What should traders do if they want to open a trade of a large volume, but they don't have enough funds for it? The solution is to use leverage.

Leverage can be used to trade various assets, including digital ones. What does crypto margin trading mean, what advantages does it have and why beginners are not recommended to try this type of trading? Read on to find it out.

You can learn more about investing in cryptocurrencies in our review about Crypto trading.

Definition and specific features

So, what is margin crypto trading? Basically, it is the same speculative operations with digital currencies enabling traders to profit on price changes.

The distinctive feature is that a trader can use not only their own funds, but also the money borrowed from an exchange or broker.

It always involves the use of leverage which is a kind of loan that allows traders to increase the volume of an order. For example, having $100 and using a leverage of 1:100, a trader can open a position not for $100, but for $10,000.

Pros and Cons of margin trading

| Pros | Cons |

|

|

Every exchange offers its own range of leverage. For example, on some platforms, the maximum leverage is 1:5, while on others it is 1:20.

To start margin trading, mere desire is not enough. To use leverage, collateral is required, which is also called the initial margin.

There is also a maintenance margin which is the minimum amount that must be in the account to keep the position open. When the price moves against a trader's forecast and the funds on the account balance decrease and approach this mark, a trader receives a corresponding notification, a Margin Call.

In such a case, a trader should either replenish the account balance or reduce the volume of the position/leverage size.

If this does not happen, a trade is automatically closed by a Stop Out. The exchange or broker take such measures to ensure that the loaned funds don't get lost and to prevent a negative balance on a trader's account.

The exchange usually charges a commission for providing leverage. Both the allowable leverage size and the commission fees are individual for each cryptocurrency platform.

Some crypto exchanges also charge an additional fee for liquidating a position, so it is important to avoid such a situation.

Here are some of the exchanges that provide leverage for crypto trading:

- IFXBIT

- KuCoin

- OKX

- Bybit

- Binance

- Bitmex

In margin trading, long and short positions are opened. In the first case, traders bet on a price increase, i.e. they buy a cryptocurrency hoping to sell it at a better price in the future.

When making a short trade, a trader sells an asset, anticipaing a decline in its cost. If a price falls, it will be possible to buy the crypto cheaper, thus profiting from it.

A simple example

Suppose a user decides to make money on crypto trading and chooses bitcoin as their trading instrument. At the time of writing this article, the price of BTC was $16,715.00.

The trader believes that the BTC price will rise in the future, so they want to buy it. However, they only have $1,000 in their account.

With this money, they can only buy around 0.06 BTC. Since profit depends on the position size, the profit in case of a winning trade will also be small.

In this situation, the trader decides to use leverage.

Let's say they choose a leverage of 1:10. In this case, their capital will automatically increase to $10,000, $1,000 of which is the trader's own money and the remaining $9,000 is borrowed.

This amount allows the user to buy approximately 0.6 BTC.

Suppose that after some time, the cryptocurrency price increases to $18,715.00, meaning the trader's expectations are met. In this case, selling 0.6 BTC would yield $11,229.

Of this amount, $9,000 automatically goes back to the broker, and $1,000 is the trader's own capital that they invested in the purchase. This means that the net profit is $1,229.

Without the use of leverage, the earnings would have been more modest, just $122.9.

In this example, we didn't take commissions into account, as they vary among brokers.

As a result, using a leverage of 1:10 increases the potential profit in case of a winning trade by tenfold. And if one applies even higher leverage, the profit will automatically increase as well.

However, in case of a failure, the losses will also multiply. Let's return to our example to demonstrate this.

Suppose that contrary to the trader's forecast, bitcoin depreciates from $16,715.00 to $16,115.00. If the trader used only their own money ($1,000), their loss would be around $33.

But with a leverage of 1:10, the loss amount would be approximately $330.

What conclusions can a trader make in this situation?

- Leverage allows you to increase the trade volume and get bigger profits in case of winning.

- If a trade turns out to be unprofitable, leveraged trades will cause bigger losses than non-leveraged ones.

- In trading you need to factor in the amount of commissions. For example, some brokers charge not only trading commission, but also interest for using borrowed funds, specifically, for transferring the position to the next day.

