Crypto trading training: Learn to trade crypto with savvy traders from scratch and yield profit. They do not teach to trade crypto in universities or talk about it in schools. However, knowing how to trade crypto is key if you want to trade successfully in the digital asset market.

From this article, you will learn where and how to get the necessary information, why learning is important, and what common mistakes beginner traders do.

If you want to know more about coins, read the article “Trading cryptocurrencies (crypto trading).”

Why learning is important

The crypto industry is constantly evolving, attracting more people.

Some use digital coins as an alternative to banking transactions because of the high speed of transactions and low commissions.

Cryptocurrencies can also be used as a means of payment. However, not all countries allow people to pay for goods and services in Bitcoin or altcoins.

Cryptocurrencies are also popular because they can bring a profit from buying and selling. In other words, people trade, purchasing coins at a lower price and selling at a higher one, thus yielding a profit.

Here we are not going to dwell on the aspects of trading and investing as they both are meant for one and the same thing, namely earning on the difference in exchange rates. It is just that trading is short-term, and investing is about holding assets longer.

Speculation is possible both in transactions with underlying assets and derivatives. In the first case, we are talking about buying and selling real coins. In other words, users become owners of coins in the process of trading.

Trading coins takes place on crypto exchanges after passing registration.

Investing is commonly about CFD trading. In this case, coins are not sold/bought, but contracts are concluded.

If users make accurate price forecasts, their trades bring them profit. If the price goes in the opposite direction, they incur losses.

That is, it does not matter what type of crypto trading you choose. What matters is how accurate your forecasts are. After all, when buying coins or betting on higher CFD prices, traders expect coins to go up.

If you bet right, a profit is guaranteed.

Therefore, the primary goal of crypto trading is to get knowledge of the theory and practice, necessary to analyze price changes and make predictions. This could be a short-term or long-term forecast depending on your trading strategy.

You can learn how to trade on your own or with the help of instructors. Combining both would be the best option.

Required knowledge and skills

Crypto trading is a rather complex and risky activity. Therefore, you should take the learning process seriously. All knowledge and skills that will be useful in the process of trading can be divided into several blocks:

- Basics

- Technical aspects

- Psychology of crypto trading

- Risk management

Let's dwell on each in more detail.

The Basics are the biggest block if you are learning crypto trading from scratch. In this case, we are talking about users who have never been involved in either financial markets or cryptocurrencies.

Before making transactions, a beginner should clearly understand the essence of the crypto market, cryptocurrencies, and blockchain technology as well as how coins are traded.

By and large, the crypto market differs from other financial floors only in assets. For example, transactions with shares are made on stock exchanges, and transactions with cryptocurrencies are made on crypto exchanges.

Sellers open short positions hoping to sell coins at higher prices.

Buyers, on the contrary, expect to purchase crypto at a lower price.

All their orders are recorded in the order book. If there are more sell orders, supply exceeds demand, and the price goes down.

Conversely, when there are more buy orders, crypto goes higher.

When buyers and sellers conduct transactions, we get a market value of a particular coin.

This is the basic information about the cryptocurrency market beginners should learn.

Understanding analysis types is also an important part of learning the Basics of crypto trading.

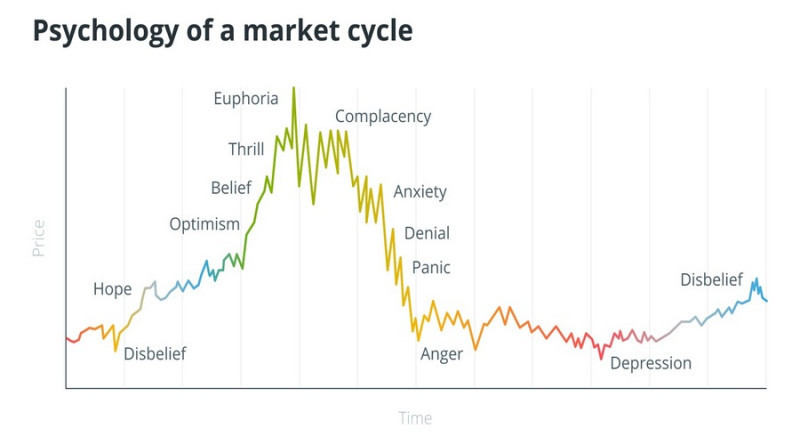

Thus, technical analysis is about studying price changes to make a forecast. Practice and time show that cryptocurrencies move in patterns, i.e. cyclically.

