Trading requires much force both from a trader and the equipment they use. One may possess vast knowledge and skills but it is rather difficult to achieve the required result without proper hardware.

In this article, we provide reasons why trading hardware is that important. To learn more about other components of successful trading in the financial markets, read the article What do you need for Forex trading.

Best computer for trading

So, what is an image of an out-of-office job such as online trading? One can imagine a happy person sipping a cocktail somewhere at the seashore, checking their laptop occasionally. Such a perfect picture: earning money while enjoying your life!

Unfortunately, in most cases it looks more down-to-earth. Even when working at home, traders need a fully equipped office to conduct their trading activities properly.

It may cost too high price for them to lie idly under a palm. Sometimes, traders should stay near the monitors. It is especially relevant for short-term traders who need to keep watch over the market situation non-stop, as it can change in merely few minutes.

There are two another important aspects: reliability and accuracy of your computer and Internet connection. These are two must-have ingredients for fast and timely execution of your trades.

Before you buy trading hardware, you'd better learn about its key features. You need to learn the information about system requirement for the installation of a trading platform you are going to use.

The operational system of a computer should fully match these requirements. They usually include the sufficient RAM, a cooling system and fast hard drives.

More experienced traders who trade various assets in several markets at once, may also need several monitors. For beginners, one monitor will be quite enough.

Basic computer features

There are no computers specially designed for trading. The necessary parameters and components can be selected individually.

As for the hardware itself, it must be powerful in order to withstand heavy loads. It should also have good protection against moisture and dust, a well-functioning ventilation system.

As already mentioned, more advanced users need several monitors. You can start with one or two, and then adjust their number to meet your needs. In addition, you need to select a video card for your best computer for trading in accordance with the number of monitors that will be used.

This is especially relevant for intraday trading. Short-term traders need to constantly monitor changes in quotes and be ready to quickly respond to a changing situation.

If a trader uses long-term strategies, then they can get by with one monitor. In this case, they do not need to constantly monitor price fluctuations. They just need to analyze the market before placing any order.

As for the parameters of the monitor itself, it should have a sufficiently large diagonal of at least 17-19 inches. The optimal size of the main trading monitor is considered to be 30 inches, while additional monitors may have a smaller diagonal.

Besides, you need to understand that a large diagonal allows you to see price charts in full. The smaller the diagonal, the smaller part of the chart you can see. In addition, chart patterns and other chart features are better visible on a larger screen.

In any case, a lot depends on what what price you can pay. If your budget is limited, it is better to invest more of it in strengthening the processor than in purchasing additional monitors.

Another important element of a trader's workstation is the uninterruptible power supply. It is necessary to have it in case of a sudden power outage in order to have time to close a trade or carry out other manipulations before turning off the device.

Trading computer assembly

When selecting a computer suitable for trading, you may come accross such a notion as the computer assembly. What is it and why one needs to assemble a computer?

The assembly involves filling the computer with those elements that any particular trader requires to meet their specific needs.

Moreover, assembling a computer, unlike buying a ready-made device, allows you both to select all the components individually and subsequently replace them with newer and more modern ones.

Qualified specialists may help you to select the necessary components and adjust the neccesary settings. It is recommended to assemble a best computer for trading with plans for further improvements.

This means that even if a trader does not currently plan to use, for example, multiple monitors, it is better to provide for the possibility of adding them later rather than to completely change the whole system.

However, one needs to take a reasonable approach. There is no need to try to add all possible features at once. It may turn out that the trader will never use all the options that they include when assembling their trading device.

In such a situation, it may turn out that the money for all these unnecessary features was wasted. In order to avoid such a situation, experts recommend laying the possibility of connecting additional functions at the very moment when it is required.

As for the computer the power, there are also different opinions. Many experts consider this parameter to be of minor importance when it comes to trading. The speed and stability of work are the aspects that really matter.

In some situations, one may use a computer not only for trading, but also for performing other tasks. For example, those who are in for programming or video games may need more powerful hardware.

Another benefit of assembling a PC is that a user can do it themselves. With the help of a special service, select all the necessary components, order or purchase them, and use the instructions to assemble the computer.

Computer components

The key element of any stationary PC is an operational unit. It is a core of any device that performs the main functions.

In turn, the key elements of an operational unit are a processor, RAM, hard drive, and a video card. Let us describe each of these elements in more detail.

