So, where should you start? Check out the article "What do You Need for Forex Trading?"

In our review, we will cover the best and most reliable trading platforms. Find out which ones are ideal for beginners and which are designed for pros. Get tips to make the right choice.

Understanding trading platform

Under the term "trading platforms," we mean computer programs designed for trading various assets like stocks, cryptocurrencies, and fiat currencies.

These platforms are a combination of technical tools and software, allowing users to open and close trades and gauge market conditions. Brokers act as intermediaries, providing clients access to these platforms.

The first trading platforms emerged in the US during the 1980s, initially as simple stock trading programs. Over time, their capabilities expanded, covering global financial markets.

Trading software operates purely online since they aren't physical entities but virtual programs. Each platform has two core components:

- The broker's server is responsible for transmitting quotes to the user's program. It executes user orders and manages client deposits.

- The trader's terminal, the user's primary tool, facilitates trading activities and manages accounts with the broker.

Both components are integrated into a unified system that facilitates trading.

Today, numerous trading platforms are available, each with distinct characteristics, advantages, and drawbacks. They can vary based on:

- Range of available functions and services.

- Interface design and customization options.

- Installation type: mobile, desktop, or browser-based.

- Set of indicators and expert advisors.

- Automated trading capabilities.

- Chart types and available time frames.

- Extra features like alerts, news feeds, and more.

Most trading software serves the following purposes:

- Provide access to financial markets, allowing traders to buy and sell assets.

- Enable users to set parameters for opening and closing positions.

- Allow for analyzing price charts.

- Offer tools for filtering, adjusting, and adding analytical instruments during trading.

- Support the use of technical indicators during trading.

- Track and record all trading activities and their outcomes.

- Deliver news updates on finance and economics that can impact asset prices.

- Facilitate switching between different trading accounts.

- Enable the creation of market and pending orders.

- Support trading in various assets and implementing diverse strategies.

- Assist in learning with demo versions.

Thus, a trading platform is not merely a tool for buying and selling currencies or securities; it is a versatile software that offers users a range of capabilities.

How to choose trading platform

Choosing the right trading software is crucial since it's not only a trader's main tool but also a key condition for trading. A trader's success hinges on the platform meeting their expectations.

Here's what to consider when picking:

- Usability: The platform should be intuitive and user-friendly.

- Innovation: The software should incorporate the latest technological advancements.

- Performance and Speed: Delays and glitches can lead to unforeseen setbacks.

- Reliability: Traders should be confident that their market moves are secure.

- Compatibility: Ensure the platform works with your device's operating system. For instance, if you're using Android, your chosen software should support it.

- Functionality: The platform's features should meet the trader's needs.

- Mobile Version: Essential if you intend to trade from mobile devices, not just a desktop.

- Market Access: Some platforms, like MT4, cater exclusively to Forex, while MT5 also includes futures and securities markets.

- Additional Services: Look for features like automated trading, copy trading, and varied order execution modes.

- Multi-Platform Use: It's a plus if the software can be used across devices, say, a PC and a tablet.

Remember that a platform can be perfect for one trader but does not suit another one. That is why beginner traders need to find software that suits their needs.

Trading platform types

There are a multitude of software options in the market, and they can be categorized in various ways. Let's delve into the most common classifications.

Classification 1: Broker-specific vs. Universal platforms.

Broker-specific platforms are, in essence, proprietary software developed by brokers.

These can be crafted in-house or commissioned through external agencies.

When you open an account with a particular broker, they typically grant you access to their unique trading platform, through which you conduct your trades.

On the other hand, universal platforms are designed by independent developers without ties to any specific brokerage. However, brokers can still adopt these platforms by entering into agreements with the developers.

Still, many brokers prefer using their proprietary software. This not only ensures customer loyalty but also eliminates the need to pay fees for using third-party platforms.

Nevertheless, several brokers, including InstaForex, provide their clients with a range of trading terminals. The choice boils down to personal preference.