When market conditions repeat, the price changes according to a similar scenario.

All patterns appear on charts. The most common and informative types of charts are bar charts and candlestick charts. Beginners usually chose line charts because they are the simplest.

You can trade in various time frames.

For example, to study global trends and track the overall situation in the market when investing, daily and weekly periods are often used. Meanwhile, to find entry points, the M15-H1 time frames are used.

As for trading that involves fast crypto transactions, the M15-D1 and M1-M5 time frames are used.

Technical analysis also requires that you know how to apply trend lines, levels, indicators, and patterns in trading.

When it comes to fundamental analysis, it is based on news backdrop as well as economic and financial factors, which can influence quotes. Even if you mostly use technical analysis, experts say you should not forget about the fundamental one.

Thus, after learning the Basics, traders should understand:

- What is crypto and how to choose the best one for trading;

- How the price is formed and what it depends on;

- How to read price charts of crypto;

- What indicators and technical analysis tools can be used in trading;

- What is the essence of fundamental analysis;

- How to create a crypto wallet, register on the exchange, and open an account with a broker.

The Technical aspects of crypto trading involve using all the knowledge in practice and working with a trading platform.

Each crypto exchange has its own platform. They can vary in functionality, design, and other features.

Some of them are designed for scalpers, while others are meant for investors. For example, the CScalp platform is used for short-term trading and Coiniginy is used for arbitration.

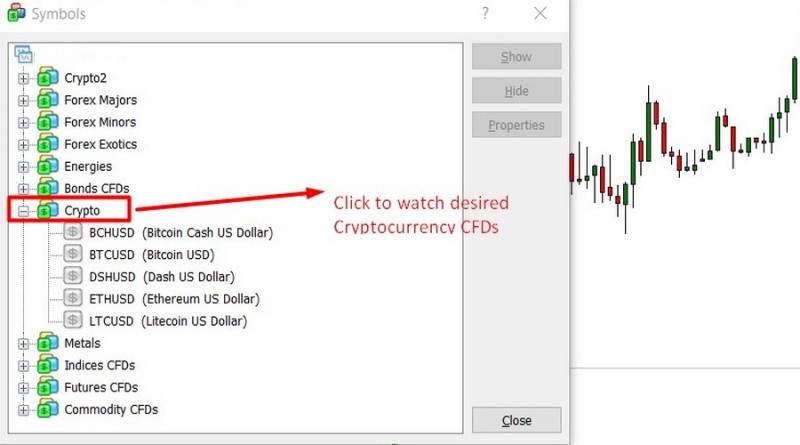

CFD traders prefer MetaTrader. Brokers, including InstaForex, mostly offer this platform to their clients.

In order not to risk real money, you can test your skills in demo trading. Some crypto exchanges and CFD brokers provide such an option.

The skills traders gain after learning the Technical aspects of crypto trading:

- Chart analysis, the use of indicators and patterns

- Conducting trades in trading platforms

- Developing and applying trading strategies

Next, you should learn the psychology of trading, which is also divided into market psychology and trader psychology.

When it comes to market psychology, traders should comprehend that any price movement is determined not only by technical and fundamental factors but also by market sentiment.

Thus, when traders are pessimistic, even good news may trigger a sell-off and a fall in the value of coins. Conversely, when traders are optimistic, they are likely to buy coins even when there is an ambiguous fundamental backdrop.

