You can become part of the community and yield profit in the crypto market in several ways. This article will give you an insight into spot cryptocurrency trading.

You will learn about spot markets, their features, and common mistakes beginners make.

If you’d like to find out more about other ways of generating profit in the crypto market, here is another article on this topic: “Trading cryptocurrencies (crypto trading).”

Spot in simple terms

The term “spot” means being at the actual place. It is used in different fields but is most common in finance.

When it comes to trading, this term refers to trades that are conducted here and now. Here the word “now” should not be taken literally as it could be about a few days.

For instance, when buying shares in the spot market, the buyer gets hold of them and transfers money to the seller right away. At the same time, the pirates do not borrow money from brokers and use solely their own funds in the process of trading.

Spot markets are places where spot operations are made. These can be transactions with securities, currency pairs, commodities, cryptocurrencies, and other assets.

There can be either exchange markets or over-the-counter (OTC) markets. In the first case, we are talking about centralized platforms playing the role of intermediaries.

They control the process of trading ensuring its safety and transparency. However, exchanges charge commissions for their services.

In OTC markets, there are no intermediaries, but there is a direct interaction between buyers and sellers. Here the safety of transactions is achieved through smart contracts.

Traders in the spot market aim to yield a profit from selling assets at prices higher than initially bought.

Shorting is also popular among spot traders. This term implies selling assets in advance of acquiring them, with the aim of making a profit when the price falls.

Spot markets are about conducting transactions on the spot. However, the processing time may vary.

- TOD: transactions are executed on the same day. Such operations are commonly conducted in crypto markets.

- TOM: transactions are executed on the following day. When this day comes, the status of a transaction changes for TOD automatically.

- SPT: transactions are executed in two days. Such operations are common for stock exchanges.

It should be noted that the above terms refer to business days. So, when an order is filled on the final business day of the week, the execution of a transaction will be automatically delayed.

Here are a few examples of spot operations on Forex.

Let’s say you want to buy 1,000 euros with US dollars. You should deposit USD to your trading account and fill in a buy order to acquire the necessary amount of euros at the current value.

Your order will be immediately displayed in the order book. A transaction is made when there is a counter order.

The buyer’s account will be debited with the necessary amount of dollars, whereas the seller’s account will be debited with 1,000 euros. However, the parties do not receive assets immediately as it takes time to process a transaction.

TOD transactions are processed on the same day, whereas TOM transactions will be processed on the following day. Once the parties get their money, they can use them the way they want.

Here it should be noted that the size of a commission depends on the type of spot trade, i.e. on the processing time. To calculate a commission for one day, the value of the key rate is divided by the number of days in a year.

So, the highest commission is charged for TOD transactions. This pricing principle explains why futures are significantly more expensive than underlying trading instruments.

Features of spot markets

High execution speed is one of the key features of spot markets.

The nature of assets on spot markets is relatively homogenous, which ensures their solid value.

A spot price is the current market price of an asset. What is spot trading in crypto?

All buy and sell offers are registered in the order book. This is an advanced system that systematizes and sorts all market orders.

It organizes orders by price levels. Buy orders are listed separately from sell orders.

The order book describes general market sentiment and the demand/profit ratio.

Once an order is executed, the spot price changes. This process never stops as prices always change.

It is important to understand that the spot price is a benchmark for derivative traders. Prices of assets that are mentioned in various reports are usually spot prices.

It is crucial that traders have the necessary assets to conduct spot trades. Thus, the seller should have assets, and the buyer should have fiat to get hold of those assets.

To understand the essence of spot markets, let’s compare them with derivative markets.

- Delivery date. In a spot market, delivery normally takes place on the spot. In a derivative market, delivery is usually delayed.

- Payment. In a spot market, the buyer pays for assets in full and on the spot. In a derivative market, the buyer is required to immediately have margin money only;

- Trading instruments. Derivatives (futures) are traded on derivative markets, while just underlying instruments are traded in spot markets;

- Money for making transactions. Traders can use borrowed funds to trade derivatives and their own money for trading in spot markets.