Classification 2: Desktop, mobile, and browser platforms. While desktop platforms are seen as the most functional, mobile ones are viewed as the most practical. That is why they are often used together.

Browser-based platforms are not in high demand, even though they do not need installation and do not take up device storage.

Top forex trading platforms

Trading on the international financial market allows one to profit from currency pair price shifts. The forex market has only gained popularity.

First, we are talking about highly liquid assets that will always be relevant. Second, trading on Forex is considered simpler than on stock exchanges. Let's list the most popular currency trading platforms:

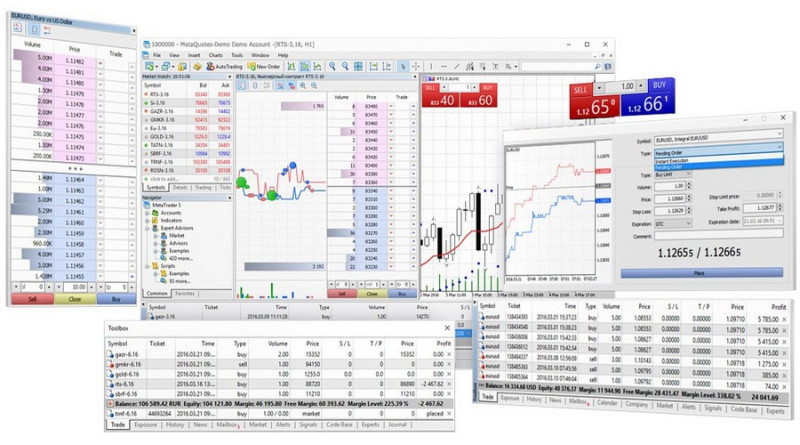

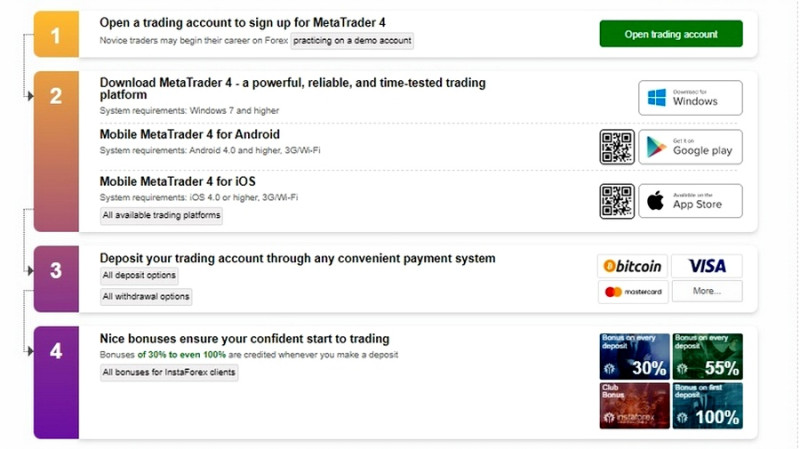

MetaTrader 4 takes the lead. Since its inception in 2005, many brokers, including InstaForex, have adopted it. Its merits can be grouped as follows:

- Trading Capabilities: Traders can use various order types, select their execution methods, implement any strategy, and trade directly from charts.

- Accessible Analysis: MT4 offers 9 time frames (from a minute to a month) with the ability to add more. It also provides 30 indicators. For those wanting more, additional options can be found online or on the platform's marketplace.

- Useful Services: Beyond its marketplace, MT4 offers trade copy features, trading signal use, and customizable alerts.

- Mobile App: Its smartphone and tablet versions allow trading from anywhere.

- News Feed: Staying updated with crucial news and events lets traders respond timely and aptly to market shifts.

- Robot Usage: MT4 supports algorithmic trading.

- Multilingual: This feature makes it accessible for traders worldwide.

- Compatibility: It works with popular operating systems: Windows, Linux, Mac OS, Android, and iOS.