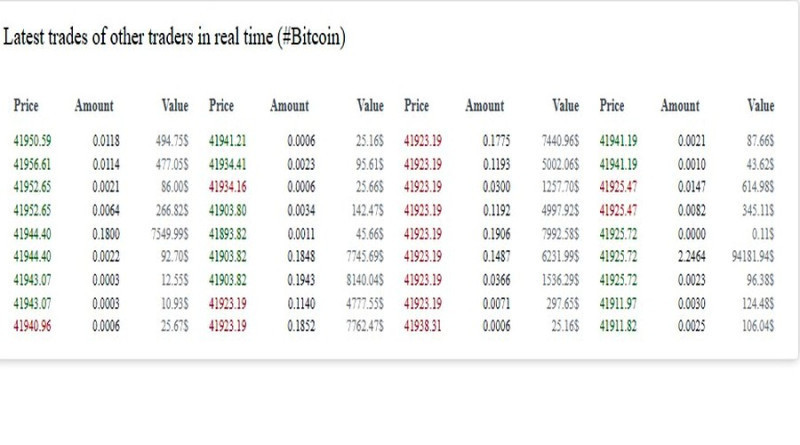

You can determine market sentiment by examining the order book, which is available on every crypto exchange. Here is the order book of the IFXBIT platform:

Trading volume data can also be useful. This is where special indicators, like Volume, come in handy.

As for trader psychology, the key emotions here are greed and fear. When traders are driven by greed, they are likely to continue trading after every profitable trade and forget about their strategy and risks.

The situation is the same when they try to offset previous losses by continuing trading. In this case, traders turn into gamblers and often lose as there is a rather small chance they could actually win.

Fear, on the contrary, is sometimes hard to overcome to open a position. When traders doubt themselves, they miss trading opportunities and do not get satisfaction from trading.

Therefore, when still learning, you should get into self-control and not allow emotions to take over common sense. If you feel you can’t control yourself, take a break and switch to other tasks.

Risk management is as important as other aspects of learning to trade crypto. Your financial results depend on how you use risk management in your work.

The basic principles of risk management are:

- Risk limits per position. This is the ratio between the Open price and the Stop Loss order. The risk limit should not exceed 2% in traditional crypto trading.

- Risk limit per capital. It is believed that the amount of all transactions should not exceed 25% of all funds in the trading account.

- Yield per position. This is a ratio between potential profits and risks. So, a Take Profit order should be placed in such a way that a possible profit is two to three times the potential loss, i.e. the stop level.

In addition to the above-mentioned pillars, risk management also has requirements for trading volumes, restrictions on the use of leverage, etc.

Example of conducting trades

Let’s consider an example of how to buy and sell crypto. We will use CFDs on crypto and take LTC/USD as an asset.

So, let’s say the LTC price is about $75.54. We carry out technical analysis, study fundamental factors, and conclude that the price will rise in the short term.

Our range is $400. That is, we can buy five coins. We use the leverage of 1:2 to increase trading volumes and, accordingly, the size of the potential profit. As a result, we have 10 CFDs equal to one LTC each.

Let’s assume LTC rises against USD. We close the contract the moment the price reaches $80.05 per coin.

Net income (excluding borrowings) in this case will be $45.1. If we traded without leverage, we would earn $22.55.

This is just an example. Besides, it does not take into account trading commissions charged by a CFD broker.