About what is spot trading in crypto

Spot crypto markets and exchangers operate based on the same algorithm. The buyer has fiat, the seller has crypto. They exchange assets.

Unlike spot trading on stock exchanges, where SPT trades are made, transactions on crypto exchanges are conducted on the spot.

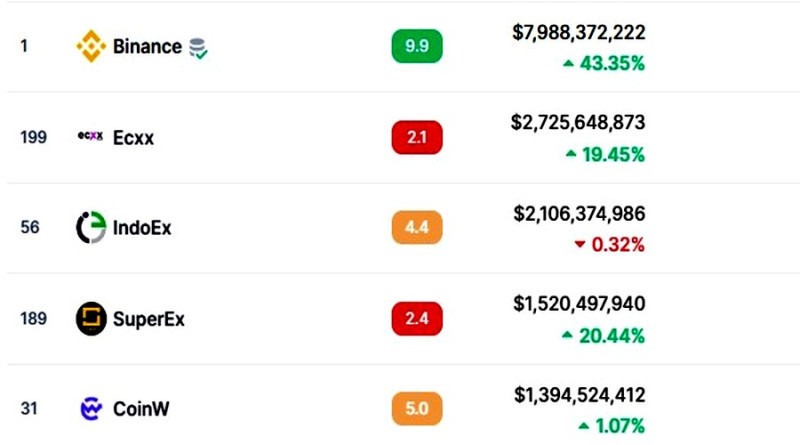

Every day, about $100 billion worth of transactions are made in the spot crypto markets, and this excludes over-the-counter transactions.

Here is the list of crypto exchanges with the highest trading volumes:

However, when trading on the spot, you can exchange cryptocurrencies for fiat or other digital assets. In both cases, deliveries occur shortly.

Spot trading is suitable for both traders and investors. Their goals and activities are the same, but periods of storing crypto are different.

Traders buy coins and sell them shortly to receive a profit. Investors store assets longer.

Crypto trading in spot markets is available through market orders and pending orders.

Market orders are executed immediately at the current price. Pending orders are processed when the price reaches the level set by a trader.

Here is how a market order is formed. Let’s say you have 1,000 USDT and want to buy BTC.

You place an order and select all funds in your account. The order is executed at the current price. At the same time, the system picks the best offers from the order book.

You will find out how many bitcoins you have managed to buy and at what price only after the execution of the order.

Another way to place market orders involves specifying a specific number of coins that you want to buy.

Meanwhile, there are several rules for placing limit orders:

- A buy limit order is only executed at the limit price or lower.

- A sell limit order, on the contrary, can only be executed at the limit price or higher.

Unlike market orders, limit orders can be canceled.

The list of all orders can be found in the order book. In addition, you can track your own trading statistics.

On the platform, you can see a list of open and executed orders.

Spot crypto markets

Spot markets are in abundance. So, every trader can choose a spot marketplace to their taste.

Markets for trading cryptocurrency can be divided into exchanges and OTC markets. Let’s now look at them closer.

Trading on OTC markets means conducting spot trades between parties without intermediaries. Brokers, private traders, and investors can be sellers and buyers.

The first-ever OTC trade on crypto was made in 2009 when a user exchanged 10,000 BTC for two pizzas.

The coin was unknown at that time and was of little value. However, when the BTC price started to grow and set records, it became clear that the user had lost a fortune.

OTC trading has its advantages. For instance, there is no slippage.

Exchanges sometimes are not able to execute large-volume orders at prices set by traders, especially when it comes to low-liquidity assets.

As a result, orders may be partially executed at different prices. When it comes to OTC trades, slippage does not take place because parties preset prices and volumes. There are also no order books in this case.

OTC markets attract large players in the first place as there is a greater chance of conducting a bigger trade at a higher price. However, there is still a risk of fraud, which may lead to the loss of all funds.

When it comes to exchanges, they can be centralized and decentralized.

Centralized exchanges are major spot trading providers. They are intermediaries controlling the trading process and storing the assets of their clients.