We have ranked MT5 second – an upgraded version of its predecessor, MetaTrader 4. Introduced in 2010, MT5 boasts the following features that set it apart:

- It offers 21 timeframes, which is over twice the number found in MT4.

- Its suite of analysis tools lists 70 instruments (compared to MT4's 23).

- Not only can you trade currencies, but also futures and securities.

- The platform integrates over 80 indicators and graphic objects.

- An Economic Calendar is included.

Notably, the MQL4 language, which MT4 is built on, is not compatible with MQL5.

In third place is cTrader. Its primary goal was to merge high functionality with ease of use. With a team of over 100 specialists, SpotWare created this platform. Here are some features of cTrader:

- It supports trading not just in Forex instruments but also ETFs, futures contracts, and CFDs.

- The platform has its programming infrastructure for crafting custom technical indicators and advisors.

- Multiple order types are available, such as market, limit, and stop.

- It is compatible with most operating systems.

- Traders can automate trades, partially close a trade, and modify placed orders.

- Users have access to more than 70 indicators.

Ninja Trader claims the fourth spot on our list, born in the USA in 2003. Its standout feature is a robust analysis foundation, with the capability to trade not just currency pairs but also futures.

Here's why traders love Ninja Trader:

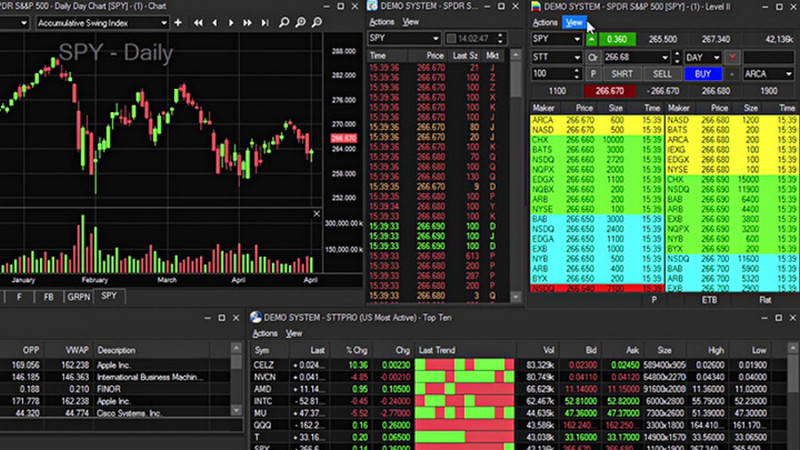

- It has SuperDOM, a tool many know as the market depth or order book. Traders can analyze the tug-of-war between bulls and bears in real-time, place trades, and set up protective orders right here.

- The Level II feature lets traders view all orders from other participants within a specified range from the current price. This helps inform their trading decisions.

- Users can create their custom indicators to aid their trading.

- The Market Replay service is a hit among traders for testing strategies, be it their own or those of others.

Rounding out our top five is Libertex. Among its main draws is its versatility in assets, offering securities, currency pairs, cryptocurrencies, and more, totaling over 250.

Libertex at a glance:

- Web-based and also available as a mobile app.

- Boasts zero spread.

- Enables swift capital management.

- Offers a selection of timeframes and charts.

- Stands out for its simplicity and ease; its interface is not cluttered.

Beyond the platforms we have ranked, traders also use other trading platforms:

- ATAS

- SB-Pro

- JForex

- R Trader

- ZuluTrade

They share similarities but each brings its distinct design, feature set, and additional services to the table.

Other trading platforms

Forex is not the only market drawing in traders; let's explore platforms designed for trading other assets, starting with stock exchanges that facilitate securities trading.

Notably, the features of such software typically include CFDs and are broader than those for Forex, often making them more complex.

However, as mentioned before, some platforms cater to both forex and stock markets.

