Every beginner in trading cryptocurrencies eventually wonders: Which asset should I focus on? Should it be traditional securities, fiat currencies, or should I dive into the world of digital coins?

What's the real deal with cryptocurrency trading? What sets it apart, and how can one reduce risks when venturing into this area? Dive into our review to get answers to these questions and more.

Specifics

Even though the crypto realm is relatively new, it's already gained substantial and passionate following. Initially, it was mostly tech enthusiasts dipping their toes into digital assets, but nowadays, it's drawing in heavyweight investors looking for substantial returns.

Bitcoin, the pioneer of digital coins, made its debut in 2009. Today, there are over 20,000 different digital assets available.

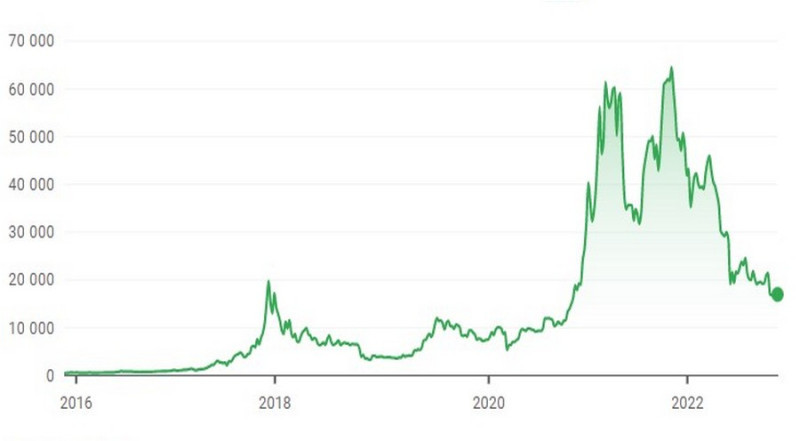

The year of 2017 was a milestone for cryptocurrencies. Bitcoin skyrocketed, seeing a massive jump from $960 to a staggering $19,000. This surge wasn't just a flash in the pan—it marked a pivotal moment in the evolution of the crypto space.

Why do we need Bitcoin and altcoins?

- For transfers. They offer an alternative to traditional banking methods.

- For purchasing real goods and services. It's crucial to note that not all countries allow coins as a legal payment method.

- For profit-making through trading. The volatility of these coins is high, allowing one to buy low and sell high, thus amplifying capital.

Every cryptocurrency is virtual and is essentially a file resulting from computer computations. In simpler terms, it's a unit of account within its respective payment system.

This system is decentralized, meaning it doesn't rely on a central authority but is maintained by a vast number of users. In contrast, in the banking sector, banks oversee and control all transfers.

The digital payment system encompasses data of all transactions. This information is accessible and stored on computers across different countries, held by various users.

This data is grouped into blocks, secured by cryptographic keys. A chain of such blocks is called a blockchain.

Digital assets are stored in crypto wallets. Due to the high level of security, their content cannot be cloned or duplicated for double use.

In other words, forging digital coins is virtually impossible.

Advantages of coins:

- Fast Transactions. Using a bank might mean waiting for hours, even days, for a transaction to complete. With crypto, transactions often take just moments.

- Inflation Resilience. Fiat currencies can frequently devalue due to excessive printing, whereas most coins have a limited supply.

- No Geographic Barriers. You can send and receive coins irrespective of the user's location.

- Minimal Fees. Unlike bank transfers, transaction fees for most cryptocurrencies are nominal.

- Anonymity. Typically, when setting up a digital wallet, there’s no need for verification, making it difficult to trace transactions back to an individual.

- Security. While it's nearly impossible to hack the blockchain due to encryption, it's essential to remember that security also depends on users. They need to ensure that unauthorized individuals can't access their wallets, meaning they must safeguard their keys to their digital storage.

- Variety. There's a wide array of coins available. From expensive to low-cost ones, and from highly volatile to more stable coins, and those with different lifespans.

However, cryptocurrency isn't a flawless or perfect instrument. This statement holds true for both trading and other realms where coins are utilized.

For instance, if one intends to use coins as a medium of exchange, there might be hurdles. Only certain shops, service providers, and organizations accept digital currency.

Besides, there are country-level restrictions. While some countries embrace the growth of the crypto realm, others may outright ban transactions involving Bitcoin and altcoins.

Drawbacks of digital assets include:

- Sometimes used for illegal payments or to hide income from authorities. The lack of regulation attracts scammers seeking opportunities for financial fraud.