As already mentioned, a computer should not be super powerful if its only intended purpose is trading. The most widely used trading platforms such as MT4 or MT5 do not require high capacity.

However, if a trader plans to use some trading bots or other automatic algorithms, it may require more powerful hardware. At the same time, some trading platforms allow for the use of other computers and hardware capacities for this purpose.

A two-core processor will be enough as trading platforms have been developed over ten years ago, so they are not supposed to lag. However, if you buy a four- or eight core computer, it will speed up the platform operation manifold.

For trading only, the RAM of 2 Gb will be sufficient.

At the same time, it is important to remember that other programms can be launched on a computer, which may cause additional load. That is why, the RAM of at least 8 Gb is considered the most optimal one.

Currently, there are hard drives of two types: HDD and SSD. The HDD drives are mechanical while the SSD ones are based on micro chips, i.e. they operate as a flash drive.

The SSD drive is a preferred option, as it is much faster than the mechanical drives. There are also hybrid options that combine the high speed of SSDs with the high capacity of HDDs.

A video card is not the key element if you are going to use one monitor. In case there will be several monitors, you'd better select a more powerful video card.

To avoid overheating of your computer, you need to buy an effecient cooling system.

What else to pay attention to?

Besides the technical components of your computer, you need to think about some other aspects. Probably, they are not that obvious as RAM or the speed of processing, but they are also rather important.

One of these aspects is the stable Internet connection. If your Internet connection is slow or there are any interruptions, you will hardly reach any success in trading, because some of your trades may simply fail.

Some experts recommend connecting to the Internet through a wire, not via Wi-Fi. It is a bit old-fashioned way indeed, but it is still the most reliable one.

Additionally, you can use a router to make the signal clearer and speed up the connection. To be on the safe side, you can also set a hot spot on your mobile device or use a mobile app for trading.

And here is one more tip: when trading, you'd better postpone downloading of any system updates as it can slow down the connection.

It is also important to take care of the antivirus software. You need to use highly effecient licenced product. Some users neglect this recommendation and use some unreliable software which may cause certain problems.

Any software should be updated from time to time, but when using unlicenced antivirus programms, you cannot do it. In connection with this, your computer may become unprotected, so you risk losing all your sensitive information including the trading data. Security should always be of the highest priority.

Trader's workspace

The need for any specially equipped workspace is directly connected to a trader's style of trading.

Long-term traders who usually hold trades open for several months or even years don't need to spend much time at their computers. They just need to check the market situation from time to time, but it can be done at any desk.

Traders who conduct medium-term trades spend longer time at their computers, but they also do not need to monitor charts all the time.

Intraday trading, in particular scalping, is the most active style. In this case, trades are made within one trading day or even minutes when it comes to scalping.

In such a case, trading is a full-time job, so it requires a well-equipped workspace. It includes a convenient desk and a comfortable chair.

Traders spend a lot of time at their workplace. Therefore, this place should be as comfortable as possible.

Avoid overloading your desk with too much stuff. It should contain only the essential things. Nothing should distract your attention from trading.

It is necessary to choose a chair with orthopedic functions, which provides support to the back and helps to maintain posture. If your furniture is not comfortable enough, you will quickly get tired, which will eventually lead to trading mistakes.

As for the number of monitors and their location, everyone has their own preferences. Intraday trading requires at least 3-4 monitors.

Currently, technical capabilities allow you to place monitors in any location, both on the table and on the wall. Rounded rather than flat monitors are considered more comfortable.

In addition, you need to make sure that a monitor or monitors are at your eye level. This is necessary in order to avoid additional strain on the eyes, which are already tired of constantly being in front of monitors.

If trading is carried out from home, it is advisable to allocate a separate place, if possible a separate office, for the equipment of the workplace.

A bedroom or other room intended for relaxation are definitely a bad choice for locating an office. Work and leisure should be separated.

Categories of traders

As we have already mentioned, traders can be divided into several categories depending on the style of trading they prefer: long-term, medium-term, intraday traders, and scalpers.

In addition, traders can also be divided into groups depending on the location of their workplace. On this basis, the following categories are distinguished:

- Floor Traders or Pit Traders. This category usually refers to individuals using an intraday trading style who trade directly on the exchange floor. Their workplace is usually located at the lowest point of a trading venue.