Here are some top-rated platforms for securities trading:

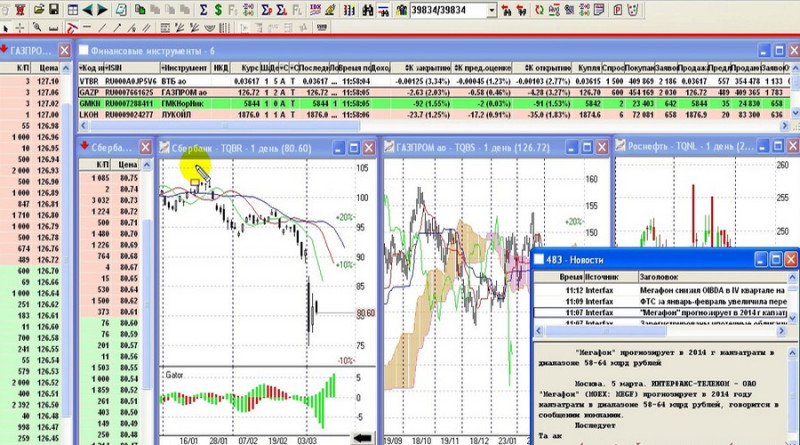

1. QUIK, primarily used by residents of CIS countries, is known for its high security using digital keys and supports algorithmic trading.

2. ThinkOrSwim offers desktop, mobile, and web versions. With over 400 indicators available, the Scan feature helps traders filter assets.

It also allows traders to develop their trading algorithms and provides economic news updates.

3. Trader Workstation is versatile and compatible with any device and all OS. Users can trade across 100 platforms in 23 countries.

It is packed with features, settings, and add-on services. Its assets list includes securities, currency pairs, and stock indices. It integrates a news feed and access to fundamental data.

4. TRANSAQ is versatile in language and device compatibility. It allows users to trade not just stocks but also derivative financial instruments. It also has cryptographic security.

5. MetaTrader 5, which we have already covered.

Regarding cryptocurrencies, some noteworthy platforms are:

- CScalp, tailored mainly for scalpers.

- Coiniginy, which offers a demo account registration.

- Margin, facilitating bot-driven trading.

- ATAS is primarily used by professionals.

- Moonbot for both manual and automated trading.

- Traderbox with multi-account connectivity.

- Capico comes with its bot and an averaging deals feature.

Best trading platforms for novice traders and professionals

Traders set their criteria when selecting a platform. For some, functionality takes the lead, while others prioritize an intuitive interface.

Notably, some experts advise considering your trading experience in the decision. While seasoned traders can confidently pick the best platform for themselves, beginners might struggle more.

A trading software suited for newbies should:

- Be easy to use and navigate.

- Have essential features without overwhelming them with too much information.

- Offer redundant functions, like opening trades through a control panel, right-click, or a single click.

- Display clear charts, legible fonts, and so forth.

- Support the trader's preferred language.

For beginners, platforms like Libertex and MetaTrader 4 are great choices.

As traders gain experience, the platform's functionality becomes more crucial. However, not all advanced traders switch platforms. Some stick to their tried-and-true software, enhancing it with specialized plugins—though not all platforms allow this.

For professional traders, these platforms are recommended:

- MetaTrader 5

- cTrader

- R Trader.

Remember that brokers grant access to these platforms. So if you have chosen a platform but it is not offered by your broker, you will either need to change your broker or the software.

It is wise to select a broker based on favorable trading conditions first, then test the platforms they offer.

Trading platforms: reviews

User feedback, especially from those who have experience with specific software, is invaluable.

Often, these reviews contain insights not found on developers' or brokers' websites, particularly concerning potential issues.

We have compiled some insightful user reviews on popular trading programs:

- "There are so many platforms nowadays; there's a lot to choose from. When selecting one, it's essential to consider your objectives, market specifics, and your broker's trading conditions."

- "I initially used Libertex: it has a straightforward interface, clean charts, and is fast. However, as I progressed, I wanted more features."

