There are many ways to gain profit from digital assets. You can invest in crypto, trade it, mine it, etc.

Crypto arbitrage is another strategy that allows traders to profit from the price difference of digital coins in different markets. Even those of you with small initial capital can try this method.

If you are looking for more information about cryptocurrencies, read our article Crypto Trading.

What is arbitrage trading in crypto?

The primary goal of trading is to buy an asset at a lower price and sell it at a higher price. The difference you get is the profit that every market participant is looking for.

Crypto trading is no exception and is also based on such moves aimed at gaining profit.

One of the ways to earn money with crypto is arbitrage. It is also based on speculation, but the process itself differs from regular cryptocurrency trading.

This strategy implies profiting from the price differences of one or several digital assets.

These are high-frequency trades that can be executed by traders or specially-designed trading bots.

What is the difference between classic crypto trading and cryptocurrency arbitrage? In a usual trading method, transactions are carried out on a single platform, and it takes time to form the difference in exchange rates.

For example, a trader purchases Bitcoin on a particular crypto exchange for $17,727.90. After some time, the coin appreciated to $17,900.90. A trader sells it and makes a profit of $173 (excluding commissions).

Cryptocurrency arbitrage functions a bit differently. Let’s suppose a trader sees that on one platform, Bitcoin is trading at $17,727.90, and on another platform, it is worth $17,927.90. In the shortest possible time, a trader buys the asset on the first exchange and sells it on the second one. The profit in this particular case is $200.

This is the simplest example of inter-exchange cryptocurrency arbitrage. It involves at least two stages where one digital asset is traded on two different platforms.

There is also intra-exchange arbitrage when the trade is performed on the same exchange and the profit comes from the difference in the price of a coin in different pairs.

We are talking about triangular arbitrage when a profit is generated from the price discrepancy of one or two cryptocurrencies on a single exchange.

This is what the process looks like:

- You buy a cryptocurrency for fiat money or stablecoins;

- Then you look for a pair containing this crypto so that its rate is good for making profit;

- After that, you exchange it for another crypto asset;

- You sell the asset and take profit.

In other words, in triangular arbitrage, a trader trades crypto in three different pairs and capitalizes on price discrepancies between these three assets.

Why do these price mismatches occur? The thing is that cryptocurrencies are highly volatile.

Sometimes, within a few minutes, the asset price can either skyrocket or drop sharply. The jump happens within a specific pair, and it takes time for this change to be reflected in other pairs.

While this difference exists, an arbitrageur must enter the game. It is necessary to act as quickly as possible as the emerging trading opportunity can disappear just as quickly as it appeared.

One of the most important things in crypto arbitrage is the right choice of crypto assets. To make the choice easier, you can use special programs that make calculations and show an estimated profit.

We will go back to this later. And now let’s discuss crypto arbitrage in more detail based on Bitcoin (BTC), Ethereum (ETH), and US dollar (USDT) trading.

This is what we have before performing arbitrage:

- BTC is worth $17,727.90;

- USDT costs $0.073;

- ETH is trading at $1,391.02.

Let’s say, you have $1,000. So, you buy $1,000 worth of BTC which is 0.056 coins.

Then you exchange these BTC tokens for ETH tokens. This leaves you with around 0.77 ETH on your account.

Then you use ETH to buy USDT and get $1,071. So, after all the transactions, you have earned $71.

This is a very general example and it does not consider deposit and withdrawal fees charged by crypto exchanges. At the same time, it demonstrates the basic principle of intra-exchange crypto arbitrage.

The cross-exchange arbitrage is similar but trades are made across several crypto platforms.

What are the risks?

There is no guarantee that intra- or cross-exchange crypto arbitrage will generate profit. The risks involved in this method are somewhat lower compared to other strategies, yet they do exist.

For example, in the case of intra-exchange arbitrage, the trading platform may have some limits. That is, special algorithms are constantly monitoring the rates of assets and eliminating price discrepancies, leaving an arbitrageur without profit.

At the same time, there are some clear advantages of this arbitrage type.

First of all, intra-exchange arbitrage has no commissions that cross-exchange arbitrage has. Besides, it saves your time as it is much more convenient to trade on a single platform than jump from one platform to another.