- The risk of irrevocably losing funds if access keys to a wallet are lost.

- Inability to reverse a transaction if coins are sent mistakenly. For instance, if an incorrect recipient wallet address is entered, there's no way to retrieve the coins.

- Unpredictability in the price of coins. Often, their value changes contrary to forecasts and expectations.

Entering the crypto industry

To immerse yourself in the cryptocurrency world, all you need is to purchase some digital coins. This can be done through exchanges, either centralized or decentralized.

With decentralized exchanges (DEX), all asset transactions are facilitated through smart contracts. These platforms don’t store clients' funds and don’t oversee the transaction processes.

On the other hand, centralized exchanges (CEX) operate similarly to stock exchanges. All users undergo a verification process, and these platforms act as intermediaries for trade facilitation.

Once you've bought Bitcoin or an altcoin, you can store it in your wallet and wait for a favorable market situation to sell it.

However, cryptocurrency exchanges aren't the only way into the crypto industry. There are other avenues to explore:

- Invest in Cryptocurrency ETFs: These are funds holding one or more digital assets, offering their shares for purchase on stock exchanges. Notable mentions include ProShares Bitcoin Strategy ETF, Valkyrie Bitcoin Strategy ETF, and Grayscale Ethereum Trust.

- Invest in Crypto Infrastructure: Direct investments could mean mining coins or pouring capital into launching cryptocurrency exchanges. This category also includes funding and subsequently profiting from digital services and technologies.

Crypto trading

As we've previously highlighted in our overview, digital assets are often used to profit from their price fluctuations. Their value can be expressed in relation to fiat currencies (like the US dollar or euro) or compared to other coins.

This price speculation is the essence of crypto trading.

In this form of trading, as with all others, there are two sides: the seller and the buyer. When there's a higher demand to purchase the asset than offers to sell, the price goes up.

Conversely, when supply exceeds demand, the coins decrease in value.

Trading cryptocurrencies takes place on crypto exchanges. Unlike stock platforms, they operate continuously, 24/7.

Trading activities with cryptocurrencies can include:

- Buying and subsequently selling them at a more favorable rate for the trader. These operations are conducted on the exchange.

- Trading derivative financial instruments. For instance, these could be contracts for difference (CFDs), a type of trading conducted through a broker.

Let's delve deeper into these options.

In the first scenario, it is spot trading. Market participants buy and sell digital assets at the price set on the exchange. Sometimes these trades are short-term, but often they involve longer-term investing.

CFD trading entails entering into a contract with a brokerage firm, but no actual purchases or sales occur. In this case, the broker pays the user the price difference of the underlying asset if the trader correctly predicts the price movement.

The difference is determined using the price at the time the contract is created and when it's closed. Let's consider a specific example with a CFD on BTC/USD.

Suppose a user believes that bitcoin will appreciate relative to the dollar, so they open a long position, implying a purchase. If their prediction comes true and the BTC price indeed rises, the trader closes the contract and earns a profit from the broker.

Although CFDs, unlike futures contracts, don't have a set expiration date, transactions with them usually close within a day. This is because commission fees are typically charged for carrying a position over to the following day.

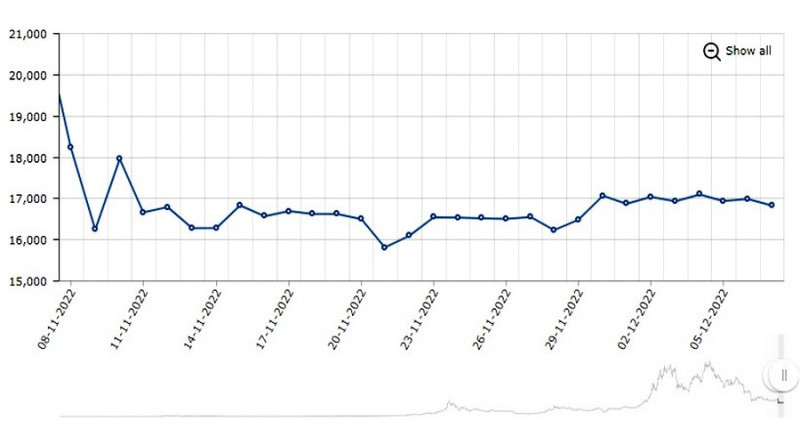

To provide a concrete example: let's say we're interested in a CFD on ETH/USD. The chart for this pair is displayed below.