- "For me, a platform's reliability and trading comfort are paramount. I've tried many, but nothing beats MT4. It's easy to add indicators and customize."

- "Libertex is great for beginners. But only Forex Club clients can use it. If you're with another broker, go for MT4."

- "NinjaTrader isn't for beginners; it's geared towards bigger and professional traders. The interface took me a while to understand."

- "NinjaTrader's only downside is the fees. The commissions and taxes are a clear indication of its US regulatory compliance."

- "MetaTrader is foolproof for those wanting a smooth trading experience. With other platforms, I struggled to even open and close trades."

- "Maybe it was a glitch, but a few times in MT4, the price seemed artificially adjusted. It would bounce off the Stop Loss and move in the opposite direction."

It is interesting how reviews on the same platform can include opposite views. Some users have negative feedback, while others only see positive sides.

Why does such disparity occur?

Firstly, a lot depends on the trader's skills. Some beginners, without fully understanding trading nuances, lose money and blame the software, not themselves.

Secondly, some reviews might be biased, written either to discredit competitors or, conversely, to promote other platforms or brokers.

You can identify fake reviews by the following:

- Users repeatedly praise or criticize a specific program, often citing the same points or giving none at all;

- Commenters pop up suddenly and disappear just as quickly from forums or review websites, indicating they have completed their paid task;

- Identical reviews appear on different websites.

Remember, everyone's experience is unique. Just because one person felt a certain way about a trading platform does not mean you will too. So, do not base your decision solely on reviews.

How to download trading platforms

Brokers provide a list of platforms for their clients. If you have chosen a broker, you do not need to hunt for download links; they will provide everything.

Follow these steps to download a trading platform:

- Visit the broker's website.

- Locate the section dedicated to trading platforms. Usually, there are several options, so pick what's best for you.

- Click the provided link, and download the setup file.

- Extract the file and launch the platform on your device.

We have described the desktop version. The mobile version is simpler: you will be directed to an app store for download. For web versions, there is no need to download the platform as you can access it via a link after logging in.

However, remember that to trade, you need a live trading account. This involves registering and verifying your identity. Be prepared to provide documents confirming your identity, address, and so on. It ensures transaction security and safeguards your finances.

Key Takeaways:

- Most trading platforms offer customization options to tailor functionality and appearance based on user preferences.

- To learn how to use a platform without risking real money, try a demo account. Nearly all brokers and platform developers offer these trial versions.

- You can enhance platforms by adding new indicators, expert advisors, signals, and other features. Check the platform’s manual for guidance.

- If you have opened a live account, start by depositing money. Check the broker’s website for deposit and withdrawal methods.

Best trading websites

Each broker provides its clients with certain trading platforms. That is why the websites for trading are most often the sites of intermediaries.

Let us acquaint you with some brokers which, in our opinion, deserve your attention.

1. InstaForex. Established in 2007, this broker offers over 300 trading instruments, including currency pairs, CFDs, futures, stock indices, and digital assets.

With over 7 million active clients, it is a significant player in the market.

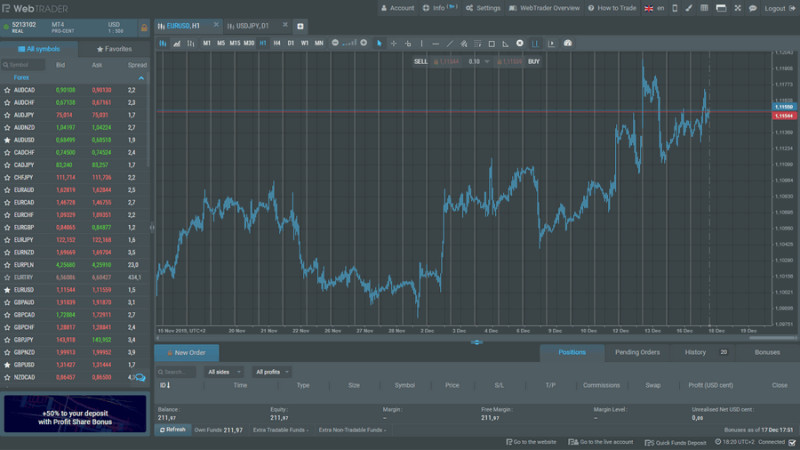

Available platforms include mobile versions, MetaTrader 4 and 5, a multi-terminal, and WebTrader.

