Whatever you do, it is always hard to take the first step, and trading is no exception. For a smooth beginning to your trading journey, you should read our article “What do you need for Forex trading.”

In this particular article, we will tell you how to choose a broker for Forex trading, what to consider when comparing intermediaries, and how not to run into scammers.

Functions brokers serve

Those traders who just make their first steps in the world of trading may be wondering about who brokers are, what they are needed for, and whether it is possible to do without them. Without a broker, trading will not work, and here is why.

A broker is an intermediary between the seller and the buyer of an asset. In other words, without a broker, trading is impossible.

Intermediary services are needed when you trade on stock, currency, and commodity exchanges. That is, if you want to access one of these markets, you will need the help of a broker.

These are companies, or legal entities, with an appropriate license granting them the right to provide intermediary services.

Main functions of an intermediary:

- Access to trading. With a broker, private traders can open accounts and use trading platforms;

- Execution of orders;

- Transfer of funds to client accounts.

Intermediaries also have a number of additional functions:

- training: here we are talking about both leveling up the skills of professional traders and spreading basic knowledge about trading among beginners. Brokers organize webinars and post video lectures as well as analytics and educational content on their websites;

- assistance: most companies have a customer support team traders can contact if needed. They answer technical and financial questions and offer possible ways out of a difficult situation;

- motivation: brokers have various Bonus programs and hold promo campaigns and contests to motivate traders;

- efficient trading: many intermediaries provide their clients with proprietary software (for example, platforms), ready-made strategies, and trading tools.

Acting as an intermediary, a broker has the right to receive money for its services.

In this case, they can charge commissions for the following services:

- Transactions. In this case, remuneration is usually a percentage of the trading volume regardless of whether it was a lucrative or unprofitable trade;

- Custody services. This option is rare;

- Leverage (the use of borrowed funds to increase one's trading position). Not all intermediaries charge this type of commission either.

What broker how to choose a broker for Forex trading

If you want to become a trader, you should start looking for an intermediary right after obtaining all the necessary knowledge about trading. Important! Trading with the first broker you come across is never the right option.

First, it is about your finances. Therefore, it is in your best interest to trust only a reliable and reputable company as there are also scammers who call themselves brokers.

Second, each broker offers its own trading conditions, and the more appealing they are for you, the more efficient your trading will be.

Nowadays, there are many companies providing brokerage services. Therefore, it gets hard to distinguish reliable firms from scammers. In order to choose the best broker, you should be guided by the following criteria:

- Presence of at least three years in the market;

- A license from a regulatory body. This information can be found on a broker's website;

- A broad clientele of at least 1 million users;

- Prestigious international financial awards;

- Positive feedback from clients;

- Information support. That includes having the support service as well as training and analytics sections on the website.

These criteria will help you filter out all the unreliable and untrusted candidates. Now you can move on to a more detailed study of the remaining options.

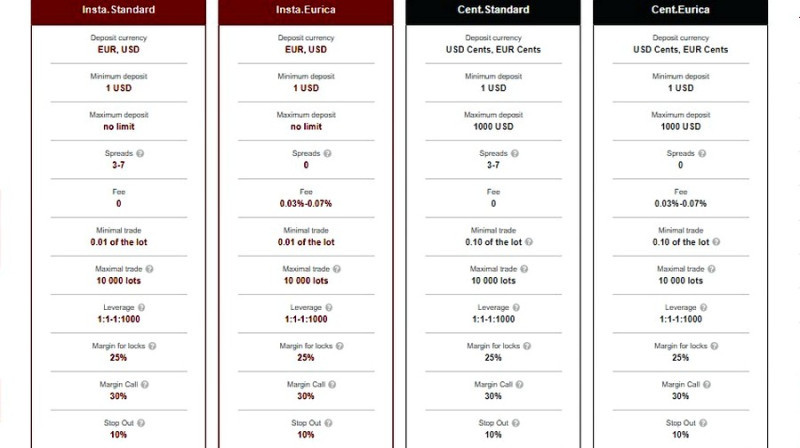

Compare trading conditions

This is a very comprehensive and important criterion when choosing an intermediary. It is important that traders study and compare the trading conditions of different brokers.

Trading conditions include:

- commission size: for example, if an intermediary charges a 1% commission for each trade, you should be ready to pay this amount from your account.

It does not matter whether a trade was profitable or not. You should also pay attention to the size of swaps and spreads if there are any; - minimum deposit: it is the amount of money required to start trading. This is an important nuance for people with limited finances and for those who are not ready to invest heavily.

With some brokers, a minimum deposit can be $1. With others, it can reach tens or even hundreds of US dollars. Therefore, beginners should start trading with small deposits; - leverage: this service is offered by almost all companies, but the difference here is in the highest-possible rate of leverage.