Types of crypto margin trading

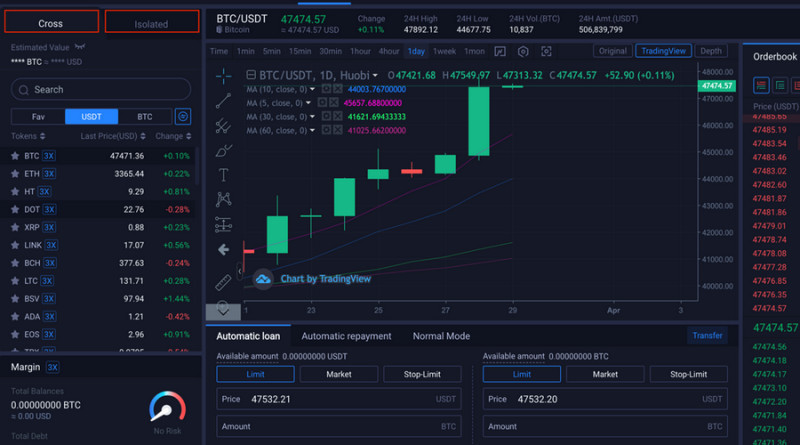

When studying leveraged crypto trading in more detail, it should be noted that there are several types of this activity. Specifically, it refers to different types of accounts for margin trading.

As mentioned earlier, margin accounts are provided separately for trading with leverage.

Some crypto exchanges offer only margin accounts, while others provide both options simultaneously.

The first type is an isolated account. It allows traders to make transactions with only one trading instrument, that is, with a currency pair.

For example, it can be the BTC/US dollar pair, litecoin/bitcoin, euro/ethereum, and so on. The first currency (fiat or digital) in the pair is the base one, while the second symbol is the currency that will be used for buying or selling the base currency.

For example, when trading the LTC/USD pair, a trader will either buy litecoin for dollars or sell the cryptocurrency in exchange for USD.

In isolated margin trading, only funds from the isolated account are used. If the equity decreases, that is, it approaches the maintenance margin level, the position may be automatically closed.

For example, if such an account is opened in USD, and the amount in the account becomes insufficient to keep the position open, the exchange will forcibly close the trade.

There are also cross-margin (also called multi-currency or cross-collateral) accounts that enable its users to trade several pairs. And if the equity for a specific open position approaches a critical level, money can be transfered from the total balance.

It allows traders to keep their positions open for a longer time, thus increasing their chances of getting profits. That's why cross-margin accounts are more popular than isolated ones.

In addition, such deposits can average risks during periods of high market volatility.

At the same time, this option poses certain risks, as a trader can lose all their funds in case of a losing trade, not only a part of a deposit they planned to invest in that trade.

What is the difference between spot and margin trading?

Spot and and margin trading are two most popular methods for exploring the crypto realm. What is the difference between them?

Spot trading is the basic type, involving buying and selling digital currencies. Such trades can be made in quite a short period of time. As a result, some market participants, i.e. buyers, get coins while others, i.e. sellers, dispose of them.

In spot trading, traders use their own money only, and trades are conducted based on the here-and-now approach.

Margin trading implies that traders use leverage. It enables them to make bigger transactions which increases both potential profits and potential losses.

The leverage is the key difference between spot and margin types of cryptocurrency trading.

Key highlights:

- In spot trading, market participants purchase a specific cryptocurrency with their own money at the market price. In margin trading, they use borrowed funds.

- In spot trading, you can make a profit only if a cryptocurrency price increases. When using margin, traders can also profit from price decreases.

- Spot trading is considered easier, as traders rely only on their own capital. They do not need to choose the size of the leverage and they face no risks of the Margin Call.

- In margin trading, the profit can be greater than in spot trading (if we are talking about the same amount of a trader's own funds). However, the risks also increase proportionally.

- Spot trading is suitable for beginners, while margin trading is used by experienced traders mostly.

What is the difference between futures and crypto margin trading?

Both futures and margin trading enable traders to profit from cryptocurrency price changes. In both cases, it is possible to get profits in both rising and falling markets.

