so on. Clients get access to the course once they register a taring account.

Beginners can adjust their training schedule. All the lessons are available for download, so the novice can train at any convenient time.

The InstaForex website also features video tutorials on the basics of trading and analytics for beginners, including fundamental analysis, forecasts, and trading plans.

InstaForex also offers beginners webinars with successful traders, available both on desktops and smartphones. The novice should open an account, pick the topic, set the date, and submit a request to participate.

In fact, all InstaForex training courses are free of charge. However, participation in webinars is available for clients with live accounts only.

In general, beginner courses do not take much time. For example, it can be a series of 10-15 lessons, each lasting 1-2 hours.

This time is enough for beginner traders to gain basic knowledge and see whether trading suits them in general.

Benefits of courses

Courses help beginners build some theoretical knowledge and practical skills, which can be divided into the following blocks:

1. Proficiency in trading terminology, which is an important aspect of trading and communicating with other traders. If a person does not understand the essence of leverage, a Stop Loss, or an order, they will never be able to trade or interact with other traders;

2. Trading software skills:

- reading and analyzing price charts: setting images (bars, lines, Japanese candlesticks), changing time frames;

- calculations: leverage, trading volumes, a Margin Call, and a Stop Out;

- conducting analysis: placing indicators on charts, setting up a news feed;

- trading: opening/closing positions, setting protective orders;

3. Risk management: minimizing risks by determining the entry/exit points, the deposit/lot size ratio, and forecasting potential trading results;

4. Technical and fundamental analysis skills;

5. An insight into selecting a broker, an intermediary between a trader and the market, by comparing their trading conditions, reliability, etc.;

6. Emotional control. Self-control is crucial for novice traders. It will help them stay calm in case of unexpected success or a loss of funds.

Beginner courses have been increasingly in demand in recent years as trading becomes a more popular source of income.

First, trading is convenient: you can open/close trades from any device and decide when to trade.

Second, having a small sum of money is enough to begin trading.

Thus, InstaForex offers a minimum deposit of just $1. By investing such a small amount of funds in trading, a newcomer does not risk losing much.

Choosing efficient training courses

With the number of beginners growing, there is a higher demand for courses. Those choosing training courses, especially beginners, should pay attention to the following aspects:

- Speaker’s/coach’s achievements: if you are going to be trained by one person, you should find out about their trading achievements as much as possible.

You should pay attention to their experience, education, and success in trading. Simply put, that should be a practicing and successful trader and not just a smart theorist; - Topics and content of beginner courses: that should be a compilation of both theory and practice. In fact, training should focus more on developing practical skills rather than theoretical ones. Ideally, the coach should show you how to open and close trades live as an example.

Important! Not a single course can guarantee you a successful trading career and a fortune. If you are promised a 100% result, such a course should give you second thoughts. - Feedback: ideally, you should try to find a former participant and hear from them whether it is worth trying this particular course.

Feedback can also be found in forums. At the same time, you should avoid reading comments on the course provider’s official website. They could be written specifically for advertising purposes; - Course format: if you choose between video lectures and webinars, the second option is considered more effective for beginners. During webinars, participants can ask questions and clarify information. In the case of video lectures, there is no such opportunity;

- Provider’s reputation: reputable brokers and business schools are interested in providing only high-quality services, including training courses for beginners.

Distinguishing between good and bad courses

Unfortunately, high demand for trading courses does not always generate a high-quality offer. Sometimes, when the provider is aimed at making money on novice traders, the quality of their courses is of little importance to them.

The following tips will help you filter options:

- The provider guarantees a 100% result. Remember, there is no guarantee at all. Traders’ financial achievements also depend on personality;

- The provider is not licensed to provide training or brokerage services. Another alarming nuance is supposedly experienced speakers, about whom there is no information in other sources;

- Participants are promised super-effective strategies and profitable products. There is no universal strategy. They may work for one trader and be useless for another;

- Potential clients are offered incredible prospects: for example, providers promise to reveal the secrets of increasing capital by 200% in an hour. For greater persuasiveness, advertising is accompanied by photographs of people who allegedly have already taken advantage of the offer;

- Aggressive advertising of training courses, webinars, etc. Potential clients are encouraged to take advantage of a unique opportunity as soon as possible, without giving them time to think;

- Classes are not so much educational as promotional in nature: for example, they advertise a specific product or a specific broker. That is usually difficult to recognize right away but becomes obvious after the first class.

Secrets of successful training

Before you start learning how to trade, you should set the goals that you want to achieve while training. In addition, you should decide how much time you can devote to training without compromising your family, leisure, and core activities.

Regardless of the course you take, it is recommended that you stick to the following rules:

- Get a special notebook to write down the information you find the most important. This way you will remember everything or be able to refresh the information if needed;

- Do not ignore independent tasks and discuss your progress in those tasks with your coach;

- Register a demo account. This is the best way to test your skills. Only after training on a demo account, you can open a real account. The Cent account is the best option to begin with;

- If you have issues with understanding certain aspects, resolve them at once. Feel free to ask the speaker questions or use the broker's support chat. Otherwise, issues will pile up, and you will make mistakes in trading;

- Do not limit yourself to just one format of training. You can combine courses with reading the blogs of savvy traders or watching training videos;

- Do not forget about self-education. As useful as classes are, you should always level up on your own: for example, by reading books about trading.

Not all courses are poor in quality and content. On the contrary, they are mostly designed to help both beginners and pros make trading easier.

A course is reliable when:

- Providers honestly admit that there is no 100% guarantee the course will bring you success in trading;

- There is a curriculum of classes and a list of speakers and coaches. All this information is either in the public domain or provided at the request of a potential client;

- Speakers are successful practicing traders, their real achievements are in the public domain.

Final thoughts

Trading courses for beginners are the first step on the way to trading in financial markets. Their main goal is to gain theoretical and practical knowledge because without it trading is impossible.

That is also a way to see whether trading is suitable for you personally as certain people sometimes realize that trading is not for them.

Training is time-consuming. It requires not only your active participation but also preparation. Remember about it when deciding to train and trade.

You may also like:

How to choose a broker for Forex trading

Trading signals WhatsApp

Trading tools

Best monitors for stock trading

Back to articles

Back to articles