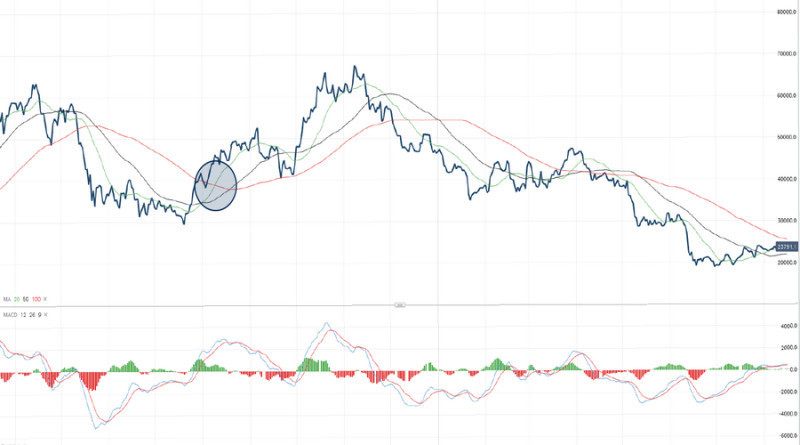

Let’s now talk about how to use technical analysis tools in crypto trading and take the Moving Average as an example.

One MA is fast, the other one is slow. When the first MA crosses the second one to the upside, it means the price is moving up and we can buy an asset as its value may then go even higher.

Conversely, if it crosses the second MA to the downside, the price is moving down. In this case, we sell crypto as the price can plunge even more.

Crypto Trading Training

You can learn how to trade crypto on your own or with the help of professionals. Beginners are usually recommended to use both at once.

Courses are one of the most common learning options. They are so popular because of their benefits:

- participants get only the most valuable information

- theory comes along with practice

- materials are structured by the level of complexity and topics

- supervision from professionals

- interactive classes where participants can ask questions and analyze mistakes

- classes are mostly held remotely

- classes are divided into theoretical and practical parts, providing a comprehensive approach to learning

Courses can be both individual and in groups. Private training suggests a more individual approach. Meanwhile, when training in groups, beginners can compare their achievements with the results of other course participants.

The high price of courses, which can sometimes exceed $1,000, is considered their main drawback.

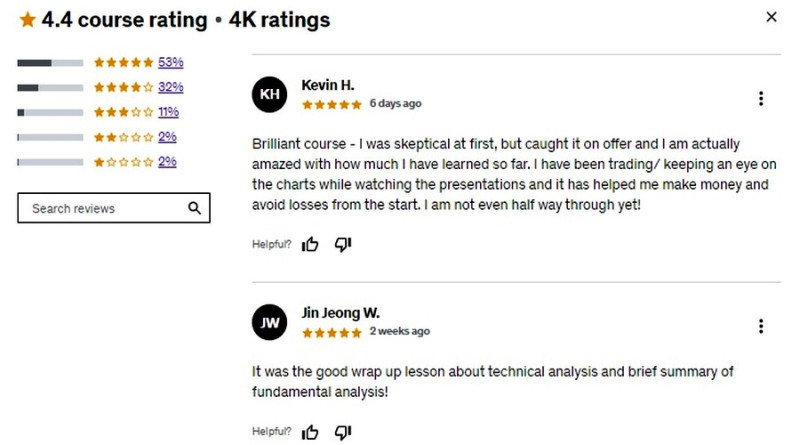

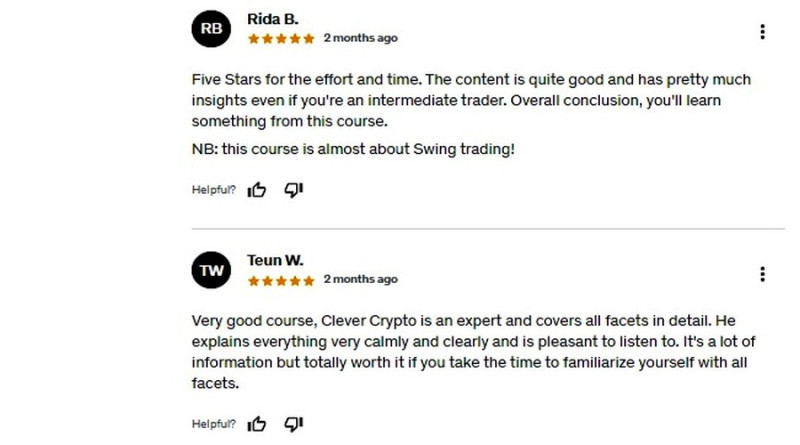

Some of the most popular online universities, including Udemy, Coursera, and Skillbox, offer crypto trading courses. You can choose a course using filters and sign up for it as well as read graduates’ feedback.