The multi-terminal allows trading on multiple accounts simultaneously.

2. Roboforex. Operating since 2009 with almost 4 million clients, this broker offers currency trading and other financial instruments. Platforms include MT4, MT5, cTrader, and their proprietary R Trader.

While cTrader caters to seasoned traders, R Trader offers both a browser version and a mobile application.

3. Forex Club. Starting in 1997, this broker has a global client base. They provide 72 trading instruments, such as currency pairs, CFDs, metals, and cryptocurrencies.

Platform options are MetaTrader versions and their in-house developed Libertex, accessible via a browser or downloadable software.

4. Capital.com. A conglomerate of several brokers serving globally, Capital.com began in 2016 and holds licenses from four regulatory bodies.

They offer over 6,000 trading assets. Both their proprietary Capital.com platform and MT4 are available for trading.

5. Just2Trade. A subsidiary of Finam, Just2Trade started in 2015 in Cyprus. They offer trading in stocks, currencies, digital assets, and other instruments.

Platforms provided are MT4 and advanced options like CGQ, ROX, and Sterling Trader PRO for professionals.

When choosing a broker, consider three essential factors:

- Trustworthiness, validated by their experience and client reviews. A significant advantage is having a regulatory license.

- Competitive trading conditions. Your trading profits hinge on commission fees, the minimum deposit, and the variety of account types available.

- Responsive customer support. It is crucial that the company's staff can provide swift and expert assistance when challenges arise.

Top exchanges for stock trading

A trading platform is indispensable for traders. Hence, every trader first registers with a broker who provides access to such a platform.

But the process does not end there. Exchanges, or the marketplaces where the actual trading of stocks, bonds, and other securities occur, are another key component.

The world's largest and most reputable stock exchanges include:

1. NYSE, located in New York. Even those unfamiliar with stock trading have heard of or know about this exchange. Founded in 1792, it has grown into an international powerhouse, symbolizing America's prosperity.

Being listed on the NYSE is a milestone for any company, as they must undergo rigorous selection criteria, ensuring their securities are reliable and stable.

Companies like Bank of America, Coca-Cola, and Ford Motor trade on this exchange, with over 4,000 companies in total.

According to data, the NYSE handles approximately 30% of all global securities transactions. It also leads in terms of the market capitalization of its listed assets.

2. NASDAQ: Another US-based exchange, NASDAQ is known for featuring tech-driven companies. With over 3,000 such firms, it started in 1971 and boasts various composite indices.

Leading companies with shares traded on NASDAQ include Amazon, Apple, and Google.

Originally, NASDAQ began as a simple quote database but has since grown into a globally recognized platform.

3. JPX (Japan Exchange Group): Formed from the merger of the Tokyo and Osaka stock exchanges, JPX started in 2013. However, its predecessors date back to the late 19th century.

The listing features securities from over 3,000 companies, both Japanese and international.

4. SSE (Shanghai Stock Exchange): Located in China and operational since 1860, SSE is now a leading player in Asia with two of its stock indices.

Besides SSE, China also hosts other prominent exchanges like HKEX and SZSE.

5. Euronext: This is the European Union's exchange, birthed by merging significant platforms from several member countries. It has been operating since 2000.

6. LSE (London Stock Exchange): Among the oldest, founded in 1698 and based in London, LSE stands out for its international reach, particularly due to its active trading in depositary receipts.