At the time of writing, one Ethereum was priced at approximately $1,227.50. Assume we decide to purchase five contracts, with each contract equivalent to one ETH.

We choose not to use leverage, meaning we'll rely solely on our own capital.

Let's assume Ethereum's value rises to $1,300.50. In this scenario, we close our position and sell the contracts at the new price.

As a result, we would realize a profit of $365. We won't account for the spread in this instance, as this example is illustrative.

On the other hand, if Ethereum's price were to drop contrary to our expectations, the transaction would result in a loss. The extent of the loss would depend on the magnitude of the price decline.

Key points to know when trading CFDs on cryptocurrencies:

- In CFD trading, you can use leverage, an option not available in spot trading.

- Trading costs in this case are higher than if you were dealing with other assets instead of cryptocurrencies.

- The asset price, which determines the CFD's value, might differ from the actual price of the digital coins. In other words, ensuring accuracy is challenging here, unlike with fiat currencies.

Besides CFDs, there are other derivative financial instruments available, such as futures on digital coins. While trading these isn't as popular as CFDs, they're still viable options to consider for trading.

Spot vs. Margin Trading Cryptocurrencies: Which to Choose?

The two methods mentioned above offer an opportunity not only to join the cryptocurrency community but also to profit. We touched upon this topic earlier; now, let's delve deeper.

What is spot cryptocurrency trading? It's the fundamental form of investing in digital coins.

It involves the direct purchase and sale of coins. Meaning, when you open a purchase transaction, you become the holder of the chosen asset.

Once the coins are acquired, you can spend them as you wish or hold onto them, selling later at a more favorable price.

This type of trading is considered relatively simple, making it suitable for beginners. The reason being, in spot trading, there isn't a pressing need to make transactions quickly, allowing time for situation analysis.

Users can hold onto the acquired assets for as long as they desire. Moreover, this option offers a balance between potential profit and risk.

For instance, if you invest $1,000 in purchasing BTC, even in the worst-case scenario, a trader won't lose more than this sum. However, they can profit by choosing the right moment to sell.

However, the profit amount in this scenario may be less than what one might gain through margin trading. The trader operates solely with their own funds, not leveraging, which limits the potential upside.

A drawback of trading cryptocurrencies in the spot market is the constant psychological tension a trader feels due to the high volatility of digital assets. Observing the sharp price fluctuations on charts, a trader might make impulsive decisions to buy or sell coins.

Quite often, such decisions are made even contrary to forecast indicators, leading the user not only to miss out on potential profits but also to incur losses.

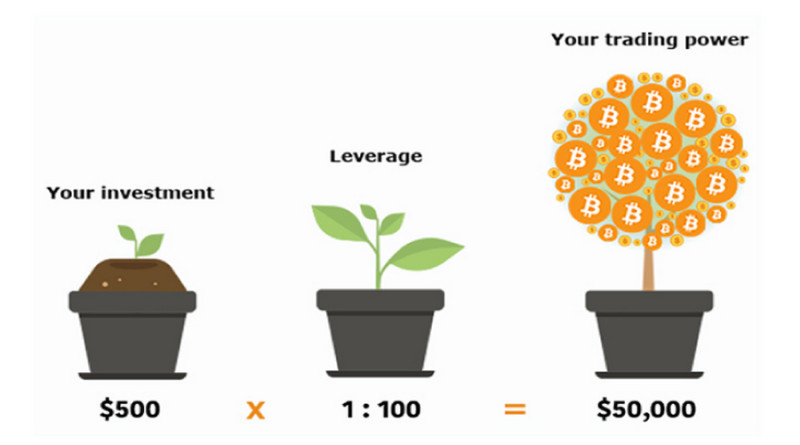

Crypto margin trading is based on price speculations. In this case, a trader can use both own funds and leverage.

Thanks to the use of leverage, a trade volume increases, so the amount of possible profit increases proportionally. However, leveraged trades also entail a risk of bigger losses.

If a user decides to engage in margin trading, it doesn't mean they can operate without their own capital. It's not possible to trade solely on borrowed funds.

For instance, to utilize a leverage of 1:50 and open a position of $10,000, the user needs to provide a kind of collateral, amounting to $200.

This collateral is called the margin. If the price moves in a direction opposite to the trader's prediction and potential losses approach the size of the initial margin, the broker alerts the trader with a Margin Call.

In such a scenario, the user can either close the position themselves or add more funds to their deposit. If neither action is taken, the position is forcibly closed, i.e. it gets stopped out.