Arbitrage trading across two exchanges requires the use of special software. It monitors prices on different crypto platforms and opens trades.

Yet, this arbitrage method has its downsides as well, and here are some of them:

- Glitches and delays in withdrawing funds from platforms. In this case, the user may be left without any profit and may even incur losses;

- Additional financial costs in the form of commissions that are charged when transferring assets from one platform to another;

- Limitations applied by crypto exchanges. If we are talking about a regulated platform, special software may track suspicious transactions and take a long time to verify them or even block them completely;

- Incorrect operation of bots.

Some professional traders use inter-exchange and intra-exchange arbitrage simultaneously. This approach allows them to take advantage of both strategies and minimize potential risks when working with cryptocurrencies.

Outlook

Arbitrage can be applied to other spheres apart from crypto trading. It is used in various markets and can even be found in our everyday life.

When the coronavirus pandemic broke out, the demand for online education soared. Many online tutor agencies took advantage of this situation.

They employed tutors from small towns who charged little for their services. Then these agencies sold their educational courses at a much higher price, thus using arbitrage and generating profit.

The value of any asset, including cryptocurrencies, changes according to the existing demand and supply. When demand is higher than supply, coins appreciate, and when the opposite happens, the price of coins decreases.

Both demand and supply are characterized by volatility. This is especially noticeable during periods of economic shocks, crises, and geopolitical conflicts.

In times of political and economic instability, people look for reliable assets that are not subject to sanctions and inflation. Cryptocurrencies meet all these requirements, making arbitrage a reliable way to generate additional income.

Another argument in favor of cryptocurrencies is low commissions and high transaction speed. Crypto transfers are much cheaper and faster than bank transfers, and users do not need to worry about their money getting stuck at a correspondent bank.

According to Bank of America, about 90% of respondents are willing to invest in cryptocurrencies during a crisis. The Boston Consulting Group's forecast is even more optimistic. According to it, by 2030, there will be as many as 1 billion crypto users worldwide.

The chart shows how the number of internet users and cryptocurrency holders has changed over time.

However, it does not mean that during periods of economic growth, crypto assets and digital arbitrage are less popular among traders. Arbitrage strategies have existed for quite some time and will never lose their relevance.

The fact is that the value of cryptocurrencies skyrockets or plummets not only due to economics and politics. Among other significant factors affecting the value of cryptocurrencies are:

- Competition: currently, there are over 20,000 digital coins;

- Exchange availability: when cryptocurrencies are listed on major platforms, this increases their appeal;

- News background and media coverage of crypto owners;

- Market sentiment.

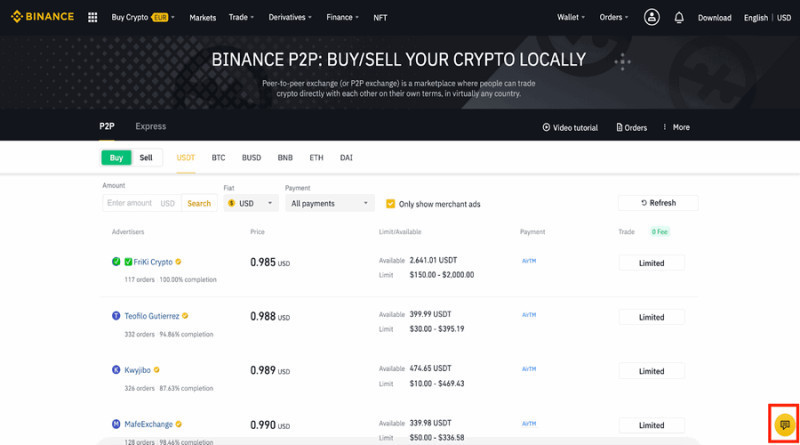

Crypto arbitrage on P2P platforms

Peer-to-peer (P2P) platforms enable direct transactions between users. On such platforms, cryptocurrency sellers and buyers trade with each other without any third party involved. Besides, on P2P platforms, the Know Your Customer (KYC) procedure is simplified.