The novice should understand that the higher the leverage, the bigger the risk. The leverage ratio of 1:100 or 1:200 is the best option to start with; - restrictions on trading volumes: some brokers set upper and lower limits: for example, it can be a range of 0.01 to 10,000 lots;

- deposits and withdrawals of profits: as a rule, there are quite a lot of options, including wire transfers, bank cards, and payment systems;

Make sure you find the one that works best for you. In addition, you should have an alternative in case your option stops working (for example, due to sanctions); - trading account types: oftentimes, brokers offer several alternatives to choose from. Users can select the most suitable requirements for the minimum deposit, currency, leverage, and so on;

- list of trading instruments: simply put, this is a list of assets that you can trade to make money.

These are currency pairs, CFDs, metals, etc. With an extensive list of trading instruments, traders will have more opportunities to diversify their investment portfolios.

In order to compare and evaluate all the data, you can create a table with the trading conditions of different intermediaries.

Paying attention to trading platforms

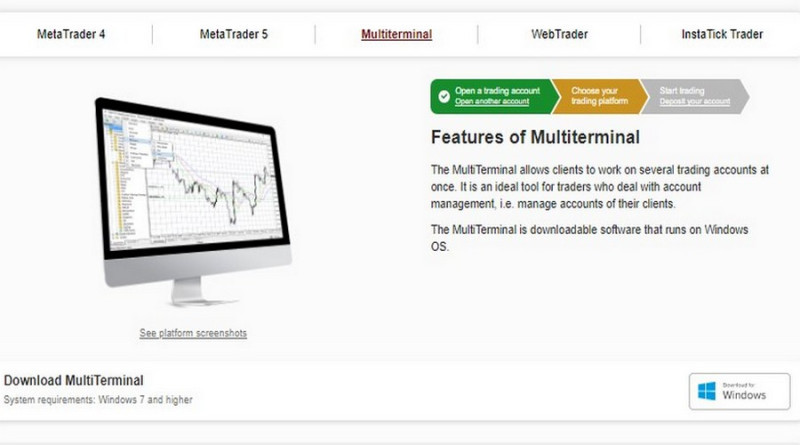

Brokers usually offer their clients several trading platforms to choose from. They are usually MetaTrader 4/MetaTrader 5 and proprietary software.

Traders' task is to pick the best suitable one.

A trading platform should be user-friendly and have all the necessary functions to ensure high data processing speed. When selecting trading software, you should pay attention to the following features:

- Mobile app: it is essential if you plan to trade not only from your computer but also from your smartphone or tablet;

- Interface: it should be intuitive and have the language version you need;

- Functionality: here you should pay attention to the list of available trading instruments, indicators, and charts. Savvy traders will find it useful to have a strategy tester and the ability to design scripts and personal trading indicators;

- Settings: they will help you make the trading platform work and look the way you want.

Brokers and developers of trading software have detailed instructions on how to use platforms on their websites. However, they are not enough to evaluate all the pros and cons of particular software.

In order to see how the chosen software work, you should try its demo version. For that, open a demo account with your broker, download the platform, and log in.

Demo trading will help you evaluate all the strengths and weaknesses of the platform.

Access to trading software is free no matter whether you are the owner of a live account or a demo account.

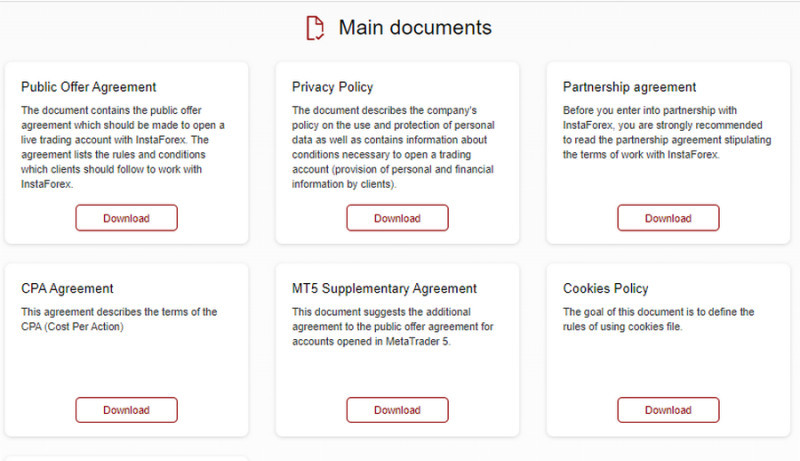

Reading agreements carefully

Certain legal documents, usually an agreement, establish the relationship between a trader and a broker, at least when it comes to honest companies.

An agreement is a mutual arrangement where the broker undertakes to provide services to the client, and the client receives the right to use those services.

A standard document called the Public Offer agreement is posted on the intermediary's website. Clients do not have to sign it. Their consent is confirmed by clicking the appropriate button.

Scrutinizing the content of this agreement is a must. Unfortunately, some novice traders make a huge mistake when agreeing to all the conditions without even looking.