The critical threshold is set by the broker or exchange that provided the leverage. Consequently, the margin, i.e., the trader's personal investment, is transferred to the broker or exchange's account.

However, in a winning trade, leveraging can amplify profits.

For example, a user with a $100 deposit, leveraging 1:1000, can amplify their capital to $100,000. They then use this amount to buy coins, which later appreciate by 10%.

In this case, the profit would be $10,000. If the trader had traded with their own funds, the profit would have been just $10.

Therefore, leveraged cryptocurrency trading for beginners is an activity associated with high risks. But the potential profits are also more attractive compared to spot trading.

The choice between these two types of trading largely depends on the goals set by the trader and their professional experience. Beginners might find the spot market more suitable, while seasoned traders confident in their skills might lean towards margin trading.

To reduce risks when trading with leverage, one should follow several simple rules:

- Use Stop Orders: Don't wait until the cryptocurrency price moves too far against your prediction. It's better to plan in advance, setting Stop Loss and Take Profit levels. With these in place, when the price reaches your set limit, your position will be automatically closed.

- Caution with Leverage Size: The maximum available leverage can yield massive profits but can also lead to significant losses. Professionals might occasionally utilize the maximum leverage, but it's not advisable for regular practice. For beginners, it's better to opt for a leverage of 1:2 or 1:3, or even abstain from leverage altogether. Notably, some cryptocurrency platforms limit or reduce the permissible leverage size for novice users.

- Consider Commission Fees: Typically, exchanges charge a commission for each trading operation, often tied to the trade volume. Hence, when leveraging, as the volume of the trade increases, so do the commissions. On some platforms, commission fees relate to the duration of leverage use: the longer a trader uses borrowed funds, the higher the fees become.

- Monitor Volatility Information: Extremely high volatility can lead to swift losses due to rapid price fluctuations. Conversely, very low volatility won't generate significant profits for the trader. Even if the price remains stagnant, commissions are still applied. Therefore, the optimal choice is to select a cryptocurrency with a moderate level of volatility.

Specifics of crypto trading

If you're looking to dive into cryptocurrency trading, it's essential to be aware that this field has its unique characteristics.

First and foremost, the cryptocurrency market is considered young, especially when compared to traditional stock or forex markets. This results in lower trade volumes, higher commissions, and increased risks.

Second, Bitcoin and altcoins are more volatile than stocks, currencies, and other trading instruments. This can be a double-edged sword. On one hand, the continuous price fluctuations offer opportunities for swift profits.

On the other hand, these can also lead to rapid capital losses. Success in this realm often hinges on a trader's experience and chosen strategy.

Third, the cryptocurrency markets offer the possibility for arbitrage. We'll delve deeper into this tactic later. For now, understand that it offers a chance to make profits with minimal risks.

Fourth, the regulation surrounding digital currencies varies greatly from one country to another. While some nations officially recognize them as legitimate payment methods, others have imposed strict bans on cryptocurrency transactions.

Crypto traders are professionals who approach their trade systematically. Their tasks don't just end at picking a promising token; they constantly analyze its price dynamics and make crucial trading decisions.

Cryptocurrency trading for beginners demands substantial time and energy. However, when approached correctly, these resource expenditures can prove worthwhile.

Let's briefly touch upon the primary roles and players in the trading cryptocurrencies landscape:

- Market Makers are usually professional entities or large organizations. Market makers serve as moderators influencing coin prices. They also ensure the necessary liquidity for cryptocurrencies, guaranteeing steady order processing.

These entities are frequently referred to as liquidity providers and are considered institutional participants. This group also includes banks, funds, and other financial institutions.

- Retail Investors can be individual traders focused on speculations or individual long-term investors. Unlike market makers, they're not categorized as institutional.

The primary difference between traders and investors lies in their investment horizon. While traders aim for quick trades, investors often hold onto their coins for an extended period before selling them.

- Crypto exchanges and brokers. In traditional securities trading, stock exchanges and brokers have distinct roles. However, in the world of crypto trading, these two roles often merge, meaning the exchange itself often plays the broker's role. It's worth noting that decentralized platforms operate differently. There, intermediaries are typically absent, as transactions are directly executed on the blockchain.

Trading Cryptocurrency: Where to Start?

Engaging in crypto transactions is always a risky endeavor, regardless of whether you're trading CFDs or actually buying and selling coins.