In fact, participants of peer-to-peer exchanges carry out the exchange process themselves. P2P arbitrage implies trading crypto on P2P platforms rather than regular crypto exchanges.

Sometimes, conventional exchanges can be used together with P2P exchanges. For example, traders can buy cryptocurrencies on a centralized platform and then offer them on a P2P platform, adding their own trading markups.

P2P platforms are characterized by relatively high transaction speed and a large variety of payment methods. Unlike centralized exchanges, P2P platforms do not have a central authority, so clients' funds are not under strict platform control.

Quite often, P2P platforms are separate versions of regular crypto exchanges. This is a good thing as it helps eliminate transactions with dishonest counterparties and protects users from transferring funds to illegal or semi-legal platforms.

To illustrate how the P2P platform works, let's provide an example. Suppose there is a user who wants to sell coins. They set their own price, meaning that they set the terms they see as the most profitable for them on the P2P platform.

The platform automatically searches for a counterparty. If the seller's offer matches the buyer’s offer, the parties make a trade.

Buyers can also make their offers, and sellers can accept them.

All orders are displayed in the P2P list of outstanding buy and sell offers, similar to Market Depth or an order book on a regular exchange. Each order features the size of a trade (amount of coins) and price.

Some popular P2P crypto exchanges include:

- Binance;

- Bybit;

- OKX;

- Kucoin;

- Huobi.

As P2P platforms bring many crypto sellers and buyers together, they are often compared to marketplaces where you can choose a counterparty with whom you’d like to make a trade.

It takes some time for the participants to find each other on the platform which is why trading speed is slower on P2P than on regular crypto exchanges. At the same time, on a P2P platform, traders have more chances to make a profitable trade.

Since this method involves no third-party mediators, you may wonder how the security of transactions is ensured. For example, if a buyer agrees with the terms of a seller, who makes sure that these terms are met?

There is no need to worry about this as reliable P2P platforms offer escrow services which means they will hold funds until the terms between a buyer and a seller are fully met.

There is a certain time limit to fulfill obligations. If the time is out, and one of the parties has not fulfilled its obligations, money will be sent back to traders’ wallets.

Pros and cons of P2P arbitrage:

| Pros | Cons |

|

|

How to minimize risks:

- Choose reliable platforms that have been operating for at least two to three years;

- carefully study available payment methods. Keep in mind that the list of payment systems may change, so it is important to have up-to-date information;

- consider the commission fees that you will have to pay. If you invest small amounts in arbitrage, various fees and commissions may eat up your profits;

- act promptly: the speed of making a trading decision is one of the important conditions for successful crypto arbitrage;

- do not be tempted by suspiciously attractive terms offered by counterparties. It is possible that very favorable rates are offered by scammers;

- Save screenshots of transfers, and ask for them from the counterparty in case of disputes and disagreements. You should also save screenshots of your correspondence to have evidence of any agreements.

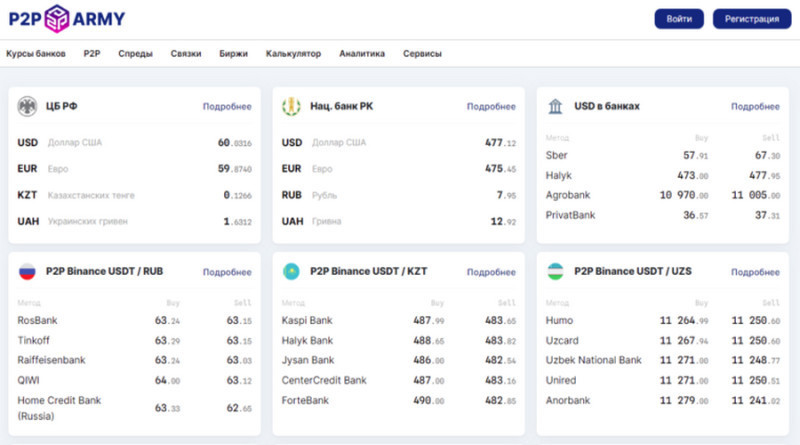

P2P bundles and arbitrage opportunities

In crypto slang, a bundle is a full cycle that starts with buying a cryptocurrency and ends with locking in profits. Typically, bundles can be long-term or temporary (momentary).