Recall that in spot trading one can profit only from a price increase.

To explain the difference between futures and margin trading, let us first describe what are the futures.

Futures are the contracts between buyers and sellers that contain the following information:

- The base asset name;

- Contract price, i.e. the cryptocurrency price that a buyer is ready to sell at while a seller agrees to pay multiplied by the number of digital coins;

- Expiration time, i.e. the moment when parties will fulfill their contract obligations.

Essentially, when trading futures, market participants trade contracts, not cryptocurrencies. This type of trading activity enables traders to bet on the future cryptocurrency cost without actually owning it.

Such contracts are often used as a hedge against excessive volatility.

Traders can use leverage in futures trading. Another common feature with margin trading is that traders pursue the same goals, that is they want to profit from price changes.

And here are the differences between futures and margin trading:

- Different markets. Margin orders are placed in spot markets which implies immediate delivery, whereas futures trades are made in derivatives markets.

- Leverage size. In futures trading, the maximum leverage is usually higher.

- Duration. In margin trading, a trader can decide for how long to hold an asset on their own. In futures trading, the expiration period is determined upon the contract conclusion.

- Types of investors. Short-term traders usually prefer margin trading while long-term investors opt for futures trading.

Advantages of crypto margin trading

At the beginning of our review, we already mentioned the pros and cons of this type of trading. Now we will describe its advantages in more detail to explain the popularity of leveraged cryptocurrency trading.

The most important benefit of using leverage is the ability to invest in assets with a small initial capital. For example, with only $100 and the leverage of 1:5, you can increase the volume of your position up to $500.

The profit margin depends on the volume. For example, if leverage 1:5 is used, the potential profit is five times more than in non-leveraged trading.

This is the second advantage of margin trading.

It should also be noted that by using leverage, a trader gets an opportunity to invest available funds in other assets.

Let's say a user has $500 available and he or she wants to buy LTC with all that money. But they can invest only $250 and increase the transaction volume to $500 using the leverage of 1:2.

The remaining $250 can be used to diversify a portfolio, that is, invest in other assets.

Another argument is that it is almost impossible to get a negative balance in margin trading. As already mentioned, when your own money is not enough on your account, a position can be liquidated by Margin Call.

It means that the situation when a trader owes anything to an exchange is ruled out.

Finally, margin trading enables users to profit in both rising and falling markets.

Where to start

To trading cryptocurrencies with the use of leverage, a trader needs to make several steps. Here are the main ones:

1. Complete training. It is a serious mistake to start trading on a crypto exchange without theoretical preparation, especially when it comes to margin trading.

Before you start trading, it is important to study the architecture of cryptocurrencies, the factors that affect their prices, and various analysis methods. Another crucial aspect is learning how to use the trading terminal.

Some crypto exchanges offer clients demo accounts, and it's worth taking advantage of the opportunity to practice with them.

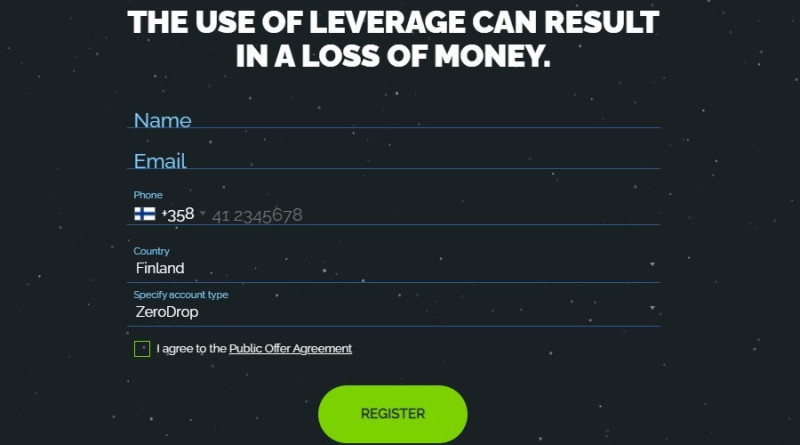

2. Register on a cryptocurrency exchange and open an account. Users should be prepared to provide personal information, as well as photos and scans of required documents.