You should focus on the following points in the document:

- Company name, details, and contact information;

- Conditions for amending and terminating the agreement;

- Responsibility of both parties. Carefully read points about the services the intermediary will provide;

- Potential trading-related risks;

- Client order processing and time;

- Provided trading software;

- It is important that trading conditions match on the website and in the agreement. This point may also list reasons for changing trading conditions;

- Leverage, its maximum rate, and circumstances under which it can be reduced or increased;

- The size of spreads, swaps, and commission fees. This is one of the most important points because it concerns your money;

- The terms for informing the client about changes in trading conditions and the content of the agreement;

- Ways of depositing and withdrawing funds as well as transaction execution terms;

- Dispute settlement procedure.

The agreement is usually quite big. Therefore, it would be wiser to print it or save it on your device. There are also other documents regulating the relationship between the trader and the broker.

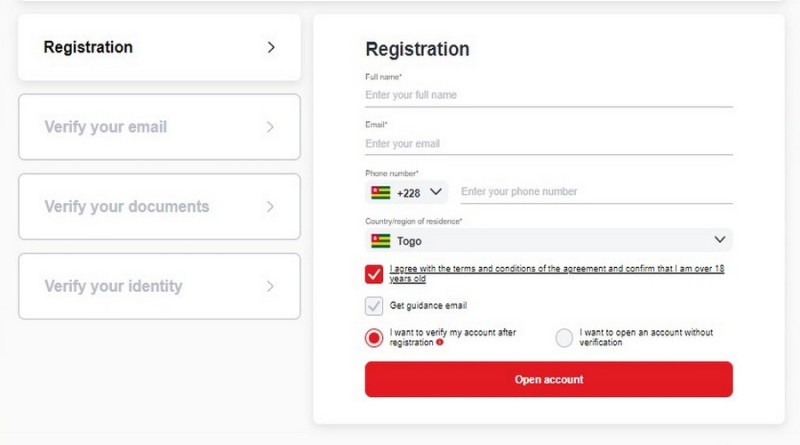

Opening an account

After picking a broker, you can open a live trading account. Remember that accounts can be of different types. Therefore, make sure you select the suitable one in advance.

The registration process may vary from broker to broker but usually consists of the following steps:

- You fill out a registration form. Here you briefly specify your personal data and contact information;

- You give more detailed information. Here you mention your residential address, date of birth, phone number, and so on.

- You choose the account type, currency, and leverage ratio. As a rule, you type this information data after entering the login and password received by email;

- You confirm the information and open an account.

If all the steps are done correctly, the system will inform you that the registration has been successfully completed. Next, you should make a deposit, download trading software, log in, and start trading.

Here we’d like to talk about verification. This procedure involves checking the data provided by the client when registering accounts.

The system may ask you to upload scans of a passport, proof of place of residency, bank statements, and so on.

Such requirements should not scare you. They are gathered to ensure the safety of all market participants, and not to control your actions.

When you give your personal details to a reliable and regulated broker, there is nothing to worry about. Your data will not be misused or get to third parties. Diligent intermediaries care about their reputation. Therefore, they keep all client information safe.

Before uploading scans of the documents, carefully study the requirements. Scans should be clear and easy to read as well as have a certain size.

Consequences of choosing the wrong broker

Traders who had to deal with dishonest intermediaries know about the negative consequences of such cooperation. As a rule, in such cases, trading not only disappoints but also leads to losses.

What are possible risks:

- Slippages, meaning the execution of orders at a price different from the one specified in the order. In the best-case scenario, you make smaller profits. In the worst-case scenario, you incur losses because slippage is negative most of the time.

Sometimes, slippage occurs for objective reasons, for example, due to a lack of liquidity or sharp jumps in quotes on the back of important macroeconomic news. Still, it also takes place because of dishonest brokers who do it on purpose; - Problems with the withdrawal of trading profits. When you deal with scammers, you can wait for your money for a long time or never receive it at all;

- Following trading recommendations that result in deposit drains. Scammers can offer clients the so-called "super-profitable" strategies and trading signals that eventually lead to losses.

For example, in the forex market, there are intermediaries you should avoid.

The first group is the so-called “one-day brokers”. They come to the market for a short time, use aggressive advertising to promote their services, and then suddenly disappear, taking the funds of traders with them.

That is why it is so important to be mindful of the working experience and image of a company when choosing a broker.

The second group includes forex kitchens. They do not utilize the interbank market to carry out transactions and conduct only inner operations.

It is about internal clearing when the orders of some clients are executed only when there are counter orders from other clients of the same company or the broker itself.

In some countries, such intermediaries are prohibited. However, experts have different views about them. For instance, when a forex kitchen firm does not artificially change market quotes and pays profits to traders, that does not pose a threat to users.

However, when quotes differ from the market ones and the broker does not specify liquidity providers, it would be wiser to avoid such an intermediary.

Final thoughts

How to choose a broker for Forex trading is a serious matter that requires weighing all pros and cons. Do not opt for the first available broker and do not trust companies that guarantee profits.

Use our guide to choosing the best broker for trading and remember that no broker can promise you trading profits.

You may also like:

Trading signals WhatsApp

Trading tools

Best monitors for stock trading

Back to articles

Back to articles