Long-term bundles occur during the day and are relatively stable. Most often, they come in the form of a spread, that is, the difference between the bid and ask prices.

As a rule, the spread does not exceed 2%.

Let’s say, on one P2P platform, the bid price of Litecoin is $74.20 and the ask price is $74.50. A trader places a buy order and purchases 100 LTC for $7,420.

Then a trader transfers these coins to their wallet and immediately sells them for $74.50 per token. He gets $7,450, with a net profit of $30.

Momentary bundles are hard to predict as they usually appear during sharp price fluctuations in the crypto market. In this situation, a spread can be as high as 20%.

This is what a trader can do in such a scenario:

- Buy coins on a P2P platform;

- Transfer them to a spot wallet;

- Buy another crypto (2) in a spot market. This way, you will exchange the cryptocurrency (1) bought in the first stage;

- Transfer crypto (2) to your wallet on the P2P platform;

- Sell crypto (2) for fiat money.

As a rule, you need to be registered on a P2P platform. If it exists as a section of a crypto exchange, you will need to create an account there.

You will also need a wallet to store coins. This can be a paper, hardware, or software wallet.

Another important thing to pay attention to is withdrawal and deposit methods. Make sure you find at least several options that suit you.

If you are planning to use arbitrage bundles, you need to remember about timing. The rates of cryptocurrencies are constantly changing. So, if you hesitate when making a trading decision, you can lose an arbitrage opportunity and even suffer losses.

So, where do you exactly look for these arbitrage bundles?

Experienced traders know market peculiarities and can spot arbitrage opportunities themselves.

As for newcomers, they can utilize special software, such as P2P-Helper, P2P.Army, P2P Machine, and so on.

We will discuss the choice of software later.

What to look for when choosing a P2P platform

As we have already mentioned above, many crypto exchanges offer their clients P2P platforms where they can implement arbitrage strategies. If the crypto exchange itself has a good reputation and is reliable, then its P2P platform can also be trusted.

Thus, reputation is one of the fundamental factors that should be considered when choosing an exchange.

There are more factors to take into account:

- Security ensured by escrow services. Another important point is the KYC procedure: if it is not mandatory, this should be a warning sign;

- Various options to deposit and withdraw funds. The wider the choice of payment methods, the better;

- Commissions: to choose the best option, compare transaction fees on several platforms;

- The number of trading participants. A large number of orders in the order book indicates that this platform is popular among users and that the speed of transactions is high;

- Interface: if it is clear and simple, a trader will not have to spend a lot of time learning all its functions. Also, make sure that the platform of your choice has the language version you need;

- Prompt support service and ways to contact them or leave feedback.

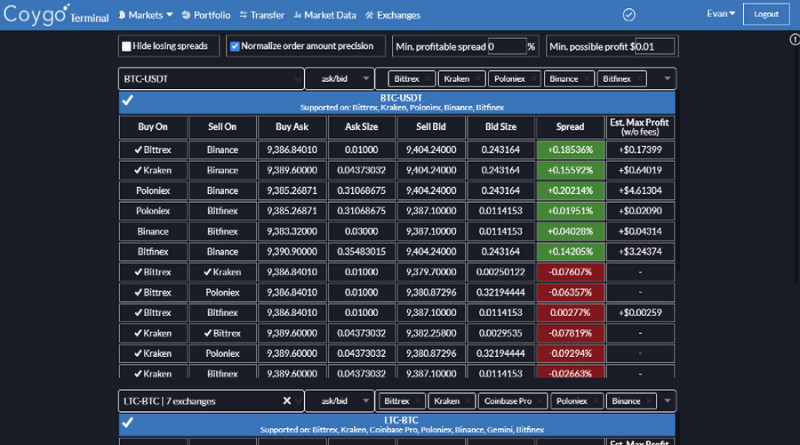

Software for cryptocurrency arbitrage

To make arbitrage strategies more efficient, you can use software that was specially created for this purpose. These programs can quickly scan asset rates and make transactions.

They facilitate the process of trading, considerably saving time and effort.

Let's dwell on this topic.