7. BSE (Bombay Stock Exchange): Situated in Mumbai, this Indian exchange dates back to the mid-19th century, making it Asia's oldest.

8. Moscow Exchange (MOEX): Russia's primary exchange, MOEX officially started in 1992, although it began its operations related to currency auctions in 1989.

In 2011, RTS, another trading platform, became part of MOEX.

The MOEX Index (IMOEX) encompasses the most liquid securities of various Russian firms across different sectors, including Gazprom, Yandex, and Sberbank.

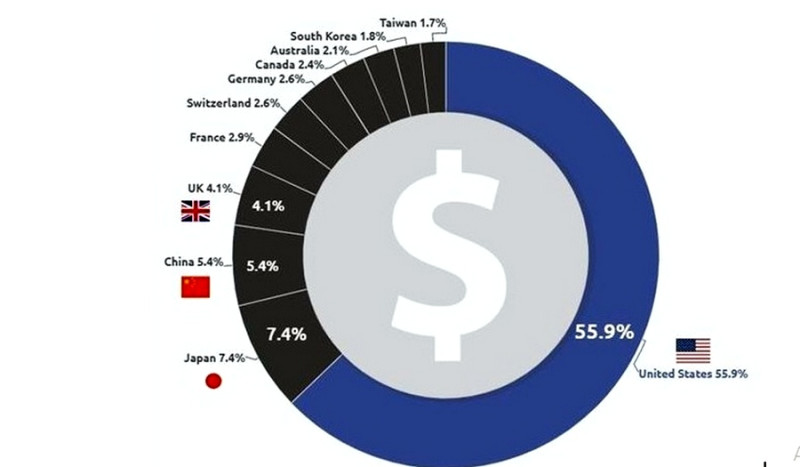

The chart below provides a global breakdown of stock exchange volumes by country. The US accounts for over half of the total value.

Best crypto exchanges

Digital assets have been gaining traction year by year. Initially, only crypto enthusiasts dabbled in trading. However, now even big investors show keen interest.

This is not just a trend. Many turn to crypto to safeguard their savings from inflation, especially during financial crises when fiat currencies lose value. The high volatility in crypto markets also offers a chance for good returns: the idea is to buy low and sell high.

Platforms for buying, selling, and exchanging digital coins are known as cryptocurrency exchanges. Some of the top ones include:

- Binance: Founded in 2017 in China but officially registered in the Cayman Islands. Known for its low fees, its unique token, and its secure cold wallet.

- Coinbase: Operating since 2012 and based in California, it serves customers across 100 countries. Features include user funds insurance, an educational base, a free wallet, and the fact that user funds aren't stored on the exchange but in an independent vault.

- Kraken: A US platform that started in 2011. Its popularity surged in 2014 after industry leader MtGox faced scandals and bankruptcy. Kraken boasts high liquidity, low fees, one-click trading, and a multilingual interface, catering to an international clientele.

- Bitfinex: It is registered in the British Virgin Islands. The exchange has operated since 2012. Its ecosystem offers digital payment services, algorithmic trading, a mobile app, and a terminal. It emphasizes strong security.

- Bybit: Based in Singapore, but its legal entity is registered in the British Virgin Islands, operating since 2018. Technologically advanced, Bybit offers mutual trade insurance, netting for purchases and sales, and a market depth analysis tool.

These platforms have significantly influenced the way traders and investors interact with the world of digital currency.

Conclusion

In trading, the functionality of trading platforms is critical. That is why it is essential to carefully choose trading platforms, weighing the pros and cons.

While expert opinions and user reviews can guide you, testing a platform using a demo account is the most effective approach. To save time, you might consider opening demo accounts with different brokers who offer varied platforms.

Despite the fierce competition and a plethora of choices in the market, both beginners and seasoned traders tend to use the most trusted platforms. Statistically, MetaTrader products come out on top.

You may also like

How to Choose Broker for Forex Trading

Back to articles

Back to articles