Such marketplaces are regulated by law to ensure the legitimacy and safety of trading.

Trading on centralized exchanges requires passing verification and paying commissions.

Decentralized platforms do not have intermediaries. Sellers and buyers find each other via blockchain technology. Such exchanges do not store client assets. Here trades are made through smart contracts.

Decentralized markets have a higher level of privacy and offer their users freedom of action. Still, resolving disputes on such platforms is more problematic.

The thing is that decentralized markets do not have a central body and support service. Moreover, there is no KYC procedure, meaning identifying users can be quite difficult.

Therefore, decentralized exchanges are less popular than centralized ones. Thus, the daily trading volume on centralized spot platforms exceeds $100 billion, whereas it is about $2 billion on decentralized exchanges.

Still, those figures are not precise and may vary.

Ways of yielding profits on spot crypto exchanges:

- Trading, including automated trading. Trades are conducted in the short term;

- Investing. Coins are held longer in order to generate profit later;

- Trading new cryptocurrencies. Promising listed coins are picked: growth in prices in the future may bring profits;

- Receiving interest from storing. This option is akin to a bank deposit. However, due to its novelty, just a few crypto exchanges offer it.

Regardless of the crypto exchange, traders will have to register. This usually takes a few minutes to do.

When traders have registered trading accounts, they can trade crypto in spot markets.

On some platforms, verification is obligatory.

All exchanges and OTC platforms have extensive functionality, which ensures the efficacy of spot trading. Some offer their clients ready-made strategies, automated trading, and so on.

In most cases, users do not have to search for trading details in third-party sources. Exchanges provide them with price charts, a profit calculator, and other services.

Advantages and disadvantages

Let’s now list all the advantages and disadvantages of spot crypto trading.

Pros:

- Simple process. This type of trading is available for all players regardless of their experience. This is the perfect option for crypto beginners because it is a transparent and clear process;

- Low risks. For example, having the same amount of funds, margin trading is riskier than spot trading;

- You can use your crypto assets the way you want. You can either store them on exchanges or withdraw them to a separate wallet and use your crypto assets for paying for goods and services;

- Transparent prices: spot prices are based on the demand/supply ratio;

- Users trade solely their own funds. They do not have to worry about possible liquidation of positions as is the case with margin trading;

- Users can trade online and conduct trades at the lowest price (TOD);

- Spot trading is universal for implementing short-term, medium-term, and long-term strategies;

Still, spot trading has its disadvantages. Its main drawback is the lack of leverage.

Because a handful of spot platforms offer various borrowing schemes we are not going to dwell on that.

Leverage ensures higher trading volumes, meaning potential profits could also be larger. However, the risks are bigger in this case.

Other cons:

- Minimum transaction size: crypto exchanges usually have a minimum trade size, which is sometimes too big for certain users;

- Traders are required to actually hold assets in order to trade;

- Traders can earn in a bull market only. For instance, when trading on margin, you can profit from both rising and falling crypto prices;

- Modest profits in comparison with other types of trading. Thus, investing one and the same amount of fiat into crypto, margin trading promises higher profits than trading on the spot;

- Prices may change when orders are processed;

- Insufficient trading volumes, needed to execute orders at attractive prices: for example, a trader wants to buy 5 ETH but can actually purchase only 3 coins at the set price. Thus, the trader will have to buy the remaining two coins at a different price.

In addition, spot crypto trading is emotionally exhausting. Due to high volatility and difficulties in predicting prices, cryptocurrencies are quite risky trading instruments.

What is more, profits from spot trading are lower than from other types of trading. Therefore, many users prefer spot trading at the beginning of their careers or for long-term investing in crypto.

Spot trading vs futures trading:

Functionality of platforms for spot crypto trading

If you have some basic ideas about trading, you will find crypto trading on spot markets quite simple. Besides, all crypto exchanges have different designs and interfaces. Meanwhile, their options are the same.