1. Algorithms that compare prices. In essence, they compare the price of an asset on different platforms and inform the user about the result.

Most often, this is an application for smartphones and computers. The application may analyze the rates of one or several crypto assets.

That is, in the first case, the program will search and compare the prices of only one selected coin, and in the second case, it will monitor several coins at once. In the settings, you can select a suitable digital asset, as well as a list of cryptocurrency platforms.

For example, to compare the cost of a coin on different exchanges, you can use the CoinMarketCap or CryptoCompare services;

2. Bots that make arbitrage trading fully automated. They usually perform the following functions:

- analyze the rates of the selected assets on chosen platforms;

- monitor spreads;

- eliminate the human factor when making trading decisions;

- make trades when a good trading opportunity comes up.

As a rule, many bots are paid: the cost of a monthly subscription can reach $100. Don’t forget that any program can have failures.

To test the work of the bot in practice, you can use the demo version. However, it is not provided by all developers.

Here are some examples of trading bots: HaasBot, Cryptobot, Cryptohopper, ApiTrade, Bitsgap, and Coinrule.

Let's explain the principle of their work on the example of ApiTrade. This algorithm continuously monitors the value of the crypto and the transactions made on the platforms it is connected to.

When a trade of a large volume is made on the exchange, the rate of an asset automatically goes up or down. The bot takes advantage of this short-term mismatch and makes a series of trades involving at least three assets.

Two crypto assets are the ones that have this price discrepancy, and the third is an additional one. The only thing left for an arbitrageur is to take profit;

3. A scanner is a program that monitors the dynamics of price changes on specific cryptocurrency platforms. Most of the time, the user can choose assets and platforms

All information obtained during scanning is presented in the form of tables and/or graphs. A trader studies them and makes a trading decision.

Scanners can be paid for and free. The main advantage of the paid version is the absence of delays as they provide the most recent data.

Here are some scanner options:

• Coygo is suitable for all popular operating systems. It can be used in a browser version and as an app for smartphones and computers.

This algorithm calculates spreads across different exchanges for a large number of coins and also shows the estimated profit in USD.

The data is generated in real time and updated every time a new order is added to the order book;

• CryptoShock is another cross-exchange scanner that recognizes the difference in the value of the same pair on different exchanges. It can process data from more than 20 crypto exchanges.

CryptoShock has a built-in profit calculator and different language versions. Like Coygo, it is available only with a paid subscription;

• Coingapp is a mobile application that allows you to scan quotes on more than 30 crypto exchanges. Compatible with iOS and Android;

• TriangularArbitrage is an intra-exchange algorithm that scans crypto prices on the Binance exchange. The program also gives advice on the implementation of trading strategies;

• CryptoAlerts operates in a similar way and scans over 50 integrated exchanges. The scanner has a built-in filter system that allows you to sort out arbitrage opportunities;

• Crypto Arbitrage is a mobile application that can scan about 20 pairs on dozens of platforms.

Conclusion

Here are some key takeaways. Cryptocurrency arbitrage is a strategy that allows traders to capitalize on slight price discrepancies of digital assets.

It has a lot in common with conventional trading. Crypto arbitrage involves certain risks. Therefore, it requires training and practical skills.

The key to success in this trading method is being really quick when making a trade. It also requires a trader to be patient and focused. As was already mentioned above, arbitrage opportunities can disappear in no time. So even the slightest delay can result in losses.

Finally, novice traders should bear in mind the following:

- Arbitrage can be more complicated than regular trading as it involves a series of trades with different assets;

- P2P platforms are good for profiting from arbitrage trading but only if they operate as part of reliable crypto exchanges;

- Inter-exchange arbitrage means not only great opportunities but also fees for transferring funds from one platform to another;

- You can utilize specialized software to facilitate arbitrage trading. Thus, trading bots can scan quotes and even open trades. Yet, the most efficient of them usually come in a paid subscription.

Recommended:

Crypto Trading Training

Crypto Margin Trading

What is Spot Trading in Crypto

Leverage Trading Crypto

Grid Trading Crypto

Short Term Crypto Trading

Crypto Demo Trading

Back to articles

Back to articles