In addition, information can be found on websites about crypto trading such as IFXBIT, InstaForex, FX.co, CoinMarketCap, and TradingView.

However, this option has one drawback – the novice can find it hard to structure content and find the most important information, which makes training a difficult and long process.

YouTube also is a nice source of information about crypto trading with webinars, videos, and blogs of successful traders in abundance.

This option is for those users who want to educate themselves whenever they want and who are not ready to spend a lot of money on that. However, they still need to stay in touch with a professional.

Crypto trading training forums are another useful source. For example, on the FX.co website, you can find analysis content and crypto forums.

Crypto trading courses: reviews

Nowadays, there is plenty of ways to learn to trade crypto. Those who choose a paid course can even select its format, date, and cost.

Of course, the abundance of options may confuse you. Besides, there are risks that courses will not bring the desired result or will turn out to be useless.

After all, not all course providers are honest.

Therefore, you should always read and analyze the reviews about the courses you want to acquire.

Make sure you read them on third-party websites. In this case, it is more likely that reviews will be provided by real users.

Aspects to pay attention to when reading feedback:

- Satisfaction with results. You should see how many course participants are content and have achieved the course goals.

- Quality of content. It is important that beginners and professional traders get different training. Otherwise, the novice will not get much from the course, while traders with experience will not level up.

- Price/quality ratio (if you pay for training)

- Criticism

- Feedback from course providers

- practical classes, home assignments (relevant for courses, webinars, and video lessons).

Still, there is no ideal option that would suit all traders without exception. Some lack practice and others are not fond of their coaches.

Therefore, you should be subjective when it comes to reviews about courses and trust your own choices and preferences. Clearly, you should not ignore what other people say about courses. Relying solely on other people’s opinions is never an option.

Most common mistakes beginners make

Any savvy crypto trader was a novice trader once. To succeed in the crypto market, traders have to come a long way and make a lot of mistakes.

Of course, you will not be able to avoid them at all. The main thing here is to know what to pay attention to.

Here is the list of common mistakes beginners make in the crypto market.

1. Conducting trades without having any cash. We have already outlined possible risks. They should always be taken into account when trading.

If a trader invests all funds into CFDs on crypto, they risk losing everything and will not have money left for buying more promising assets or for averaging.

2. Trading a single instrument. Diversification minimizes potential risks: when trading one crypto asset ends up with losses, trading other crypto assets can offset this.

3. Lack of system. Trading where users do not pursue the chosen strategy resembles gambling rather than trading.

Therefore, you should train how to trade crypto and always stick to a developed strategy;

4. Emotional trading. Greed and fear lead to rational trading.

This inevitably leads to losses.

5. Failure to acknowledge mistakes. Quite often, it takes novice traders a lot of time to recoup losses in the hope to make a profit.

This can last until there is no money left in the account. If you can’t predict a market situation and your actions do not bring profit, it is better to take losses than to continue draining the deposit.

Final thoughts

In this article “Crypto Trading Training”, we have tried to explain to you that trading is not gambling. The price of coins never stops fluctuating.

On the one hand, high volatility is an abundance of trading opportunities and potential profits. On the other hand, it is also a great risk of losses.

Therefore, you must know how to trade if you want to invest in digital assets.

You should not worry if this takes a lot of time and/or money as investments in training always pay off.

What is more, you should never stop learning, even if you have been successful in the crypto market. This is a never-ending process, which requires more effort from the novice than from the pros.

Recommended:

Cryptocurrency Arbitrage

Crypto Margin Trading

What is Spot Trading in Crypto

Leverage Trading Crypto

Grid Trading Crypto

Short Term Crypto Trading

Crypto Demo Trading

Back to articles

Back to articles