It's crucial not only to be aware of the potential risks but also to strive to minimize them as much as possible. This can't be achieved without understanding the nuances of the chosen asset and the rules for working with it.

We'll delve deeper into the learning process later on. For now, let's discuss the steps a trader should follow:

1. Register on a platform. For instance, you can choose platforms like IFXBIT, Kraken, Coinbase, and other.

If you're planning to trade CFDs on cryptocurrencies, take note of InstaForex.

Typically, when opening an account, the system will request personal information and scans of documents to verify that information.

2. Deposit funds into your account to start trading. Typically, crypto exchanges offer several options for depositing funds.

3. Choose an investment instrument. From the list of available options, it's best to select the one you're most familiar with. We'll discuss other criteria in more detail later.

4. Start trading. If you're new to the world of cryptocurrencies, it's best to begin with a demo account. For instance, demo accounts are available at IFXBIT.

The principle of cryptocurrency trading for beginners is similar to that used with other instruments. There are two participants: the seller and the buyer.

When buyers are more active, they naturally place more orders. In this scenario, demand exceeds supply, and the coin's value increases.

When the initiative is on the side of the sellers, the coins become cheaper.

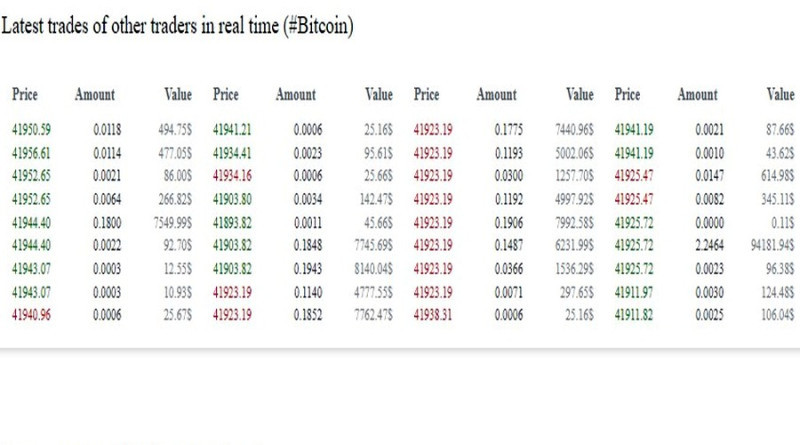

To understand the current market situation, one can use the so-called exchange interface. Typically, purchases and sales are indicated by different colors – green and red.

Based on their ratio, one can determine the current trend. The screenshot shows the BTC order book on the IFXBIT crypto exchange.

The issue of coin storage should be discussed separately. If you frequently trade, you can store Bitcoin and altcoins directly on the exchange.

However, if you adhere to more long-term strategies, it's essential to have a wallet. It can be a hardware wallet, which externally resembles a USB flash drive, a software wallet that's installed on a computer or smartphone, or even a paper wallet.

Storage solutions are also categorized into hot wallets that operate only with an internet connection and cold wallets that don't require an internet connection.

Hardware wallets are considered the most secure, but their main drawback is the high cost: some models are priced around $1000.

Software wallets are the most convenient, which is why they are the most popular.

As for paper wallets, they also offer a relatively high level of security. However, because the piece of paper with the QR code for access can quickly get worn off, few traders opt for this method.

What strategies to use

Cryptocurrency trading for beginners on exchanges shares many similarities with activities on other platforms such as stock, currency, commodity, and so on. The primary goal of any market participant is to profit from trading digital instruments.

As we've already discussed, this can involve the actual purchase of coins followed by their sale, or trading CFDs.

In both cases, the trading outcome will depend on the accuracy of the forecast and the effectiveness of the chosen strategy.

Strategies are essential to ensure that a trader clearly understands when to trade and when to take a pause, which timeframes are of primary significance. Additionally, a strategy should define the conditions required for entry and exit, as well as the list of indicators used in the process.

Let's explore some strategy options that are not overly complex but are still effective.

1. Trend trading, which is an optimal choice for those new to crypto trading. The concept here is straightforward: determine the price movement direction and trade accordingly, ensuring that the trend is clear and stable.

If there's a bullish trend, it's advisable to buy crypto, and if bearish, to sell it. It's crucial to understand that trends can be both local and global.

The former is favored by proponents of short-term strategies (often choosing timeframes no older than H1), while the latter is used for medium and long-term approaches.

In practice, trend algorithms like Stochastic RSI, MACD, and Moving Average combined with Volume can be used.