- Hall Traders. This group includes professional traders who usually represent the interests of several clients or companies and place large orders. Their workplaces are above the level of an exchange floor, so they can better see other traders and information boards.

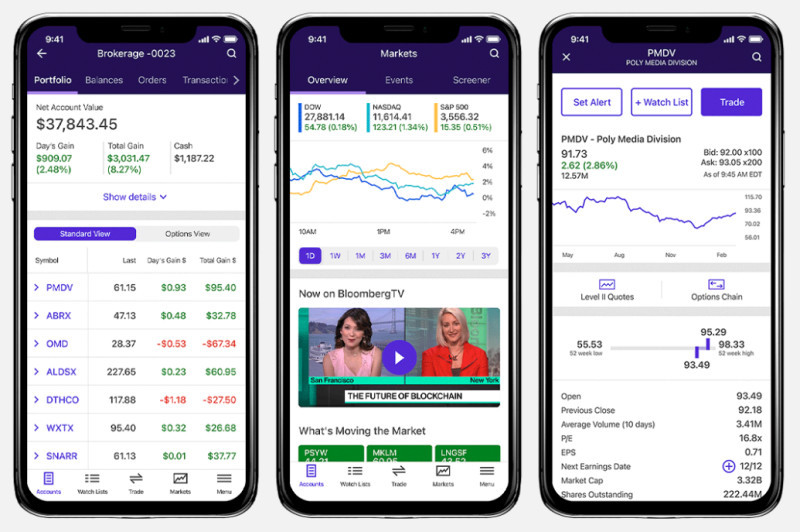

- Monitor traders. This is a category of users who work outside an exchange room. They trade on specialized trading platforms where they can see actions and orders of other traders, so they can open their own positions based on this information. Trading platforms also combine many other functions. Specifically, they can be used to track news and quotes history, conduct market analysis and other options.

Notably, the first two categories of traders are a rare phenomenon nowadays, thanks to the wide accessibility of the Internet and the ability to trade using trading platforms. This is the most popular trading method currently used by traders around the world.

Desk of a professional trader

Professional traders usually work at offices or dealing centers. An ordinary user may be awed by the look of a trader's workplace.

Professionals use several monitors connected to one system unit. Moreover, they can even use several computers with several keyboards and mice.

Professionals need to use several computers because they need to solve numerous tasks simultaneously and process a large amount of data, such as:

- graphics from data providers and trading servers;

- pip and exchange calculators;

- modeling and execution systems as well as risk controlling systems;

- any additional applications.

Large dealing centers also provide the ability to connect additional gadgets, such as headphones, a microphone, printers, scanners, and so on.

Naturally, in such a situation, it is quite difficult for a trader to concentrate on work. It is also inconvenient as it slows down the user's ability to process information.

Therefore, most companies use various options for remote best computer for trading interfaces, which are also called KVM extenders or KVM switches.

With these devices, you can reduce the amount of equipment used to one set. The workplace turns into a distributed access console, where you can freely switch between computers using a single mouse or keyboard shortcuts.

Currently, such switches allow you to combine up to 8 systems and monitors with any configuration into one workplace.

In dealing centers where a large number of professional traders are located at the same time, it is possible to place all the equipment in a separate room. It is called a server room.

Such server rooms can even be located on separate floor or in separate buildings. At the same time, they are connected in a single KVM network with a centralized control panel.

Within such a network, every employee can remotely connect to any device, even being tens of kilometers away from it.

The key advantages of such networks are:

- Centralized control of employees' access to computers and elimination of possible information leaks, since physical access to a PC is limited.

- It is possible for several employees to work together in one computer or display information from one PC to a common video stand.

- The equipment is located in a separate equipped room with temperature and humidity control, which prolongs its service life.

- Managers can track the connection history to any PC, as well as connect to employees' computers to monitor their work.

Mobile trading

Nowadays, most trading platforms are available both desktop and as mobile apps that enable their users to trade right on a smartphone or a tablet.

The most popular operating systems on mobile devices are Android and iOS. Most mobile applications of trading platforms have been developed on base of these systems.

On the one hand, it seems to be an advantage, as you can monitor both the situation on the market and your trades at any time and from anywhere. At the same time, this method of trading has its drawbacks.

Firstly, a significant disadvantage of using smartphones is their small screen. We have already explained the importance of a big-size computer monitor.

On a small screen, it is impossible to fully view the chart, even if a user removes all indicators and other distracting add-ons.