There is no need to worry, as the verification procedure is required only for security purposes. If the crypto exchange operates legally, this information will not fall into the hands of third parties and will not be used in violation of the user's rights and legal interests.

3. Make a deposit. Usually, exchanges offer their clients several options, so it is always possible to choose a suitable one from the list.

It's essential to note that when transferring funds, payment systems and banks may charge additional fees.

It's also important to understand that margin trading usually involves opening specific margin accounts. These accounts can be either isolated or cross-margin accounts.

In both cases, the money that a trader plans to use for margin trading should be transferred from the standard account to the margin account.

4. Choose an appropriate cryptocurrency for trading. Although it usually happens when a trader signs in a trading platform after registration and account funding, it's better to decide on a specific cryptocurrency in advance.

The list of available trading pairs can usually be found in the main menu of the trading platform.

5. Place a trade. A trader needs to decide whether to buy or sell an asset and set the volume.

As for leverage, exchanges usually offer a special form to be filled out where the leverage size should be specified.

6. Set Stop Loss and Take Profit orders to protect your account against financial losses.

After completing these steps, a trader needs to monitor the market situation and find the optimal moment to close the position. It can be kept open as long as the trader deems necessary.

However, it's important to remember that interest may be charged for using leverage. It is also necessary to control the amount of funds in the margin account and avoid a Margin Call.

To store coins, a trader needs to create a wallet. It can be a software or hardware wallet. Crypto exchanges have storage facilities, but it is better to keep only a portion of coins there for quick transactions.

The rest should be transferred to a separate wallet.

How to reduce risks?

Any form of trading in the financial market involves risk, as there is always a possibility that quotes will move contrary to forecasts. With digital assets, this risk is even higher, as coins are characterized by high volatility and unpredictability in their movements.

Crypto margin trading is riskier compared to spot trading, so it is important for traders to do their best to reduce these risks. Here are some tips that can help accomplish this task.

1. Do not transfer all your money to the margin account. Keep a portion of the funds at your disposal for making transactions in the spot market.

2. Pay attention to commissions. They are often charged for each day of using borrowed funds. Before applying leverage, make sure its use will bring you profit.

3. Always set Stop Loss orders when trading. They will help limit financial losses in case the price starts moving against your expectations.

4. Remember to place Take Profit. Not only it helps traders fix their profit, but also it is an effective risk management tool. As practice shows, the desire to earn as much as possible often leads to losses.

5. Do not try to recoup losses after making a losing trade. By making hasty decisions, you risk losing much more.

6. Do not strive to use the maximum possible leverage. Experienced traders often apply leverage that does not exceed 1:10, while the maximum leverage size for beginners should be 1:3.

7. Choose the assets with a medium level of volatility. If you opt for too volatile instruments, there will be a greater risk of financial losses due to frequent and significant price changes.

Conversly, if volatility is too low, profit can be insignificant. It may even turn up to lower than commissions charged. While quotes are barely moving, leverage fees are charged, so the effectiveness of such a trade is questionable.

8. Do not trade against the trend. It is better to open positions according to the vector of strong dynamics and put trading on hold if a trend is unlikely to develop further.

9. Do not invest more than you can afford to lose. A loss should not devastate your personal budget.

Conclusion

Leveraged crypto trading is becoming increasingly popular, so many exchanges provide clients with leverage. First, it is an advantage for traders, as they can open trades of bigger volume with the use of leverage.

Second, it is also an advantage for crypto exchanges because the higher a trade volume, the bigger commission is charged. Additionally, many exchanges impose daily fees for the use of leverage.

However, these obvious advantages come along with certain disadvantages of leveraged trading. The key one is a risk of financial losses.

Margin trading is always riskier than non-leveraged trading. When it comes to cryptocurrencies known for their high volatility, the risk of losses is even higher.

Recommended:

Crypto Trading Training

Cryptocurrency Arbitrage

What is Spot Trading in Crypto

Leverage Trading Crypto

Grid Trading Crypto

Short Term Crypto Trading

Crypto Demo Trading

Back to articles

Back to articles