2. Cryptocurrency Arbitrage is a method that involves profiting from the price difference of the same cryptocurrency or a related asset. The different prices must be recorded simultaneously whether on different exchanges or on the same platform.

The essence of implementing this strategy is to buy the coin on a platform at a lower price and then sell it at a higher one.

In the case of inter-exchange arbitrage, a user selects two platforms where the cryptocurrency price differs. Discrepancies can be found using websites like CoinMarketCap or CryptoCompare.

As practice shows, during periods of high volatility, the gap can reach up to 5%.

Seeing this, a trader buys the coin on an exchange where the price is low, transfers it to another platform, and sells it at a higher price. However, it's not as straightforward as it seems at first glance.

Firstly, there's always the risk that the price on the second exchange will change rapidly, and this movement may not favor the trader. Secondly, the profit might be minimal due to transaction fees.

Regarding intra-exchange arbitrage, an additional pair is used in this case, as the same coin in different pairs sometimes has a different price.

For example, a user exchanges Bitcoin for Ethereum, then buys Litecoin with the acquired ETH, and finally sells LTC to get BTC. The main source of profit is the spread, which increases as liquidity decreases.

However, it's essential to remember that with low liquidity, order execution can take a long time. This is the primary risk associated with this type of arbitrage.

3. Scalping is a strategy involving a large number of trades within a single trading day. Short-term cryptocurrency trading for beginners can be very risky for novice market participants, but for experienced traders, it can yield substantial profits.

Two critical aspects in its implementation are determining Support/Resistance levels and the direction of price dynamics, i.e., the trend. If the chart bounces off the lower level and heads upwards, it's advisable to buy the asset; if it bounces off the upper level and heads downwards, it's best to sell.

Indicators that can be used include:

- Volume (helps identify divergences);

- MACD, SMA (a Moving Average crossover can signal a reversal);

- Relative Strength Index (RSI) (to determine the strength of the trend);

- Parabolic SAR (identifies the trend and signals a trend reversal).

Regarding timeframes, scalpers often use periods ranging from M1 to M30.

4. Breakout Strategy: This option can be used in situations where a new trend hasn't yet formed, but a breakout has already occurred. A breakout can indicate a reversal of the previous trend.

Quite often, before a change in direction, the price remains flat. On the chart, one can observe the following: the resistance level remains unchanged, while the support level seems to approach it.

In this case, after the breakout, a bullish trend forms. Traders should ensure that the new support line is above the previous resistance level before opening a buy trade.

If there's a breakout of the support level, short positions are advisable. That is, if the breakout isn't false, further trading follows the trend.

This strategy is versatile in terms of timeframes. As for indicators, the Moving Average, RSI, and a volume algorithm can be useful to guard against false breakouts.

5. Cryptocurrency grid trading involves placing orders at specific price zones. When these orders are triggered, the chosen instrument is bought or sold (in the case of the spot market).

Each zone has its levels, visually resembling a grid. Orders are set up by bots: they buy crypto when the price is low and sell it when the price has risen.

Grid Trading is most effective when working with volatile assets.

In this case, traders don't need to spend time analyzing charts; they just need to set the grid parameters, and bots handle the rest. However, automation carries certain risks.

A sharp and unexpected price movement upwards or downwards can negatively impact the financial results of trading.

6. Day Trading is one of the most popular methods used by crypto traders. The essence of this strategy is that trades are made within a day, meaning profits are generated from intraday price fluctuations.

Since crypto exchanges operate 24/7, a day refers to a 24-hour period. In contrast, on stock exchanges, day trading refers to activity within a trading session.

7. Swing Trading is a strategy that falls under the long-term category. Positions are held for more than a day, with the maximum duration often not exceeding one month.

During this period, so-called volatility waves form, allowing for profit extraction. To determine entry points, traders typically use elements of technical and fundamental analysis;

8. Range Trading is based on a price corridor formed by Support and Resistance levels. When the price approaches the upper line, sell trades are made; when it approaches the lower line, buy trades are made, anticipating a subsequent bounce.

9. Dollar-Cost Averaging is a strategy that is frequently used not only on cryptocurrency exchanges but also on many other markets. The essence of this method lies in the regularity of transactions to purchase a specific coin.

Transactions are made after a set period, and from one transaction to the next, this period remains unchanged and does not depend on the altcoin's price.

Let's provide a specific example. Suppose a trader decided to invest in Bitcoin. Instead of investing their entire $500 at once, they divide this amount over five months.