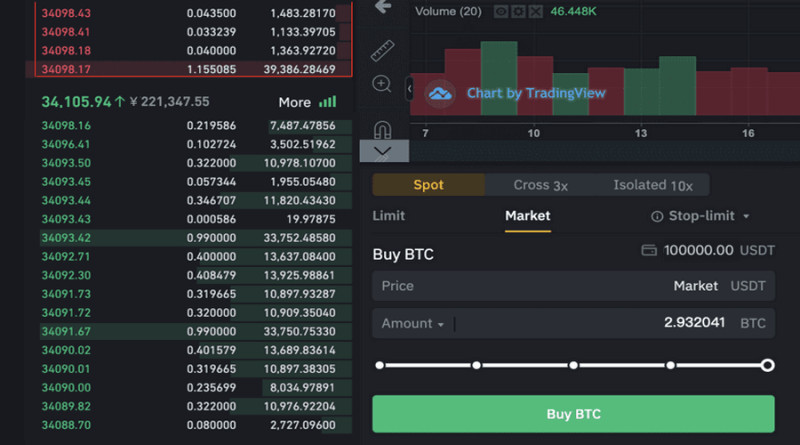

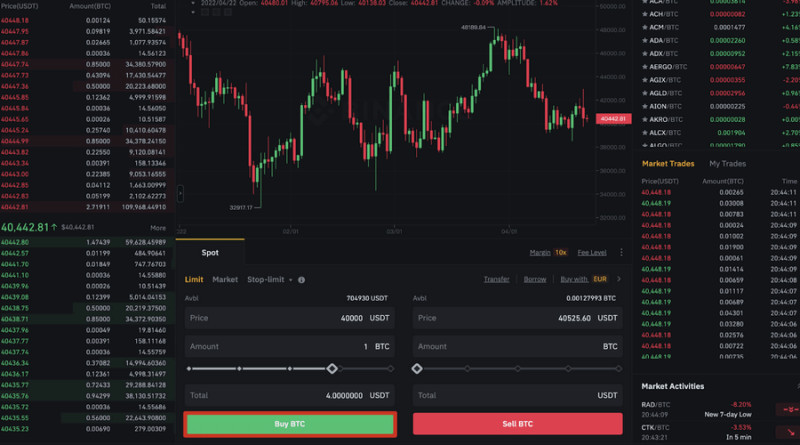

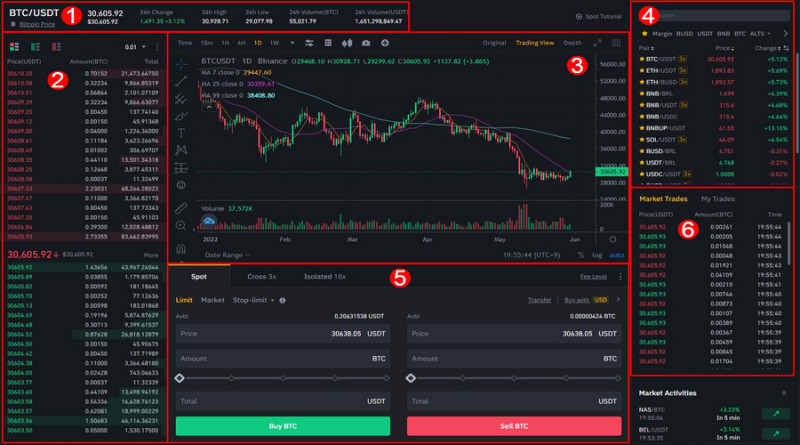

Let’s look at one of the platforms and see how to navigate it and what data is available on it.

1. The most important and latest information about trading, including prices, trading volumes, etc. can be found at the very top;

2. Quite a lot of interface space is usually occupied by the order book (in our case, it is located on the left). Orders are often divided into two groups: those placed by sellers (red font) and those set by buyers (green font).

The most attractive offers are located at the very top. The Bid is the highest price at which someone is willing to buy an instrument, the Ask is the lowest price at which someone is willing to sell it.

Let’s say a trader wants to buy 10 ETH at a price of $1,220.53 per coin.

In the order book, there are just 5 ETH available at this price. In such a case, the trader may buy them right away and wait for a suitable offer to purchase the rest.