The next disadvantage is inconveniency. If you have to use your smartphone or tablet in public transport or other public places, there can be many factors that prevent you from concentrating.

For productive and efficient work, a trader needs comfortable conditions, so the ideal place for trading is still a specially equipped place at home or in the office.

Of course, tablets or smartphones can be considered as an additional tool for controlling the situation on the market. Nevertheless, you should not get carried away with using them too much, since you still won’t be able to fully analyze and trade with their help.

Many traders have to trade on the go, as they are forced to combine their main work with trading. In such a situation, the analysis and preliminary preparation is carried out on a stationary, well-equipped computer, and a mobile application is used to control trades.

It is also not recommended to use short-term strategies. When trading mobile, it is better to try on medium-term or long-term ones. Active trading in such circumstances may be quite difficult.

Trading laptop

A laptop is another tool for mobile trading. It combines the properties of a desktop best computer for trading and mobile devices, allowing the user not to be tied to one place.

A good laptop suitable for trading should have several important features:

- A sufficiently large monitor with the minimum size of at least 17 inches. However, few laptops have such large monitors.

- High performance for working with trading platforms, as well as the ability to use trading robots.

- Compatibility with additional devices, such as several monitors or other equipment.

Why are these features that important? A large monitor is essential for viewing and analyzing charts effeciently.

High performance is needed so that a device does not fail at any important moment of work. In addition, you need to understand that trading robots do not operate through a server, but are installed directly on a user's computer.

Automatic trading is carried out continuously, which creates an additional load on the device. If a laptop fails, this will have a negative impact on a trader's deposit.

In addition, there are other criteria that should be factored in when choosing a mobile device. So, for example, many traders are comfortable working on Mac computers. However, the most popular MT4 and MT5 trading platforms are not compatible with Mac OS.

To use these trading platforms, you need to install special programs on your device, the so-called emulators. This creates additional inconvenience for a user and increases a load on a laptop.

Desktop or laptop: what to choose?

On the one hand, a computer and a laptop have much in common. On the other hand, they also have a number of differences. Each of the options has both advantages and disadvantages.

Modern laptops are as powerful as desktop computers. They also have high performance and an advanced set of functions. At the same time, they enable a user to be more mobile and, if necessary, trade outside the home or office.

However, this advantage of a laptop is not important if a trader needs to use several monitors.

A significant advantage of a desktop computer is that it can be upgraded. In the system unit, you can replace outdated parts with new ones, strengthen the processor, change a video card, enhance RAM, and so on.

Another important advantage of a desktop device over a portable one is the monitor size. Desktop monitors can have a diagonal of 27 inches or more, while in laptops this parameter is limited to 15-17 inches.

It is very important for a trader to be able to see the chart in maximum resolution. Therefore, the monitor size plays an important role. By the way, some modern monitors for computers are full HD, so they allow you to see two platforms at the same time without an additional monitor.

However, desktop computers with several monitors are necessary for experienced traders. They know how to use them and make this interaction as effective as possible.

For novice traders, one monitor is enough and a portable device is quite suitable. It does not take up much space, and it may be as powerfull and effecient as a desktop computer,

By the way, another advantage of a laptop over a stationary device is that it can run on battery power. A sudden power outage will not be a problem for it.

Conclusion

In this article, we have described various options for organizing a trader's workplace. It can be a well-equipped office or one laptop.

Much depends on the trading style of each user. If a trader chooses long-term or medium-term strategies, they do not need to stay near a best computer for trading all the time. Accordingly, there is no urgent need for any equipment of a special workplace.

As for the intraday trading and scalping, then a separate place is a must. There you can place a computer, as well as additional monitors for it.

Professional traders work in specially equipped offices. Besides, modern technologies allow you to place all the equipment in separate rooms or even buildings and connect to it remotely.

Speaking of trading computers for individuals, it is better to assemble your device rather than use a ready-made option. In such a case, all components for a computer are selected individually according to the trader's needs.

Another advantage of an assembled computer is that you can later improve the device and replace components with newer and more modern ones.

At the same time, a trading laptop also has its advantages, such as mobility and the ability to work autonomously in the event of a sudden power outage.

You may also like:

How to choose a broker for Forex trading

Trading signals WhatsApp

Trading tools

Best monitors for stock trading

Back to articles

Back to articles