Every month, they buy Satoshis worth $100, and at the end of the period, they realizes a profit. This profit arises because the average purchase price turns out to be lower than the maximum value of the asset.

Cryptocurrency trading for beginners from scratch

Once you decide to earn on crypto trading, the first thing you should think about is education. This subject is not taught in school, so you'll need some alternative sources for obtaining the knowledge.

Specifically, you can take a crypto learning course that usually combines practical skills and theory, thus ensuring comprehensive education.

Such courses can take from several months to several years. It depends on how much time a student can spend for learning and what amount of knowledge and skill is taught.

Courses are usually held online and come with a set of mandatory assignments. Sometimes, the entire course package can set you back as much as $1000.

It's essential to consider the course organizer's reputation and ensure they're offering legitimate services. Sadly, there are some shady providers out there too.

Why take these courses?

- They offer well-organized content, ensuring systematic learning experience.

- You get a chance to correct mistakes with expert guidance.

- You can engage directly and interactively with instructors.

- It's a time-saver: finding this information on your own would take much longer.

Moreover, many crypto exchanges and brokers provide valuable insights on their websites. For example, IFXBIT has a beginner-friendly section that introduces you to the basics of cryptocurrencies, blockchain, and profiting from crypto trades.

In addition to the previously mentioned resources, you can find educational materials in the following places:

- YouTube. This platform is a treasure trove of video tutorials, webinars, and instructional clips. Pay special attention to channels run by crypto traders. They often focus on the hands-on aspects of trading, such as strategy application and risk management.

- Thematic Forums. For instance, the InvestSocial trader community is a place where crypto discussions are frequent.

- Analytical Platforms such as FX.co, for example. They consistently update their news feed dedicated to cryptocurrencies, showcasing Bitcoin and altcoin quotes. The portal also offers reviews of the most popular crypto assets, analytical content, up-to-date signals, and patterns.

- Books, Crypto Trading Websites, and Successful Traders' Blogs: These are invaluable resources to delve deeper into the world of crypto trading.

Mastering crypto trading is a must for anyone looking to succeed with Bitcoin and altcoins. Whether you're into CFDs or buying and selling coins on the spot market, proper education is crucial.

The table below outlines the foundational knowledge and skills a budding trader should acquire during their learning journey.

Essentials for Crypto Trading:

| Theoretical knowledge | Practical skills |

|

|

After completing a training course, it's important to understand that not all your trades will be profitable, and trading won't always bring only positive emotions and satisfaction.

It's crucial to recognize that even professionals with extensive trading experience have losing trades. This is because cryptocurrencies are not only highly volatile but also unpredictable in their movements.

Even the most effective and proven strategies can sometimes fail. This is perfectly normal.

Another essential aspect to consider is the trader's psychological readiness for trading. In this regard, self-control is vital: one should trade with their mind, not their emotions.

Key risks of crypto trading

In any financial market, even professionals sometimes face setbacks. A strategy and analysis method that once yielded positive results might prove ineffective for a particular trade.

This should be accepted as an inevitable reality. If there were a 100% effective strategy and the value of assets was entirely predictable, all traders would be profitable, which is theoretically impossible.

That's why, before starting trading activities in any market, including the cryptocurrency market, it's essential to first weigh and assess all potential risks.

These can include:

1. Volatility. The prices of Bitcoin and altcoins fluctuate more significantly and frequently than other trading instruments.

Even within a short span of time, the value can soar or plummet considerably. For instance, in November 2022, Bitcoin lost about 17% of its value in just one day.

2. Periodic crashes that occur in the cryptocurrency market. Ups and downs are characteristic not only of separate coins but also of the entire crypto sphere.

For instance, in August 2021, the market capitalization of all coins was nearly $2.1 trillion. However, a year later (in August 2022), this figure decreased to approximately $1 trillion.

The negative trends can be attributed to the lax or absent regulation of the crypto sphere, fraudulent schemes, money laundering, and so on.

3. Hacks of cryptocurrency platforms. Even though exchanges take measures to enhance security, the tactics of malicious actors also evolve.

This is why some traders prefer not to buy and sell coins directly but instead trade CFDs through brokers.

Trading Cryptocurrencies: How to Choose a Digital Asset

Before starting to trade coins, it's essential to know which asset will be used for potential profit. While seasoned market participants might work with multiple coins simultaneously, beginners are better off focusing on a single option.