Another option will be to buy all 10 ETH where 5 coins will be purchased at a price of $1,220.53, and the other 5 coins at the Ask price that comes next in the order book.

In other words, the trader will buy all the coins at once but at an average price higher than $1,220.53

3. The chart illustrates how prices change in various time frames. In addition, technical indicators can be applied.

4. The list of all assets available for trading on this platform shows them in pairs: crypto/fiat or crypto/crypto.

5. There is an area for placing limit, market, and stop-limit orders.

Market orders are executed on the spot. Limit and stop-limit orders are executed when the price of a crypto asset reaches the level set by the trader. The difference between the limit order and the stop-limit order is that in the latter case, a trader sets both the acceptable amount for a transaction to take place and the one at which an order will trigger.

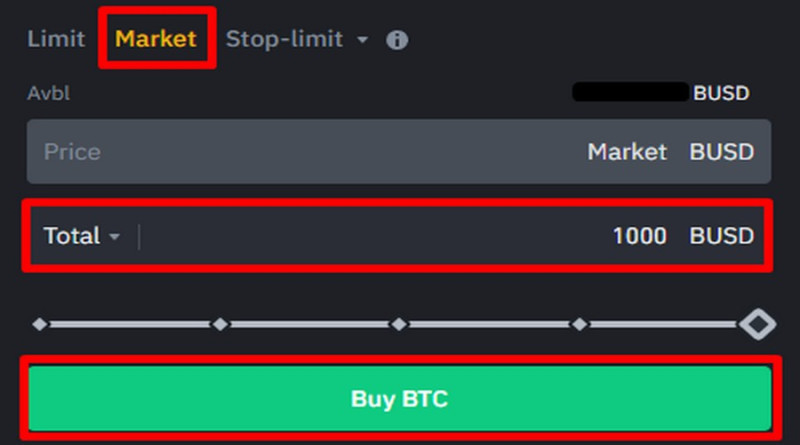

In the screenshot below, you can see how a market order to buy BTC is formed. A trader has 1,000 BUSD (a stablecoin pegged to USD).

Once the trader clicks “Buy”, 1,000 BUSD are transferred to the seller’s crypto account, and the buyer receives BTC.

6. There are also market trades and the executed orders of users. In both cases, information on asset prices, trading volumes, and the number of coins is available.

Tips for beginners

Spot crypto prices change all the time. Sometimes, they show steady growth or a steady fall. Sometimes, they trade sideways.

Traders should conduct trades depending on price changes. In spot markets, they buy assets, hold them, and then sell them to get a profit.

Traders hold assets in the short term (scalping, intraday trading), medium term, and even long term (investing for months, weeks). Regardless of the strategy, beginners should obey the following rules:

1. Never rush when trading. Novice traders often sell all crypto they have once the price starts to go down or, on the contrary, buy coins when the price begins to grow.

When it comes to fluctuations, sticking to such a strategy may result in losses. Therefore, traders should act based on long-term trends, not on short-term changes.

2. Use averaging: you buy coins in parts, i.e. gradually. This way you may minimize risks associated with the high volatility of crypto assets and pick the right entry points.

3. Use diversifications. Investing in one asset is always risky regardless of its potential.

4. Place a Stop Loss and a Take Profit. These orders bring potential profits and risks into equilibrium.

5. Never spend all your money in an account on trading.

6. Improve the quality of your theoretical and practical knowledge. In fact, it is not just about your experience and skills, it is also about expanding your trading activities.

Final thoughts

This article “What is spot trading in crypto” is about spot crypto trading and its distinctive features as well as why it is the ideal option for beginners.

You should never invest in assets you know nothing about. You may trade crypto in the bull spot market only. Otherwise, you may incur losses.

Recommended:

Crypto Trading Training

Cryptocurrency Arbitrage

Crypto Margin Trading

Leverage Trading Crypto

Grid Trading Crypto

Short Term Crypto Trading

Crypto Demo Trading

Back to articles

Back to articles