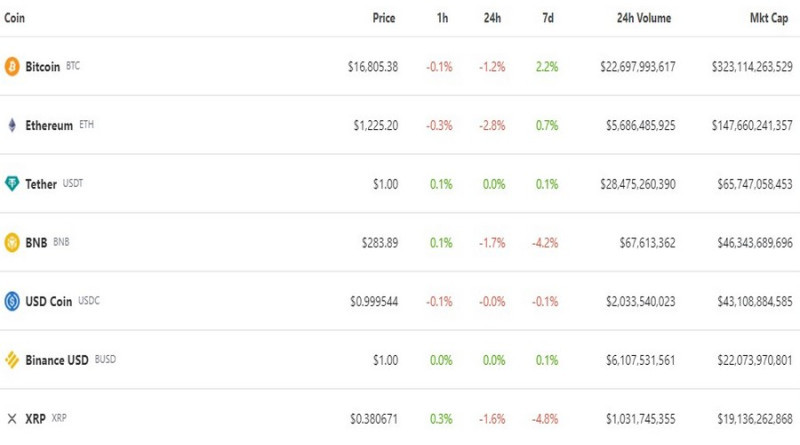

As we've mentioned before, it's best to start with an asset you're most familiar with. Typically, these are the most well-known coins that are frequently discussed and written about.

These include Bitcoin, Ethereum, Litecoin, and so on. Another compelling reason to opt for famous coins is their relative predictability compared to lesser-known assets.

When choosing a suitable cryptocurrency for trading, also consider:

- Its infrastructure characteristics: the purposes the coin can serve, and how quickly transactions are confirmed.

- Exchanges where the digital asset can be bought and sold. The more platforms available, the better.

- The price: at the time of writing this article, one BTC is priced at nearly $17,000, while LTC is around $75. It's crucial to understand that more expensive coins can yield significant profits or substantial losses.

- Volatility: the higher it is, the greater the chance of making a profit in a short time. To determine volatility levels, short timeframes are used, but information is also verified over longer periods.

- Media presence: if well-known individuals invest in the coins, their value increases.

- Emission: if the total coin supply is limited and a significant portion is already in circulation, demand will be high.

- Market capitalization: the higher this figure, the more reliable and robust the coin. This doesn't mean you should only use the top-listed cryptocurrencies, but it's better if they aren't at the bottom.

- Trading volume, typically recorded over the last 24 hours. If it's high, it indicates the asset was in high demand among market participants.

How to Test Your Skills Risk-free

Before investing real money into digital assets, it's wise to test your knowledge and skills on a practice account. You can learn more about this in the article Cryptocurrency Trading: Demo Account.

The primary advantage of a practice account is that you don't need to fund it. Simply register an account, and immediately after, a certain amount of virtual money will be available in your deposit, which you can adjust.

You can invest this virtual money in trades, and if they turn out to be unprofitable, the trader won't lose anything but will have the opportunity to learn from their mistakes.

Additionally, one can familiarize themselves with the terminal's functionality, as the platform for practice doesn't differ from the one intended for real crypto trading.

Another purpose of the demo account is to test strategies. That's why not only beginners but also experienced traders who want to try out a new tactic use such accounts.

Some crypto exchanges with demo accounts include:

- Bybit

- Phemex

- Binance

- Bitmex

- ОКХ

Apart from crypto exchanges, you can also open a demo account with a broker. We've already mentioned that some Forex brokers offer their clients crypto trading via CFDs.

The registration process is simple and won't take much of your time. The screenshot indicates the data required when registering a demo account with InstaForex.

Despite the aforementioned advantages of demo accounts, it's essential to mention a significant drawback. The fact is, when trading with virtual money, a trader subconsciously downplays potential risks.

As a result, if one uses a practice account for too long, violating risk management rules can become a habit.

Conclusion

Trading cryptocurrencies is an exciting activity. It's no coincidence that an increasing number of users are choosing digital assets as trading instruments.

This type of trading is considered one of the most enticing. Online, one can find numerous stories about how beginners earned fortunes trading digital coins.

Unfortunately, there are also opposite scenarios where trading not only disappoints the player but also results in losses. In most cases, this happens due to mistakes made by the trader during the trading process.

Experts have identified three primary errors leading to massive losses:

- Insufficient preparation (both theoretical and practical)

- Inability to control emotions

- Excessive overconfidence or, conversely, a lack of confidence in one's abilities.

It is important to address these three mistakes before starting trading and investing in digital coins.

Back to articles

Back to articles